Sections 110(1) and 111:Payment and Withholding Notices under the 1996 Act

SECTIONS 110(1) AND 111: PAYMENT AND WITHHOLDING NOTICES UNDER THE 1996 ACT

(1) Overview

Introduction and Summary

13.01 Sections 110(2) and 111 of the 1996 Act deal with the notices which the paying party must serve informing the payee of the amount which it proposes to pay, and whether any amounts have been withheld. The straightforward intention behind both of these provisions is to ensure transparency so that the payee is made aware of, and able to challenge if appropriate, any dissatisfaction on the part of the payer as to the work performed. Thus:

1. Section 110(2) requires every construction contract to provide for the giving of a notice by the paying party specifying the amount (if any) of the payment proposed to be made, and the basis on which that amount was calculated.

2. Section 111 provides that a party to a construction contract may not withhold payment of a sum due under the contract after the final date for payment unless it has given effective notice in advance of its intention to do so.

13.02 Unfortunately, ss. 110(2) and 111 have proved problematic in their application for a number of reasons. The right to payment under s. 111 hinges on proving the ‘sum due under the contract’. As the phrase suggests, the sum due is thus determined by the terms of the contract itself and not necessarily the amount either applied for by the payee, or set out in the payment notice served by the payer. Compounding this problem is the fact that the 1996 Act provides no fall-back position in the event that the payer does not serve the payment notice that he is supposed to provide.

13.03 The resulting uncertainty as to what payment is due, and therefore whether a withholding notice is required if the payer intends to pay less, is clearly undesirable. Further, since many important matters hinge upon the payee being paid the sum due, not least its ability to suspend work under s. 112, and the right to claim interest, the unhelpful drafting of ss. 110(2) and 111 has become all important. Dissatisfaction with this position has led to both ss. 110(2) and 111 being substantially redrafted in the Local Democracy, Economic Development and Construction Act 2009 (‘the 2009 Act’). The position under the 2009 Act affecting construction contracts entered into after 1 October 2011 is considered in Chapter 14. The requirements relating to payment and withholding notices under ss. 110(2) and 111 of the 1996 Act are summarized below:

1. Every construction contract shall provide for the giving of a payment notice not later than five days after the date on which payment becomes due under the contract specifying the amount, if any, of the payment made or proposed to be made and the basis on which the amount was calculated. (s. 110(1)).

2. If the contract does not so provide then the relevant provision of the Scheme for Construction Contracts (‘the Scheme’) (Part II, paragraph 9) will be implied into the contract to require that a payment notice should be given.

3. The payer may not withhold payment after the final date for payment of a sum due under the contract unless it has given effective notice of its intention to withhold payment (s. 111).

4. To be effective, the notice must comply with the requirements of the Act as to content and timing. A payment notice under s. 110(2) of the Housing Grants Construction and Regeneration Act 1996 (‘the 1996 Act’) may also give effective notice of withholding providing it also complies with the requirements of s. 111.

5. Notices should be in writing addressed to the other party, and specify the grounds and amounts in sufficient detail for the party receiving the notice to understand any complaints made against it. Correspondence issued prior to the payment application is unlikely to be effective.

6. An effective withholding notice entitles the employer to withhold sums against the amount otherwise due after the final date for payment, but only until the payee successfully challenges (if indeed they mount such a challenge) the grounds for withholding.

7. The notice will generally only be effective to the extent that the amounts or grounds relied upon in any later justification of the withholding are those set out in the notice.

8. If an adjudicator finds that the notice was effective (ie that it was served in time and contained the necessary information), but that the amounts withheld should be paid (the basis for withholding having been found invalid) then payment should be within seven days.

9. If no withholding notice is given, or if it is not effective, then payment should be made immediately.

10. In such circumstances, the amount that should be paid depends on how the contract defines the ‘sum due’. This will not necessarily be the same as the amount that has been applied for, or even the amount in the payment notice.

