Chapter 5 Wages, salaries, and other earnings ey.com/EYTaxGuide

Ask most people how much they get paid, and, if they are willing to admit anything, they’ll tell you what their salary is. Usually, there’s more to income than that.

The way the IRS sees it, “gross income means all income from whatever source derived.” That means not only is your salary subject to tax, but so are many of the fringe benefits provided by your employer that you might receive—everything from country club memberships and employer-provided discounts to a company car. This chapter spells out in greater detail items of compensation that are taxable.

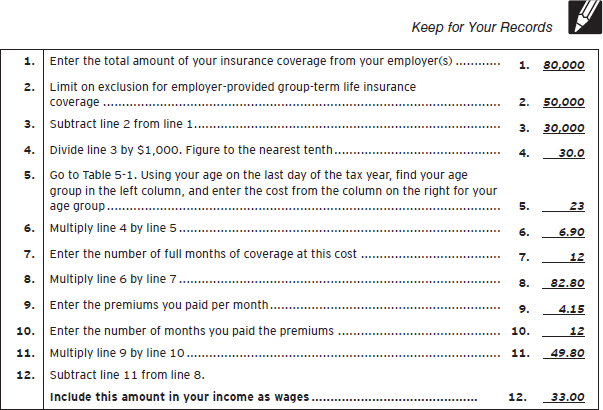

Some fringe benefits you receive from your employer are tax-free. For example, the cost of the first $50,000 of coverage in a group-term life insurance plan will be tax-free if all employees in the plan are treated in the same way. But, if your employer, in a moment of detached and disinterested generosity, presents you with a Rolls-Royce as a gift, you will probably have to pay taxes on it. This chapter prepares you—in a tax sense—for whatever lies ahead.

Foreign income. If you are a U.S. citizen or resident alien, you must report income from sources outside the United States (foreign income) on your tax return unless it is exempt by U.S. law. This is true whether you reside inside or outside the United States and whether or not you receive a Form W-2, Wage and Tax Statement, or Form 1099 from the foreign payer. This applies to earned income (such as wages and tips) as well as unearned income (such as interest, dividends, capital gains, pensions, rents, and royalties).

Withholding on wages. If you’re getting a very large refund when you file your return, remember that you can claim withholding allowances based on your expected deductions for 2015. Claiming more allowances will increase the amount of your take-home pay. For more details, see Getting the Right Amount of Tax Withheld in chapter 4 Tax withholding and estimated tax .

Health Flexible Spending Arrangements (FSAs). If your employer provides you with an FSA (also known as a cafeteria plan), consider taking advantage of it. You can contribute part of your salary to the arrangement on a pre-tax basis (not subject to income, social security, or Medicare taxes). You can then pay for qualified health care expenses (including prescription medication and insurance co-payments) tax-free. FSA coverage and reimbursement are now allowed for your children who are under age 27 as of the end of your tax year. For more details, see Cafeteria Plans chapter 22 , Medical and dental expenses .

401(k) and 403(b) plan contributions. You can reduce your taxable wages (and your tax bill) by contributing on a pre-tax basis to a 401(k) or 403(b) plan sponsored by your employer. In 2014, you can contribute up to $17,500 ($23,000 if you are 50 or older by the end of the year). For more details, see chapter 10 Retirement plans, pensions, and annuities .

Disability Income. If you become disabled, any benefits paid to you while you can’t work are usually taxable income. But if an insurance company pays the benefits, and the premium payments were originally taxable to you, those benefits will not be taxable. Check to see how your employer treats those premium payments. For more details, see Disability Pensions chapter 10 , Retirement plans, pensions, and annuities .

Health Savings Accounts (HSAs). If you are covered by a health plan with a high deductible amount (HDHP) and meet other certain requirements, you may want to consider establishing a health savings account (HSA). Contributions made by you would be a deduction from your adjusted gross income, and contributions by your employer are excluded from your income and are not subject to employment taxes. Similar to FSAs, HSA’s coverage and reimbursement are now allowed for your children under age 27 as of the end of your tax year. For frequently asked questions related to HSAs, see Publication 969, Health Savings Accounts and Other Tax-Favored Health Plans , and additional information included in this chapter.

