Chapter 4 Tax withholding and estimated tax ey.com/EYTaxGuide

April 15 is the date by which most people file their income tax return for the previous year, but it is not the day most people actually pay their taxes. The bulk of your tax liability is paid during the year, either through money withheld from your paycheck by your employer or through payment of estimated taxes every quarter. The tax system operates on a pay-as-you-go policy, which generally requires that at least 90% of your tax liability be paid during the year.

The tax law imposes severe penalties if you underwithhold or underpay your estimated taxes. Yet, it is clearly not in your best interest to overwithhold or overpay estimated taxes, as the U.S. government does not pay interest on such overpayments. Therefore, it is essential that you estimate your tax liability as accurately as possible so you neither underpay nor overpay your taxes. This chapter helps you do just that.

Salaries and wages are subject to withholding by your employer regardless of the amount you are paid, the frequency of payment, or the form of payment. Nevertheless, you are entitled to reduce the amount of withholding by filing a completed Form W-4 with your employer. This form takes into account not only your marital status, personal exemptions, and dependents, but also your estimated deductions and tax credits. Form W-4 may prove especially beneficial if you have large itemized deductions.

Estimated tax payments cover sources of income not subject to withholding; for example, income from partnerships, S-corporations, rental property, royalties, self-employment, trusts and estates, interest, dividends, and capital gains. While generally your tax withholding and estimated payments have to cover 90% of your tax liability for you to avoid paying some stiff penalties, this is not always the case. This chapter discusses all the important exceptions.

The Affordable Care Act (ACA) imposes two permanent taxes on income that started in 2013. Taxpayers are still learning how these taxes may impact their tax liability and tax returns.

Additional Medicare tax on wages and compensation. The ACA imposes an additional Medicare tax of 0.9% on earned income in excess of $200,000 ($250,000 for married filing jointly, $125,000 for married taxpayers filing separately). For married couples filing jointly, the additional 0.9% tax applies to the couple’s combined wages in excess of $250,000. (These thresholds not adjusted annually for inflation.) This 0.9% tax is assessed in addition to the basic 1.45% Medicare tax employees already pay. Earned income includes wages and other compensation, as well as self-employment income. There is, however, no corresponding employer portion of the Additional Medicare Tax.

Employers are required to withhold the 0.9% Additional Medicare Tax on wages paid to an employee in excess of $200,000 regardless of the tax filing status (married or single) of the individual indicated on the Form W-4 that you submit to your employer and without regard to any other earned income on which the 0.9% Additional Medicare Tax may be owed. So, you may see this additional tax being withheld even though you may not even be liable for it because, for example, your wages or other compensation together with those of your spouse (when filing a joint return) does not exceed the $250,000 threshold that would make you liable for the 0.9% additional tax. If this is the case, any Additional Medicare Tax withheld from you can be credited against your total tax liability—including income taxes—shown on your income tax return (Form 1040).

On the other hand, since an employer is only allowed to withhold the 0.9% Additional Medicare Tax on wages paid in excess of $200,000, married employees who file separately may have too little of this additional tax withheld. This is because the threshold at which the 0.9% tax kicks in is only $125,000 for married taxpayers filing separately. If this is your situation, you may need to make quarterly estimated tax payment to the IRS to make up the difference and avoid a tax underpayment penalty.

Net investment income tax (NIIT). The other tax enacted by the ACA is the 3.8% Net Investment Income Tax (NIIT) on unearned income. It is assessed on the lesser of your net investment income or the excess of your modified adjusted gross income over $200,000 ($250,000 if you are married filing jointly or a qualifying widow(er) with dependent child; $125,000 if married filing separately). Income subject to the 0.9% Additional Medicare Tax is specifically exempted from the 3.8% NIIT, and certain allocable deductions are permitted in arriving at net investment income.

The NIIT falls broadly into three categories:

Investment income including interest, dividends, rents, and annuities not derived in the ordinary course of a trade or business Trade or business income from passive activities or from trading in financial instruments or commodities Net gains from the disposition of property not used in a trade or business

Tax withholding. Most people pay their tax liability through withholding from their wages. But there are a number of other items of income which are subject to withholding (either mandatory or at your election). These items include pension distributions, IRA distributions, gambling winnings, and social security benefits. If you don’t want to have to make quarterly estimated tax payments, you can ask that taxes be withheld from some of these payments. And no matter when the withholding takes place during the year, the IRS will treat it as being withheld equally throughout the year, unless you ask otherwise.

