Other credits including the earned income credit

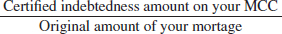

Chapter 37 Adoption credit. The maximum adoption credit is $13,190 for 2014. See Adoption Credit. Excess withholding of social security and railroad retirement tax. Social security tax and tier 1 railroad retirement (RRTA) tax were both withheld during 2014 at a rate of 6.2% of wages up to $117,000. If you worked for more than one employer and had too much social security or RRTA tax withheld during 2014, you may be entitled to a credit for the excess withholding. See Credit for Excess Social Security Tax or Railroad Retirement Tax Withheld. Alternative fuel vehicle refueling property credit (non-hydrogen refueling property). Generally, this credit is not available for property placed in service after 2013, except for hydrogen refueling property. See Alternative Fuel Vehicle Refueling Property Credit. Health Coverage Tax Credit. The legislation that authorized this credit has expired. The tax credit is not available for tax years after 2013. Nonbusiness energy property credit. The credit is not available for property placed in service after December 31, 2013. Plug-in electric drive motor vehicle credit. This credit is not available for electric motorcycles and three-wheeled vehicles placed in service after December 31, 2013. Premium Tax Credit. If you purchased your health insurance through the Health Insurance Marketplace, you may be eligible for the Premium Tax Credit. Whether you chose to have some or all of the estimated credit paid in advance directly to your insurance company to lower what you paid out-of-pocket for your monthly premiums during 2014 or you decided to wait to get the credit when you file your 2014 income tax return in 2015, you must claim the credit you are actually allowed by filing a federal income tax return. See Premium Tax Credit, later. This chapter discusses the following nonrefundable credits. This chapter also discusses the following refundable credits. Several other credits are discussed in other chapters in this publication. Nonrefundable credits. The first part of this chapter, Nonrefundable Credits, covers ten credits that you subtract from your tax. These credits may reduce your tax to zero. If these credits are more than your tax, the excess is not refunded to you. Refundable credits. The second part of this chapter, Refundable Credits, covers five credits that are treated as payments and are refundable to you. These credits are added to the federal income tax withheld and any estimated tax payments you made. If this total is more than your total tax, the excess will be refunded to you. You may want to see: The credits discussed in this part of the chapter can reduce your tax. However, if the total of these credits is more than your tax, the excess is not refunded to you. You may be able to take a tax credit of up to $13,190 for qualified expenses paid to adopt an eligible child. The credit may be allowed for the adoption of a child with special needs even if you do not have any qualified expenses. If your modified adjusted gross income (AGI) is more than $197,880, your credit is reduced. If your modified AGI is $237,880 or more, you cannot take the credit. Qualified adoption expenses. Qualified adoption expenses are reasonable and necessary expenses directly related to, and whose principal purpose is for, the legal adoption of an eligible child. These expenses include: Nonqualified expenses. Qualified adoption expenses do not include expenses: Eligible child. The term “eligible child” means any individual: Child with special needs. An eligible child is a child with special needs if all three of the following apply. When to take the credit. Generally, until the adoption becomes final, you take the credit in the year after your qualified expenses were paid or incurred. If the adoption becomes final, you take the credit in the year your expenses were paid or incurred. See the Instructions for Form 8839 for more specific information on when to take the credit. Foreign child. If the child is not a U.S. citizen or resident at the time the adoption process began, you cannot take the credit unless the adoption becomes final. You treat all adoption expenses paid or incurred in years before the adoption becomes final as paid or incurred in the year it becomes final. How to take the credit. Figure your 2014 nonrefundable credit and any carryforward to 2015 on Form 8839 and attach it to your Form 1040. Include the credit in your total for Form 1040, line 54. Check box c and enter “8839” on the line next to that box. More information. For more information, see the Instructions for Form 8839. You may be able to take this credit if you place a qualified fuel cell vehicle in service in 2014. Amount of credit. Generally, you can rely on the manufacturer’s certification to the IRS that a specific make, model, and model year vehicle qualifies for the credit and the amount of the credit for which it qualifies. In the case of a foreign manufacturer, you generally can rely on its domestic distributor’s certification to the IRS. Ordinarily the amount of the credit is 100% of the manufacturer’s (or domestic distributor’s) certification to the IRS of the maximum credit allowable. How to take the credit. To take the credit, you must complete Form 8910 and attach it to your Form 1040. Include the credit in your total for Form 1040, line 54. Check box c and enter “8910” on the line next to that box. More information. For more information on the credit, see the Instructions for Form 8910. You may be able to take a credit if you place qualified hydrogen refueling property in service in 2014. Qualified hydrogen refueling property. Qualified hydrogen refueling property is any property (other than a building or its structural components) used for either of the following. Text intentionally omitted. Amount of the credit. For personal use property, the credit is generally the smaller of 30% of the property’s cost or $1,000. For business use property, the credit is generally the smaller of 30% of the property’s cost or $30,000. How to take the credit. To take the credit, you must complete Form 8911 and attach it to your Form 1040. Include the credit in your total for Form 1040, line 54. Check box c and enter “8911” on the line next to that box. More information. For more information on the credit, see the Form 8911 instructions. Tax credit bonds are bonds in which the holder receives a tax credit in lieu of some or all of the interest on the bond. You may be able to take a credit if you are a holder of one of the following bonds. In some instances, an issuer may elect to receive a credit for interest paid on the bond. If the issuer makes this election, you cannot also claim a credit. Interest income. The amount of any tax credit allowed (figured before applying tax liability limits) must be included as interest income on your tax return. How to take the credit. Complete Form 8912 and attach it to your Form 1040. Include the credit in your total for Form 1040, line 54. Check box c and enter “8912” on the line next to that box. More information. For more information, see the Instructions for Form 8912. You generally can choose to take income taxes you paid or accrued during the year to a foreign country or U.S. possession as a credit against your U.S. income tax. Or, you can deduct them as an itemized deduction (see chapter 23). You cannot take a credit (or deduction) for foreign income taxes paid on income that you exclude from U.S. tax under any of the following. Limit on the credit. Unless you can elect not to file Form 1116 (see Exception, later), your foreign tax credit cannot be more than your U.S. tax liability (Form 1040, line 44), multiplied by a fraction. The numerator of the fraction is your taxable income from sources outside the United States. The denominator is your total taxable income from U.S. and foreign sources. See Publication 514 for more information. How to take the credit. Complete Form 1116 and attach it to your Form 1040. Enter the credit on Form 1040, line 48. Exception. You do not have to complete