Appointment, Retirement and Removal of Trustees

Appointment, retirement and removal of trustees

AIMS AND OBJECTIVES

By the end of this chapter you should be able to:

■ identify when and how an appointment of trustees may be made

■ understand the circumstances as to when a trustee may retire from the trust

■ appreciate the occasions when a trustee may be removed from office

13.1 Introduction

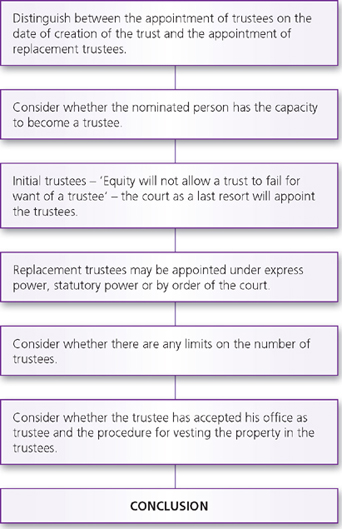

The settlor has the freedom to select eligible persons to be the first trustees. He may appoint the trustees inter vivos or by his will. In the case of an inter vivos trust the settlor is required to transfer the property to the trustees for failure to achieve this result will make the trust imperfect. In the case of a trust created on the settlor’s death, the trust can never be imperfect for the settlor has managed to part with the trust property. If he does not name the trustees in his will or those named are unable or unwilling to act, the trust will still be valid for it is completely constituted and the maxim is ‘Equity will not allow a trust to fail for want of a trustee.’

A replacement trustee will be appointed under express or statutory power or by the court. Similarly, the retirement or removal of a trustee may be effected under express or statutory power or by the order of the court.

13.2 Appointment

There are only two occasions when it may be necessary to appoint trustees:

■ on the creation of a new trust – whether inter vivos or by will; and

■ during the continuance of an existing trust, either in replacement of a trustee or as an additional trustee.

13.2.1 Creation of a new trust

The settlor or testator who creates a trust usually appoints the first trustees. If, in purported creation of a trust inter vivos, the settlor fails to nominate trustees, the intended trust will be imperfect. This principle, however, does not extend to trusts created by wills because, on the death of the testator, the trust becomes completely constituted. The deceased would have managed to part with the trust property. On the assumption that the trust is completely constituted, but the testator does not name trustees in his will or the trustees named are unwilling or unable to act, a replacement trustee will be appointed as on a continuance of the trust (see below). The principle applied here is that ‘Equity will not allow a trust to fail for want of a trustee.’

13.2.2 Continuance of the trust

When a trust is created (whether inter vivos or by will) the trust property (real or personal) vests in all the trustees as joint tenants. The effect is that on the death of a trustee the property devolves on the survivors. This is the effect of s 18(1) of the Trustee Act 1925.

On the death of the sole or surviving trustee, the property vests in his personal representatives, subject to the trust, until replacement trustees are appointed. This principle is enacted in s 18(2) of the Trustee Act 1925.

The authority to appoint replacement trustees is derived from three sources, namely:

■ an express power;

■ a statutory power;

■ the court.

This hierarchical order of authority to appoint trustees is required to be followed strictly. It is only when there is no person in one group willing to make an appointment that the power can be exercised by a person in a different group: see Re Higginbottom [1892] 3 Ch 132, where the majority of the beneficiaries under a trust were not able to prevent the sole executrix of the sole surviving trustee from appointing new trustees.

Express power

The trust instrument may confer the authority to appoint a trustee. This is exceptional because the statutory power to appoint is generally regarded as adequate. The express authority may be ‘general’ or ‘special’. A general authority is one which confers an authority to appoint trustees in any circumstances. If the person named in the instrument is willing to exercise the power, this will be decisive as to the authority to appoint trustees provided that the power is exercised in good faith. If the authority is special (i.e. exercisable in limited circumstances) it would be strictly construed by the courts.

CASE EXAMPLE

| Re Wheeler and De Rochow [1896] 1 Ch 315 A nominee was entitled to appoint trustees in specified circumstances, including the occasion when a trustee became ‘incapable’ of acting. One of the trustees became bankrupt. The court decided that this made him ‘unfit’ but not incapable of acting as a trustee. Thus, the nominee did not have the authority to appoint. |

Similarly, where two or more persons have the power to appoint new trustees, they are required to exercise the authority jointly, unless there are express provisions to the contrary. It follows that such a joint power cannot be exercised where one of the appointors dies or cannot agree on the candidate to be appointed as trustee. This was decided in Re Harding [1923] 1 Ch 182.

Statutory power (s 36 of the Trustee Act 1925)

The statutory power to appoint trustees is contained in s 36 of the Trustee Act 1925 (replacing the Trustee Act 1893). The occasions giving rise to the need to appoint trustees are enacted in s 36(1) (replacement trustees) and s 36(6) (additional trustees).

Replacement trustees (s 36(1))

There are seven circumstances listed in s 36(1) when a replacement trustee may be appointed. These are:

1. When a trustee is dead. Under s 36(8), this includes a person nominated as trustee under a will but predeceasing the testator.

