Tracing and Actions Against Strangers to the Trust

Chapter 13

Tracing and Actions Against Strangers to the Trust

Chapter Contents

Actions Against Strangers to the Trust

This chapter considers two subjects, both connected to remedies: (i) the process of tracing and (ii) personal remedies against strangers to the trust. Tracing is the ability to follow property into another’s hands. Personal remedies against a stranger to the trust continues the study of personal actions against individuals who have assisted in the commission of a breach of trust by the trustee. This latter subject builds upon personal actions against the trustee himself discussed in Chapter 12.

As You Read

Look out for the following issues:

what tracing is, what it involves and why it might be more advantageous for a beneficiary to pursue on some occasions as an alternative to a personal action against the trustee;

what tracing is, what it involves and why it might be more advantageous for a beneficiary to pursue on some occasions as an alternative to a personal action against the trustee;

how tracing leads to different remedies at common law and in equity. At common law, tracing may give rise to an action for money had and received; in equity, it renders the recipient of the property liable to account for it as a constructive trustee; and

how tracing leads to different remedies at common law and in equity. At common law, tracing may give rise to an action for money had and received; in equity, it renders the recipient of the property liable to account for it as a constructive trustee; and

how equity might enable a claim to be taken against anyone helping a trustee in committing a breach of trust, or for receiving trust property.

how equity might enable a claim to be taken against anyone helping a trustee in committing a breach of trust, or for receiving trust property.

Tracing

Chapter 12 considered how a beneficiary might pursue a trustee personally for a breach of trust. On occasion, even if a trustee would otherwise be found liable for a breach of trust, it may not be worthwhile for the beneficiary to bring an action against him. If, for instance, the trustee has been made bankrupt, the beneficiary is in no stronger a position than the rest of the trustee’s creditors who are owed by him. The beneficiary will simply have to wait his turn in the queue of general creditors. Alternatively, if the trustee has breached the terms of the trust and has then disappeared, any action against him personally will be all but impossible to commence.

Fortunately, another process is available. It is a proprietary action. This means that it is a right in rem in that it attaches itself to the property itself that has been misused. It is known as ‘tracing’.

Tracing may occur at common law or in equity. Common law tracing involves the trustee pursuing the legal title to property which has found its way into the wrong hands. Equitable tracing offers someone who has benefited from a fiduciary relationship (for example, a beneficiary) the ability to follow the equitable interest in property which has been misappropriated.1

As tracing is a proprietary claim, the claim is not against the recipient of the property personally but instead against the actual property. So, for example, this means that in the event of the trustee’s bankruptcy, the beneficiary is able to circumvent the trustee’s other creditors by claiming that the trust property itself should be returned to the trust and should not be available as part of the trustee’s personal assets to be distributed to his general creditors.

‘Tracing’ was defined by Millett LJ in Boscawen v Bajwa.2 To Millett LJ, tracing was neither a remedy nor a claim in its own right. It was, instead, a process. This process could be pursued not just against a wrongdoer but anyone who had knowingly assisted in a breach of trust or who had received the property, knowing that it was really trust property. ‘Tracing’, said Millett LJ, was:

the process by which the plaintiff traces what has happened to his property, identifies the persons who have handled or received it, and justifies his claim that the money which they handled or received (and, if necessary, which they still retain) can properly be regarded as representing his property.3

What can be shown from this definition is that tracing is where the claimant follows his property and brings a claim to have it — or its value — returned to the trust. It does not matter how many people have handled the property provided that, generally, the trust property remains identifiable. The claim to the property is ‘based on the retention by him of a[n] … interest in the property which the defendant handled or received.’4

A successful tracing claim does not depend on proving that the defendant has been enriched by the claimant’s property. Tracing is not dependent on principles of the law on unjust enrichment5 being met. It can be illustrated diagrammatically in the following example.

