Variation of Trusts

Variation of trusts

AIMS AND OBJECTIVES

By the end of this chapter you should be able to:

■ appreciate the rule in Saunders v Vautier

■ understand the various methods of varying the management powers of trustees

■ list the various methods of varying beneficial interests prior to the passing of the Variation of Trusts Act 1958

■ comprehend the relevant conditions to be satisfied under the Variation of Trusts Act 1958

■ distinguish between a variation of trusts and re-settlements

15.1 Introduction

Trustees are required to administer the trust in accordance with its terms. They have a primary duty to obey the instructions as detailed by the settlor or implied by law. Any deviation from the terms of the trust is a breach making them personally liable, irrespective of how well intentioned the trustees may have been. But circumstances may arise, since the setting up of the trust, which indicate that the trust might be more advantageously administered if the terms were altered.

For example, authority may be needed to use funds from the trust to maintain an infant beneficiary; an investment or the impact of a potential liability to taxation may have the effect of depreciating the trust assets if no action is taken. A partitioning of the trust property between the life tenant and remainderman may have the effect of avoiding inheritance tax if the life tenant survives for seven years or more, whereas, if no action is taken, the entire capital may suffer inheritance tax on the death of the life tenant and a second time on the death of the remainder.

In these circumstances the trustees are in need of some mechanism whereby authority may be conferred on them to depart from or vary the terms of the trust. Such authority may be conferred in a variety of ways.

15.2 The rule in Saunders v Vautier

Where the beneficiaries are of full age and of sound mind and are absolutely entitled to the trust property, they may deal with the equitable interest in any way they wish. They may sell, exchange or gift away their interest. As a corollary to this rule, such beneficiaries acting in unison are entitled to terminate the trust. Equally, such beneficiaries acting in concert are entitled to empower the trustees to perform such acts as they (the beneficiaries) consider appropriate. In short, the beneficiaries, collectively, are entitled to rewrite the terms of the trust.

CASE EXAMPLE

| Saunders v Vautier [1841] 4 Beav 115 Stock was bequeathed upon trust to accumulate the dividends until Vautier (V) attained the age of 25. At this age, the trustees were required to transfer the capital and accumulated income to V. V attained the age of majority (21) and claimed the fund at this age. The question in issue was whether the trustees were required to transfer the fund to V. Lord Langdale MR decided that since the fund had vested in V, the sole beneficiary, subject to the enjoyment being postponed, and he was of full age, he was entitled to claim the entire fund. The beneficiary had a vested interest in the income, and the accumulations were for his sole benefit, which he was entitled to waive: |

JUDGMENT

| ‘I think that principle has been repeatedly acted upon; and where a legacy is directed to accumulate for a certain period, or where the payment is postponed the legatee, if he has an absolute indefeasible interest in the legacy, is not bound to wait until the expiration of that period, but may require payment the moment he is competent to give a valid discharge.’ Lord Langdale MR |

But where minors or persons under a disability or persons unborn are beneficiaries (or potential beneficiaries) there cannot be a departure from the terms of the trust without the court’s approval.

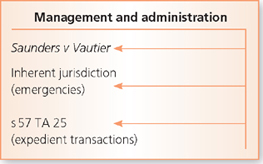

The courts drew a distinction between:

■ a variation concerning the management and administration of trusts; and

■ a variation of the beneficial interests under the trusts.

We shall now consider the first of these.

15.3 Variation of the management powers of trustees

15.3.1 Inherent jurisdiction of the court

The court has an inherent jurisdiction to depart from the terms of a trust in the case of an ‘emergency’, i.e. an occasion when no provision was made in the trust instrument and the event could not have been foreseen by the settlor. This power is very narrow and arises in order to ‘salvage’ the trust property, such as effecting essential repairs to buildings.

The power was exercised in Re New [1901] 2 Ch 534, which was described as the ‘high water mark’ of the emergency jurisdiction.

CASE EXAMPLE

| Re New [1901] 2 Ch 534 The trust property consisted of shares in a company divided into £100 units. The court approved a scheme of capital reconstruction on behalf of minors and unborn persons by splitting the shares into smaller units so that they could be more easily realised. |

JUDGMENT

| ‘In a case of this kind, which may reasonably be supposed to be one not foreseen or anticipated by the author of the trust, where the trustees are embarrassed by the emergency that has arisen and the duty cast on them to do what is best for the estate, and the consent of all the beneficiaries cannot be obtained by reason of some of them not being sui juris or in existence, then it may be right for the court to sanction on behalf of all concerned such acts on behalf of the trustees.’ Romer LJ |

In Re Tollemache [1903] 1 Ch 955, the court refused to sanction a scheme authorising the mortgage of the life tenant’s beneficial interest in order to increase her income. There was no emergency.

15.3.2 Section 57 of the Trustee Act 1925

The section is drafted in fairly wide terms and empowers the court to confer the authority on the trustees to perform functions whenever it is expedient to do so.

Section 57(1) provides:

SECTION

| ‘57(1) Where in the management or administration of any property…, any sale, lease, mortgage, surrender, release or other disposition or any purchase, investment, acquisition, expenditure or other transaction is in the opinion of the court expedient, but the same cannot be effected by reason of the absence of any power… the court may by order confer on the trustees, either generally or in any particular instance the necessary power.’ |

The purpose of s 57 is to secure that the trust property is managed as advantageously as possible in the interests of the beneficiaries and to authorise specific dealings with the trust property outside the scope of the inherent jurisdiction of the court. It may not be possible to establish an emergency or that the settlor could not reasonably have foreseen the circumstances which have arisen. In these circumstances the court may sanction the scheme presented for its approval.

However, there are a number of limitations within s 57. First, the scheme proposed by the trustees is required to be for the benefit of the trust as a whole and not only for an individual beneficiary. In Re Craven’s Estate (No 2) [1937] Ch 431, the court refused to sanction a scheme authorising an advancement to a beneficiary for the purpose of becoming a Lloyd’s underwriter. The scheme would not have been expedient for the trust as a whole. Second, additional powers may only be conferred on the trustees with regard to the ‘management or administration’ of the trust. No power exists under s 57 to alter the beneficial interest or to rewrite the trust administration clause as opposed to merely authorising specific dispositions or transactions. This distinction is one of degree. In Re Coates’ Trusts [1959] 1 WLR 375 and Re Byng’s Will Trusts [1959] 1 WLR 375, orders were made approving arrangements to confer wider powers of investment on the trustees. Orders approving such arrangements were frequently made between the passing of the Variation of Trusts Act in 1958 and the passing of the Trustee Investment Act 1961.

Under s 57 the courts have sanctioned schemes for the partition of land (Re Thomas [1939] 1 Ch 194); a sale of land where the necessary consent could not be obtained (Re Beale’s Settlement Trust [1932] 2 Ch 15); the sale of a reversionary interest which the trustees had no power to sell until it fell into possession (Re Heyworth’s Contingent Reversionary Interest [1956] Ch 364); blended two charitable trusts into one (Re Shipwrecked Fishermen’s and Mariners’ Benevolent Fund [1959] Ch 220); and extended investment powers of pension fund trustees (Mason v Farbrother [1983] 2 All ER 1078).

On a variation of beneficial interests, the court has the jurisdiction to approve schemes which go beyond an alteration of the management powers of trustees and to effect arrangements which vary the beneficial interests under a trust.

15.4 Variation of beneficial interests

15.4.1 Section 53 of the Trustee Act 1925

Where an infant is beneficially entitled to real or personal property and the property does not produce income which may be used for the infant’s maintenance and education or benefit, the court may adopt a proposal authorising a ‘conveyance’ of the infant’s interest with a view to the application of the capital or income for his maintenance, education or benefit.

The section may not be used simply to terminate a settlement without making some new trust provision for the infant.

CASE EXAMPLE

| Re Meux [1958] Ch 154 The claimant was a life tenant of a trust fund and his infant son was entitled to a contingent reversionary interest. The court sanctioned a scheme on behalf of the infant whereby a person was appointed to convey the infant’s interest to the claimant in consideration of a purchase price which was paid to the trustees for the benefit of the infant. |

15.4.2 Section 64 of the Settled Land Act 1925

This section applies where land is settled. The court has the power to sanction ‘any transaction … which in the opinion of the court would be for the benefit of the settled land or the persons interested under the settlement’.

This section has a wider application than s 57 of the Trustee Act 1925, because it is not limited to managerial or administrative matters but allows alterations to be made to the beneficial interests. Moreover, it extends to both settled land and land held under a trust for sale. In Raikes v Lygon [1988] 1 All ER 884, the court decided that s 64 was wide enough to permit the creation of a second settlement.

This statutory provision was recently considered in the following case:

CASE EXAMPLE

| Hambro v Duke of Marlborough, The Times, 25 March 1994 The court decided that it had jurisdiction under s64 of the Settled Land Act 1925 to authorise the tenant for life to vary the beneficial interest of a beneficiary under the 1706 parliamentary settlement of Blenheim Palace, without that beneficiary’s consent. However, this is subject to the condition that the variation is either for the benefit of the settled land or all the beneficiaries under the settlement. |

15.4.3 Sections 23 and 24 of the Matrimonial Causes Act 1973

These sections give the court power to make property adjustment orders between spouses on divorce, separation or nullity, and this includes a power to make orders extinguishing or reducing the interest of either of the parties to the marriage.

15.4.4 Section 96 of the Mental Health Act 1983

This section gives the Court of Protection wide powers to authorise the making and variation of settlements of the property of mental patients.

15.4.5 Compromise (inherent jurisdiction)

The court has an inherent jurisdiction to approve compromise arrangements governing the rights of beneficiaries including infants and unborn persons under trusts. Before the House of Lords’ decision in Chapman v Chapman [1954] AC 429, there was some doubt as to whether the jurisdiction existed if there was not a genuine dispute between the beneficiaries. The House of Lords in that case clarified the meaning of the expression ‘compromise’, by deciding that its jurisdiction concerned cases of genuine disputes about the existence of rights.

CASE EXAMPLE

| Chapman v Chapman [1954] AC 429 The trustees applied for leave to execute a scheme releasing certain properties from the trust in order to avoid estate duty. Some of the interests were enjoyed by infants and might be enjoyed by unborn persons, so that any rearrangement of interests required the consent of the court. The House of Lords held that the scheme would not be approved because the court had no jurisdiction to sanction a rearrangement of beneficial interests on behalf of infants and unborn persons where there was no real dispute. |

JUDGMENT

| ‘[T]he question which presents difficulty in this case … is whether… the compromise category should be extended to cover cases in which there is no real dispute as to rights and, therefore, no compromise, but it is sought by way of bargain between the beneficiaries to rearrange the beneficial interests under the trust instrument and to bind infants and unborn persons to the bargain by order of the court. … in the present case it appears to me that to accept this extension in any degree is to concede exactly what has been denied. It is the function of the court to execute a trust, to see that the trustees do their duty and to protect them if they do it, to direct them if they are in doubt and, if they do wrong, to penalise them. It is not the function of the court to alter a trust because alteration is thought to be advantageous to an infant beneficiary.’ Lord Simonds LC |

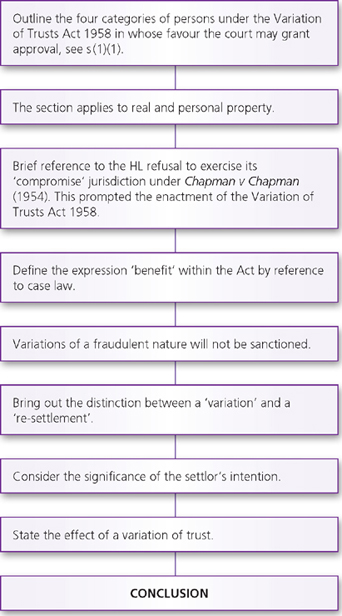

15.4.6 The Variation of Trusts Act 1958

The Variation of Trusts Act 1958 was passed in order to reverse the decision of the House of Lords in Chapman v Chapman (1954) and to introduce sweeping changes in the law. The jurisdiction of the courts was extended in order to approve variations of trusts (in respect of both administrative matters and beneficial interests) on behalf of infants, unborn persons and others who lacked the capacity to consent to an arrangement. The court is entitled to sanction ‘any arrangement varying or revoking all or any trusts or enlarging the powers of the trustees of managing or administering any of the property subject to the trusts’.

The court in its discretion may make an order approving a scheme, provided that the following four conditions are satisfied:

1. property, whether real or personal, is held on trust; and

2. the trust was created by will or inter vivos settlement or other disposition; and

3. the four categories as enumerated in s 1(1) of the 1958 Act, namely:

SECTION

′1(1)(a) any person having directly or indirectly, an interest, whether vested or contingent under the trusts, who, by reason of infancy or other incapacity is incapable of assenting, or (b) any person (whether ascertained or not) who may become entitled, directly or indirectly, to an interest at a future date or on the happening of a future event, a person of any specified description or a member of any specified class of persons, but not including any person who would be of that description or a member of that class if the said date had fallen or the said event had happened at the date of the application to the court, or (c) any person unborn, or (d) any person in respect of any discretionary interest of his under protective trusts where the interest of the principal beneficiary has not failed or determined.’ and: 4. provided that, with the exception of para (d) above, the arrangement was carried out for the benefit of that person. |

The purpose of the 1958 Act is to permit the court to approve arrangements on behalf of beneficiaries who cannot give their consent by virtue of infancy or other incapacity or because their identity is unascertained, such as a future spouse. It follows, therefore, that the court has no jurisdiction to approve arrangements on behalf of beneficiaries who are sui juris, adult and ascertained. Thus, the consent of all adult, ascertained beneficiaries must be obtained before the court may grant its approval to a scheme.

ACTIVITY

| T1 and T2 hold property on trust for A (adult) for life, with the remainder to B (an infant) for life, with the remainder to C (adult) absolutely. A scheme of equal division is proposed. The court may approve the scheme on behalf of B (the infant) but not in respect of A and C. Will their consent be required? The only exception to the above rule is to be found in s 1 (1)(d) of the 1958 Act, namely the court may consent on behalf of an adult ‘beneficiary’ who may become entitled to an interest on the failure of the principal beneficiary’s interest under a protective trust. |

ACTIVITY

| Trustees hold property on protective trust for M for life. A scheme is submitted for the approval of the court to grant M’s wife, W, a one-fifth share of the capital. 1. Will the court approve the arrangement on behalf of W? 2. Is M required to consent to the scheme? |

In Allen v Distillers Co (Biochemicals) Ltd [1974] QB 384, the court decided that the Act was not applicable to an out-of-court settlement of litigation.

CASE EXAMPLE

| Allen v Distillers Co (Biochemicals) Ltd [1974] QB 384 The trust funds were received pursuant to a negotiated settlement of the Thalidomide litigation. The desire of many of the parents of children affected was to ensure that the sums held for their children should not become their absolute property at the age of 18. Eveleigh J decided that he had the power to achieve the objective of the parents under the court’s inherent jurisdiction, but he had no power under the 1958 Act because that Act did not apply to the payment out to trustees under an out-of-court settlement of litigation. This was not the type of trust contemplated in the 1958 Act: |

JUDGMENT

| ‘The Act contemplates a situation where a beneficial interest is created which did not previously exist and probably one which is related to at least one other beneficial interest. Moreover, the Act is designed to deal with a situation where the original disposition was intended to endure according to its terms but which in the light of changed attitudes and circumstances it is fair and reasonable to vary.’ Eveleigh J |

In D (a child) v O [2004] 3 All ER 780, the High Court decided that it had the power to lift the statutory limitation that exists under s 32 of the Trustee Act 1925 (power of advancement). This power was exercisable under the Variation of Trusts Act 1958, whereas, in Allen v Distillers (see above) the court ruled that it did not have jurisdiction to modify an interest under the VTA 1958. However, in the present case the court distinguished Allen v Distillers on the ground that Eveleigh J was not considering the sort of case of absolute entitlement that was before the court on this occasion. In D v O, what was proposed would have the effect of accelerating the benefit to the claimant by allowing the whole of the claimant’s fund or capital to be used for her benefit while she was still under age. It could not have been for the claimant’s benefit to divert any part of the fund from her.

Section 1(1)(b) of the 1958 Act

Generally, the court may consent on behalf of potential beneficiaries who have a contingent interest in the trust (see s 1(1)(b)), i.e. ‘a person who may become entitled … to an interest’, for example a future spouse of a beneficiary. But the proviso to s 1(1)(b) prevents the court from approving on behalf of adult beneficiaries who are ascertainable and stand only one step removed from entitlement under the trust. It was the intention of Parliament that such persons should be allowed to consent for themselves.

For example: trustees hold property on trust for A for life with an ultimate remainder for his next of kin. A is a widower with one son, B (adult). A scheme is proposed in order to divide the fund equally between A and B. In such a case B is required to consent to the arrangement under the proviso to s 1(1)(b), on the ground that B is only one step removed from acquiring a vested interest, namely the death of A. This principle may be illustrated by the following case.

CASE EXAMPLE

| Re Suffert’s Settlement [1961] Ch 1 Under a settlement, B was granted a protected life interest with a power to appoint the capital and income on trust for her children. The settlement provided that if B had no children the property was to be transferred to anyone in respect of whom B may appoint (i.e. a general power) with a gift over in default of appointment in favour of B’s statutory next of kin. B was 61 years of age, unmarried and without issue. She had three first cousins (next of kin) all of whom had attained the age of majority. B and one of her cousins sought to vary the settlement. The other two cousins had not consented and were not joined as parties. The court was asked to approve the arrangement on behalf of any unborn or unascertained persons and the two adult cousins. The court held that it had jurisdiction to approve on behalf of unborn and unascertained persons, but could not approve on behalf of the two cousins. Their consent was required. |

JUDGMENT

| ‘What the subsection required was that the applicant should be treated as having died at the date of the issue of the summons, to find out who in that event would have been her statutory next of kin, and any persons who are within that class are persons whose interest the section provides that the court cannot bind. It is impossible to say who are the statutory next of kin of somebody who is alive, but it is not impossible to say who are the persons who would fill that description on the hypothesis that the propositus is already dead.’ Buckley J |

In Knocker v Youle [1986] 1 WLR 934 the court decided that it could not grant its approval on behalf of beneficiaries with contingent interests in the trust property.

CASE EXAMPLE

| Knocker v Youle [1986] 1 WLR 934 The court decided that it had no jurisdiction in the circumstances. Section 1(1)(b) of the Act was not applicable to a person who had an interest under the trust. The children of the settlor’s four sisters had a contingent interest under the trust, however remote, thus depriving the court of jurisdiction. |

JUDGMENT

| ‘It is not strictly accurate to describe the cousins as persons who may become entitled … to an interest under the trusts. There is no doubt of course that they are members of a specified class. Each of them is, however, entitled now to an interest under the trusts, albeit a contingent one (in the case of those who are under 21, a doubly contingent one) and albeit also that it is an interest that is defeasible on the exercise of the general testamentary powers of appointment vested in Mrs Youle and Mr Knocker. Nonetheless, it is properly described in legal language as an interest, and the word interest is used in its technical, legal sense. Otherwise, the words whether vested or contingent in s 1(1)(a) would be out of place. It seems to me, however, that a person who has an actual interest directly conferred upon him or her by a settlement, albeit a remote interest, cannot properly be described as one who may become entitled to an interest.’ Warner J |

Variation or re-settlement?

Although the 1958 Act gives the court a wide discretion to approve a scheme varying the terms of a trust, there appears to be a limitation on this discretion. The courts have adopted the policy of not ‘rewriting’ the trust. Accordingly, a distinction is drawn between a ‘variation’ and a ‘re-settlement’. A ‘variation’ retains the basic fundamental purpose of the trust but alters some important characteristic of the trust, whereas a ‘resettlement’ destroys the foundation or substance of the original design or purpose of the trust. Whether a scheme amounts to a variation or a re-settlement will vary with the facts of each case.

CASE EXAMPLE

| Re Ball’s Settlement [1968] 1 WLR 899 A settlement conferred a life interest on the settlor, with the remainder, subject to a power of appointment, in favour of his sons and grandchildren. In default of appointment the fund was to be divided between the two sons of the settlor or their issue per stirpes (i.e. to the son’s issue if either predeceased the settlor). A scheme was proposed for approval by the court whereby the original settlement would be revoked and replaced by new provisions in which the fund would be split into two equal portions each held on trust for each of the sons for life and subject thereto, for such of each of the son’s children equally as were born before 1 October 1977. The court approved the scheme. |

JUDGMENT

| The test is if the arrangement changes the whole substratum of the trust, then it may well be that it cannot be regarded merely as varying that trust. But if an arrangement, while leaving the substratum, effectuates the purpose of the original trusts by other means, it may still be possible to regard that arrangement as merely varying the original trusts, even though the means employed are wholly different and even though the form is completely changed … In this case, it seems to me that the substratum of the original trust remains. True, the settlor’s life interest disappears; but the remaining trusts are still in essence trusts of half the fund for each of the two named sons and their families … The differences between the old and new provisions lie in detail rather than substance.’ Megarry J |

Settlor’s intention

The 1958 Act makes no mention of the settlor or testator. Rules of Court (RSC Ord 93 r 6(2)) have been made requiring the joinder of the settlor, if living, as a defendant to an application under the Act. In exercising its discretion whether to approve an arrangement or not, the function of the court is to determine, by reference to all the circumstances, whether the arrangement as a whole is beneficial to the stipulated class of beneficiaries. However, in the context of deciding whether to approve an arrangement or not, the intention of the settlor or testator is only a factor (if relevant) to be taken into consideration by the court. But the settlor’s or testator’s intention is certainly not an overriding factor, nor even a weighty consideration in determining how the discretion of the court is to be exercised. The role of the court is not to act as a representative of the settlor or testator in varying the trusts.

tutor tip

‘Variations of trust may affect the trustees’ managerial powers and duties and also the interests of the beneficiaries.’