If you reside outside the United States, you may be able to exclude part or all of your foreign source earned income. For details, see Publication 54, Tax Guide for U.S. Citizens and Resident Aliens Abroad.

This chapter discusses compensation received for services as an employee, such as wages, salaries, and fringe benefits. The following topics are included.

Bonuses and awards. Special rules for certain employees. Sickness and injury benefits. The chapter explains what income is included in the employee’s gross income and what is not included.

You may want to see:

463 Travel, Entertainment, Gift, and Car Expenses525 Taxable and Nontaxable Income This section discusses various types of employee compensation including fringe benefits, retirement plan contributions, stock options, and restricted property.

Form W-2. If you are an employee, you should receive Form W-2 from your employer showing the pay you received for your services. Include your pay on line 7 of Form 1040 or Form 1040A, or on line 1 of Form 1040EZ, even if you do not receive a Form W-2.

If you performed services, other than as an independent contractor, and your employer did not withhold social security and Medicare taxes from your pay, you must file Form 8919, Uncollected Social Security and Medicare Tax on Wages, with your Form 1040. These wages must be included on line 7 of Form 1040. See Form 8919 for more information.

Childcare providers. If you provide childcare, either in the child’s home or in your home or other place of business, the pay you receive must be included in your income. If you are not an employee, you are probably self-employed and must include payments for your services on Schedule C (Form 1040), Profit or Loss From Business, or Schedule C-EZ (Form 1040), Net Profit From Business. You generally are not an employee unless you are subject to the will and control of the person who employs you as to what you are to do and how you are to do it.

Babysitting. If you babysit for relatives or neighborhood children, whether on a regular basis or only periodically, the rules for childcare providers apply to you.

This section discusses different types of employee compensation.

Advance commissions and other earnings. If you receive advance commissions or other amounts for services to be performed in the future and you are a cash-method taxpayer, you must include these amounts in your income in the year you receive them.

If you repay unearned commissions or other amounts in the same year you receive them, reduce the amount included in your income by the repayment. If you repay them in a later tax year, you can deduct the repayment as an itemized deduction on your Schedule A (Form 1040), or you may be able to take a credit for that year. See Repayments chapter 12 .

In some cases, an advance payment of a commission or salary may be considered a loan, thus permitting you to delay paying tax on that amount. If the loan is repaid, you will not have to recognize any taxable income. If the loan is forgiven, you will recognize the amount of the loan as compensation in the year in which it was forgiven. See Canceled Debts chapter 12 , Other income , for a complete discussion. Commissions and salaries are considered to be income when they are paid to you or when they are applied as a reduction to your loan account.

The key question is: When may a payment be characterized as a loan? Generally, for a transaction to be considered a loan, a debtor-creditor relationship must exist from the beginning. In other words, the lending party expects and will eventually receive monetary repayment. Payment in return for a future obligation to render services is not a loan. Thus, an advance on your wages is not a loan. Whether a payment is or is not a loan is usually a question of fact, requiring a review of each case’s unique circumstances.

If you receive an advance of your January 2015 salary on December 31, 2014, you will have taxable income in 2015.

Allowances and reimbursements. If you receive travel, transportation, or other business expense allowances or reimbursements from your employer, see Publication 463. If you are reimbursed for moving expenses, see Publication 521, Moving Expenses.

Back pay awards. Include in income amounts you are awarded in a settlement or judgment for back pay. These include payments made to you for damages, unpaid life insurance premiums, and unpaid health insurance premiums. They should be reported to you by your employer on Form W-2.