(2) Payment Notices under s. 110(2)

Introduction

13.04 The purpose of s. 110(2) is: to enable both contractor and employer to know the basis on which there is a disagreement between them on any given payment application. It provides an agenda either for further discussion or for a subsequent adjudication.1

The notice is also supposed to serve a function of acting as a ‘baseline’ from which the payee can judge whether any further withholdings have been applied before the final date for payment and, therefore, whether a withholding notice should be served.2

13.05 The problem with this mechanism is that s. 110(2) requires simply that the contract must contain a provision for the payer to give notice of payment within five days of it becoming due. However, the1996 Act specifies no statutory penalty where the contract contains such a mechanism but the payer fails to comply with it. Notwithstanding that this will be a breach of contract, the practical effect is that the payer may be free to disregard this requirement.

13.06 Furthermore it is the contract terms which determine what sum is due and therefore the s. 110(2) payment notice may serve no purpose other than to notify the payee in advance of payment how much the payer considers is due. Depending on the terms of the contract, the following situations might arise:

1. The absence of a s. 110(2) notice may not matter much in contracts where the terms provide that the amount due is that contained in a certificate issued by a third party (for example JCT Standard Building Contract 2005 clause 4.9.1). In such a contract the certificate both crystallizes the sum due and notifies the contractor of the sum due. It is against this crystallized sum that the employer may or may not decide to withhold other sums.

2. The same will apply in contracts where the sum due is crystallized by the payee’s application followed by the payer’s notice (for example the JCT Standard Form of Building Contract (with Contractor’s Design) 1998, clause 30.3). In those contracts the sum due is determined by either the unchallenged contractor’s application or by the employer’s payment notice.

3. The difficulty arises in contracts which define the sum due as ‘the value of work performed in accordance with the contract’ or similar formulations. In these situations the payee may not know how much the payer considers to be due until payment is made. Depending on the precise terms of the contract, this may be the case regardless of whether a contract administrator has issued a certificate, and even where the payer himself has issued a payment notice.3

13.07 The problems that this third type of contract poses for the payee go further than this. In the absence of a withholding notice, the paying party has potentially far greater opportunities to challenge a contractor’s application for payment than it does where the contract provides for interim certificates setting out the sum due for stage payments. This is explained in more detail in 13.28–13.39 below.

13.08 For these reasons, s. 110(2) has been replaced in its entirety under the 2009 Act to create a new fall-back position similar to that described in point 2 above.4 The detail of this provision, and how it will operate for contracts entered into after the new Act comes into force, is discussed in Chapter 14 below.

Section 110(2): Fall-back Application of the Scheme

13.09 Notwithstanding the above issues, it remains a statutory requirement for construction contracts to make provision for the service of a payment notice in the terms set out in 13.01 above. If the contract does not include such a provision, then the Scheme applies: s. 110(3). The Scheme requires, quite simply, that the party making payment should give such a notice in the identical terms and within the same five-day period as is required by s. 110(2) of the Act.5 Unlike most of the payment provisions of the Act, it is not permissible for the parties to agree an alternative time for issue of the payment notice, and therefore this notice should be served in all cases within the five-day period set out in the Act.

Section 110(2): Payment Notices Required even where Payment Is Zero

13.10 A payment notice should be given in all circumstances, whether or not an assessment results in a payment being due. Thus, if a periodic or stage payment is due to be made, but rights of set-off or abatement exist so that the amount due is reduced or extinguished by the amounts payable by the payee, then a payment notice should still be given setting out how the zero sum has been determined. Indeed, it is in circumstances such as these that the payment notice is arguably of greatest value, enabling the payee to understand the reasons for non-payment and if necessary giving it valuable time to prepare to challenge the assessment of the sum due.

Can a Third Party Serve a s. 110(2) Notice?