Tax refunds. Some people like getting a large refund when they file their tax return. But a refund isn’t necessarily a good thing—it means you overpaid your taxes during the year. And, because the IRS doesn’t pay you interest on that overpayment, you’ve essentially made an interest-free loan to Uncle Sam. From a financial perspective, you’re probably better off breaking even or paying a balance when you file. Of course, some people treat overwithholding as forced savings, because they’re afraid they’ll spend the money if it’s included in their paycheck.

Estimated taxes. For people receiving income not subject to withholding, such as income from self-employment, partnerships, S corporations, rental property, royalties, trusts and estates, interest, dividends, and capital gains, the tax liability associated with such income is generally covered through quarterly estimated tax payments. Because many individuals don’t know what their tax liability will be in the coming year, the law allows them to base their estimated tax payments on the previous year’s tax liability. See this chapter for more details on how to calculate the amount of estimated taxes you need to pay in order to avoid underpayment penalties.

Tax law changes for 2015. When you figure how much income tax you want withheld from your pay and when you figure your estimated tax, consider tax law changes effective in 2015. For more information, see Publication 505.

Estimated tax safe harbor for higher income taxpayers. If your 2014 adjusted gross income was more than $150,000 ($75,000 if you are married filing a separate return), you must pay the smaller of 90% of your expected tax for 2015 or 110% of the tax shown on your 2014 return to avoid an estimated tax penalty.

This chapter discusses how to pay your tax as you earn or receive income during the year. In general, the federal income tax is a pay-as-you-go tax. There are two ways to pay as you go.

Withholding. If you are an employee, your employer probably withholds income tax from your pay. Tax also may be withheld from certain other income, such as pensions, bonuses, commissions, and gambling winnings. The amount withheld is paid to the IRS in your name.Estimated tax. If you do not pay your tax through withholding, or do not pay enough tax that way, you may have to pay estimated tax. People who are in business for themselves generally will have to pay their tax this way. Also, you may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rent, and royalties. Estimated tax is used to pay not only income tax, but self-employment tax and alternative minimum tax as well. This chapter explains these methods. In addition, it also explains the following.

Credit for withholding and estimated tax. When you file your 2014 income tax return, take credit for all the income tax withheld from your salary, wages, pensions, etc., and for the estimated tax you paid for 2014. Also take credit for any excess social security or railroad retirement tax withheld (discussed in chapter 37 Underpayment penalty. If you did not pay enough tax during the year, either through withholding or by making estimated tax payments, you may have to pay a penalty. In most cases, the IRS can figure this penalty for you. See Underpayment Penalty for 2014 You may want to see:

505 Tax Withholding and Estimated Tax W-4 Employee’s Withholding Allowance CertificateW-4P Withholding Certificate for Pension or Annuity PaymentsW-4S Request for Federal Income Tax Withholding From Sick PayW-4V Voluntary Withholding Request1040-ES Estimated Tax for Individuals2210 Underpayment of Estimated Tax by Individuals, Estates, and Trusts2210-F Underpayment of Estimated Tax by Farmers and Fishermen This section discusses income tax withholding on:

Salaries and wages, Tips, Taxable fringe benefits, Sick pay, Pensions and annuities, Gambling winnings, Unemployment compensation, and Certain federal payments. This section explains the rules for withholding tax from each of these types of income.

This section also covers backup withholding on interest, dividends, and other payments.

Income tax is withheld from the pay of most employees. Your pay includes your regular pay, bonuses, commissions, and vacation allowances. It also includes reimbursements and other expense allowances paid under a nonaccountable plan. See Supplemental Wages

If your income is low enough that you will not have to pay income tax for the year, you may be exempt from withholding. This is explained under Exemption From Withholding

You can ask your employer to withhold income tax from noncash wages and other wages not subject to withholding. If your employer does not agree to withhold tax, or if not enough is withheld, you may have to pay estimated tax, as discussed later under Estimated Tax for 2015

Military retirees. Military retirement pay is treated in the same manner as regular pay for income tax withholding purposes, even though it is treated as a pension or annuity for other tax purposes.

