Chapter 29 Miscellaneous deductions ey.com/EYTaxGuide

IRS Publication 17 (Your Federal Income Tax ) has been updated by Ernst & Young LLP for 2014. Dates and dollar amounts shown are for 2014. Underlined type is used to indicate where IRS text has been updated. Places where text has been removed are indicated by the sentence: Text intentionally omitted .

ey.com/EYTaxGuide

Ernst & Young LLP will update the EY Tax Guide 2015 website with relevant taxpayer information as it becomes available. You can also sign up for email alerts to let you know when changes have been made.

This chapter covers a variety of expenses, some of which are deductible on your tax return and some of which are not. Deductible expenses can be broadly broken down into three categories: (1) deductible employee expenses, (2) deductible expenses of producing or collecting income, and (3) other deductible expenses. The general rule is that you may deduct any “ordinary and necessary” expense related to your trade or business, connected with producing or collecting other taxable income, or paid to determine your tax. Note, however, that your deductions may be limited depending on the type of the expense and your income level. (See discussion later regarding Deductions Subject to the 2% Limit

Nondeductible expenses, by definition, are all expenses that are not deductible. These expenses are typically personal in nature. The nondeductible expenses discussed in this chapter are not all-inclusive, but rather reflect the more common expenses that people may think are (or should be) deductible.

With proper planning, you may be able to deduct more than you think. Be sure to take note of the special comments throughout this chapter with respect to documenting the appropriateness of your deductions. Also, check out the list at the front of the book for 50 of the Most Easily Overlooked Deductions

Standard mileage rate. The 2014 rate for business use of a vehicle is 56 cents per mile.

This chapter explains which expenses you can claim as miscellaneous itemized deductions on Schedule A (Form 1040). You must reduce the total of most miscellaneous itemized deductions by 2% of your adjusted gross income. This chapter covers the following topics.

Deductions subject to the 2% limit. Deductions not subject to the 2% limit. Expenses you cannot deduct.

Whether or not the miscellaneous itemized deductions you claim are subject to the 2% limit, miscellaneous itemized deductions—with the exception of casualty and theft losses and gambling losses—along with other specified itemized deductions (including home mortgage interest, state and local taxes, and charitable deductions), may be further reduced by an additional “overall” limitation. (Medical expense and investment interest expense deductions are not subject to this overall limitation.) The total of this group of itemized deductions must be reduced by 3% of the amount of your adjusted gross income (AGI) in excess of certain thresholds; i.e. $254,200 for individual filers, $279,650 for heads of households, $305,050 if married filing jointly or a surviving spouse, and $152,520 if married filing separately. (The threshold amounts are indexed annually for inflation.) However, no more than 80% of the otherwise allowable deductions are phased out. See chapter 30 Limit on Itemized Deductions , for more information.

You must keep records to verify your deductions. You should keep receipts, canceled checks, substitute checks, financial account statements, and other documentary evidence. For more information on recordkeeping, get Publication 552, Recordkeeping for Individuals.

Job-hunting expenses. Job-hunting expenses are deductible whether or not you find a new job. For job-search expenses to be deductible, you must be looking for employment in the same trade or business in which you are engaged. Accepting temporary employment in another line of work won’t affect your deduction for expenses in searching for permanent employment in your regular line of work. But job-hunting costs aren’t deductible if you are looking for a job in a new trade or business, even if you find employment as a result of the search.

IRA fees. Fees you pay to an IRA custodian are deductible as miscellaneous deductions as long as they are paid from an account other than your IRA account. If they are paid directly from your IRA, you get no deduction and your IRA account is reduced.

Deduction for estate tax on income in respect of a decedent. This deduction is missed by many taxpayers. If someone bequeaths taxable income (such as an IRA or nonqualified stock option) to an estate or beneficiary, the recipient is entitled to an income tax deduction for any federal estate tax paid which is allocable to that income. The deduction is not subject to the 2%-of-adjusted-gross-income (AGI) floor.