13.11 Section 110(2) provides that the notice should be given by a party to the contract and there is no provision for a notice to be served by a third party such as the contract administrator or project manager. Certain contracts, such as the NEC 3 Option Y2.2, expressly provide that the project manager’s certificate constitutes notice from the employer under s. 110(2) of the 1996 Act. In these cases it would seem clear that the project manager has authority as agent to the employer and there should be no question that the certificate stands as the payment notice. In other cases judges have been willing to accept that the certificate of a third party does stand as the employer’s payment notice6 but those were cases where the point was not in dispute. This issue has now been addressed in the 2009 Act which provides that a ‘specified person’ may serve the payment notice or pay-less notice on behalf of the payer.7

Section 110(2) Notice May Serve as s. 111 Notice

13.12 Where a payment notice has been served setting out the basis for all deductions from sums which would otherwise have been due, there is no further need to serve a withholding notice. Section 111(1) of the 1996 Act provides that the notice mentioned in s. 110(2) may suffice as a notice of intention to withhold payment provided it complies with the requirements of s. 111. This requires that the payment notice should:

1. set out the amount proposed to be withheld and the ground for withholding or, if there is more than one ground, each ground and the amount attributable to it and

2. be given not later than the prescribed period before the final date for payment (i.e. seven days under the Scheme, or such other time as the parties have agreed under the contract).

13.13 Thus, even if the payment notice has been served later than the five-day period prescribed by s. 110(2), it will still be effective to give notice of withholding, provided it has been served no later than the date for withholding notices set out in the contract (or, if no date has been specified, the Scheme).

13.14 There is therefore a large degree of overlap between the payment notice specified by s. 110(2) and withholding notices under s. 111 which has led to some confusion as to why separate notices have been prescribed, and their respective purposes. This is yet another of the issues dealt with by the 2009 Act which brings the content of payment and withholding notices into line so that the withholding notice becomes, in effect, a revision of the payment notice.8 This appears to confirm that the purpose of both notices is in fact the same in that, although one is expressed as a payment notice and the other a withholding notice, their joint purpose is in informing the payee of the amounts proposed to be paid (if any), and the basis of their calculation.

13.15 Even under the original provisions of the 1996 Act, provided a notice is sufficiently clear as to these points, then it can stand as both a s. 110(2) and s. 111 notice regardless of whether it is referred to as a payment notice or a withholding notice. The payer can serve two separate notices, or combine them into one. The potential for two separate notices effectively gives the payer two bites at the cherry: it may serve notice of withholding in the payment notice, or wait until the last day for serving a withholding notice to give notice of the same or further deductions.

What Happens if a Payment Notice Is Not Served or Is Served Late?

13.16 As has been seen, the consequences of not serving a payment notice may not be severe since it is the contract and not necessarily the payment notice which determines the sum due. Problems only arise when the contract states that it is the payment notice that determines the amount that is due and/or the timing of payments. In such cases the absence of a payment notice is likely to cause real problems for determining the amount of the payment that is due and/or the date that it is due and the final date for payment. Moreover, if the sum due is not capable of being ascertained in the absence of a payment notice, it will be unclear to the payee whether any amounts have been withheld which should have been the subject of a withholding notice. This situation is considered at13.28–13.39.

13.17 In many contracts, however, the sum due and timings of payments are defined not by the payment notice, but by the amounts specified in a third party’s payment certificate or else measured by reference to the value of work performed. In these cases the absence of a payer’s payment notice may not be material although other issues may arise in terms of ascertaining the sum due for the purposes of determining the amount to be paid and whether a withholding notice should have been issued. These cases are discussed at 13.40–13.57 below.

Contracts where the Payment Notice Determines the Sum Due

13.18 The parties are free to include terms in the contract whereby the payer’s payment notice determines the sum due under the contract. However, in such cases, if no payment notice is served, then one of the first questions that may arise is whether a payment has become due at all. Some standard form and bespoke contracts provide that the payer’s payment notice determines not only the amount due, but also the date for payment. If this is the case, then it will be a question for interpretation of the contract whether the payment mechanism is adequate to provide for a due date and final date of payment, or whether the provisions of the Scheme apply instead.

