Using Economic Measures for Global Control of Air Pollution from Ships

Chapter 16

Using Economic Measures for Global Control of Air Pollution from Ships

Shuo Ma*

1. Introduction

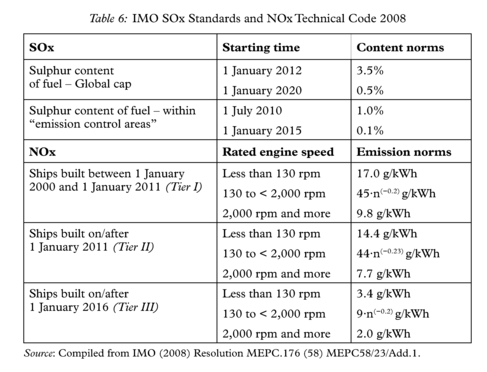

It is claimed that maritime transport is environmentally friendly due to the fact that the CO2 emission to transport one tonne of cargo for one kilometre is 15 grams for a 8,000 dwt vessel; 50 grams for a heavy truck, and 540 grams for a Boeing 747 freighter.1 However there is no guarantee that this “green” image will always be associated with shipping since great efforts have been made in recent years to reduce the emission levels of other modes of transport, with higher standards continuously being introduced, while no corresponding improvements have been evident in the maritime transport sector. It is estimated that should the current development trends continue shipping will become a major source of air pollution. For example, it has been reported that before 2020, international shipping would overtake all land-based transport to be the biggest emitter of both NOx and SOx in Europe (Friedrich, Heinen and Kamakaté, 2007). It is clear that specific and bold actions have to be taken urgently if the shipping sector is to massively reduce air pollution levels. Given the growth perspective of seaborne trade, the environmental challenges faced by the international shipping community are enormous.

To address the air pollution problems caused by the shipping industry, traditional approaches are insufficient. As far as international shipping is concerned, the International Maritime Organisation (IMO) is the main regulatory body. Here the control method is to set up technical standards then leave the enforcement to the IMO Member States. This approach is often referred to as the “command-and-control” method which has the advantage of being clear, flexible and enforceable. However, it may be argued that such approaches lack efficiency because by using uniform standards the differences in pollution control costs between polluters are ignored. Economic approaches, which are also called market-based instruments, take these costs into consideration by giving economic incentives to those polluters whose control costs are low, and consequently encouraging the employment of new and more advanced control technologies. Market-based instruments have been successfully used in a number of non-maritime situations. It is therefore time for the maritime community, within the framework of the IMO, to embrace these economic approaches and use them as supplementary tools in reducing emissions from ships and achieving overall environmental objectives.

At the IMO, the market-based instrument is a relatively new concept which has not been fully understood or appreciated. This chapter has three objectives: first, to explain why economic approaches can lead to a better and more cost efficient emission control; second, to analyse the two major market-based instruments and their application to the reduction of ship-originated emissions; and third, to suggest an integrated approach using both standards and market-based instruments for the control of emissions from ships. The chapter is divided into six sections. After the introduction, Section 2 presents the theoretical framework and analyses the features of the economic control method; Section 3 discusses the reasons that economic approaches have not been used in shipping related environmental regulations; Section 4 looks into the necessity of introducing market-based instruments in maritime environmental regulations; Section 5 concentrates on the application of market-based instruments in shipping; and finally, Section 6 presents the conclusion.

2. For Environmental Protection, Public Intervention is Necessary

One of the cornerstones of the market economy is the clearly defined property rights, which are exclusive, transferable and protected. In the absence of such property rights, markets will fail. This actually is the case of environmental goods. These goods (i.e. environment benefits or damages) have the characteristics of public goods. For instance, there is no individual person who can be identified as the exclusive victim of air pollution incurred in a harbour. Contrary to exclusive property rights, which imply private and individual ownership, public goods are characterised as non-exclusive in consumption. This means that the damage caused to one person does not increase or reduce the amount of damage to another person. Expressed in another economic concept, environmental products have a zero marginal cost. Such a weakness or absence of property rights may result in an inefficient allocation of resources and a failure to achieve environmental objectives, as there is a lack of any incentive for a rational person to make an investment since s/he cannot own, and transfer, the full benefits.