Form 1116 to take the credit if all of the following apply. More information. For more information on the credit and these requirements, see the Instructions for Form 1116. The mortgage interest credit is intended to help lower-income individuals own a home. If you qualify, you can take the credit each year for part of the home mortgage interest you pay. Who qualifies. You may be eligible for the credit if you were issued a qualified mortgage credit certificate (MCC) from your state or local government. Generally, an MCC is issued only in connection with a new mortgage for the purchase of your main home. Amount of credit. Figure your credit on Form 8396. If your mortgage loan amount is equal to (or smaller than) the certified indebtedness (loan) amount shown on your MCC, enter on Form 8396, line 1, all the interest you paid on your mortgage during the year. If your mortgage loan amount is larger than the certified indebtedness amount shown on your MCC, you can figure the credit on only part of the interest you paid. To find the amount to enter on line 1, multiply the total interest you paid during the year on your mortgage by the following fraction. Certified indebtedness amount on your MCC/Original amount of your mortgage Limit based on credit rate. If the certificate credit rate is more than 20%, the credit you are allowed cannot be more than $2,000. If two or more persons (other than a married couple filing a joint return) hold an interest in the home to which the MCC relates, this $2,000 limit must be divided based on the interest held by each person. See Publication 530 for more information. Carryforward. Your credit (after applying the limit based on the credit rate) is also subject to a limit based on your tax that is figured using Form 8396. If your allowable credit is reduced because of this tax liability limit, you can carry forward the unused portion of the credit to the next 3 years or until used, whichever comes first. If you are subject to the $2,000 limit because your certificate credit rate is more than 20%, you cannot carry forward any amount more than $2,000 (or your share of the $2,000 if you must divide the credit). How to take the credit. Figure your 2014 credit and any carryforward to 2015 on Form 8396, and attach it to your Form 1040. Be sure to include any credit carryforward from 2011, 2012, and 2013. Include the credit in your total for Form 1040, line 54. Check box c and enter “8396” on the line next to that box. Reduced home mortgage interest deduction. If you itemize your deductions on Schedule A (Form 1040), you must reduce your home mortgage interest deduction by the amount of the mortgage interest credit shown on Form 8396, line 3. You must do this even if part of that amount is to be carried forward to 2015. For more information about the home mortgage interest deduction, see chapter 24. Recapture of federal mortgage subsidy. If you received an MCC with your mortgage loan, you may have to recapture (pay back) all or part of the benefit you received from that program. The recapture may be required if you sell or dispose of your home at a gain during the first 9 years after the date you closed your mortgage loan. See the Instructions for Form 8828 and chapter 15 for more information. More information. For more information on the credit, see the Form 8396 instructions. The tax laws give special treatment to some kinds of income and allow special deductions and credits for some kinds of expenses. If you benefit from these laws, you may have to pay at least a minimum amount of tax in addition to any other tax on these items. This is called the alternative minimum tax. The special treatment of some items of income and expenses only allows you to postpone paying tax until a later year. If in prior years you paid alternative minimum tax because of these tax postponement items, you may be able to take a credit for prior year minimum tax against your current year’s regular tax. You may be able to take a credit against your regular tax if for 2013 you had: How to take the credit. Figure your 2014 nonrefundable credit (if any), and any carryforward to 2015 on Form 8801, and attach it to your Form 1040. Include the credit in your total for Form 1040, line 54, and check box b. You can carry forward any unused credit for prior year minimum tax to later years until it is completely used. More information. For more information on the credit, see the Instructions for Form 8801. You may be able to take this credit if you placed in service for business or personal use a qualified plug-in electric drive motor vehicle in 2014 and you meet some other requirements. Qualified plug-in electric drive motor vehicle. This is a new vehicle with at least four wheels that: Text intentionally omitted. Certification and other requirements. Generally, you can rely on the manufacturer’s (or, in the case of a foreign manufacturer, its domestic distributor’s) certification to the IRS that a specific make, model, and model year vehicle qualifies for the credit and, if applicable, the amount of the credit for which it qualifies. However, if the IRS publishes an announcement that the certification for any specific make, model, and model year vehicle has been withdrawn, you cannot rely on the certification for such a vehicle purchased after the date of publication of the withdrawal announcement. The following requirements must also be met to qualify for the credit. How to take the credit. To take the credit, you must complete Form 8936 and attach it to your Form 1040. Include the credit in your total for Form 1040, line 54. Check box c and enter “8936” on the line next to that box. More information. For more information on the credit, see the Form 8936 instructions. Text intentionally omitted. You may be able to take a credit of 30% of your costs of qualified solar electric property, solar water heating property, fuel cell property, small wind energy property, and geothermal heat pump property. The credit amount for costs paid for qualified fuel cell property is limited to $500 for each one-half kilowatt of capacity of the property. If you are a member of a condominium management association for a condominium you own or a tenant-stockholder in a cooperative housing corporation, you are treated as having paid your proportionate share of any costs of the association or corporation for purposes of this credit. Basis reduction. You must reduce the basis of your home by the amount of any credit allowed. How to take the credit. Complete Form 5695 and attach it to your Form 1040. Enter the credit on Form 1040, line 52. More information. For more information on these credits, see the Form 5695 instructions. You may be able to take this credit if you, or your spouse if filing jointly, made: However, you cannot take the credit if either of the following applies. Student. You were a student if during any part of 5 calendar months of 2014 you: School. A school includes a technical, trade, or mechanical school. It does not include an on-the-job training course, correspondence school, or school offering courses only through the Internet. How to take the credit. Figure the credit on Form 8880. Enter the credit on your Form 1040, line 51, or your Form 1040A, line 34, and attach Form 8880 to your return. More information. For more information on the credit, see the Form 8880 instructions. The credits discussed in this part of the chapter are treated as payments of tax. If the total of these credits, withheld federal income tax, and estimated tax payments is more than your total tax, the excess can be refunded to you. Premium Tax Credit. The premium tax credit is an advanceable, refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace, also known as the Exchange, beginning in 2014. You can choose to have the credit paid in advance to your insurance company to lower what you pay for your monthly premiums, or you can claim all of the credit when you file your tax return for the year. If you choose to have the credit paid in advance, you will reconcile the amount paid in advance with the actual credit you compute when you file your tax return.

