Chapter 3 Personal exemptions and dependents ey.com/EYTaxGuide

Introduction In 2014, you are entitled to a $3,950 deduction for yourself, your spouse, and each person you support who otherwise qualifies as a dependent. This is a $50 increase over the personal exemption amount of $3,900 that was effective for 2013. The amount of the personal exemption generally increases over time because of the statutory requirement to adjust the amount annually for inflation. This chapter tells you what specific qualifications you have to meet to take this deduction. This chapter also informs you about the special rules and procedures that apply to divorced and separated couples with children, widows and widowers, and residents of community property states. Perhaps most important, this chapter suggests when it might not be a good idea to take a deduction, even though you could qualify for it.

There are two types of dependents: a qualifying child and a qualifying relative.

First, a word about a qualifying child. A uniform definition of a “qualifying child” applies to all of the following tax benefits:

Dependency exemption Child tax credit Earned income credit Child and dependent care credit Head of household filing status The exclusion from income for dependent care benefits In order to claim an exemption for a qualifying child, the following four tests must be met:

Relationship test Residency test Age test Support test In addition to these four tests, the child must not file a joint return, unless the return was filed only as a claim for refund. In addition, special rules apply if the child is a qualifying child of more than one person. These tests are discussed in greater detail later in this chapter. You should be aware, however, that a child who is not a qualifying child might still be a dependent as a qualifying relative. Other rules apply in determining whether someone is a “qualifying relative.” These rules are also discussed in detail in this chapter.

The original intent of personal exemptions for dependents was to provide tax relief so that even the poorest citizen would be left with enough money after taxes to support themselves and their family. Obviously, a $3,950 deduction can save the taxpayer only a small portion of the income necessary to live. Ironically, the higher your income level and the higher your marginal tax rate, the greater economic benefit you derive from these deductions. A $3,950 deduction is worth $593 to a married couple filing a joint return with a taxable income of up to $73,800 and a marginal tax rate of 15%. The same $3,950 deduction is worth $1,106 to a married couple filing a joint return with a taxable income over $148,850 and a marginal tax rate of 28%. Figuring out who should claim whom as a dependent can be a difficult matter. For example, when parents are divorced, the custodial parent may sign a declaration permitting the noncustodial parent to claim the exemption for the dependent child. Consequently, if the noncustodial parent is in a higher tax bracket, a greater tax benefit can be obtained. However, if the noncustodial parent has an income over $305,050 and a filing status of married filing jointly, he or she will have a reduction in the tax benefit received due to the fact that the exemption is phased out for high income earners. The exemption is fully phased out and there is no tax benefit if you have an income above $427,550 and a filing status of married filing jointly. Either parent is entitled to claim the medical expenses paid for the child, even if that parent cannot claim the child as a dependent.

Tax Breaks and Deductions You Can Use Checklist Personal exemption. You can claim a deduction for yourself, called a personal exemption. You can claim a deduction for your spouse on a joint return. You can also claim a deduction for each of your dependents. In 2014, the exemption amount is $3,950 (each year it is indexed for inflation). The amount of the personal exemption is not prorated. That means if your dependent was born or died in 2014, you are still entitled to the full $3,950 exemption for the dependent even though he or she did not live with you for the full year. The amount of your allowable deduction is phased out once your adjusted gross income goes above a certain level for your filing status. See Phaseout of Exemptions

Personal exemption for dependent. You can claim an exemption for each dependent who meets the definition of either a “qualifying child” or a “qualifying relative” and who also meets certain additional tests as explained in detail later in this chapter. Below are some helpful hints regarding planning and the personal exemption for dependents:

(1) If you claim your child as a dependent, only you may claim the education credit for the child’s qualified tuition and related expenses. If, however, you are eligible to claim your child as a dependent but choose not to do so, your child may claim the education credit for his or her qualified tuition and related expenses even if the tuition and expenses were paid by you, the parent. It is important to note, however, that if a parent who is eligible to claim a dependency exemption for a student does not do so, the student is not allowed to take a personal exemption for himself or herself on his or her own return. As a result, the exemption for the student may be lost. If you are subject to the income phaseout limitation of the education credits, you should review the overall tax effect of not claiming an exemption for your child and allowing your child to claim the education credits. You should not claim your child as your dependent if the education tax credit will provide a greater tax benefit for your child than your tax benefit from the $3,950 exemption amount. The maximum tax benefit for a married couple, in the 28% tax bracket, to claim a child as a dependent is $1,106. For further information, see chapter 36 Education credits and other education tax benefits .