Bonuses and awards. Bonuses or awards you receive for outstanding work are included in your income and should be shown on your Form W-2. These include prizes such as vacation trips for meeting sales goals. If the prize or award you receive is goods or services, you must include the fair market value of the goods or services in your income. However, if your employer merely promises to pay you a bonus or award at some future time, it is not taxable until you receive it or it is made available to you.

Employee achievement award. If you receive tangible personal property (other than cash, a gift certificate, or an equivalent item) as an award for length of service or safety achievement, you generally can exclude its value from your income. However, the amount you can exclude is limited to your employer’s cost and cannot be more than $1,600 ($400 for awards that are not qualified plan awards) for all such awards you receive during the year. Your employer can tell you whether your award is a qualified plan award. Your employer must make the award as part of a meaningful presentation, under conditions and circumstances that do not create a significant likelihood of it being disguised pay.

However, the exclusion does not apply to the following awards:

A length-of-service award if you received it for less than 5 years of service or if you received another length-of-service award during the year or the previous 4 years. A safety achievement award if you are a manager, administrator, clerical employee, or other professional employee or if more than 10% of eligible employees previously received safety achievement awards during the year. Example. Ben Green received three employee achievement awards during the year: a nonqualified plan award of a watch valued at $250, and two qualified plan awards of a stereo valued at $1,000 and a set of golf clubs valued at $500. Assuming that the requirements for qualified plan awards are otherwise satisfied, each award by itself would be excluded from income. However, because the $1,750 total value of the awards is more than $1,600, Ben must include $150 ($1,750 – $1,600) in his income.

Differential wage payments. This is any payment made to you by an employer for any period during which you are, for a period of more than 30 days, an active duty member of the uniformed services and represents all or a portion of the wages you would have received from the employer during that period. These payments are treated as wages and are subject to income tax withholding, but not FICA or FUTA taxes. The payments are reported as wages on Form W-2.

Government cost-of-living allowances. Most payments received by U.S. Government civilian employees for working abroad are taxable. However, certain cost-of-living allowances are tax free. Publication 516, U. S. Government Civilian Employees Stationed Abroad, explains the tax treatment of allowances, differentials, and other special pay you receive for employment abroad.

Nonqualified deferred compensation plans. Your employer will report to you the total amount of deferrals for the year under a nonqualified deferred compensation plan. This amount is shown on Form W-2, box 12, using code Y. This amount is not included in your income.

However, if at any time during the tax year, the plan fails to meet certain requirements, or is not operated under those requirements, all amounts deferred under the plan for the tax year and all preceding tax years are included in your income for the current year. This amount is included in your wages shown on Form W-2, box 1. It is also shown on Form W-2, box 12, using code Z.

Note received for services. If your employer gives you a secured note as payment for your services, you must include the fair market value (usually the discount value) of the note in your income for the year you receive it. When you later receive payments on the note, a proportionate part of each payment is the recovery of the fair market value that you previously included in your income. Do not include that part again in your income. Include the rest of the payment in your income in the year of payment.

If your employer gives you a nonnegotiable unsecured note as payment for your services, payments on the note that are credited toward the principal amount of the note are compensation income when you receive them.

Severance pay. You must include in income amounts you receive as severance pay and any payment for the cancellation of your employment contract.

Accrued leave payment. If you are a federal employee and receive a lump-sum payment for accrued annual leave when you retire or resign, this amount will be included as wages on your Form W-2.

If you resign from one agency and are reemployed by another agency, you may have to repay part of your lump-sum annual leave payment to the second agency. You can reduce gross wages by the amount you repaid in the same tax year in which you received it. Attach to your tax return a copy of the receipt or statement given to you by the agency you repaid to explain the difference between the wages on the return and the wages on your Forms W-2.

Outplacement services. If you choose to accept a reduced amount of severance pay so that you can receive outplacement services (such as training in résumé writing and interview techniques), you must include the unreduced amount of the severance pay in income.