Household workers. If you are a household worker, you can ask your employer to withhold income tax from your pay. A household worker is an employee who performs household work in a private home, local college club, or local fraternity or sorority chapter.

Tax is withheld only if you want it withheld and your employer agrees to withhold it. If you do not have enough income tax withheld, you may have to pay estimated tax, as discussed later under Estimated Tax for 2015

Farmworkers. Generally, income tax is withheld from your cash wages for work on a farm unless your employer does both of these:

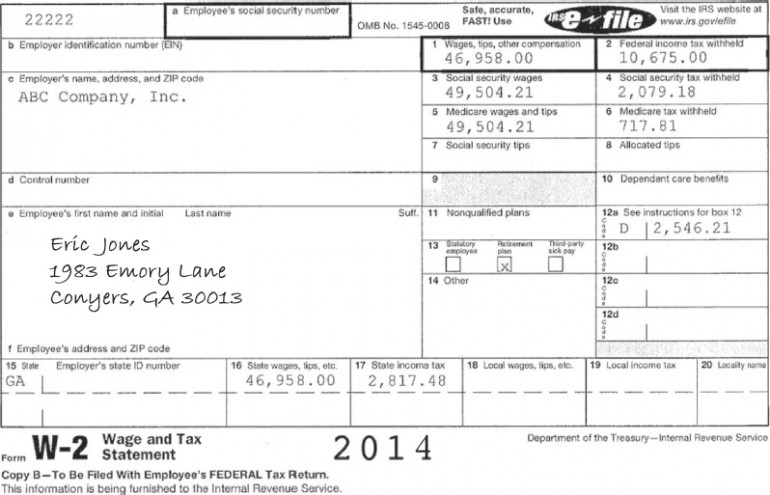

Pays you cash wages of less than $150 during the year, and Has expenditures for agricultural labor totaling less than $2,500 during the year. Differential wage payments. When employees are on leave from employment for military duty, some employers make up the difference between the military pay and civilian pay. Payments to an employee who is on active duty for a period of more than 30 days will be subject to income tax withholding, but not subject to social security or Medicare taxes. The wages and withholding will be reported on Form W-2, Wage and Tax Statement.

Text intentionally omitted .

Determining Amount of Tax Withheld Using Form W-4

The amount of income tax your employer withholds from your regular pay depends on two things.

The amount you earn in each payroll period. The information you give your employer on Form W-4. Form W-4 includes four types of information that your employer will use to figure your withholding.

Whether to withhold at the single rate or at the lower married rate. How many withholding allowances you claim (each allowance reduces the amount withheld). Whether you want an additional amount withheld. Whether you are claiming an exemption from withholding in 2015. See Exemption From Withholding Note. You must specify a filing status and a number of withholding allowances on Form W-4. You cannot specify only a dollar amount of withholding.

When you start a new job, you must fill out Form W-4 and give it to your employer. Your employer should have copies of the form. If you need to change the information later, you must fill out a new form.

If you work only part of the year (for example, you start working after the beginning of the year), too much tax may be withheld. You may be able to avoid overwithholding if your employer agrees to use the part-year method. See Part-Year Method in chapter 1 of Publication 505 for more information.

Employee also receiving pension income. If you receive pension or annuity income and begin a new job, you will need to file Form W-4 with your new employer. However, you can choose to split your withholding allowances between your pension and job in any manner.

During the year changes may occur to your marital status, exemptions, adjustments, deductions, or credits you expect to claim on your tax return. When this happens, you may need to give your employer a new Form W-4 to change your withholding status or your number of allowances.

If the changes reduce the number of allowances you are allowed to claim or changes your marital status from married to single, you must give your employer a new Form W-4 within 10 days.

Generally, you can submit a new Form W-4 whenever you wish to change the number of your withholding allowances for any other reason.

Changing your withholding for 2016. If events in 2015 will decrease the number of your withholding allowances for 2016, you must give your employer a new Form W-4 by December 1, 2015. If the event occurs in December 2015, submit a new Form W-4 within 10 days.

After you have given your employer a Form W-4, you can check to see whether the amount of tax withheld from your pay is too little or too much. If too much or too little tax is being withheld, you should give your employer a new Form W-4 to change your withholding. You should try to have your withholding match your actual tax liability. If not enough tax is withheld, you will owe tax at the end of the year and may have to pay interest and a penalty. If too much tax is withheld, you will lose the use of that money until you get your refund. Always check your withholding if there are personal or financial changes in your life or changes in the law that might change your tax liability.