EXPLAINING THE LAW EXPLAINING THE LAW |

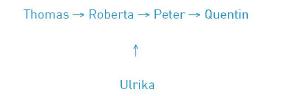

Thomas is a trustee administering a trust on behalf of Ulrika, the beneficiary. Thomas commits a breach of trust by selling trust property to Roberta and then disappears with the proceeds of sale. Roberta sells the trust property to Peter who, in turn, sells it to Quentin. Each of the purchasers is aware that the property is trust property.

Ulrika may, in theory, bring an action against Thomas personally for breach of the trust. But such an action would be difficult as he has disappeared. Instead, Ulrika’s better claim would be against Quentin. She would seek to trace the trust property into Quentin’s hands.

Tracing may be undertaken against the wrongdoer or anyone who has knowingly acquired an interest in the trust property or knowingly assisted in the breach of trust. In Boscawen v Bajwa, Millett LJ identified three defences that a defendant subjected to a tracing process may put forward:

the tracing exercise is not valid because, in reality, the claimant has no claim against the property;

the tracing exercise is not valid because, in reality, the claimant has no claim against the property;

the defendant is a bona fide purchaser of the property without notice of the trust and there-fore takes the property free from the trust; and/or

the defendant is a bona fide purchaser of the property without notice of the trust and there-fore takes the property free from the trust; and/or

the defendant has innocently changed his position since he acquired the trust property.6

the defendant has innocently changed his position since he acquired the trust property.6

At common law, the remedy that tracing leads to is restitutionary. It is for money had and received. The money that the defendant has received must be returned by him to the claimant. Nowadays, this remedy that the claimant enjoys is subject to the defendant successfully arguing that he has innocently changed his position as a result of the money being given to him, or that he acted in good faith and provided full consideration for the money.7

If tracing is pursued in equity, the main remedy that the claimant enjoys is a personal one against the recipient of the property. That would entail the recipient paying equitable compensation to the beneficiary or restoring the trust fund to the value it was worth before the breach of trust occurred.

The claimant may wish to have the trust property returned to him. Thus he may pursue a proprietary remedy against the property itself, or what it has subsequently turned into if the recipient of it has used it in some way. To do so, he must prove that the property is still in the defendant’s hands. If this can be shown, the court may order that the defendant holds the property on constructive trust for the claimant and further compel the defendant to transfer it to him. If the defendant has, however, used the trust property in some way, other proprietary remedies may be open to the claimant to pursue. In Boscawen v Bajwa, Millett LJ gave the example of where trust property had been used to improve a building. The beneficiary may ask the court for a charge over the building to the amount by which the building has increased in value.

Key Learning Point

Tracing is merely the road along which a claimant must travel to seek his remedy. It is not the remedy in itself. The remedy awarded depends if the claimant traces at common law or in equity.

At common law, tracing leads to a claim for money had and received by the defendant. The defendant must return the money he has received — or what remains of it.

In equity, the remedy is normally equitable compensation or, alternatively, a declaration that the defendant holds the money on constructive trust for the claimant and must return it to him.

In both cases, the claimant may generally enjoy an ‘uplift’ if the money has been success-fully used by the defendant to generate further money.

Tracing v Following

Tracing is different from following. As Lord Millett said in Foskett v McKeown, ‘[f]ollowing is the process of following the same asset as it moves from hand to hand’.8 In contrast, ‘[t]racing is the process of identifying a new asset as the substitute for the old’.9

The recent decision in Sinclair Investments (UK) Ltd v Versailles Trade Finance Ltd (in administrative receiv-ership)10 gave the Court of Appeal the opportunity to comment generally on tracing and in particular on (i) when a proprietary interest arises and (ii) what would constitute sufficient notice to defeat a bona fide purchaser’s claim that he bought without notice in good faith.