13.19 Such a contract was under consideration in Ringway Infrastructure Service Ltd v Vauxhall Motors Ltd (2007)9 (Key Case). Here, the judge decided that, despite no payment notice having been issued, the date for payment had been triggered on the date on which the employer should have given notice. It was not open to the employer to rely on its own breach of contract to delay payment indefinitely. As to the amount that became due, the fall-back position in the JCT contract applied and the amount of the contractor’s application was the sum due.

13.20 It should be noted that the decision in Ringway is not directly applicable in other situations since it relied upon the provision of clause 30.3.5 of the JCT Standard Form of Building Contract (with Contractor’s Design) 1998 which states that in the absence of a payment or withholding notice the contractor’s application becomes due instead. This condition does not appear in other main standard forms of contract issued prior to 2011.10 Since the 2009 Act came into force, however, a fall-back position similar to that in Ringway now has statutory force and will apply in situations where the payer (or specified person) is required to issue a payment notice but fails to do so.

Key Case: Where the Payment Notice Determines the Sum Due

(3) Withholding Notices under s. 111

When Is a Withholding Notice Required?

13.24 Section 111 prohibits the withholding of payment of a ‘sum due under the contract’ after the final date for payment unless the payer has given an effective notice of intention to withhold that payment. Thus, when a party to a construction contract covered by the 1996 Act wishes to enforce a claim for payment it must show first that a particular sum was due under the contract and, secondly, that there was no effective notice entitling the payer to withhold payment of that sum due.

13.25 The 1996 Act does not dictate how the sum due under the contract shall be defined, that is a matter left to the terms of the contract. The only requirement of the 1996 Act is that the contract shall contain an adequate mechanism for determining the sum due, the due date, and a final date for payment.11 Construction contracts determine the sum due under the contract in a variety of ways. Therefore, depending on the terms of the contract, failure to serve a withholding notice may not preclude arguments about the amount actually due under the contract in question.

13.26 This reading of s. 111(1) has left the door open for payers to challenge claims for interim or stage payments, even where there is no withholding notice, on the terms that the sum was never due under the contract in the first place.

Withholding against the Sum Due

13.27 The following sections consider the requirement for a withholding notice to be served in a variety of different contractual situations, and demonstrate the importance of considering each contract carefully on its terms.

When the Sum Due Is the Value of Work Performed

13.28 Some contracts fail to specify that any of the payment notice, certificate, or the payee’s application represent the sum due. Often, this is a matter of interpretation and an intent might be discovered that one of these three is in fact the sum due. In other cases, however, the sum due may simply be defined by reference to the valuation mechanism contained in the contract. In these cases the ‘sum due’ may be disputed between the parties which may cause difficulties for determining whether a withholding notice is required to be issued.

13.29 One of the earliest cases on the subject was SL Timber Systems Ltd v Carillion Construction Ltd (2001) (Key Case)12 a decision of the Scottish Outer House. Despite Carillion having served no payment notice and a withholding notice that was out of time,13 it was successfully argued before Lord Macfadyen that the sum claimed by SL Timber was not the amount due under the contract because it was not the value of work performed in the relevant period. The adjudicator had erred in awarding the amount of SL Timber’s application in lieu of notice; however the decision was still enforced as it was an error of law and was not an error the consequences of which went to the adjudicator’s jurisdiction.

13.30 Whilst the judgment does not reveal the precise terms of the contract that applied, it appears that the sum due was determined as the value of work performed. Such terms are similar to those found in the Scheme. Thus, Carillion should have been entitled as a matter of law to raise a dispute about whether work had been done at all, whether it had been properly measured or valued, or whether some other event had occurred on which a contractual liability to make payment depended. These arguments went to the question of whether the sum claimed was due under the contract and did not involve an attempt to ‘withhold … a sum due under the contract’. Therefore there was no requirement to serve a notice of intention to withhold payment.

