Profit Differentials and Royalty Rates

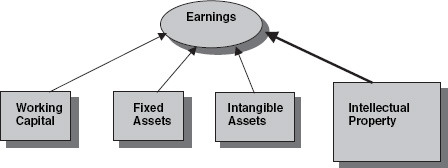

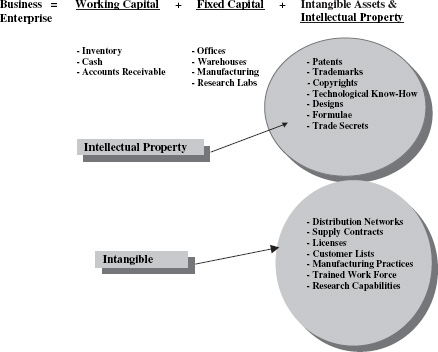

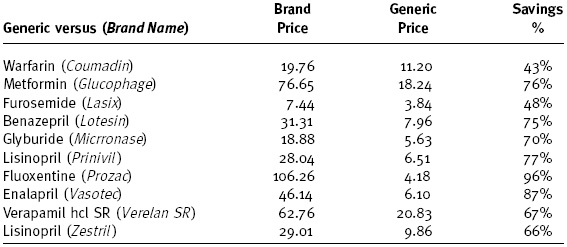

Chapter 8 Converting intellectual property (IP) into revenues, profits, and value still requires a framework of integrated complementary business assets. These assets are needed to produce the product, package it, sell it, distribute it, collect payments, and implement the many other business functions required for running a business. Companies that create IP, and then license it to others, are still not free of the fundamental need for complementary assets. While licensors may not need to acquire and use complementary assets, successful commercialization of the licensed IP is still dependent on the licensee organizing such assets. Shown below is the composition of a typical business enterprise, as comprised of working capital, fixed assets, intangible assets, and IP. It represents the collection of asset categories that all companies use, to participate in an industry and generate profits. Business Enterprise = Working Capital + Fixed Assets + Intangible Asset + IP Working capital is the net difference between the current assets and current liabilities of a company.1 Current assets are primarily composed of cash, accounts receivable, and inventory. Current liabilities include accounts payable, accrued salary, and other obligations due for payment within twelve months. The net difference between current assets and current liabilities is the amount of working capital used in the business. Fixed assets include manufacturing facilities, warehouses, office equipment, office furnishings, delivery vehicles, research equipment, and other tangible equipment. This asset category is sometimes referred to as “hard assets.” The amount of funds invested in this category can vary greatly for different companies, dependent on the industry in which they participate. As an example, huge investments in manufacturing assets are needed by companies participating in the automotive, aerospace, paper, semiconductor, and telecommunications industries. In other industries the manufacturing asset investment requirement is lower. Arguably, assemblers of electronic consumer goods fall into this category. Also in this category are insurance brokers, computer software publishers, manufacturers of cosmetics, and many business service companies. Intangible assets and IP are the soft assets of a company. Generally, IP is created by law; such as the provision in the U.S. Constitution that established the patent system. Trademarks, patents, copyrights, and trade secrets are examples. Intangible assets are of a similar nature. They often do not possess a physical embodiment but are, nonetheless, very valuable to the success of a business. Customer lists, distribution networks, regulatory approval know-how, clinical trial know-how, and good manufacturing practices are examples. All of the assets of the business enterprise contribute to the revenue and profit-generating capability of the business. The equity, and long-term debt values, represent the basis by which all other assets of a company are acquired, whether by purchase or internal creation. They are also the underlying basis for the value of the business as depicted below. Business Enterprise Value = Value of Equity + Value of Long Term Debt The equation above also shows that the value of the business enterprise equals the value of the aggregate asset categories. The value of the enterprise is equal to the value of the equity, and the long-term debt, of the company. The sum of these two components is also referred to as the “invested capital” of the company. All of the assets comprising the business enterprise contribute to the commercialization of IP, by allowing for the creation and delivery of products or services, which generate revenue and profit. The ability of a company to sustain earnings makes it a valuable investment.2 Estimating the portion of earnings attributed to specific IP can quantify the relative value of IP. Exhibit 8.1 shows how the profits of an enterprise can be allocated to the different asset categories that comprise the enterprise. The amount of profits enjoyed by an enterprise is directly related to the existence of the different asset categories. Companies lacking any one category of assets would have different profits, because the earnings of a business are derived from exploiting its assets. The amount of assets in each category, along with the nature and quality of the assets, determines the level of earnings the business generates. For pharmaceutical and biotechnology companies, IP is the largest contributor. Exhibit 8.2 presents a more detailed illustration of a typical business enterprise framework. Some of the key IP and intangible assets, specific to pharmaceutical and biotechnology companies, include Working capital, fixed assets, and intangible assets are commodity assets that all businesses can possess and exploit. A company possessing only these limited assets will enjoy only limited amounts of earnings, because of the competitive nature of commodities. A company that generates superior, or excess, earnings must have something special, usually in the form of IP, such as patented technology, trademarks, or copyrights. The contribution of excess earnings to commercial operations generally occurs in three ways: Price premiums can be obtained from the sale of technology-based products, where the marketplace is willing to pay a higher price than it otherwise would, for products lacking the technologically-based enhancement of utility. When all, or a portion, of the premium survives manufacturing costs and operating expenses, the enhanced, bottom-line profit margins are considered to be directly attributed to the existence of unique technology, or other IP. Cost savings can enhance the bottom-line profits, though the marketplace may not provide a product price premium. When a technology allows for a product or service to be produced and/or delivered at a reduced cost, the enhanced earnings are attributed to the technology used in the operations. Expanded market share can also generate incrementally higher profit margins, from economies of scale that come from high volume production. This can occur even when premium product pricing, or manufacturing cost savings, are not possible. Gravel quarries are generally an excellent example of a commodity business. The products delivered by quarries lack the enhanced utility introduced by technological IP. These companies possess the typical business enterprise asset categories previously discussed, except for IP. They may even possess extensive amounts of intangible assets, in the form of customer lists, corporate procedures, and favorable contracts. Yet the nature of their product places gravel quarries in a very competitive position, where excess earnings beyond those obtainable in a commodity business are not sustainable for the long term. Overall, profit margins in the quarry business are slim. The reason is the absence of IP. Later in this chapter, we will show that the allocation of earnings, among the asset categories of a business enterprise, is the foundation of deriving royalty rates. The allocation is based on each asset category earning a fair rate of return on the value of the category. When the profits of the company are allocated, among the investment rate of return requirements for working capital, fixed and intangible assets, sometimes little earnings are available for allocation to IP. Such would be the case for a gravel quarry business enterprise. In other industries, like medical therapies, substantial amounts of earnings are still available, after the rate of return requirements of non-IP assets are satisfied. The excess amount of earnings is derived from the existence of IP. In many cases, technology is the driving force. The primary forces driving the value of IP and royalty rates are listed below.3 It is important to remember that these forces must be considered within the framework of the business enterprise previously discussed. Amount of Profits Duration of Profits Risk Associated with the Expected Profits Amount of profits is the economic benefit generated, by the subject IP, after allowing for the economic benefits derived from the investment in complementary assets4

Profit Differentials and Royalty Rates

BUSINESS ENTERPRISE FRAMEWORK

Beyond Commodity Earnings

DRIVING FORCES BEHIND ROYALTY RATES