(2) Generally, the parent in the higher tax bracket should be designated as the parent to claim the dependency exemption for a child, assuming that (1) the parent meets all the tests for claiming the dependency deduction and (2) the parent is not subject to the exemption phaseout for higher income taxpayers. If one parent’s exemptions are partially or fully phased out, the other parent, although at a lower tax bracket, may receive a higher tax benefit by claiming the dependency exemption. Also, you need to consider if the person with the highest tax bracket is subject to alternative minimum tax (AMT) to maximize your tax savings. A taxpayer subject to the AMT receives no tax benefit from claiming a dependency deduction. In that case, it will be more beneficial for the parent in the lower tax bracket to claim the child as a dependent. See chapter 31 How to figure your tax , for further discussion regarding the AMT.

Exemption amount. The amount you can deduct for each exemption has increased. It was $3,900 for 2013. It is $3,950 for 2014.

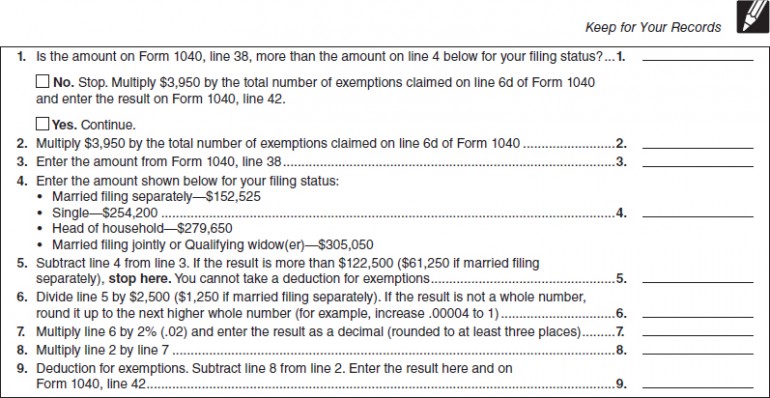

Exemption phaseout. You lose at least part of the benefit of your exemptions if your adjusted gross income is more than a certain amount. For 2014, this amount is $152,525 for a married individual filing a separate return; $254,200 for a single individual; $279,650 for a head of household; and $305,050 for married individuals filing jointly or a qualifying widow(er). See Phaseout of Exemptions , later.

This chapter discusses the following topics.

Personal exemptions—You generally can take one for yourself and, if you are married, one for your spouse. Exemptions for dependents—You generally can take an exemption for each of your dependents. A dependent is your qualifying child or qualifying relative. If you are entitled to claim an exemption for a dependent, that dependent cannot claim a personal exemption on his or her own tax return. Phaseout of exemptions—Your deduction is reduced if your adjusted gross income is more than a certain amount. Social security number (SSN) requirement for dependents—You must list the SSN of any dependent for whom you claim an exemption. Deduction. Exemptions reduce your taxable income. You can deduct $3,950 for each exemption you claim in 2014. But you may lose at least part of the dollar amount of your exemptions if your adjusted gross income is more than a certain amount. See Phaseout of Exemptions

How to claim exemptions. How you claim an exemption on your tax return depends on which form you file.

If you file Form 1040EZ, the exemption amount is combined with the standard deduction amount and entered on line 5.

If you file Form 1040A, complete lines 6a through 6d. The total number of exemptions you can claim is the total in the box on line 6d. Also complete line 26.