Note. You cannot give your employer a payment to cover withholding on salaries and wages for past pay periods or a payment for estimated tax.

Form W-4 has worksheets to help you figure how many withholding allowances you can claim. The worksheets are for your own records. Do not give them to your employer.

Multiple jobs. If you have income from more than one job at the same time, complete only one set of Form W-4 worksheets. Then split your allowances between the Forms W-4 for each job. You cannot claim the same allowances with more than one employer at the same time. You can claim all your allowances with one employer and none with the other(s), or divide them any other way.

Married individuals. If both you and your spouse are employed and expect to file a joint return, figure your withholding allowances using your combined income, adjustments, deductions, exemptions, and credits. Use only one set of worksheets. You can divide your total allowances any way, but you cannot claim an allowance that your spouse also claims.

If you and your spouse expect to file separate returns, figure your allowances using separate worksheets based on your own individual income, adjustments, deductions, exemptions, and credits.

Alternative method of figuring withholding allowances. You do not have to use the Form W-4 worksheets if you use a more accurate method of figuring the number of withholding allowances. For more information, see Alternative method of figuring withholding allowances under Completing Form W-4 and Worksheets in Publication 505, chapter 1 .

Personal Allowances Worksheet. Use the Personal Allowances Worksheet on Form W-4 to figure your withholding allowances based on exemptions and any special allowances that apply.

Deduction and Adjustments Worksheet. Use the Deduction and Adjustments Worksheet on Form W-4 if you plan to itemize your deductions, claim certain credits, or claim adjustments to the income on your 2015 tax return and you want to reduce your withholding. Also, complete this worksheet when you have changes to these items to see if you need to change your withholding.

Two-Earners/Multiple Jobs Worksheet. You may need to complete the Two-Earners/Multiple Jobs Worksheet on Form W-4 if you have more than one job, a working spouse, or are also receiving a pension. Also, on this worksheet you can add any additional withholding necessary to cover any amount you expect to owe other than income tax, such as self-employment tax.

In most situations, the tax withheld from your pay will be close to the tax you figure on your return if you follow these two rules.

You accurately complete all the Form W-4 worksheets that apply to you. You give your employer a new Form W-4 when changes occur. But because the worksheets and withholding methods do not account for all possible situations, you may not be getting the right amount withheld. This is most likely to happen in the following situations.

You are married and both you and your spouse work. You have more than one job at a time. You have nonwage income, such as interest, dividends, alimony, unemployment compensation, or self-employment income. You will owe additional amounts with your return, such as self-employment tax. Your withholding is based on obsolete Form W-4 information for a substantial part of the year. Your earnings are more than the amount shown under Check your withholding in the instructions at the top of page 1 of Form W-4. You work only part of the year. You change the number of your withholding allowances during the year. Cumulative wage method. If you change the number of your withholding allowances during the year, too much or too little tax may have been withheld for the period before you made the change. You may be able to compensate for this if your employer agrees to use the cumulative wage withholding method for the rest of the year. You must ask your employer in writing to use this method.

To be eligible, you must have been paid for the same kind of payroll period (weekly, biweekly, etc.) since the beginning of the year.

Your Form W-4 should be reviewed periodically as your sources and levels of income change and as your deductible expenses and credits increase or decrease.

You have an estimated net loss from a partnership of $2,000, which you would report on Schedule E of your Form 1040. You are not required to make any payments of estimated tax. You may use your $2,000 partnership loss to figure the number of withholding allowances you may claim on your Form W-4.

In addition to wages, you have alimony income of $5,000 and an estimated net loss from business of $3,000, which you would report on Schedule C. If you did not have the estimated business loss, you would have been required to make payments of estimated tax on your alimony income of $5,000. The business loss can be netted against the alimony income in order to figure the amount of net income on which you would be required to pay estimated tax—$2,000 in this case. You may not use your business loss to figure your withholding allowances since the loss is already used to offset the alimony income.

You have an estimated net loss from your farm of $5,000, which you would report on Schedule F. You would otherwise be required to make payments of estimated tax on rental income of $4,000. To figure your withholding allowances, you may include only $1,000 of your farm loss ($5,000 estimated net loss minus $4,000 income subject to estimated tax).

You expect to have itemized deductions of $15,000, which you would report on Schedule A. You also expect to have $9,000 of self-employment income on which you would otherwise have to pay estimated tax. To figure your withholding allowances for Form W-4, you should include only $6,000 of your itemized deductions ($15,000 total itemized deductions minus the $9,000 self-employment income subject to estimated tax). This will, in effect, allow you to withhold through your salary any estimated tax due on your self-employment income. However, you will still be subject to self-employment tax on the $9,000 income.

Rules relating to when you may properly claim withholding allowances. For the purpose of figuring your withholding allowances for estimated deductions and estimated tax credits, estimated means the dollar amount of each item you reasonably expect to claim on your 2015 return. That dollar amount should be no more than the sum of the following:

The amount of each item shown or expected to be shown on your 2014 return that you also reasonably expect to show on your 2015 return Additional amounts that you can determine for each item for 2015 Additional amounts that can be determined. These are amounts that are not included in (1) and that can be shown to result from identifiable events in 2014 or 2015. Amounts can be shown to result from identifiable events if the amounts relate to payments already made during 2015, to binding obligations to make payments (including payments of taxes) during 2015, and to other events or transactions that have been started and that you can prove at the time you file your Form W-4.

Amounts disallowed by the Internal Revenue Service. Generally, to figure your withholding allowances for 2015, you should not include any amount shown on your 2014 return that has been disallowed by the IRS. If you have not yet filed your 2014 return, you should not include any amount shown on your 2013 return that has been disallowed by the IRS.

To make sure you are getting the right amount of tax withheld, get Publication 505. It will help you compare the total tax to be withheld during the year with the tax you can expect to figure on your return. It also will help you determine how much, if any, additional withholding is needed each payday to avoid owing tax when you file your return. If you do not have enough tax withheld, you may have to pay estimated tax, as explained under Estimated Tax for 2015

You can use the IRS Withholding Calculator at www.irs.gov/Individuals instead of Publication 505 or the worksheets included with Form W-4, to determine whether you need to have your withholding increased or decreased.

It may be helpful for you to know some of the withholding rules your employer must follow. These rules can affect how to fill out your Form W-4 and how to handle problems that may arise.

New Form W-4. When you start a new job, your employer should have you complete a Form W-4. Beginning with your first payday, your employer will use the information you give on the form to figure your withholding.

If you later fill out a new Form W-4, your employer can put it into effect as soon as possible. The deadline for putting it into effect is the start of the first payroll period ending 30 or more days after you turn it in.

No Form W-4. If you do not give your employer a completed Form W-4, your employer must withhold at the highest rate, as if you were single and claimed no withholding allowances.

Repaying withheld tax. If you find you are having too much tax withheld because you did not claim all the withholding allowances you are entitled to, you should give your employer a new Form W-4. Your employer cannot repay any of the tax previously withheld. Instead, claim the full amount withheld when you file your tax return.

However, if your employer has withheld more than the correct amount of tax for the Form W-4 you have in effect, you do not have to fill out a new Form W-4 to have your withholding lowered to the correct amount. Your employer can repay the amount that was withheld incorrectly. If you are not repaid, your Form W-2 will reflect the full amount actually withheld, which you would claim when you file your tax return.

Only gold members can continue reading.

Log In or

Register to continue

505 Tax Withholding and Estimated Tax

505 Tax Withholding and Estimated Tax  W-4 Employee’s Withholding Allowance Certificate

W-4 Employee’s Withholding Allowance Certificate W-4P Withholding Certificate for Pension or Annuity Payments

W-4P Withholding Certificate for Pension or Annuity Payments W-4S Request for Federal Income Tax Withholding From Sick Pay

W-4S Request for Federal Income Tax Withholding From Sick Pay W-4V Voluntary Withholding Request

W-4V Voluntary Withholding Request 1040-ES Estimated Tax for Individuals

1040-ES Estimated Tax for Individuals 2210 Underpayment of Estimated Tax by Individuals, Estates, and Trusts

2210 Underpayment of Estimated Tax by Individuals, Estates, and Trusts 2210-F Underpayment of Estimated Tax by Farmers and Fishermen

2210-F Underpayment of Estimated Tax by Farmers and Fishermen