However, you can deduct the value of these outplacement services (up to the difference between the severance pay included in income and the amount actually received) as a miscellaneous deduction (subject to the 2%-of-adjusted-gross-income (AGI) limit) on Schedule A (Form 1040).

Sick pay. Pay you receive from your employer while you are sick or injured is part of your salary or wages. In addition, you must include in your income sick pay benefits received from any of the following payers:

A welfare fund. A state sickness or disability fund. An association of employers or employees. An insurance company, if your employer paid for the plan. However, if you paid the premiums on an accident or health insurance policy, the benefits you receive under the policy are not taxable. For more information, see Publication 525.

Social security and Medicare taxes paid by employer. If you and your employer have an agreement that your employer pays your social security and Medicare taxes without deducting them from your gross wages, you must report the amount of tax paid for you as taxable wages on your tax return. The payment also is treated as wages for figuring your social security and Medicare taxes and your social security and Medicare benefits. However, these payments are not treated as social security and Medicare wages if you are a household worker or a farm worker.

Stock appreciation rights. Do not include a stock appreciation right granted by your employer in income until you exercise (use) the right. When you use the right, you are entitled to a cash payment equal to the fair market value of the corporation’s stock on the date of use minus the fair market value on the date the right was granted. You include the cash payment in your income in the year you use the right.

Fringe benefits received in connection with the performance of your services are included in your income as compensation unless you pay fair market value for them or they are specifically excluded by law. Abstaining from the performance of services (for example, under a covenant not to compete) is treated as the performance of services for purposes of these rules.

Accounting period. You must use the same accounting period your employer uses to report your taxable noncash fringe benefits. Your employer has the option to report taxable noncash fringe benefits by using either of the following rules.

The general rule: benefits are reported for a full calendar year (January 1–December 31). The special accounting period rule: benefits provided during the last 2 months of the calendar year (or any shorter period) are treated as paid during the following calendar year. For example, each year your employer reports the value of benefits provided during the last 2 months of the prior year and the first 10 months of the current year. Your employer does not have to use the same accounting period for each fringe benefit, but must use the same period for all employees who receive a particular benefit.

You must use the same accounting period that you use to report the benefit to claim an employee business deduction (for use of a car, for example).

Form W-2. Your employer must include all taxable fringe benefits in box 1 of Form W-2 as wages, tips, and other compensation and, if applicable, in boxes 3 and 5 as social security and Medicare wages. Although not required, your employer may include the total value of fringe benefits in box 14 (or on a separate statement). However, if your employer provided you with a vehicle and included 100% of its annual lease value in your income, the employer must separately report this value to you in box 14 (or on a separate statement).

In most cases, the value of accident or health plan coverage provided to you by your employer is not included in your income. Benefits you receive from the plan may be taxable, as explained later under Sickness and Injury Benefits.

For information on the items covered in this section, other than Long-term care coverage , see Publication 969, Health Savings Accounts and Other Tax-Favored Health Plans.

Long-term care coverage. Contributions by your employer to provide coverage for long-term care services generally are not included in your income. However, contributions made through a flexible spending or similar arrangement (such as a cafeteria plan) must be included in your income. This amount will be reported as wages in box 1 of your Form W-2.

Contributions you make to the plan are discussed in Publication 502, Medical and Dental Expenses.

Archer MSA contributions. Contributions by your employer to your Archer MSA generally are not included in your income. Their total will be reported in box 12 of Form W-2 with code R. You must report this amount on Form 8853, Archer MSAs and Long-Term Care Insurance Contracts. File the form with your return.

Health flexible spending arrangement (health FSA). If your employer provides a health FSA that qualifies as an accident or health plan, the amount of your salary reduction, and reimbursements of your medical care expenses, in most cases, are not included in your income.

Note.

Only gold members can continue reading.

Log In or

Register to continue

463 Travel, Entertainment, Gift, and Car Expenses

463 Travel, Entertainment, Gift, and Car Expenses 525 Taxable and Nontaxable Income

525 Taxable and Nontaxable Income