If you file Form 1040, complete lines 6a through 6d. The total number of exemptions you can claim is the total in the box on line 6d. Also complete line 42.

You may want to see:

There are two types of exemptions you may be able to take:

Personal exemptions for yourself and your spouse, and Exemptions for dependents (dependency exemptions). While each is worth the same amount ($3,950 for 2014), different rules apply to each type.

You are generally allowed one exemption for yourself. If you are married, you may be allowed one exemption for your spouse. These are called personal exemptions.

You can take one exemption for yourself unless you can be claimed as a dependent by another taxpayer. If another taxpayer is entitled to claim you as a dependent, you cannot take an exemption for yourself even if the other taxpayer does not actually claim you as a dependent.

Your spouse is never considered your dependent.

Joint return. On a joint return you can claim one exemption for yourself and one for your spouse.

Filing a joint return with your spouse will prevent anyone else from claiming him or her as a dependent, even if that person was otherwise entitled to do so. However, filing as married, filing separately, can allow someone else to claim your spouse as a dependent.

Jake and Elena attended college for 6 months during 2014 and were married in November of that year. Jake earned $12,000 and Elena earned $3,000 during 2014. If the newlyweds file a joint income tax return, they will owe $0 in taxes. However, Elena’s parents will then be unable to claim their daughter as a dependent, even though they provided more than half her support that year.

If Jake and Elena file as married, filing separately, Elena will owe no tax and Jake will owe $185. In addition, Elena’s parents, who are in the 28% tax bracket, will be entitled to claim Elena as a dependent, giving them a tax benefit of $1,106. Thus, if the newlyweds file separate returns, their overall tax liability combined with that of Elena’s parents will be reduced by $921 (the $1,106 tax savings to Elena’s parents less the additional $185 tax Jake and Elena incur by filing separate returns). If Jake’s parents also provided half of his support in 2014 and can claim him as a dependent, the combined tax liability for everybody involved will be even lower.

Separate return. If you file a separate return, you can claim an exemption for your spouse only if your spouse had no gross income, is not filing a return, and was not the dependent of another taxpayer. This is true even if the other taxpayer does not actually claim your spouse as a dependent. You can claim an exemption for your spouse even if he or she is a nonresident alien; in that case, your spouse must have no gross income for U.S. tax purposes, must not be filing a return, and must not be the dependent of another taxpayer.

Death of spouse. If your spouse died during the year and you file a joint return for yourself and your deceased spouse, you generally can claim your spouse’s exemption under the rules just explained in Joint return Separate return

If you remarried during the year, you cannot take an exemption for your deceased spouse.

If you are a surviving spouse without gross income and you remarry in the year your spouse died, you can be claimed as an exemption on both the final separate return of your deceased spouse and the separate return of your new spouse for that year. If you file a joint return with your new spouse, you can be claimed as an exemption only on that return.

Divorced or separated spouse. If you obtained a final decree of divorce or separate maintenance during the year, you cannot take your former spouse’s exemption. This rule applies even if you provided all of your former spouse’s support.

You are allowed one exemption for each person you can claim as a dependent. You can claim an exemption for a dependent even if your dependent files a return.

The term “dependent” means:

A qualifying child, or A qualifying relative. The terms “qualifying child qualifying relative

You can claim an exemption for a qualifying child or qualifying relative only if these three tests are met.

Dependent taxpayer test Joint return test Citizen or resident test These three tests are explained in detail later.

All the requirements for claiming an exemption for a dependent are summarized in Table 3-1

Table 3-1

Caution. This table is only an overview of the rules. For details, see the rest of this chapter.