Gambling losses. Gambling losses can be claimed as a miscellaneous deduction not subject to the 2%-of-adjusted-gross-income (AGI) floor. But gambling losses are only deductible to the extent that you have gambling winnings during the same year. If your winnings are over certain specified amounts, they will be reported to you on Form W-2G, Certain Gambling Winnings. See Gambling Losses Up to the Amount of Gambling Winnings

You may want to see:

463 Travel, Entertainment, Gift, and Car Expenses525 Taxable and Nontaxable Income529 Miscellaneous Deductions535 Business Expenses587 Business Use of Your Home (Including Use by Daycare Providers)946 How To Depreciate Property Schedule A (Form 1040) Itemized Deductions2106 Employee Business Expenses2106-EZ Unreimbursed Employee Business Expenses You can deduct certain expenses as miscellaneous itemized deductions on Schedule A (Form 1040). You can claim the amount of expenses that is more than 2% of your adjusted gross income. You figure your deduction on Schedule A by subtracting 2% of your adjusted gross income from the total amount of these expenses. Your adjusted gross income is the amount on Form 1040, line 38.

Generally, you apply the 2% limit after you apply any other deduction limit. For example, you apply the 50% (or 80%) limit on business-related meals and entertainment (discussed in chapter 27

2% limitation. First, you must determine which expenses are deductible. Next, you must calculate the amount that is deductible, taking into account any limitation for certain types of expenses (e.g., 50% for meals and entertainment). The sum of all of your allowable miscellaneous deductions is then reduced by 2% of your adjusted gross income (AGI).

Assume an individual’s adjusted gross income is $45,000 in 2014. This person paid $1,500 in 2014 for the preparation of his 2013 income tax returns and also had $200 of unreimbursed business-related meal expenses for 2014. Both of these expenses are deductible. The $1,500 tax preparation fee is fully deductible, whereas only 50% of the $200 meal expense is deductible. Therefore, total miscellaneous deductions are $1,600 ($1,500 + [50% × $200]). However, 2% of the individual’s AGI is $900 ($45,000 × 2%), so he is permitted a deduction of only $700 ($1,600 of total allowable deductions reduced by 2% of AGI, or $900).

Deductions subject to the 2% limit are discussed in the three categories in which you report them on Schedule A (Form 1040).

Unreimbursed employee expenses (line 21). Tax preparation fees (line 22). Other expenses (line 23). Generally, you can deduct on Schedule A (Form 1040), line 21, unreimbursed employee expenses that are:

Paid or incurred during your tax year, For carrying on your trade or business of being an employee, and Ordinary and necessary. An expense is ordinary if it is common and accepted in your trade, business, or profession. An expense is necessary if it is appropriate and helpful to your business. An expense does not have to be required to be considered necessary.

Unreimbursed employee business expenses. If you are an employee and have business expenses that are either not reimbursed or are more than the amount reimbursed by your employer, you can generally deduct them only as a miscellaneous deduction (subject to the 2%-of-adjusted-gross-income limit) on Schedule A (Form 1040).

If you can get your employer to reimburse you for what would otherwise be unreimbursed business expenses, in lieu of an equal amount of future salary, you should do so. The reimbursement for those expenses is not included on your Form W-2 as compensation, so your tax liability should be less. You benefit at no additional cost to your employer because reimbursed employee business expenses that you have adequately reported to your employer are deductible by your employer the same as wages. This only works, however, if you give up your right to receive payment in the event you don’t incur any business expenses.

Examples of unreimbursed employee expenses are listed next. The list is followed by discussions of additional unreimbursed employee expenses.

Business bad debt of an employee. Education that is work related. (See chapter 28 Legal fees related to your job. Licenses and regulatory fees. Malpractice insurance premiums. Medical examinations required by an employer. Occupational taxes. Passport for a business trip. Subscriptions to professional journals and trade magazines related to your work. Travel, transportation, entertainment, and gifts related to your work. (See chapter 27

Business bad debt of an employee. A business bad debt is a loss from a debt created or acquired in your trade or business, or a loss when there is a very close relationship between the debt and your trade or business when the debt is created (e.g., as an employee, your main motive for creating the debt is a business reason). For example, if an employee makes a bona fide loan to his employer in order to keep his job, and the company fails to pay the debt, the employee has a business bad debt. See Publication 535 for more information on business bad debts.

