Chapter 15

Selling your home

ey.com/EYTaxGuide

Excluding gain realized from selling your home. You may be able to exclude from your gross income up to $250,000 ($500,000, if you file jointly with your spouse) of the gain from the sale of your main home. For more information, see

Excluding the Gain, later.

Reduced exclusion available if you do not meet the ownership and use requirements for the sale of your main home. Generally, in order to qualify to exclude gain realized from the sale of your main home, you must have owned and occupied the property as your main home for at least 2 years within the 5-year period that preceded the sale. However, you may be able to claim a reduced, prorated exclusion even if you do not meet the ownership or use tests or sold more than one main home during a 2-year period if you sold the home due to:

- A change in your place of employment, and the new place of employment is at least 50 miles farther from the home you sold than was your former place of employment; or

- Health reasons; or

- An unforeseen circumstance

For more information on what constitutes a sale for health reasons or an unforeseen circumstance, and how to calculate the reduced exclusion, see Reduced Maximum Exclusion, later.

Exclusion reduced to extent gain relates to nonqualified use. You will not be able to exclude the gain realized from the sale or exchange of a principal residence to the extent that the gain is associated with a period of nonqualified use after December 31, 2008. For this purpose, a period of nonqualified use means any period after December 31, 2008, where the home is not used as a principal residence by you, your spouse, or your former spouse. See Periods of nonqualified use, later.

Loss on the sale of a home. You cannot deduct any loss realized from the sale of your home. However, if you own a house as an investment—and do not use it for personal purposes—you may be able to deduct the loss. For more information, see Amount of Gain or Loss: Loss on sale, later.

Mortgage debt forgiveness. From 2007 through 2013, you may have been able to exclude from your gross income the income realized from the forgiveness or cancellation of up to $2 million ($1 million if married filing separately) of “Qualified principal residence indebtedness.” (Note, however, that the amount of any canceled debt you can exclude from your income reduces your basis in your principal residence. That will increase the amount of gain (or decrease any loss) you realize when you ultimately sell your home.)

As of the date this book was published, this exclusion is not available after 2013. While Congress had been considering legislation that would extend its availability at least through 2015, no such extension had yet been passed. The discussion of mortgage debt forgiveness is included in this chapter in case Congress acts to extend it. For updated information on this and any other tax law changes that occur after this book was published, see our website, ey.com/EYTaxGuide.

Repayment of first-time homebuyer credit claimed in 2008. If you claimed the first-time homebuyer credit for a principal residence you purchased in 2008, you should have begun repaying the credit in 2010, and must continue repaying the credit in equal installments through 2024.

Home sold with undeducted points. If you have not deducted all the points you paid to secure a mortgage on your old home, you may be able to deduct the remaining points in the year of the sale. See Mortgage ending early under Points in chapter 24.

This chapter explains the tax rules that apply when you sell your main home. In most cases, your main home is the one in which you live most of the time.

If you sold your main home in 2014, you may be able to exclude from income any gain up to a limit of $250,000 ($500,000 on a joint return in most cases). See Excluding the Gain, later. Generally, if you can exclude all the gain, you do not need to report the sale on your tax return.

If you have gain that cannot be excluded, it is taxable. Report it on Form 8949, Sales and Other Dispositions of Capital Assets, and Schedule D (Form 1040). You may also have to complete Form 4797, Sales of Business Property. See Reporting the Sale, later.

If you have a loss on the sale, you generally cannot deduct it on your return. However, you may need to report it. See Reporting the Sale, later.

The following are main topics in this chapter.

- Figuring gain or loss.

- Basis.

- Excluding the gain.

- Ownership and use tests.

- Reporting the sale.

Other topics include the following.