• You cannot claim any dependents if you (or your spouse, if filing jointly) could be claimed as a dependent by another taxpayer. • You cannot claim a married person who files a joint return as a dependent unless that joint return is filed only to claim a refund of withheld income tax or estimated tax paid. • You cannot claim a person as a dependent unless that person is a U.S. citizen, U.S. resident alien, 1 • You cannot claim a person as a dependent unless that person is your qualifying child or qualifying relative . Tests To Be a Qualifying Child Tests To Be a Qualifying Relative 1. The child must be your son, daughter, stepchild, foster child, brother, sister, half brother, half sister, stepbrother, stepsister, or a descendant of any of them. 1. The person cannot be your qualifying child or the qualifying child of any other taxpayer. 2. The child must be (a) under age 19 at the end of the year and younger than you (or your spouse, if filing jointly), (b) under age 24 at the end of the year, a student, and younger than you (or your spouse, if filing jointly), or (c) any age if permanently and totally disabled. 2. The person either (a) must be related to you in one of the ways listed under Relatives who do not have to live with you 2 (and your relationship must not violate local law). 3. The child must have lived with you for more than half of the year.2 3. The person’s gross income for the year must be less than $3,950.3 4. The child must not have provided more than half of his or her own support for the year. 4. You must provide more than half of the person’s total support for the year.4 5. The child is not filing a joint return for the year (unless that return is filed only to get a refund of income tax withheld or estimated tax paid). If the child meets the rules to be a qualifying child of more than one person, only one person can actually treat the child as a qualifying child. See the Special Rule for Qualifying Child of More Than One Person to find out which person is the person entitled to claim the child as a qualifying child.

Housekeepers, maids, or servants. If these people work for you, you cannot claim exemptions for them.

Child tax credit. You may be entitled to a child tax credit for each qualifying child who was under age 17 at the end of the year if you claimed an exemption for that child. For more information, see chapter 35

If you can be claimed as a dependent by another person, you cannot claim anyone else as a dependent. Even if you have a qualifying child or qualifying relative, you cannot claim that person as a dependent.

If you are filing a joint return and your spouse can be claimed as a dependent by someone else, you and your spouse cannot claim any dependents on your joint return.

You generally cannot claim a married person as a dependent if he or she files a joint return.

Exception. You can claim an exemption for a person who files a joint return if that person and his or her spouse file the joint return only to claim a refund of income tax withheld or estimated tax paid.

Example 1—child files joint return . You supported your 18-year-old daughter, and she lived with you all year while her husband was in the Armed Forces. He earned $25,000 for the year. The couple files a joint return. You cannot take an exemption for your daughter.

Example 2—child files joint return only as claim for refund of withheld tax. Your 18-year-old son and his 17-year-old wife had $800 of wages from part-time jobs and no other income. Neither is required to file a tax return. They do not have a child. Taxes were taken out of their pay so they filed a joint return only to get a refund of the withheld taxes. The exception to the joint return test applies, so you are not disqualified from claiming an exemption for each of them just because they file a joint return. You can claim exemptions for each of them if all the other tests to do so are met.

Example 3—child files joint return to claim American opportunity credit . The facts are the same as in Example 2 except no taxes were taken out of your son’s pay. He and his wife are not required to file a tax return. However, they file a joint return to claim an American opportunity credit of $124 and get a refund of that amount. Because claiming the American opportunity credit is their reason for filing the return, they are not filing it only to get a refund of income tax withheld or estimated tax paid. The exception to the joint return test does not apply, so you cannot claim an exemption for either of them.

You cannot claim a person as a dependent unless that person is a U.S. citizen, U.S. resident alien, U.S. national, or a resident of Canada or Mexico. However, there is an exception for certain adopted children, as explained next.

Exception for adopted child. If you are a U.S. citizen or U.S. national who has legally adopted a child who is not a U.S. citizen, U.S. resident alien, or U.S. national, this test is met if the child lived with you as a member of your household all year. This exception also applies if the child was lawfully placed with you for legal adoption.

Child’s place of residence. Children usually are citizens or residents of the country of their

If you were a U.S. citizen when your child was born, the child may be a U.S. citizen and meet this test even if the other parent was a nonresident alien and the child was born in a foreign country.