You are not allowed to deduct the travel expenses of family members, even if there is a business purpose for their presence on the trip, unless the family member is also an employee. If your employer reimburses you for travel expenses, the portion of the expense attributable to family members who are not employees of the company may be included in your W-2 income. See chapter 27 Car expenses and other employee business expenses , for more information.

The deduction percentage for meals consumed while away from home by individuals subject to hours of service limitations of the Department of Transportation, such as interstate truck and bus drivers, certain railroad employees, and certain merchant marines, is 80%. (See Exceptions to the 50% Limit 50% Limit in chapter 27 , Car expenses and other employee business expenses .) Note that you must apply this percentage before applying the 2%-of-adjusted-gross-income (AGI) limitation.

Records you should keep. Adequate records should be kept for the amount of your travel and entertainment expenses, the time and place they occurred, the business purpose of the expenses, and the business relationship to the persons entertained in order for you to substantiate your deduction.

Business gifts. You can deduct no more than $25 for business gifts to any one person per year. See chapter 27 Car expenses and other employee business expenses , for more information.

You can deduct insurance premiums you paid for protection against personal liability for wrongful acts on the job.

If you break an employment contract, you can deduct damages you pay your former employer that are attributable to the pay you received from that employer.

You can claim a depreciation deduction for a computer that you use in your work as an employee if its use is:

For the convenience of your employer, and Required as a condition of your employment.

“For the convenience of your employer” means that your use of the computer is for a substantial business reason of your employer. All facts must be considered in making this determination. The use of your computer during your regular working hours to carry on your employer’s business is generally for the convenience of your employer.

“Required as a condition of your employment” means that you cannot properly perform your duties without it. Whether or not you can properly perform your duties without the computer depends on all the facts and circumstances. It is not necessary that your employer explicitly requires you to use your computer. But neither is it sufficient that your employer merely states that your use of this item is a condition of your employment.

You are an engineer with an engineering firm. You occasionally take work home at night rather than work late at the office. You own and use a computer that is similar to the one you use at the office to complete your work at home. Because your use of the computer is not for the convenience of your employer and is not required as a condition of your employment, you cannot claim a deduction.

Cellular phones and other telecommunication equipment were subject to the same rules applicable to computers. However, the Small Business Jobs Act of 2010 provided that telecommunication equipment, including cell phones, can now be deducted or depreciated like other business property, without the recordkeeping requirements that apply to computers. This provision became effective for tax years ending after December 31, 2009.

The rules for depreciation of a computer that you use in your work as an employee differ from the rules for depreciation of a computer owned or leased and used only in your home office. See the section later regarding home offices and Publication 529, Miscellaneous Deductions , for more information.

Personal computers. Home computers are frequently used for both business and personal purposes. Video games, children’s homework, and personal finances are considered personal uses. If you don’t have separate personal and business computers, some type of allocation should be made between business use and personal use of the same computer.

The point to remember is that it is difficult to claim a deduction for your home computer. The IRS position is that no deduction will be allowed for a personal computer unless it meets the “for the convenience of your employer” and “required as a condition of your employment” tests described earlier.

Records you should keep. Adequate records must be maintained to support your business use of the property in order to claim a depreciation expense deduction.

In case the IRS challenges your deductions for depreciation on home computers, you should keep the following information to support your claim for home computer depreciation deductions:

Documentation from your employer that use of the home computer is required by the employer; and A log of time spent using the computer and whether time was for personal or business use. For details on allowable methods of depreciation, see chapter 9 Rental income and expenses . The Section 179 deduction is explained in chapter 38 Self-employment income: How to file Schedule C .

For more information about the rules and exceptions to the rules affecting the allowable deductions for a home computer, see Publication 529.

You may be able to deduct dues paid to professional organizations (such as bar associations and medical associations) and to chambers of commerce and similar organizations, if membership helps you carry out the duties of your job. Similar organizations include:

Boards of trade, Business leagues, Civic or public service organizations, Real estate boards, and Trade associations. Lobbying and political activities. You may not be able to deduct that part of your dues that is for certain lobbying and political activities. See Dues used for lobbying Nondeductible Expenses , later.

Text intentionally omitted. If you were an educator in 2014, you can deduct educator expenses as a miscellaneous itemized deduction subject to the 2% limit.

For 2013, elementary and secondary school teachers and other eligible school professionals were allowed to claim as an “above-the-line deduction” up to $250 in qualified expenses paid or incurred for books, qualifying supplies, equipment (including computer equipment, software, and services).

An “above-the-line” deduction is a deduction (also called an adjustment) you take to reduce your gross income in order to calculate your adjusted gross income. This above-the-line deduction expired at the end of 2013, and is therefore not available for 2014. As of the date this book was published, however, Congress had been considering legislation that would extend the availability of the $250 above-the-line deduction at least through 2014, but no such extension had yet been passed. For updated information on this and any other tax law changes that occur after this book was published, see our website, ey.com/EYTaxGuide

Whether or not the above-the-line deduction is extended, ordinary and necessary educator expenses may otherwise be deductible as a miscellaneous itemized deduction subject to the 2% limitation.

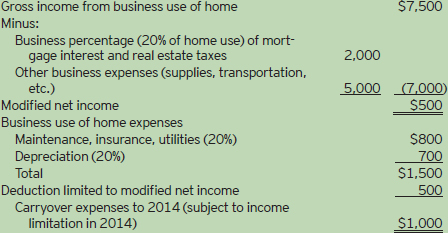

If you use a part of your home regularly and exclusively for business purposes, you may be able to deduct a part of the operating expenses and depreciation of your home.

Home office deduction. It is now easier for taxpayers to claim a home office deduction. Furthermore, the IRS has adopted an optional simplified method for calculating your deduction. (see Simplified option for home office deduction

Individuals claiming home office deductions on Schedule C are required to figure those deductions on Form 8829, Expenses for Business Use of Your Home . However, if you are an employee claiming unreimbursed job-related expenses, use Form 2106, Employee Business Expenses, if applicable, or include the amount directly on Schedule A.

You can claim this deduction for the business use of a part of your home only if you use that part of your home regularly and exclusively:

As your principal place of business for any trade or business, As a place to meet or deal with your patients, clients, or customers in the normal course of your trade or business, or In the case of a separate structure not attached to your home, in connection with your trade or business.

A home may be a house, an apartment, a condominium, a mobile home, or even a boat. It may also be other structures on the same property as the house you live in, such as a studio, a barn, a greenhouse, or an unattached garage.

The regular and exclusive business use must be for the convenience of your employer and not just appropriate and helpful in your job. See Publication 587 for more detailed information and a worksheet.

A home office deduction will only be allowed if you use your home in connection with a trade or business. All profit-seeking activities are not trades or businesses (e.g., if you invest from home and are not a broker or dealer investing on behalf of clients or are not a “trader,” you are not in the business of investing). However, you may take a home office deduction for a trade or business that is not your full-time occupation, as long as all appropriate tests are met (an example would be an attorney who uses his home office for managing rental properties he owns).

Principal place of business. Administrative and management activities for your trade or business that are performed exclusively and regularly in your home will qualify your home as your principal place of business if you have no other fixed location where you perform substantial administrative or management activities. Activities that are considered administrative or managerial include billing clients, customers, or patients; keeping books and records; ordering supplies; setting up appointments; and writing reports.

In addition, certain administrative and management activities may be performed in other locations and not disqualify your home office as your principal place of business for purposes of meeting the test described earlier. For example, you may hire another person or company to perform your administrative activities, such as computing employee payrolls, at locations other than your home. You may also conduct administrative and management activities at places that are not fixed locations, such as hotel rooms or airports, and you may occasionally conduct minimal administrative and managerial activities at a fixed location outside of your home. Also, performing substantial nonadministrative activities outside of your home, such as servicing clients or making sales calls, will not disqualify your home as your principal place of business. And, significantly, you may even have suitable space available to you outside your home for performing administrative and managerial tasks but choose to use your home instead. (Note, however, that if you are an employee, any use of your home must be for the convenience of your employer in order to qualify for the home office deduction.)