Other credits including the earned income credit

What’s New

Useful Items

Publication

502 Medical and Dental Expenses

502 Medical and Dental Expenses

514 Foreign Tax Credit for Individuals

514 Foreign Tax Credit for Individuals

530 Tax Information for Homeowners

530 Tax Information for Homeowners

590 Individual Retirement Arrangements (IRAs)

590 Individual Retirement Arrangements (IRAs)

Form (and Instructions)

1116 Foreign Tax Credit

1116 Foreign Tax Credit

2439 Notice to Shareholder of Undistributed Long-Term Capital Gains

2439 Notice to Shareholder of Undistributed Long-Term Capital Gains

5695 Residential Energy Credit

5695 Residential Energy Credit

8396 Mortgage Interest Credit

8396 Mortgage Interest Credit

8801 Credit For Prior Year Minimum Tax—Individuals, Estates, and Trusts

8801 Credit For Prior Year Minimum Tax—Individuals, Estates, and Trusts

8828 Recapture of Federal Mortgage Subsidy

8828 Recapture of Federal Mortgage Subsidy

8839 Qualified Adoption Expenses

8839 Qualified Adoption Expenses

8880 Credit for Qualified Retirement Savings Contributions

8880 Credit for Qualified Retirement Savings Contributions

8910 Alternative Motor Vehicle Credit

8910 Alternative Motor Vehicle Credit

8911 Alternative Fuel Vehicle Refueling Property Credit

8911 Alternative Fuel Vehicle Refueling Property Credit

8912 Credit to Holders of Tax Credit Bonds

8912 Credit to Holders of Tax Credit Bonds

8936 Qualified Plug-in Electric Drive Motor Vehicle Credit

8936 Qualified Plug-in Electric Drive Motor Vehicle Credit

8962 Premium Tax Credit (PTC)

8962 Premium Tax Credit (PTC)

Nonrefundable Credits

Adoption Credit

Alternative Motor Vehicle Credit

Hydrogen Refueling Property Credit

Credit to Holders of Tax Credit Bonds

Foreign Tax Credit

Mortgage Interest Credit

Nonrefundable Credit for Prior Year Minimum Tax

Plug-in Electric Drive Motor Vehicle Credit

Residential Energy Efficient Property Credit

Retirement Savings Contributions Credit (Saver’s Credit)

Refundable Credits

Premium Tax Credit