Foreign students’ place of residence. Foreign students brought to this country under a qualified international education exchange program and placed in American homes for a temporary period generally are not U.S. residents and do not meet this test. You cannot claim an exemption for them. However, if you provided a home for a foreign student, you may be able to take a charitable contribution deduction. See Expenses Paid for Student Living With You chapter 25 .

U. S. national. A U.S. national is an individual who, although not a U.S. citizen, owes his or her allegiance to the United States. U.S. nationals include American Samoans and Northern Mariana Islanders who chose to become U.S. nationals instead of U.S. citizens.

Five tests must be met for a child to be your qualifying child. The five tests are:

Relationship Age Residency Support Joint return These tests are explained next.

To meet this test, a child must be:

Your son, daughter, stepchild, foster child, or a descendant (for example, your grandchild) of any of them, or Your brother, sister, half brother, half sister, stepbrother, stepsister, or a descendant (for example, your niece or nephew) of any of them. Adopted child. An adopted child is always treated as your own child. The term “adopted child” includes a child who was lawfully placed with you for legal adoption.

Foster child. A foster child is an individual who is placed with you by an authorized placement agency or by judgment, decree, or other order of any court of competent jurisdiction.

To meet this test, a child must be:

Under age 19 at the end of the year and younger than you (or your spouse, if filing jointly), A student under age 24 at the end of the year and younger than you (or your spouse, if filing jointly), or Permanently and totally disabled at any time during the year, regardless of age. Example. Your son turned 19 on December 10. Unless he was permanently and totally disabled or a student, he does not meet the age test because, at the end of the year, he was not under age 19.

Child must be younger than you or spouse. To be your qualifying child, a child who is not permanently and totally disabled must be younger than you. However, if you are married filing jointly, the child must be younger than you or your spouse but does not have to be younger than both of you.

Example 1—child not younger than you or spouse. Your 23-year-old brother, who is a student and unmarried, lives with you and your spouse. He is not disabled. Both you and your spouse are 21 years old, and you file a joint return. Your brother is not your qualifying child because he is not younger than you or your spouse.

Example 2—child younger than your spouse but not younger than you. The facts are the same as in Example 1 except your spouse is 25 years old. Because your brother is younger than your spouse, and you and your spouse are filing a joint return, your brother is your qualifying child, even though he is not younger than you.

Student defined. To qualify as a student, your child must be, during some part of each of any

A full-time student at a school that has a regular teaching staff, course of study, and a regularly enrolled student body at the school, or A student taking a full-time, on-farm training course given by a school described in (1), or by a state, county, or local government agency. The 5 calendar months do not have to be consecutive.

Full-time student. A full-time student is a student who is enrolled for the number of hours or courses the school considers to be full-time attendance.

School defined. A school can be an elementary school, junior or senior high school, college, university, or technical, trade, or mechanical school. However, an on-the-job training course, correspondence school, or school offering courses only through the Internet does not count as a school.

Vocational high school students. Students who work on “co-op” jobs in private industry as a part of a school’s regular course of classroom and practical training are considered full-time students.

For full-time students under the age of 24, the parents must continue to provide over half of the child’s support to take the deduction as a qualifying child.

Mr. and Mrs. Wong’s 22-year-old unmarried son, Robert, graduated from college in June 2014 and got a job for the remainder of the year that paid him $10,000 in taxable income. Because Robert was a full-time student for at least 5 months during 2014 and he is under the age of 24, he meets the age test under the definition of qualifying child. Nevertheless, Mr. and Mrs. Wong will not be able to take a $3,950 deduction for Robert as their dependent unless they can prove that they provided over half of Robert’s support during the entire year. If they are entitled to take the deduction for him, Robert is not entitled to claim an exemption for himself on his return.

Assuming the exemption for Robert is more valuable on his parents’ return than on Robert’s own return, Robert’s parents should document that they did furnish over half their son’s support during the year by paying for his tuition and room and board while he was in school. Robert should have used as large a portion of his income as possible for things that did not constitute support. The more money he saved and invested in 2014, the better. Then Mr. and Mrs. Wong would be entitled to claim Robert as a dependent and take a $3,950 deduction.