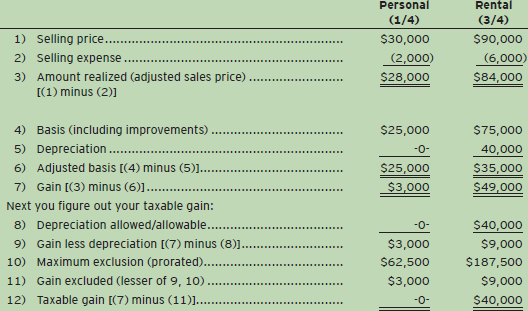

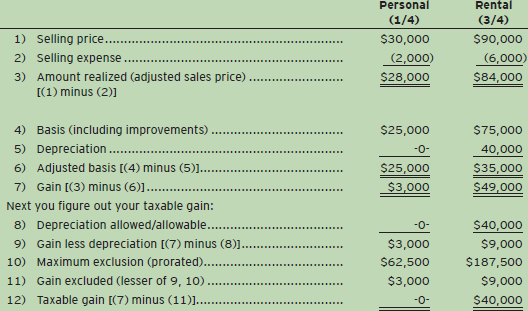

- Business use or rental of home.

- Recapturing a federal mortgage subsidy.

You may want to see:

523 Selling Your Home

523 Selling Your Home

530 Tax Information for Homeowners

530 Tax Information for Homeowners

547 Casualties, Disasters, and Thefts

547 Casualties, Disasters, and Thefts

Schedule D (Form 1040) Capital Gains and Losses

Schedule D (Form 1040) Capital Gains and Losses

982 Reduction of Tax Attributes Due to Discharge of Indebtedness

982 Reduction of Tax Attributes Due to Discharge of Indebtedness

8828 Recapture of Federal Mortgage Subsidy

8828 Recapture of Federal Mortgage Subsidy

8949 Sales and Other Dispositions of Capital Assets

8949 Sales and Other Dispositions of Capital Assets

This section explains the term “main home.” Usually, the home you live in most of the time is your main home and can be a:

- House,

- Houseboat,

- Mobile home,

- Cooperative apartment, or

- Condominium.

To exclude gain under the rules of this chapter, you in most cases must have owned and lived in the property as your main home for at least 2 years during the 5-year period ending on the date of sale.

Land. If you sell the land on which your main home is located, but not the house itself, you cannot exclude any gain you have from the sale of the land. However, if you sell vacant land used as part of your main home and that is adjacent to it, you may be able to exclude the gain from the sale under certain circumstances. See Vacant land under Main Home in Publication 523 for more information.

Example. You buy a piece of land and move your main home to it. Then you sell the land on which your main home was located. This sale is not considered a sale of your main home, and you cannot exclude any gain on the sale of the land.

More than one home. If you have more than one home, you can exclude gain only from the sale of your main home. You must include in income gain from the sale of any other home. If you have two homes and live in both of them, your main home is ordinarily the one you live in most of the time during the year.

Example 1. You own two homes, one in New York and one in Florida. From 2010 through 2014, you live in the New York home for 7 months and in the Florida residence for 5 months of each year. In the absence of facts and circumstances indicating otherwise, the New York home is your main home. You would be eligible to exclude the gain from the sale of the New York home but not of the Florida home in 2014.

Example 2. You own a house, but you live in another house that you rent. The rented house is your main home.

Example 3. You own two homes, one in Virginia and one in New Hampshire. In 2010 and 2011, you lived in the Virginia home. In 2012 and 2013, you lived in the New Hampshire home. In 2014, you lived again in the Virginia home. Your main home in 2010, 2011, and 2014 is the Virginia home. Your main home in 2012 and 2013 is the New Hampshire home. You would be eligible to exclude gain from the sale of either home (but not both) in 2014.

Property used partly as your main home. If you use only part of the property as your main home, the rules discussed in this publication apply only to the gain or loss on the sale of that part of the property. For details, see Business Use or Rental of Home, later.

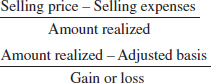

To figure the gain or loss on the sale of your main home, you must know the selling price, the amount realized, and the adjusted basis. Subtract the adjusted basis from the amount realized to get your gain or loss.

The selling price is the total amount you receive for your home. It includes money and the fair market value of any other property or any other services you receive and all notes, mortgages or other debts assumed by the buyer as part of the sale.

Payment by employer. You may have to sell your home because of a job transfer. If your employer pays you for a loss on the sale or for your selling expenses, do not include the payment as part of the selling price. Your employer will include it as wages in box 1 of your Form W-2, and you will include it in your income on Form 1040, line 7.