2. Where a trustee remains outside the United Kingdom for a continuous period of 12 months or more. The United Kingdom includes England, Wales, Scotland and Northern Ireland but does not include the Channel Islands or the Isle of Man. The motive for remaining outside the UK is irrelevant; this condition will be satisfied even if the trustee remains outside the UK against his will.

3. Where a trustee desires to be discharged from all or any of the trusts or powers reposed in or conferred on him. Thus, a trustee may retire from part only of the trust.

4. Where a trustee refuses to act. This includes the occasion when the trustee disclaims his office. It is advisable that the disclaimer be executed by deed.

5. Where a trustee is unfit to act. Unfitness refers to some defect in the character of the trustee which suggests an element of risk in leaving the property in the hands of the individual, for example a conviction for an offence involving dishonesty or bankruptcy (see Re Wheeler and De Rochow (1896)).

6. Where a trustee is incapable of acting. Incapacity refers to some physical or mental inability to administer the trust adequately, but does not include bankruptcy (see Re Wheeler and De Rochow (1896)). Under s 36(3), a corporation becomes incapable of acting on the date of the dissolution.

7. Where the trustee is an infant, i.e. a person under the age of 18. Such a person may become a trustee under an implied trust (resulting or constructive). An infant is incapable of becoming an express trustee.

Section 36(1) lists, in chronological order, the persons who are entitled to exercise the statutory power of appointing replacement trustees. These are:

■ The person or persons nominated in the trust instrument for the purpose of appointing new trustees (see the discussion earlier).

■ The surviving or continuing trustee, if willing to act. This subsection was enacted to empower a sole retiring trustee to appoint his successor. It enables a ‘retiring’ or ‘refusing’ trustee to participate with the surviving trustees in appointing a successor (s 36(8) of the Trustee Act 1925). But there is no obligation on such a ‘retiring’ trustee to concur in making the appointment. An appointment by the remaining trustees would be valid if the retiring trustee did not participate in the appointment: see Re Coates (1886) 34 Ch D 370.

A trustee who is legitimately removed as a trustee is not a ‘continuing’ or ‘refusing’ or ‘retiring’ trustee for the purposes of s 36(8). He is a removed trustee. This was decided in Re Stoneham’s Settlement Trust [1953] Ch 59.

■ The personal representatives of the last surviving or continuing trustee. In order to become a surviving or continuing trustee, the property is required to vest in the individual. Accordingly, if all the persons entitled as trustees under a will predecease the testator, the personal representative of the last to die would not be empowered to appoint new trustees. The personal representative of the testator will become the trustee and, subject to provisions to the contrary, will be entitled to appoint new trustees.

Section 36(4) provides that the personal representative of the last surviving or continuing trustee includes those who have proved the will of the testator or the administrator of a person dying intestate.

Section 36(5) provides that a sole or last surviving executor intending to renounce probate shall have the power of appointment of trustees at any time before renouncing probate.

Additional trustees (s 36(6) of the Trustee Act 1925)

Section 36(6) authorises the appointment of additional trustees although no trustee needs to be replaced:

SECTION

| ‘36(6) Where a sole trustee, other than a trust corporation, is or has been originally appointed to act in a trust, or where, in the case of any trust, there are not more than three trustees (none of them being a trust corporation) either original or substituted and whether appointed by the court or otherwise, then and in any such case– | |

(a) the person or persons nominated for the purpose of appointing new trustees by the instrument, if any, creating the trust; or (b) if there is no such person, or no such person able and willing to act, then the trustee or trustees for the time being may, by writing, appoint another person or other persons to be an additional trustee or additional trustees, but it shall not be obligatory to appoint any additional trustee, unless the instrument, if any, creating the trust, or any statutory enactment provides to the contrary, nor shall the number of trustees be increased beyond four by virtue of any appointment.’ |

The subsection is self-explanatory but it may be observed that a trust corporation (corporate professional trustee, such as a bank or an insurance company) has the power of two or more individual trustees. No power exists under s 36(6) to increase the number of trustees beyond four.

Direction of the beneficiaries

Sections 19–21 of the Trusts of Land and Appointment of Trustees Act 1996 (TOLATA 1996) invested new powers in the beneficiaries to direct a retirement of trustees and/or appointment of trustees. These provisions relate to trusts of all types of property (whether land or personalty). But the provisions may be excluded in whole or in part by the trust.

Section 19 of TOLATA 1996 applies where there is no person nominated under the trust instrument to appoint new trustees, and all the beneficiaries are of full age and capacity and collectively are absolutely entitled to the trust property. The beneficiaries have either one or both of the following rights. A right to direct in writing that one or more of the trustees shall retire from the trust, and/or that a named person or persons be appointed, in writing, as new trustee or trustees. The direction may be by way of substitution for a trustee or trustees directed to retire or as an additional trustee or trustees.

tutor tip

‘The mechanics of the appointment, retirement and removal of trustees are of practical significance and integral for express trusts.’