Payment and Pay-less Notices under the 2009 Act

PAYMENT AND PAY-LESS NOTICES UNDER THE 2009 ACT

Contract Terms Allowing Payment to Be Withheld in the Case of the Payee’s Insolvency | |

(1) Overview

Introduction and Summary

14.01 As a result of the problems that have been encountered in the application of ss. 110(2) and 111, these provisions have now been entirely rewritten by the Local Democracy, Economic Development and Construction Act 2009 (‘the 2009 Act’). The changes apply to all construction contracts entered into after 1 October 2011. This chapter considers the changes and how they have been incorporated into the Scheme for Construction Contracts (‘the Scheme’) and the main standard forms. It should be read in conjunction with the previous chapter insofar as that chapter discusses issues relating to the effect, content, and timing of notices which are considered to be common to notices served under contracts governed by the Housing Grants Construction and Regeneration Act 1996 (‘the 1996 Act’) and the 2009 Act.

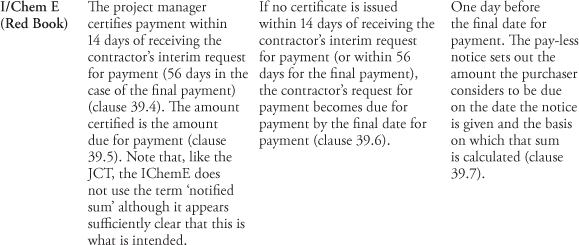

The following summary sets out the changes to ss. 110(2) and 111 under the 2009 Act:

1. References to the ‘sum due’ and ‘withholdings’ have been removed: instead the payer is obliged to pay the ‘notified sum’ which is the sum set out in the payer’s, specified person’s, or payee’s payment notice.

2. If the payer intends to pay less than the notified sum, then it or the specified person must issue a further notice (the ‘pay-less notice’) which is, in effect, a revision of the payment notice.

3. If the payer or specified person is required to issue the payment notice but fails to do so by the required date, then the notified sum is the amount set out in the payee’s application or, if none, a notice given by the payee setting out the amounts to be paid. If the latter, then the final date for payment may be adjusted.

4. The Scheme has been amended to provide for the giving of a payment notice by the payer or specified person not later than five days after the payment-due date, and the pay-less notice not later than seven days before the final date for payment. These provisions remain consistent with the 1996 Act but take account of the new terminology.

5. Further amendments have been made to clarify the position regarding withholdings in the case of the payee’s insolvency (Melville Dundas Ltd v George Wimpey UK Ltd (2007))1 and to allow a third party (‘specified person’) to provide a payment notice in place of the payer.

(2) The 2009 Act Amendments to Notice Requirements

Introduction

14.02 The 2009 Act removes all mention of the terms ‘withholding’ and ‘sum due’, and in their place is a new obligation to pay the ‘notified sum’ which is the sum set out in a payment notice given either by the payer, a ‘specified person’ (who will normally be a project manager, architect, or other administrator), or by the payee itself. If the payer intends to pay less than the notified sum, then it is obliged to set this out in a revision to the payment notice by the latest date for serving such a notice under the contract or, if no date is specified, the date calculated in accordance with the Scheme.

14.03 Complex though the new provisions appear, their drafting has no doubt been informed by the need to be as precise as possible in order to avoid the ambiguities that have blighted the notice provisions of the 1996 Act. The draftsmen have therefore focused on imposing obligations which are as prescriptive as possible, and on providing remedies where these are not observed. Thus:

1. The parties are required to include provisions within their contract for a payment notice to be given no later than five days after a payment-due date setting out the amount that the notifying party considers due as at the payment-due date, and the basis on which it has been calculated (s. 110A(1)–(3)).

2. The contract may specify that the party giving the notice may be either the employer, a specified person, or the contractor (s. 110A(1)).