The facts concerned a fraudulent investment scheme. Versailles Group plc owned the defendant trading company. The main shareholder of Versailles Group plc was Mr Carl Cushnie. Versailles Group plc sought investments from both individuals and banks. Their money would be given to another company, Trading Partners Ltd, again controlled by Mr Cushnie, who would buy goods and resell them. Any money not used to buy goods was to be placed in a bank account. The investors would receive a share of the profits on the goods bought and resold. The defendant company managed the workings of Trading Partners Ltd.

In fact, the money received by Trading Partners Ltd was passed to the defendant company but it was not used as agreed. Instead, it was used to pay the profits to the investors, stolen by Mr Cushnie (to buy a house in Kensington, London, for nearly £10 million) or sent to other companies controlled by Mr Cushnie. Effectively, Mr Cushnie was using the investors’ funds simply to circulate around between the other investors, himself and his other companies. The purpose of such circulation was to inflate (falsely) the value of the defendant’s turnover. Mr Cushnie eventually floated the company and it was listed on the London Stock Exchange. He sold some of his shares for nearly £29 million and distributed the proceeds to various parties including effectively himself and various banks who had advanced loans to him.

Eventually, in 2000, Versailles Group plc collapsed as the scale of the fraud (involving hundreds of millions of pounds) became clear. The traders were owed nearly £23 million. The banks were owed £70.5 million. The claimant in the action was one of the traders that were owed money.

The claimant brought two claims. The first is relevant here: that it was entitled to the proceeds of the shares that Mr Cushnie had sold and which proceeds had subsequently been distributed to, inter alia, various banks. The claimant’s case was that Mr Cushnie held the proceeds on constructive trust for it. This claim was based on Mr Cushnie, as a director, owing fiduciary duties to Trading Partners Ltd not to make a secret profit and not to misuse funds.11 Breach of these duties resulted in a £29 million gain for Mr Cushnie. The claimant said that it was entitled to trace its money through these shares to the eventual recipients (the banks).

Delivering the only substantive judgment of the Court of Appeal, Lord Neuberger MR held tracing required the party to show that he had owned an interest in property which could then be followed. A ‘consistent line’12 of previous Court of Appeal decisions had stated that a beneficiary of a fiduciary’s duties could not claim a proprietary interest in property unless the beneficiary had originally enjoyed an equitable interest in that property. If the beneficiary had owned no interest in the property, his remedy was limited to equitable compensation for breach of fiduciary duty.

Mr Cushnie had not acquired the shares in Versailles Group plc with any money that had originally been owned by Trading Partners Ltd. The claim for the profits of £29 million that Mr Cushnie gained was based on the transaction in which that profit was made. That gave rise to a duty to pay equitable compensation only. As Trading Partners Ltd had not provided the money to purchase the shares originally, there could be no tracing of any of their property to be done through to the eventual profit Mr Cushnie made.

In reaching this conclusion, Lord Neuberger MR disagreed with the Privy Council’s earlier decision in Attorney-General for Hong Kong v Reid.13 Mr Reid was a solicitor who worked as the Acting Director of Public Prosecutions in Hong Kong. He accepted substantial bribes for not prosecuting certain individuals. He purchased three properties in New Zealand with the bribes. The Crown brought an action claiming the value of those properties, which were worth HK  12.4 million. The properties had increased in value from when Mr Reid had originally purchased them.The Privy Council held that the claimant could trace the bribe into the properties.

12.4 million. The properties had increased in value from when Mr Reid had originally purchased them.The Privy Council held that the claimant could trace the bribe into the properties.

The Privy Council decided that a recipient of a bribe held the legal title in that bribe, but that equity would insist that the recipient of the bribe should hold the bribe on trust for the person to whom his fiduciary duties were owed. In this case, that was the Government of Hong Kong. It could not be the provider of the bribe as he had committed a criminal act in offering the bribe. If the bribe was used and increased in value, the beneficiary had to be entitled to that gain as well as the original bribe, to prevent the ‘guilty’ individual from benefiting from breach of his fiduciary duties.