13.31 The conclusion reached by Lord Macfadyen in SL Timber was consistent with the earlier decisions of Judge Thornton in Woods Hardwick Ltd v Chiltern Air Conditioning Ltd (2001),14 and Judge LLoyd in KNS Industrial Services Birmingham Limited v Sindall Limited (2000)15 (Key Cases).

13.32 Whether a withholding notice is required under contracts of this variety depends on whether the arguments for not making payment go to the question of whether the sum claimed is due under the contract, or not. This means that matters which are properly characterized as a defence to the sum due under the contract can still be raised. Matters which are properly characterized as a cross-claim, must be contained in a withholding notice.16

13.33 The decision in SL Timber has its critics, notably the editors of Keating on Building Contracts (9th edn), at paragraph 18–060, who submit that a court will give s. 111 a purposive construction to meet the mischief intended, so that in the absence of a withholding notice a payer may not rely on set-off or abatement as a defence to a payee’s claim.

Key Cases: Withholding where the Sum Due Is the Value of Work Performed

When the Sum Due Is that Stated in a Certificate

13.40 A different approach was taken by the Court of Appeal in Rupert Morgan Building Services (LLC) Ltd v David Jervis and Harriet Jervis (2003)19 (Key Case) where the construction contract determined the sum due as being that contained in a third party certificate.

13.41 It is common for standard-form contracts to say expressly that the sum due to a contractor is the amount contained within an interim valuation certificate issued by a third party such as the project manager or architect. An example of such a provision is found in clause 4.9.1 of the JCT Standard Building Contract 2005 which provides that the architect shall issue interim certificates ‘stating the amount due to the Contractor from the Employer’. Whilst the architect is obliged to include within the interim certificate the gross value of the works (assessed in accordance with the contract rules)20 the amount due to the contractor is defined simply as the amount contained in the certificate.

13.42 In such contracts the Court of Appeal, in Rupert Morgan, said that the sum is determined by the certificate. It is not the actual work done which defines the sum due; it is simply defined as the amount in the certificate.21 The certificate may be wrong and the architect may have missed out work he ought to have included, or may have wrongly measured the work in question but, in the absence of a withholding notice, s. 111(1) operates to prevent the withholding of payment of the sum that has been certified.22 This means the payee is entitled to the money right away. Arguments about whether the payee should repay some or all of that stage payment on the grounds that it was overvalued can be made in the next payment cycle or when the final account is being negotiated.

13.43 The Court of Appeal in Rupert Morgan construed the contract as meaning that when a sum is contained in a certificate, that crystallizes the sum due and no further defences can be raised under the contract to that being the sum due. That interpretation of the contract may be thought to be something of a stretch given that the relevant terms of the contract said ‘the employer shall pay to the Contractor the amount certified within 14 days of the date of the certificate, subject to any deductions and set-offs due under the contract’.23 Nevertheless, the Court of Appeal was clearly minded to give a purposive construction to the terms of the ASI contract in issue, and appear to have interpreted this proviso as relating to deductions and set-offs properly notified in a withholding notice.

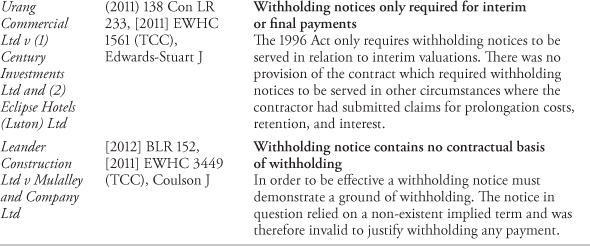

13.44 The decision has been applied in both the TCC and the Outer House Court of Session in relation to various contracts issued by the JCT: Balfour Beatty Construction Northern Ltd v Modus Corovest (Blackpool) Ltd (2008),24 Urang Commercial Ltd v Century Investments Ltd (2011),25 Fleming Buildings Ltd v Forrest or Hives (2008)26 (Key Cases).