Marine environmental products, which are the same as any environmental product, create an external cost or externality. Because of this, public intervention is desired to internalise such a cost. A ship, for example, emits exhaust air into the atmosphere during operations either on the high sea or close to the coast. Such emission travels and may harm the health of a population far away. Obviously the ship owner and the sufferers do not have any contractual relationship between them and the environmental product, or the emission, is not priced and stays outside the market. Often it is practically impossible for the sufferer to identify the exact polluter who has caused the damage. Consequently, the production cost incurred to the producer, who uses this to determine the production level in order to maximise profit, is incomplete and in the case of negative externality it is at a lower level than it actually should be. Such a

distorted cost curve leads to the ship owners to produce more than they should, resulting in badly allocated resources.

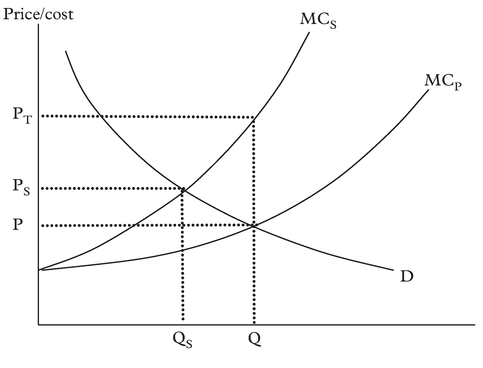

This situation is illustrated in Figure 1 where the demand curve for the port service, as represented by D, is also the curve for marginal revenue in the case of a competitive market. MCP is the marginal cost for the shipping company and MC is the marginal social cost which includes the environmental cost associated with the shipping operation. In this case MCS is always higher than MCP since the externality is negative and the society bears both the costs of production and the environment-related costs resulting from the production. However, with unpriced environmental costs, the company considers only its direct marginal cost and it will maximise its surplus by keeping the transport production at Q. Such a production level will incur a marginal production cost at P and a marginal social cost at PT, creating a net externality cost (PT – P). In the above case such external costs are therefore paid by the victims of the pollution, their families, insurance and the social security system whenever applicable. The figure indicates further that if such externality is internalised, i.e. the shipping company is made to cover the social cost PT, then the producer will reduce the production to arrive at new demand–supply equilibrium. The production is therefore reduced to QS, at which point the company has to raise its price, which is based on the marginal social cost curve, to PS. Also, at this reduces the production level, the external cost diminishes and the total social cost decreases too, to PS.

Since the market fails to reflect an important part of the production cost in the final price of transactions, the social cost is unfairly paid for by society rather than by those who benefit from the transaction. To correct this, government intervention is required for the purpose of internalising the external costs.

2.1 Economic instruments are better than regulatory instruments

As far as government intervention is concerned, there are generally two approaches. The first is to use economic instruments such as emission tax or emission trading

schemes. The second is to use rules and regulations in the form of compulsory emission standards which are often referred to as the “command-and-control” (CAC) method. This approach consists of the promulgation of laws, rules and regulations with the specification of objectives, standards, technologies and operational procedures that polluters must comply with. In the broad context of such laws and regulations, specific rules and standards are normally established aiming at agreed objectives. From both the theoretical and practical viewpoints, each of the regulatory and economic approaches has advantages and disadvantages.

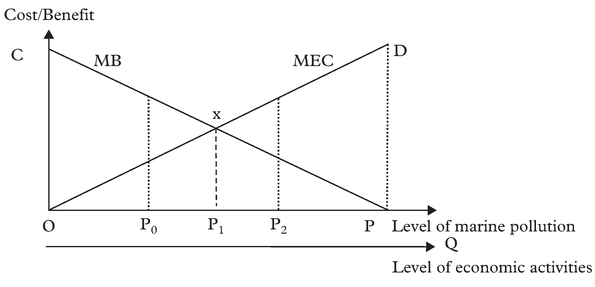

Using the “command-and-control” method, pollution could be controlled to its optimal level through a “bargaining” process. This is because the optimal pollution level is achieved when the marginal benefit (MB) (or marginal control cost – MCC) and marginal external cost (MEC) are identical. While the MB or MCC can be measured, the calculation of the level of MEC in a precise manner is difficult. The method commonly used for the measurement is called “willingness to pay” (Ma, 2002) where the equilibrium of the two costs is normally achieved by a process of “competition”. This means that under the pressure of the public opinion, which can be represented by, say, two opposing interest groups, such as pro-business versus pro-environment groups, the emission standard would then be negotiated and moved, mostly by the government or similar public authorities, towards the optimal level of pollution.

This phenomenon can be seen in Figure 2 above. If the initial standard is set at P0 which is stricter than the optimal level for the society at P1, such a policy would generate strong opposition from the producers who would request for the standard to be revised. Then a re-evaluation of the pollution damage and pollution control costs would reveal that the initial standard is too stringent and as a consequence an adjustment is likely to be undertaken in such a way that more pollution would be allowed. By the same token, if the emission standard is too relaxed at P2, which is below the optimal level of pollution, public opinion would lean towards the advocates of the environment which would lead to a strengthening of the rules with the amount of pollution being permitted at a lower level.

Such a pollution standard setting mechanism can also be seen in the establishment of maritime legislation at, for example, the IMO. At any given time and for a particular item of maritime regulation, optimal standards are sought through consultation, negotiation, debate and discussion; a “competitive process” amongst various interest groups which are most often countries or groups of countries. As an outcome of such policy making, or standard-setting process, the optimal pollution level, which is also the optimal regulation level, is realised. An important implication of this analysis is that the bigger the differences between the interest groups, the harder the process will be and the longer time it will take to reach a compromise. It is also true that the bigger the divergence, the lower the average satisfactory level of all the stakeholders, due to the fact that the “optimal” standards please neither business-minded nor environment-minded people.

The “command-and-control” method has several advantages, which have made it appealing and become the principal way of pollution control of most governments. Firstly, it is straightforward and with often an explicit target and clearly defined technical or numerical norms; Secondly, when a substance is known to be extremely harmful, e.g. a particular type of paint used on ships, it can effectively limit or eliminate the substance from the market; Thirdly, the producers may like this method partly because the industry input is often called for when the standard is set and partly because it may be perceived as being a fair treatment to all producers; Fourthly, this approach is quite attractive to both the environmentalists and the politicians because emission standards, which may well be in the form of strong statements, have an symbolic value to demonstrate the activeness of a decision maker in response to the expectations of specific interest groups or the general public (Stavins, 1998). The regulatory instruments or the “command-and-control” approach have a number of shortcomings too. One of the most important weaknesses is that when the technological level of different producers is not the same, which in most cases is the reality, a single uniform emission standard will prove to be ineffective, as shown in Figure 3 below.

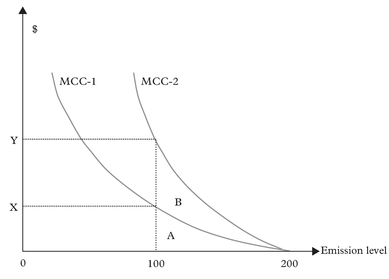

In Figure 3, two ships are operating in a market and they each use a different pollution control technology, with ship 1 using a better technology and thus having a lower marginal pollution control cost (MCC-1) than ship 2 (MCC-2). Supposing an environment mandate is fixed to control the total amount of emission up to 200 units and consequently, the public authority sets a uniform emission standard of 100 units for each of the two ships, the pollution control cost for ship 1 would be represented by area A and that for ship 2 would be represented by area A + B. From the figure, it can be clearly seen that to control the level of emission to 100 units, ship 1 spends much less than ship 2 (Y – X). The total pollution control cost would have been much lower if ship 1 had controlled more than 100 units while ship 2 had been allowed to control less, correspondingly, than 100 units. Obviously, it is when the marginal control cost is the same for both ships that the lowest total control cost would be achieved. When single emission standards are applied, no distinction is made between the ships in terms of the type of technology they use. So, by the uniform emission standard the most cost-effective pollution control can only be achieved if all the ships in question are using identical emission processing technology, therefore having the same pollution control costs. The reality is that in maritime transport, as in most other sectors, such a condition does not exist.

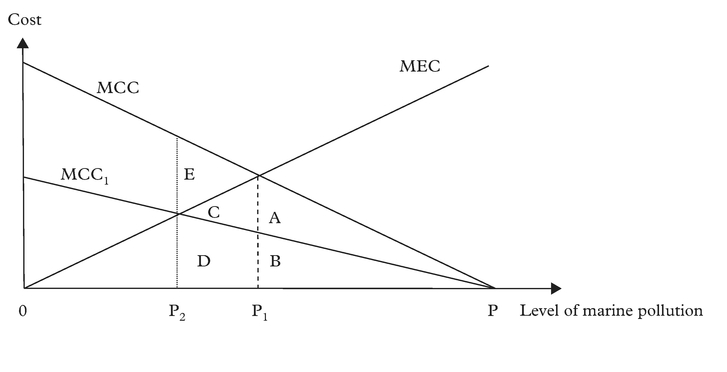

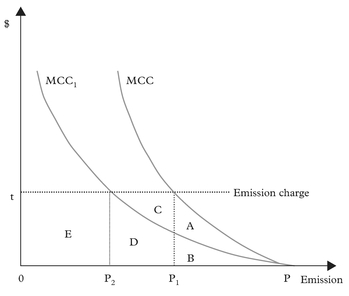

Another important shortcoming of regulatory instruments is that the very principle of determining the emission standard level may well become a counterproductive factor to discourage shipping companies to invest in new technology. We can use Figure 4 below to illustrate this point. As explained above, the optimal pollution level at which an emission standard is established by the public authority is generally achieved through a competitive bargaining process and such a standard is stabilised and generally accepted when it is close or at the intersection of the marginal control cost (MCC) and the marginal external cost (MEC). Such a principle however implies that when costs change, either the MCC or MEC or both, the emission standard ought to be re-established against the point of the new equilibrium. This is, in fact, where the problem arises. Assuming that without regulation, a shipping company would not have taken any pollution processing measures and would have emitted all waste at point P,

whereas, with a proper regulation, the initial emission standard was set at P1. At this point, the ship’s pollution control cost is A+B. By regulation, the ship cannot emit more than P1, but theoretically, it can improve its profitability by reducing the control cost if new technology is introduced. For the ship owner to invest in this nonetheless, s/he has to be convinced that the cost savings from the use of the new technology will be big enough to recover the investment. Assuming the use of the new technology would enable the ship owner to shift the marginal control cost from MCC to MCC1, and given that the emission standard is always at P1, the new control cost would be B, the area below the MCC1 curve, and the net cost saving would be area A. However, the ship owner knows very well that such an investment would lead to a reduction of the marginal control cost to MCC1 and consequently provide the regulatory authorities and advocates of the environment with an argument to revise the emission standard by making it more stringent. In such a case, to satisfy the principle of equilibrium of MCC and MEC, the emission standard would be set at P2 and the cost savings for the ship owner from the use of the new technology would only be A–D.

From the above analysis, we can see an important implication that the bigger the technological innovation is, the larger the reduction in the pollution control cost will be. Given the increasing public awareness and global concern about the environment, the marginal external cost curve (MEC) would unlikely to be higher in the future. So a reduction in the control cost would drive the balance of the two costs to the left, which means the likelihood of more demanding regulations. With regard to the use of new ship technology, a break-even point exists beyond which the extra cost represented by area D will be bigger than the cost savings represented by area A. This in itself constitutes a disincentive for ship owners to adopt new technology. In addition, there are often high financial and technical risks associated with the application of many major maritime technological innovations. As a result, a ship owner might rather refuse, delay or hide the use of a new technology.2

2.2 The main features of economic instruments

In contrast to the above, economic instruments for pollution control have a number of advantages over the “command-and-control” or regulatory approach. By properly employing a market solution, the public authority can effectively achieve the objective of pollution control with minimum abatement costs. As indicated earlier, economic instruments usually come in the form of emission charges (or pollution levy or tax) or tradable emission permits where, for example, shipping companies receive an incentive for pollution abatement on a sustainable basis. As a result, government intervention is minimal, and, most important of all, producers are encouraged to adopt new and better technologies of pollution abatement.

What is an emission charge? It is a kind of levy expressed in per unit money terms on pollutants, for example USD xx/tonne of CO2. It is generally imposed by a public authority on producers for the effluent generated from the production. The tax actually represents a message that “pollution is not free”. We can see, with the help of Figure 5, how an emission charge would encourage a shipowner to invest in a better method of pollution control and in the use of new technology. Without a pollution tax, the shipowner has no incentive to control pollution and the emission level would be at point P. With an emission charge t imposed and given the marginal emission control cost being MCC, it is in the ship owner’s interest to control the emission to P1 as it

would cost less to control the emission than to pay the tax. For the ship, keeping the emission level at P1, the total emission control cost would be the area represented by A + B and the total emission charge payment would be C + D + E. Assuming there is new technology available, its use will enable the ship to reduce its marginal control cost from MCC to MMC1. Should such a technology be employed, the total control cost would be the area B + D and the tax payment would be E. So the net cost savings would be A + C with A as control cost savings and C as tax cost savings. Note that in the same situation the total cost savings would only be area A if the regulatory instrument with uniform emission standard is applied. Therefore, area C represents an extra incentive for the shipowner to invest in new technology.

Other advantages of emission charge, apart from the positive impact on the use of new technology, are the following: it provides more opportunities to be a fair as the chances for special interest groups to influence standards is limited. It requires less government intervention than the regulatory approach. It rewards environmentally efficient ships and penalises the inefficient ones. It generates an income, which can be used to support the administration of the system. The emission charge as a pollution control instrument is not perfect. Its major weaknesses are: first of all it is difficult and costly to determine the right charge level, to monitor the pollution and to exercise policy enforcement; Secondly, as a tax, it represents a financial burden on producers. It may therefore create an unfairness between producers if the tax is not levied universally; Thirdly, with market fluctuation, in the short-term, when the market is high, producers, short of sufficient control capability, may prefer to pollute more even by paying higher emission charges.

The idea of tradable emission permits finds its origin in the Coase theorem on property rights (Coase, 1960). When first proposed in the 1960s, it was considered as

an improvement to the emission standard instrument whereby the public authority, instead of simply decides on pollution standards, defines the total amount of allowable emission which corresponds to the total amount of tolerable pollution (Dale, 2002) and leaves the market to decide on who can pollute how much. The tradable emission permit is in essence designed to create a market for pollution rights. What is specific with the emission trading instrument is that the public authority also allocates the initial pollution rights or permits among polluters and allows them to trade such permits freely. For tradable emission permits instruments to function, the following conditions have to be satisfied.

- a polluter, a ship for example, has a legal right, in the form of permits, to pollute;

- such rights are clearly defined; any excess of permitted amount is subject to penalty;

- public authorities define the total amount of permits and distribute or sell initial permits to polluters;

- pollution permits are freely tradable in the market place.

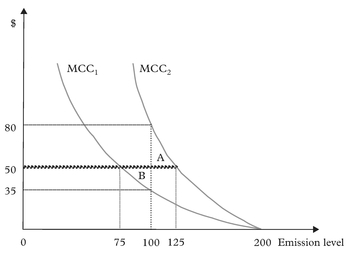

Given the above conditions, an emission permit trading system can achieve the environmental objectives with cost efficiency. This is illustrated in Figure 6 where, for the sake of simplicity, we assume that two ships are independently operating in the market. Without any environmental regulation, each ship would discharge 200 tonnes of sulphur dioxide per year into the air from the operation. The public authority, after a consideration of all the relevant aspects and information decides to cut the SOx emission level by half and thus issues a total of 200 emission permits representing 200 tonnes of sulphur dioxide per year. The permits are equally distributed to the two ships, which means that each ship is allowed to emit 100 tonnes of SOx per year into the atmosphere. Supposing that the two ships are employing different technologies for emission control, Ship 1 which is using a more efficient technology, has a marginal control cost represented by curve MCC-1 or $35 per tonne at the one-hundredth tonne of SOx emission level. Whilst for Ship 2, which is using a less efficient pollution control technology, the marginal control cost, represented by MCC-2, is $80 per tonne at the one-hundredth tonne of emission level. Since the emission permits are transferable, the two ships would engage in mutually beneficial negotiations of permit trading. For Ship 1, it is in its best interest to control more pollution and at the same time sell some of the permits to Ship 2 as long as the extra control cost is less than the income for the transfer. Similarly, Ship 2 would also find it beneficial to control less pollution and at the same time buy the corresponding emission permits from Ship 1, so long as the control cost savings is more than the price paid for the extra permits. From Figure 6, we can see clearly that this is exactly the case. The two ships would continue their negotiations and transactions until the marginal control cost curves of the two ships are the same, the point at which no more benefits can be drawn from the trading. This point of equilibrium corresponds to the price of the permit at $50 per tonne. Ship 1 has a total benefit from selling permits equivalent to area A and Ship 2 has a total benefit saving in control cost equivalent to area B. From the above analysis we can conclude that, by using tradable emission permit instrument, while the total emission level remains the same at 200 tonnes, both ships are better off and so is the society since the total pollution control cost is reduced. The positive impact of this tradable pollution permit on the use of new technology is similar to the pollution tax as shown in Figure 5.

Other important implications of emission trading can be derived from the above discussions.

- Under the condition of freely tradable permits the initial distribution of pollution permits, which is often considered to be a critical and difficult activity of the public authority, has no effect on how the permits are finally allocated among polluters through the market mechanism. Obviously the fair allocation of initial permits is an important issue.

- The example in Figure 6 is a simple case of only two ships. However, the tradable pollution permit instrument works even better in a bigger market with larger number of parties involved in the transaction of emission permits.

- By free trading, the best allocation of environmental resources is achieved, which means that efficient technology is rewarded by being utilised to the maximum while inefficient technology is discouraged through minimal use.

- Thanks to the free emission trading market, environmental products have a price; for example in Figure 6, the equilibrium price is $50 per permit.

- The amount of transactions is positively correlated with the differences of marginal pollution control cost, or the technology level, among the ships: the bigger the divergence of technological levels among ships, the more the trading will be and vice versa.

- The permit price level is negatively correlated with the average marginal control cost or the average level of technology: the higher the average level of technology, the lower the permit price, and vice versa.

- There is no limit to newcomers, even when the maximum emission level has been attained in a market. The emission permit trading policy encourages new and more efficient ships to enter the market by purchasing the emission needed.

From the analysis of pollution tax and emission permit trading, as illustrated in Figures 4 and 5, we can see clearly that the two approaches have the same effect with regard to cost efficiency. Using either of these approaches, the total control costs can be minimised and the positive impact on incentives to use new technology is also similar. The ultimate choice by the authority between the two methods depends on the following aspects. First, the non-economic factors, such as political acceptability, are very important influential elements, effluent tax being often rejected because of the political sensitivity. Secondly, aspects concerned with implementation costs; this includes the transaction cost, for example in the case of emission permit trading, or control cost. Thirdly, are the case-specific factors.

3. For the Prevention of Pollution from Ships, Economic Instruments have not been Used

Given the nature of the sector, the environmental regulation of maritime transport has a unique character that it is more regulated at the international level rather than at national levels. In 1958, the International Maritime Organisation (IMO), which is a specialised agency of the United Nations, was created

“to provide machinery for cooperation among Governments in the field of governmental regulation and practices relating to technical matters of all kinds affecting shipping engaged in international trade; to encourage and facilitate the general adoption of the highest practicable standards in matters concerning maritime safety, efficiency of navigation and prevention and control of marine pollution from ships”(UN, 1948).