Lord Neuberger MR doubted that the reasoning of the Privy Council was correct in that case. The decision was odd in that the Government of Hong Kong was held to be entitled to recover both the bribe and its gain even though it had never enjoyed an equitable interest in the money used in the bribe. It had never had any proprietary interest in the original money which had, as a bribe, been paid to the corrupt employee by a third party.

Lord Neuberger MR thought that where the beneficiary did not have any equitable interest in property, he could not pursue a proprietary claim. His claim was limited to that of equitable compensation for the breach of fiduciary duty that the fiduciary had committed by conducting the transaction. This conclusion reflected many earlier Court of Appeal cases.14

Making connections

In delivering his judgment, Lord Neuberger MR reminded the court of the doctrine of precedent. There had been a number of Court of Appeal decisions over the previous 95 years deciding that tracing could only occur if the tracing party could show that he had previously owned an interest in the property. Then a Privy Council decision in Attorney-General for Hong Kong v Reid had decided that such Court of Appeal cases were wrongly decided.

Lord Neuberger MR believed that the Court of Appeal must follow its own previous decisions in preference to one of the Privy Council. This had been decided earlier in Young v Bristol Aeroplane Company Ltd15 It was, if necessary, to be left to the Supreme Court to overrule a Court of Appeal decision if it felt it was wrong, not for the Court of Appeal effectively to do that itself by following a Privy Council decision in preference to its own.

Whilst Lord Neuberger MR was not stating anything radical, the effect of his words is perhaps radical, for it involved the rejection of a principle decided by Law Lords sitting as the Privy Council just 17 years previously.

Lord Neuberger MR hesitantly thought that the actual result in Attorney-General for Hong Kong v Reid might be justified on a policy ground, presumably that a corrupt employee in receipt of a bribe should not be allowed to keep the bribe or any profit generated by its use. But the reasoning underpinning the employer acquiring that profit was suspect. It did not depend on tracing. He thought that if the beneficiary, as the employer in Attorney-General for Hong Kong v Reid, was to benefit from the gain made by the fiduciary (the employee), that should be reflected by an increase in the award of equitable compensation, as opposed to holding that tracing could occur without the beneficiary enjoying a proprietary interest in the original trust property. This last point was entirely new as it seems to have been rejected in the earlier leading Court of Appeal decision in Lister v Stubbs.16

Bona fide purchaser for value without notice

In a purely obiter part of his judgment, Lord Neuberger MR addressed the type of notice required for a bona fide purchaser for value of assets to take free of an interest. The banks’ alternative argument was that, when they received the proceeds from the shares sold by Mr Cushnie in partial discharge of their loans, they received it as a bona fide purchaser for value without notice of the Trading Partners’ equitable claim to the money. Strictly this part of the judgment was unnecessary, as Lord Neuberger MR had already decided that there was no tracing claim. But if there was, he considered whether the banks would have had a good defence, based on whether they had notice of Trading Partners’ interest. This depended on what ‘notice’ constituted. It meant whether the banks knew, or should be taken to have known, of the relevant facts surrounding their repayments by Mr Cushnie. But it also revolved around whether the banks should have been taken to know the relevant legal consequences of accepting the money in partial discharge of their loans (i.e. if they knew that the money was paid to them under suspicious circumstances, should then they be taken to have known that the money was probably owned by another party and susceptible to a tracing claim).

Lord Neuberger MR did not believe it was right automatically to say that the banks either knew or should have known of the legal consequences of accepting the money from Mr Cushnie. He said the question was whether:

a reasonable person with their attributes (i.e. those of a responsible large bank with the benefit of highly experienced insolvency practitioners as their appointed administrative receivers) should either have appreciated that a proprietary claim probably existed or should have made inquiries or sought advice, which would have revealed the probable existence of such a claim.17

Lord Neuberger MR held that the trial judge had been right to conclude that the banks were bona fide purchasers for value and took the money without notice of Trading Partners‘ claim. In terms of the facts, it had subsequently been made clear that the transactions made by the group of companies were fraudulent, but that was not apparent at the time the banks accepted the money from Mr Cushnie. As those facts were not clear at the time, it could not be said that the banks should have appreciated the potential legal consequence that the money paid by Mr Cushnie might have been owned by Trading Partners Ltd.

Tracing may occur at common law or in equity.

Tracing at Common Law

Tracing at common law involves following the legal interest in the trust property into another’s hands and claiming that it, or the property it has subsequently become, should be returned to the trust. As it is the legal interest in trust property that is being traced, action will normally be taken by the trustee. Millett LJ has described there being ‘no merit in having distinct and different tracing rules at law and in equity’18 but be that as it may, it seems that different rules do exist. The ability to trace the legal interest of trust property at common law is curtailed more than the right to trace the beneficial interest of the trust property in equity.

The ability to trace at common law

The right to trace trust property at common law is said to arise from the decision in Taylor v Plumer.19 The decision in that case was given by the Court of King’s Bench (a common law court) and so it was, for many years, assumed that the common law therefore gave its own right to trace trust property. It has subsequently been accepted by Millett LJ20 in the Court of Appeal’s decision of Trustee of the Property of F C Jones & Sons (A Firm) v Jones, that the Court of King’s Bench was actually applying equitable principles. Millett LJ’s view was that equity was following the law, as per its maxim, but the law happened not to be declared until much later.

The facts concerned the instruction by the defendant to a Mr Walsh, a stockbroker, to purchase Exchequer bills on his behalf. The defendant gave him £22,200 to effect the purchase. Mr Walsh spent £6,500 on the purchase of Exchequer bills. But then he had a different plan, for his own personal gain. He was insolvent. He planned to use the remainder of the money in the purchase of American government bonds and gold bullion. He duly did so, but not before he had exchanged some of the defendant’s money for a banker’s draft which he then used to buy the gold bullion. He then proceeded to Falmouth, where he was due to board a ship to begin a new life in America.

The defendant heard about Mr Walsh’s plan and managed to send a police officer to intercept him. Mr Walsh surrendered the bullion and the American bonds.

The case came about because Mr Walsh had been made bankrupt. His trustee in bankruptcy brought an action at common law, seeking the court’s decision on whether he was entitled to some or all of the American bonds and bullion. His claim was that they were owned by Mr Walsh and, upon his bankruptcy, passed to the trustee in bankruptcy. The defendant argued that the bonds and bullion were rightfully his, as they had been bought with his money.

Lord Ellenborough CJ held that the defendant was entitled to retain the bonds and bullion as his own property. The property given to Mr Walsh had been subject to a trust in favour of the defendant and the trust still stood. It made no difference that the original money that the defendant had given Mr Walsh had changed its composition into American government bonds and bullion for as Lord Ellenborough said:

if the property in its original state and form was covered with a trust in favour of the principal, no change of that state and form can divest it of such trust.21

Tracing depended, however, on there being a clear link between the original trust property and what that property had been turned into. Here there was a clear link: it was clear that the bonds and bullion were only purchased with the defendant’s money and so the money had been turned into those bonds and bullion.

Where, however, it was not possible to show such a link between the original trust property and what that property had turned into, tracing would not be available. Such an occasion would be where the trust property was turned into money and the money was then mixed with other money. Lord Ellenborough CJ said this gave rise to a ‘difficulty of fact and not of law’22 in that it was then simply not possible to say which of the mixed money was the original trust property. All that would remain would be ‘an undivided and undistinguishable mass of current money’23Tracing original trust property which had been mixed with other money would need to wait for the development of the later equitable rules on tracing.

Key Learning Point

The common law will, therefore, permit tracing to occur provided that the trust property remains clearly identifiable. It is not the case that the common law will not permit money to be traced, merely that the money must have been kept separate from any other money.

Money was kept separate in Banque Belge pour L’Etranger v Hambrouck.24

The facts concerned a company called A M Pelabon which had its bank account with the claimant bank. The company’s chief assistant accountant, Mr Hambrouck, fraudulently forged a number of the company’s cheques and made them payable to himself. He paid the cheques in and, over a period of two years, appropriated £6,680 from the company to himself in this manner. He then wrote cheques to his mistress, Mademoiselle Spanoghe. She paid the cheques into her personal bank account. By the time the fraud was discovered, £315 remained in her account. The claimant bank brought an action for the recovery of that sum. They wished to trace the legal title of the money and reclaim it. The trial judge found the claimant could trace the money. Mlle Spanoghe appealed, claiming that because the money had passed through two bank accounts before it reached her, it was not possible to identify the money which she received as the claimant’s original money.

Two Lords Justices in the Court of Appeal rejected the proposition that tracing could not occur at common law. Atkin LJ pointed out that the only restriction on tracing money identified in Taylor v Plumer was where the trust money could no longer be ascertained. Equity had summoned up the courage since that case25 to go further and hold that tracing could occur in equity where trust money had been mixed with other money and it was difficult to identify the original trust money. Yet here there was no difficulty in identifying the original trust money. The same money belonging to A M Pelabon had been paid into Mr Hambrouck’s personal account. There had never been any other money in his bank account. He withdrew cheques on that account to pay them to his mistress. She paid them into her personal account and again, there was never any other money in that account. The money in Mlle Spanoghe’s account could, clearly, be ascertained as trust money. The process of tracing could thus be undertaken. The remedy in the case was for the claimant to have a claim for money had and received against Mlle Spanoghe.

Not all of the judges in the Court of Appeal reached the same conclusion, illustrating that tracing at common law remains a difficult concept. Scrutton LJ thought that tracing at common law was not possible on the facts, as the money had probably changed its identity when Mr Hambrouck paid it into his own bank account. Scrutton LJ thought that tracing was permitted in equity on the facts of the case.

That tracing at common law remains separate and distinct from tracing in equity and that it can only occur provided the original trust property remains ascertainable was emphasised by the Court of Appeal in Trustee of the Property of F C Jones & Sons (A Firm) v Jones.26

The facts concerned speculation in potato futures. A firm of potato growers was in financial difficulties. One of the partners of the firm gave his wife, the defendant, a cheque for £11,700 drawn on the firm’s account. She used the money to speculate on the London potato futures market. She was very successful at this and the original money grew into a sum of £50,760 which she paid into a deposit account that she had opened. The Official Receiver demanded the money, saying that the original sum had been released by the partnership in breach of trust to her as it had been released to her after the partnership was effectively bankrupt.The Official Receiver’s argument was that it was not the partnership’s money to release to the defendant as it became his when the partnership became bankrupt. As a proprietary action, the Official Receiver wished to trace the original sum into what it had turned into, thus ensuring a large ‘uplift’ if the whole successful investment could be traced.

All three Lords Justices in the Court of Appeal held that the defendant had no legal or equitable title to the money. The defendant held no ownership in the original money at all. The legal title was vested in the Official Receiver when the firm committed an act of bankruptcy. As such, its only claim was to trace the legal title in the original money into the profit which had been made. The £11,700 had not been mixed with any other money during the transactions and it was clearly traceable at common law. The Official Receiver could follow the £11,700 from the hands of the defendant into the broker who invested the money on the London potato futures market and from the profit generated there back to the account into which that profit had been paid.

The Court of Appeal held that the Official Receiver was entitled to all of the profit made by the defendant. That was due to the nature of the claim. The Official Receiver’s claim was a chose in action and it constituted the right not to claim merely the original amount but also the balance, whether or not that represented a profit or loss.

Tracing was the process which gave the Official Receiver the ability to follow the legal title in the original sum to the profit made. Nourse LJ pointed out that the remedy granted to the Official Receiver was that it had a right to claim for money had and received.

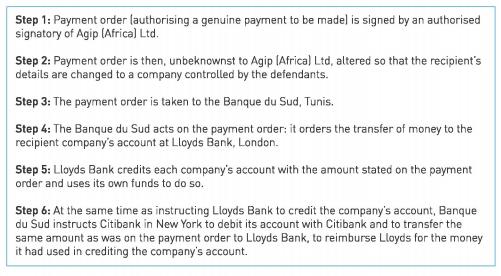

If the ability to ascertain the trust property has been lost, tracing will not be permitted at common law. This was emphasised in Agip (Africa) Ltd v Jackson.27

Agip (Africa) Ltd was part of the larger Italian oil giant, Agip SPA. It held permits to drill for oil in Tunisia. It also had a bank account at the Banque du Sud in Tunis. Its chief accountant, Mr Zdiri, fraudulently altered payment orders signed by directors of the claimant (the payment orders were instructions to the claimant’s bank to pay a certain recipient) to make payments to different recipients instead. The different recipients were companies controlled by the defendants. This fraud occurred over many years, but between March 1983 and when the fraud was discovered in January 1985,  10.5 million was fraudulently taken by this method. The action in the case concerned the ability of the claimant to recover nearly

10.5 million was fraudulently taken by this method. The action in the case concerned the ability of the claimant to recover nearly  519,000 — the final payment before the fraud was discovered — from the defendant.

519,000 — the final payment before the fraud was discovered — from the defendant.

The companies controlled by the defendants were shell companies which did not trade. They seem to have been established simply for receiving, and then distributing, the money fraudulently received from the claimant. The companies each had a bank account with Lloyds Bank in London. The procedure of transferring the money from the claimant to the companies is set out in Figure 13.1 below.

In giving the substantive judgment of the Court of Appeal, Fox LJ pointed out that tracing at common law did not depend on the existence of a fiduciary relationship. Liability depended simply on the fact of the defendant receiving the claimant’s money. As tracing at common law hinged upon receipt, it was irrelevant that the defendant had not retained the money. It also did not matter whether the defendant had acted honestly or not.

But what was essential for tracing to occur at common law was that the money had to be clearly identified in the defendant’s hands. This was not the case here. The money had been mixed in the New York clearing system. The original payment order had been taken into the Banque du Sud. That bank then instructed Lloyds Bank to credit the companies’ accounts. Lloyds Bank duly did so, but because of the time difference between the US and the UK, it would be some time later that Lloyds Bank would be reimbursed the amount by which it had credited the companies’ accounts. Lloyds Bank therefore paid the companies with its own money — money that was different from that original payment order taken into the Banque du Sud. That payment order was mixed into the New York clearing system and then came out later from the clearing system to reimburse Lloyds Bank. The original money and the money which found its way to the companies controlled by the defendants was not the same. Consequently, tracing at common law could not be established.

The claimant did, however, successfully argue that tracing could be permitted in equity.28

The remedy at common law if tracing is successful

The remedy at common law is restitutionary in nature. It is that the claimant may bring an action against the defendant for money had and received. This is founded on principles of unjust enrichment. The defendant, through the misuse of the claimant’s money, has unjustly enriched himself at the claimant’s expense and should return the money to the claimant.

Such remedy was awarded by the Court of Appeal against Mrs Jones in Trustee of F C Jones & Sons (A Firm) v Jones where it was held that the claimant could claim the additional money that had been made with the original investment. That was due to the nature of the claim the claimant enjoyed. The claimant’s chose in action could be taken against the balance left in the account, whether that was greater or lesser than the original investment. As Lord Goff explained in Lipkin Gorman v Karpnale Ltd:29

‘tracing’ or ‘following’ property into its product involves a decision by the owner of the original property to assert his title to the product in place of his original property.

The claim for money had and received has existed for centuries. It is based upon a simple premise: the principle that the defendant cannot, in good conscience, retain the money he has received.30 Money had and received is a personal claim against the defendant.

In Lipkin Gorman v Karpnale Ltd,31