Option to buy. If you grant an option to buy your home and the option is exercised, add the amount you receive for the option to the selling price of your home. If the option is not exercised, you must report the amount as ordinary income in the year the option expires. Report this amount on Form 1040, line 21.

Form 1099-S. If you received Form 1099-S, Proceeds From Real Estate Transactions, box 2 (Gross proceeds) should show the total amount you received for your home.

However, box 2 will not include the fair market value of any services or property other than cash or notes you received or will receive. Instead, box 4 will be checked to indicate your receipt or expected receipt of these items.

The amount realized is the selling price minus selling expenses.

Selling expenses. Selling expenses include:

- Commissions,

- Advertising fees,

- Legal fees, and

- Loan charges paid by the seller, such as loan placement fees or “points.”

While you owned your home, you may have made adjustments (increases or decreases) to the basis. This adjusted basis must be determined before you can figure gain or loss on the sale of your home. For information on how to figure your home’s adjusted basis, see Determining Basis, later.

To figure the amount of gain or loss, compare the amount realized to the adjusted basis.

Gain on sale. If the amount realized is more than the adjusted basis, the difference is a gain and, except for any part you can exclude, in most cases is taxable.

Loss on sale. If the amount realized is less than the adjusted basis, the difference is a loss. A loss on the sale of your main home cannot be deducted.

Jointly owned home. If you and your spouse sell your jointly owned home and file a joint return, you figure your gain or loss as one taxpayer.

Separate returns. If you file separate returns, each of you must figure your own gain or loss according to your ownership interest in the home. Your ownership interest is generally determined by state law.

Joint owners not married. If you and a joint owner other than your spouse sell your jointly owned home, each of you must figure your own gain or loss according to your ownership interest in the home. Each of you applies the rules discussed in this chapter on an individual basis.

Some special rules apply to other dispositions of your main home.

Foreclosure or repossession. If your home was foreclosed on or repossessed, you have a disposition. See Publication 4681, Canceled Debts, Foreclosures, Repossessions, and Abandonments, to determine if you have ordinary income, gain, or loss.

Abandonment. If you abandon your home, see Publication 4681 to determine if you have ordinary income, gain, or loss.

Trading (exchanging) homes. If you trade your old home for another home, treat the trade as a sale and a purchase.

Example. You owned and lived in a home with an adjusted basis of $41,000. A real estate dealer accepted your old home as a trade-in and allowed you $50,000 toward a new home priced at $80,000. This is treated as a sale of your old home for $50,000 with a gain of $9,000 ($50,000 – $41,000).

If the dealer had allowed you $27,000 and assumed your unpaid mortgage of $23,000 on your old home, your sales price would still be $50,000 (the $27,000 trade-in allowed plus the $23,000 mortgage assumed).

Transfer to spouse. If you transfer your home to your spouse or you transfer it to your former spouse incident to your divorce, you in most cases have no gain or loss. This is true even if you receive cash or other consideration for the home. As a result, the rules in this chapter do not apply.

More information. If you need more information, see Transfer to spouse in Publication 523 and Property Settlements in Publication 504, Divorced or Separated Individuals.

Involuntary conversion. You have a disposition when your home is destroyed or condemned and you receive other property or money in payment, such as insurance or a condemnation award. This is treated as a sale and you may be able to exclude all or part of any gain from the destruction or condemnation of your home, as explained later under Special Situations.

Only gold members can continue reading.

Log In or

Register to continue

523 Selling Your Home

523 Selling Your Home 530 Tax Information for Homeowners

530 Tax Information for Homeowners 547 Casualties, Disasters, and Thefts

547 Casualties, Disasters, and Thefts  Schedule D (Form 1040) Capital Gains and Losses

Schedule D (Form 1040) Capital Gains and Losses 982 Reduction of Tax Attributes Due to Discharge of Indebtedness

982 Reduction of Tax Attributes Due to Discharge of Indebtedness 8828 Recapture of Federal Mortgage Subsidy

8828 Recapture of Federal Mortgage Subsidy 8949 Sales and Other Dispositions of Capital Assets

8949 Sales and Other Dispositions of Capital Assets