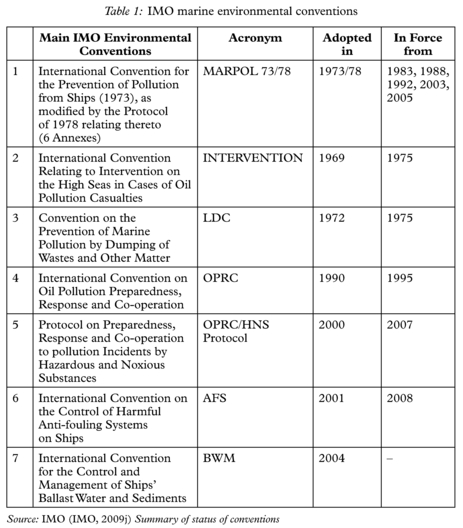

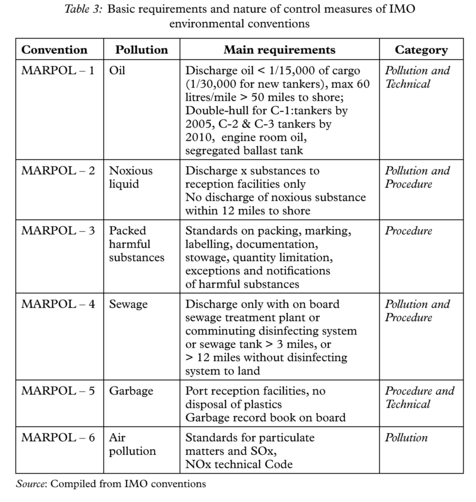

Since then, the IMO has produced many international treaties, conventions and agreements. The current number of IMO conventions totals 29, seven of which are in the area of marine environment protection; six being in force and one, the convention adopted in 2004 on ballast water management, not yet in force. These conventions are summarised in Table 1. Among the seven IMO environmental conventions, MARPOL 73/78 is the most important covering a wide range of aspects of ship-originated pollution. This convention addresses different aspects of pollution from ships through its six annexes which have been amended several times according to the need. These Annexes have entered into force on various dates with the latest, Annex VI on air pollution from ships, entering into force in 2005.

3.1 Accidental versus operational pollution from ships

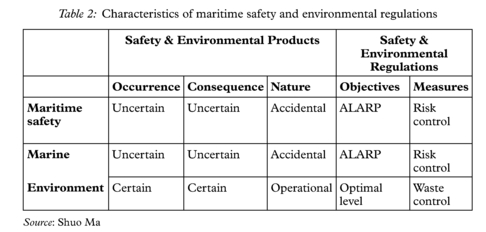

There are many similarities between maritime safety and marine environment protection regulations. This is because when an incident or accident occurs, it very often presents a threat to both the humans on board the ship and to the surrounding environment. However, there is a remarkable difference between maritime safety and environmental protection; while maritime safety related regulations exclusively deal with accidental cases, environmental regulations deal with both accidental and operational cases. If maritime safety and environmental products can be measured by their occurrence and consequences, in other words by the frequency and severity of the safety and/or pollution events, then for all maritime safety and part of marine environmental products, the outcomes are

uncertain. So these products are accidental such as, for example, a ship grounding causing casualties and oil spills. For some environmental products, both occurrences and consequences are fairly predictable. For example, to legally discharge waste oil into the ocean or emit harmful exhausts from the operating engine into the atmosphere. Such discharges are allowed and are deliberately undertaken and are referred to as operational.

Obviously, because of the differences in the nature of maritime safety and marine environmental products, the corresponding regulations should have different characteristics as well. For accidental cases, the political objective might be a total elimination,3 and the statistical objective for the IMO regulations is normally what is called ALARP or As Low As Reasonably Practicable. For operational cases, the objectives are to identify the optimal

pollution conditions and levels and to make sure that these conditions and levels are properly met. Referring to the discussions of the earlier section, this means to find out the marginal environmental damage cost curve and the marginal pollution control cost curve. The type of measures to take in order to implement the regulations is different too. For accidental cases, risk management principles should be followed and techniques should be employed. The IMO conventions such as OPRC and INTERVENTION or double hull requirements for tanker ships in MARPOL Annex I are examples of this type of measures. With regard to operational environmental cases, waste management principles and techniques should be utilised. This may include, for example, setting up the conditions and limits for the discharge of waste, such as oil or sewage into the sea.

To conclude, we can say that the distinction of maritime safety and environmental regulations between accidental and operational categories, as shown in Table 2, is very important in understanding the objectives of the regulations and the appropriate measures to implement.

Given the above distinction, a discussion of regulation instruments can be done based on the basic requirements of the IMO marine pollution prevention conventions. These conventions, in the form of regulations, can be broadly divided into three categories.4

- Pollution standards: These concern the conditions and levels of pollution from ships. Some pollution is totally forbidden, such as TBT-based contents in paint. Some pollution is allowed to take place but with conditions, such as not discharging noxious substances within 12 miles of the nearest shore, or air pollution according to the NOx Code.

- Technical norms: The availability and technical standards of equipment may be required. Most technical norms are imposed on ships such as double-hull tankers, or segregated ballast tanks. Shore-based equipment may also be required, such as reception facilities.

- Procedural requirements: These are standards of operational processes; for example, keeping a bunkering book or a ballast management record on board, the packing, marking, documentation, stowage and notification of harmful substances on board.

Since the sub ject of this chapter concerns the use of economic instruments for ship pollution control, the scope of the discussion should therefore be limited to operational environmental products only. This is because one of the pre-conditions, as discussed in the previous section, is that pollution has to be legal and voluntary.5 This means that a ship should have the legal right to pollute, which is the case of operational pollution, which is mostly addressed by the MARPOL Convention.

Table 3 summarises the MARPOL Convention with an outline of the basic requirements of each of the six Annexes. Each of these regulatory instruments can then be grouped into one of the three categories of pollution standards, technical norms or procedural requirements, as discussed above. All these methods are regulatory instruments coming under the sphere of the “command-and-control” approach.

3.2 Why are “command-and-control” instruments favoured at the IMO?

So far, the IMO has never used an economic approach or market-based instrument in its environmental regulations. As discussed above, the “command-and-control” instruments have been a favourable choice for most public authorities around the world in their environmental policies, and it is only recently that economic approaches have become an option. At the IMO, there are good reasons and powerful arguments in favour of the “command-and-control” approach since a multinational and international maritime regulatory body, using a regulatory or “command-and-control” approach rather than economic method is always considered to be politically more acceptable. Such a situation can be examined from the angles of three groups of people: (1) the maritime industry or the polluters; (2) the governments or the regulators and (3) public opinion.

The shipping industry, such as the shipping companies, shipbuilders, marine engine makers, classification societies, marine insurers, etc. can be considered as the recipients of marine environmental regulations. For them, “command-and-control” instruments are often preferred.6 This is partly because they are relatively simple and less resource demanding than, for instance, an economic solution like pollution tax or tradable permits. This is partly also because pollution standards are almost always made with substantial inputs, in one way or another, directly or indirectly, from the existing industry and large companies. At the IMO, many countries’ delegates include representatives of the leading maritime firms of the country, or clos e consultation and other similar efforts are made so that the leading industry’s opinions are sufficiently represented and their interests adequately reflected in the country’s position vis-à-vis a particular piece of international maritime regulation. The industry’s influence on the regulation setting tends to push the regulation in the direction so as to give advantages for existing companies and constitute some sorts of barriers to newcomers. If an economic instrument is used, only the total amount of pollution is decided by the regulator; the choices of control technology as well as who is allowed to generate how much pollution being totally left to the market to decide. Consequently, the lobbying efforts, the influence and special relationship would be much undermined.

With regard to the government side, the IMO has 170 Member States and territories. These are the makers of international maritime regulations and conventions. When it comes to marine environmental regulations, the governments have also a preference for “command-and-control” instruments, due mainly to three reasons. First, most governments have a tendency to avoid all sorts of risks; agreeing to a new type of tax on, for example, marine bunkers, might be seen as a risky move in the context of the internal politics of a country. It is also because the effects of economic instruments are not always directly presented; as they are more difficult to see, they are seemingly less certain than that of the standards. For example, a bunker tax should encourage operators to control pollution and eliminate inefficient ships from the market, thus improving the environmental performance as a whole. However, the effects of economic driven pollution control measures are only seen in the level of final consumption aggregates, and ship inefficiency may be caused by numerous factors. It may appear to be uncertain as to how much pollution has been reduced and whether or not the most polluting ships have been driven out of the market by the tax. On the other hand, the effects of pollution standards are more certain; such instruments therefore being less risky. Secondly, at the IMO, a UN agency, decisions are made by consensus and resolutions are formulated based on the votes of the member states. It is normal that, in case a choice has