On the other hand, if Mr. and Mrs. Wong are subject to the phaseout of personal exemptions for regular income tax purposes, or the alternative minimum tax (AMT), claiming Robert as a dependent may not offer any tax savings. In 2014, the personal exemption phaseout begins at $305,050 for joint returns. If Mr. and Mrs. Johnson have an adjusted gross income of $380,000, they would only be able to deduct $1,582 deduction from claiming Robert as a dependent. If they are subject to AMT, they will recognize no tax benefit since personal exemptions are not deductible for purposes of calculating the AMT.

Permanently and totally disabled. Your child is permanently and totally disabled if both of the following apply.

He or she cannot engage in any substantial gainful activity because of a physical or mental condition. A doctor determines the condition has lasted or can be expected to last continuously for at least a year or can lead to death. To meet this test, your child must have lived with you for more than half the year. There are exceptions for temporary absences, children who were born or died during the year, kidnapped children, and children of divorced or separated parents.

Temporary absences. Your child is considered to have lived with you during periods of time when one of you, or both, are temporarily absent due to special circumstances such as:

Illness, Education, Business, Vacation, or Military service. Your child is also considered to have lived with you during any required hospital stay following birth, as long as the child would have lived with you during that time but for the hospitalization.

Death or birth of child. A child who was born or died during the year is treated as having lived with you more than half of the year if your home was the child’s home more than half of the time he or she was alive during the year.

Child born alive . You may be able to claim an exemption for a child born alive during the year, even if the child lived only for a moment. State or local law must treat the child as having been born alive. There must be proof of a live birth shown by an official document, such as a birth certificate. The child must be your qualifying child or qualifying relative, and all the other tests to claim an exemption for a dependent must be met.

Stillborn child. You cannot claim an exemption for a stillborn child.

Kidnapped child. You may be able to treat your child as meeting the residency test even if the child has been kidnapped. See Publication 501 for details.

Children of divorced or separated parents (or parents who live apart). In most cases, because of the residency test, a child of divorced or separated parents is the qualifying child of the custodial parent. However, the child will be treated as the qualifying child of the noncustodial parent if all four of the following statements are true.

The parents:Are divorced or legally separated under a decree of divorce or separate maintenance, Are separated under a written separation agreement, or Lived apart at all times during the last 6 months of the year, whether or not they are or were married. The child received over half of his or her support for the year from the parents. The child is in the custody of one or both parents for more than half of the year. Either of the following statements is true.The custodial parent signs a written declaration, discussed later, that he or she will not claim the child as a dependent for the year, and the noncustodial parent attaches this written declaration to his or her return. (If the decree or agreement went into effect after 1984 and before 2009, see Post-1984 and pre-2009 divorce decree or separation agreement Post-2008 divorce decree or separation agreement A pre-1985 decree of divorce or separate maintenance or written separation agreement that applies to 2014 states that the noncustodial parent can claim the child as a dependent, the decree or agreement was not changed after 1984 to say the noncustodial parent cannot claim the child as a dependent, and the noncustodial parent provides at least $600 for the child’s support during the year. Custodial parent and noncustodial parent. The custodial parent is the parent with whom the child lived for the greater number of nights during the year. The other parent is the noncustodial parent.

If the parents divorced or separated during the year and the child lived with both parents before the separation, the custodial parent is the one with whom the child lived for the greater number of nights during the rest of the year.

A child is treated as living with a parent for a night if the child sleeps:

At that parent’s home, whether or not the parent is present, or In the company of the parent, when the child does not sleep at a parent’s home (for example, the parent and child are on vacation together). Equal number of nights. If the child lived with each parent for an equal number of nights during the year, the custodial parent is the parent with the higher adjusted gross income (AGI).

501 Exemptions, Standard Deduction, and Filing Information

501 Exemptions, Standard Deduction, and Filing Information 2120 Multiple Support Declaration

2120 Multiple Support Declaration 8332 Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent

8332 Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent