Discretionary Trusts

Discretionary trusts

AIMS AND OBJECTIVES

By the end of this chapter you should be able to:

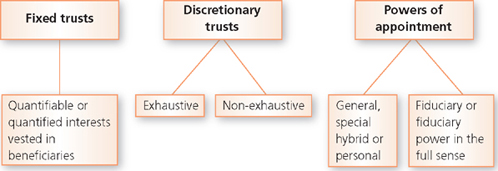

■ define a discretionary trust, distinguish it from a fixed trust and classify discretionary trusts

■ contrast a discretionary trust with a power of appointment

■ list the duties imposed on fiduciaries

■ appreciate the individual and collective interests of objects under discretionary trusts and powers of appointment

■ understand a protective trust under s 33 of the Trustee Act 1925

6.1 Introduction

A discretionary trust exists where the trustees are given a discretion to pay or apply property (the income or capital or both) to or for the benefit of all or anyone selected from a group or class of objects on such terms and conditions as the trustees may see fit. In tax law this type of trust is known as a trust without an interest in possession. The trust is created in accordance with the express intention of the settlor. The relevant property is transferred to the trustees and the scope of the trustees’ discretion expressed in the trust instrument.

For example, S, a settlor, transfers a cash fund of £100,000 to trustees on trust to pay or apply the income and capital (including accumulations of income) to or for the benefit of any or all of the settlor’s children, A, B and C, as the trustees may decide in their absolute discretion.

In this example, a discretionary trust is created in respect of both income and capital. The trustees are required to decide in whose favour the property (income and capital) may be distributed. In Year 1, the trustees may distribute the entire income to A. In Year 2, the trustees may distribute the income and a portion of the capital to B and in Year 3 the income may be distributed equally to A, B and C and the entire capital distributed to C.

Fixed trusts

trust instrument

The instrument setting out the terms of an express trust.

The alternative type of express trust that may be created is a ‘fixed’ trust or a trust with an interest in possession. This is the case if, on the date of the creation of the trust, the settlor has not only identified the beneficiaries under the trust but also quantified the interest vested in each beneficiary. Thus, each beneficiary is entitled to sell, exchange or gift away his interest, subject to provisions to the contrary as detailed in the trust instrument. In a fixed trust the trustees do not have a discretion to decide the extent of the beneficial interest which the objects may enjoy, for example trustees hold specified property on trust for the children of the settlor, D, E and F, in equal shares absolutely. On the date of the creation of the trust, each beneficiary has a fixed one-third share of the fund that he may retain or dispose of as he likes.

Discretionary trusts

Under a discretionary trust, the individual members of the class of objects have only a hope or ‘spes’ of acquiring a benefit under the trust. In other words, under a discretionary trust, the members of the class of objects, prior to the exercise of the trustees’ discretion, do not enjoy an interest in the trust property but are treated as potential beneficiaries and are incapable of disposing of their potential interests by way of a trust.

6.2 Exhaustive/non-exhaustive discretionary trusts

A discretionary trust may be either ‘exhaustive’ or ‘non-exhaustive’. This is determined by reference to the intention of the settlor.

An exhaustive discretionary trust is one where, during the trust period, the trustees are required to distribute the income or capital, or both, but retain a discretion as to the mode of distribution and the persons to whom the distribution may be made. The trustees are required to distribute the income each year as it arises, but have a discretion regarding the persons who may actually benefit.

A non-exhaustive discretionary trust is one where the trustees are given a discretion as to whether or not to distribute the property (either income or capital). A non-exhaustive discretionary trust of income exists where the trustees may legitimately decide not to distribute the income and the settlor has specified the effect of non-distribution; for instance, the undistributed income may be accumulated or paid to another. In short, a non-exhaustive discretionary trust of the income is a trust for distribution of the income coupled with a power to accumulate or otherwise dispose of the undistributed income.

For example, a settlor transfers £50,000 to trustees, T1 and T2, upon trust to distribute the income in their discretion in favour of the settlor’s children, A, B and C, as the trustees may decide in their absolute discretion. At this stage this is an exhaustive discretionary trust of the income in favour of the children of the settlor. But if the settlor had inserted in the trust instrument a power to accumulate the income in the trustees’ discretion, the trust would become non-exhaustive with regard to the income.

It follows that the distinction between an exhaustive and non-exhaustive discretionary trust is based on the power of the trustees to refrain from distributing the property that is within the discretion of the trustees. In the ordinary course of events the trustees will be required to accumulate the income that has not been distributed. The accumulated income is treated as capitalised income or capital in both trust law and tax law. In IRC v Blackwell Minor’s Trustees (1925) 10 TC 235, the accumulation of undistributed surplus income at the discretion of the trustees was treated as capital of the beneficiary, and not liable to income tax.

6.3 Period of accumulation

Prior to its abolition, the period of accumulation was determined by reference to a number of statutory provisions. The combined effect of s 164 of the Law of Property Act 1925 and s 13 of the Perpetuities and Accumulations Act 1964 was that the settlor became entitled to select any one (but only one) of a specified number of periods as the maximum period during which the trustees may accumulate the income. These periods were unduly complex, and outlived their usefulness.

The Perpetuities and Accumulations Act 2009 was passed, following the recommendations of the Law Commission in its report published in 1998. The Law Commission analysed the policy behind the rule against excessive accumulations and decided that the application of the current principles were disproportionate and unnecessarily complex, and ought to be abolished, except for charitable purposes, where the period ought to be modified. The reason for dealing separately with charitable trusts is that it was regarded as being in the public interest to restrict the period for which income may be accumulated. In its report, the Law Commission concluded as follows:

QUOTATION

| ‘In relation to the rule against excessive accumulations, the Law Commission found that there was no longer a sound policy for restricting settlors’ ability to direct or allow for the accumulation of income, except in the case of charitable trusts (for which there is a public interest in limiting the time for accumulations, so that income is spent for the public benefit, rather than accumulated indefinitely).’ | |

| Law Commission report 1998 |

Sections 13 and 14 of the Perpetuities and Accumulations Act 2009 reflected the opinion of the Law Commission. This Act came into force on 6 April 2010. Section 13 introduced the general principle and abolished the rule against excessive accumulation, except for charities. The effect is that in the case of a non-charitable trust, the trustees are entitled to accumulate the trust income for as long as they consider reasonable.

Section 13 of the Perpetuities and Accumulations Act 2009:

SECTION

| ‘These provisions cease to have effect- (a) sections 164 to 166 of the Law of Property Act 1925 (which impose restrictions on accumulating income, subject to qualification); (b) section 13 of the Perpetuities and Accumulations Act 1964 (which amends section 164 of the 1925 Act).’ |

With regard to charitable trusts, the Law Commission’s recommendation for a modification of the accumulation period was enacted in s 14 of the Perpetuities and Accumulations Act 2009. It was considered to be in the interest of the public that charitable income, including accumulated income, be distributed within a short period of time. This was considered to be a period of 21 years. Thus, income accumulated for charitable purposes is required to be distributed by the trustees within 21 years from the date that the income accrued. A power inserted in the trust instrument which exceeds the statutory period is valid for 21 years and void in respect of the excess period.

SECTION

| Section 14 of the Perpetuities and Accumulations Act 2009: ‘(1) This section applies to an instrument to the extent that it provides for property to be held on trust for charitable purposes. (2) But it does not apply where the provision is made by a court or the Charity Commission for England and Wales. (3) If the instrument imposes or confers on the trustees a duty or power to accumulate income, and apart from this section the duty or power would last beyond the end of the statutory period, it ceases to have effect at the end of that period … (4) The statutory period is a period of 21 years starting with the first day when the income must or may be accumulated as the case may be.’ |

6.4 Reasons for creating discretionary trusts

6.4.1 Flexibility

Where a settlor wishes to make a present disposition on trust but is uncertain as to future events and would like the trustees to react to changed circumstances and the needs of the potential beneficiaries, he may create a discretionary trust. This would require the trustees to take into consideration the circumstances, including fiscal factors surrounding individual members of the class of objects. The trustees may well take into account that the distribution of income will be more tax-efficient if paid to objects with lower income, and transfers of capital may be more beneficial to those with larger incomes. The effect is that the discretionary trust has the advantage of flexibility. The settlor may nominate himself as one of the trustees and, even if he does not, he may still be entitled to exercise some influence over the trustees.

6.4.2 Protection of objects from creditors

Since an object under a discretionary trust is not entitled to an interest in the trust property, prior to the exercise of the discretion in his favour, but is merely entitled to a hope of acquiring a benefit, the bankruptcy of such an object does not entitle the trustee in bankruptcy to a share of the trust fund. The trustee in bankruptcy is only entitled to funds paid to the object in the exercise of the discretion of the trustees. Moreover the trustee in bankruptcy is not entitled to claim funds paid to third parties (such as tradesmen and hoteliers) in discharge of obligations bona fide undertaken by the potential beneficiaries.

6.5 Administrative discretion

Discretionary trusts are distinct from the administrative discretions that accompany all trusts. Thus, the trustees may have a power or discretion over the type of investments that may be made by the trust, whether to appoint agents on behalf of the trust, whether to apply income for the maintenance of infant beneficiaries, whether to make an advancement on behalf of a beneficiary, whether to appoint additional trustees, etc. But these powers and discretions are of an administrative nature and do not affect the beneficial entitlement of the objects. Accordingly, the existence of such administrative powers does not create discretionary trusts but is consistent with both fixed and discretionary trusts.

6.6 Mere powers and trust powers

The settlor may authorise another or others to distribute property to a class of objects but without imposing an obligation to distribute the same. This is called a mere power of appointment (or bare power, or power collateral).

prima facie

Of first appearance, or on the face of it.

gift over in default of appointment

An alternative gift in the event of a failure to distribute property under a power of appointment.

In order to dispense with the resulting trust, it is customary for the settlor to insert an ‘express gift over in default of appointment’ in the trust instrument. If this clause is inserted, the objects under the ‘gift over’ take the property unless the donee of the power validly exercises the power. Indeed, prima facie, the individuals entitled on a gift over in default of appointment are entitled to the property subject to such interest being defeated on a valid exercise of the power.

It was pointed out in Chapter 3 that a mere power of appointment may be ‘personal’ or ‘fiduciary’. A ‘personal’ power is one granted to a donee of the power in his personal capacity, such as the testator’s widow in the above example. Such powers impose no duties on the donee of the power, save for a distribution in favour of the objects if the appointor wishes to exercise his discretion. Conversely, a fiduciary power is created where the appointor acquires the property in his capacity as a fiduciary or trustee. A number of fiduciary duties are imposed on the appointor. These were listed by Megarry VC in Re Hay’s Settlement Trust [1982] 1 WLR 202, as a duty to consider periodically whether or not the power ought to be exercised, a duty to consider the range of objects of the power and a duty to consider the appropriateness of individual appointments.

Both personal and fiduciary powers may be released by the appointor, but Warner J in Mettoy Pension Fund Trustees Ltd v Evans [1990] 1 WLR 1587, created a further category of powers, called ‘fiduciary powers in the full sense’. The distinctive feature of this last type of power is that it cannot be released by the appointor. If the donee of the power fails to exercise his discretion the court will ensure that the discretion is exercised in favour of the objects.

6.7 Trust powers (discretionary trusts)

A trust power is in substance a discretionary trust but, in form, the gift resembles a power. The court construes the instrument and decides that, in accordance with the intention of the settlor, a discretionary trust was intended. Accordingly, the trustees may not release their discretion and if they refuse to exercise their discretion the court will intervene.

JUDGMENT

| There are not only a mere trust and a mere power, but there is also known to this court a power, which the party to whom it is given, is entrusted and required to execute; and with regard to that species of power the court considers it as partaking so much of the nature and qualities of a trust, that if the person who has that duty imposed on him does not discharge it, the court will, to a certain extent, discharge the duty in his room and place.’ |

| Lord Eldon in Brown v Higgs (1803) 8 Ves 561 |

CASE EXAMPLE

| Burrough v Philcox [1840] 5 My & Cr 72 |

| The testator transferred property on trust for his two children for life, with remainder to his issue, and declared that if they should die without issue, the survivor should have the power to dispose by will ‘among my nieces and nephews, or their children, either all to one or to as many of them as my surviving child shall think fit’. The testator’s children died without issue and without any appointment having been made by the survivor. It was held that a trust was created in favour of the testator’s nieces and nephews and their children. The trust was subject to a power of selection in the surviving child. |

JUDGMENT

| ‘Where there appears a general intention in favour of a class, and a particular intention in favour of individuals of a class to be selected by another person, and the particular intention fails from that selection not having been made, the court will carry into effect the general intention in favour of the class.’ |

| Lord Cottenham |

On the other hand, in Re Weekes’s Settlement [1897] 1 Ch 289, the court, on construction of the instrument, concluded that a mere power was created.

CASE EXAMPLE

| Re Weekes’s Settlement [1897] 1 Ch 289 |

| The testatrix transferred property to her husband for life with ‘power to dispose of all such property by will amongst our children’. There was no gift over in default of appointment. There were children but the husband died intestate without having exercised the power. It was held that a mere power of appointment was given to the husband and not a trust power. The court was not entitled to intervene in favour of the children. Thus the property was not divided among the children equally but went to the testatrix’s heir. |

JUDGMENT

| ‘[N]ow, apart from the authorities, I should gather from the terms of the will that it was a mere power that was conferred on the husband, and not one coupled with a trust that he was bound to exercise. I see no words in the will to justify me in holding that the testatrix intended that the children should take if her husband did not execute the power.’ |

| Romer LJ |

Ultimately, the question whether a ‘mere power of appointment’ or a ‘trust power’ was created varies with the intention of the settlor. This is a question of fact. Decided cases illustrate how unpredictable this question is likely to be. There are two types of gifts that are consistent with the conclusion that a mere power of appointment was intended by the settlor. These are:

■ The creation of an express gift over in default of appointment. This is an express alternative gift in the event of the donee of the power failing to exercise the power. The settlor has made provision by declaring alternative beneficiaries in the event of the failure to exercise the power, for example ‘50,000 is transferred to trustees to distribute the income for a period not exceeding 15 years in favour of such of the relatives of the settlor as the trustees may decide in their absolute discretion. In the event of the trustees failing to distribute any part of the income to the relatives, Mr X will be entitled to the same’. In this case the clause entitling Mr X to a beneficial interest is an express gift over in default of appointment. The material feature is that the clause is only activated if the trustees fail to distribute the property in favour of the relatives of the settlor. Re Mills [1930] 1 Ch 654 illustrates this principle.

■ A general power of appointment is incapable of being a trust power, for the courts are incapable of exercising such power. A general power of appointment is one which entitles the donee of the power to appoint in favour of anyone, including himself. Thus, there are no limits to the objects of such a power of appointment. Similarly, a hybrid power of appointment is incapable of being a trust power. A hybrid power is similar in appearance to a general power save for the disqualification of an excluded class of objects, for example ‘on trust for X to appoint in favour of anyone except the settlor and his spouse’.

In Blausten v IRC [1972] Ch 256, the settlement gave the trustees the power to introduce any person other than the settlor as a member of a class of objects, but subject to the written consent of the settlor. It was held that a hybrid power of appointment was created.

Likewise, in Re Manisty’s Settlement [1973] 3 WLR 341, the court decided that a hybrid power was created. In this case the trustees were given a power to add objects to a class of potential beneficiaries which excluded the settlor, his wife and certain named persons.

However, a special power of appointment may or may not create a trust power. A special power of appointment confers on the trustee an authority or a duty to distribute the fund in favour of a specific class of objects, such as the children of the settlor. If there is no express gift over in default of appointment, it is extremely difficult to know whether a special power of appointment creates a trust power or a mere power. The issue is one of construction of the terms of the gift. The absence of an express gift over in default of appointment is nothing more than an argument that the settlor did not intend to create a trust. The weight of such an argument will vary with the facts of each case.

JUDGMENT

| The authorities do not show, in my opinion, that there is a hard-and-fast rule that a gift to A for life with a power to A to appoint among a class and nothing more must, if there is no gift over in the will, be held a gift by implication to the class in default of the power being exercised. In my opinion the cases show … that you must find in the will an indication that the testatrix did intend the class or some of the class to take — intended in fact that the power should be regarded in the nature of a trust.’ |

| Romer LJ in Re Weekes’s Settlement (1897) |

ACTIVITY

| Self-test question |

| How would you distinguish a mere power of appointment from a trust power? |

< div class='tao-gold-member'>