Connor is a self-employed anesthesiologist, working for three different local hospitals. One of the hospitals provides him with a small shared office where he could perform administrative or management activities. However, Connor prefers to use a room in his home as an office. He regularly and exclusively uses this room to schedule patients, maintain patient logs, bill patients, and read medical journals.

Prior to 2001, Connor’s home office did not qualify as his principal place of business because his most important activity, administering anesthetics, was performed in the hospitals. Under the current rules, Connor’s office qualifies for the home office deduction in 2014 (i.e., his home office will qualify as his principal place of business) because he conducts administrative and managerial activities for his business there and has no other fixed location where these activities take place. Neither the fact that Connor has available space at the hospital for performing administrative tasks nor the fact that his most important task is performed outside of his home disqualifies his home office as his principal place of business.

To qualify for the regular and exclusive use test, you must use a specific area of your home only for your trade or business and on a continuing basis. The specific area can be a separate room or any identifiable space (the space does not need to be marked off by a permanent enclosure). Any personal use of the space will cause you to fail the requirements of the exclusive use test. Occasional or incidental use will cause you to fail the regular use test, even if that area of your house is not used for any other purposes.

Note that there is an exception to the regular and exclusive use test if you use part of your home as a daycare facility for children, persons age 65 or older, or individuals who are physically or mentally incapable of caring for themselves. The daycare provider must be licensed or certified under applicable state law, or exempt from licensing, for the exception to apply. There is also an exception to the regular and exclusive use test if you use part of your home to store inventory or product samples. If your home is the principal place of your business, the space used for inventory and sample storage qualifies for the home office deduction as long as it is used regularly, but not necessarily exclusively, for business.

Many home sales operations require a great deal of personal time and attention but produce a minimum of deductible expenses. You should note, however, that the use of space in your home to store inventory or product samples may produce valuable deductions for otherwise underutilized spaces, such as attics and basements. Remember, the storage space must be a specific area that is used as a part of your principal place of business.

Daycare providers. Daycare providers who operate businesses in their homes may benefit from a recent IRS ruling. The square footage of a room that is regularly used for daycare and is available throughout the business day will be considered used for daycare for the entire business day. Previously, taxpayers had to take partial days based on the hours of actual business use. The deduction for daycare providers is equal to the total costs of maintaining the home (e.g., electricity, gas, water, trash collection, general maintenance) to provide daycare, multiplied by the following two fractions:

The resulting deduction is subject to the income limitation, discussed later. IRS Form 8829 will help you work through this calculation.

A daycare provider uses a bedroom (available for child care throughout the business day) for the children’s morning and afternoon naps every day. Although the bedroom is not used during every hour of the business day, the total square footage of that room is considered as daycare usage for the entire business day when the total area for business is calculated.

If you are an employee and you meet the tests described earlier for the use of your home in your trade or business, you will only qualify for a home office deduction if your use of your home is for the convenience of your employer and you do not rent your home office to your employer. It is not sufficient that a home office is helpful to your job; it must be a requirement of your employer. Your home office must also be justified by the nature of your job, which depends on all the facts and circumstances.

How to figure the deduction. To figure the percentage of your home used for business, you may compare the square feet of space used for business to the total square feet in your home. Or, if the rooms in your home are approximately the same size, you may compare the number of rooms used for business to the total number of rooms in your home. You may also use any other reasonable method. Generally, you figure the business part of your expenses by applying the percentage to the total of each expense.

Only gold members can continue reading.

Log In or

Register to continue

463 Travel, Entertainment, Gift, and Car Expenses

463 Travel, Entertainment, Gift, and Car Expenses 525 Taxable and Nontaxable Income

525 Taxable and Nontaxable Income 529 Miscellaneous Deductions

529 Miscellaneous Deductions 535 Business Expenses

535 Business Expenses 587 Business Use of Your Home (Including Use by Daycare Providers)

587 Business Use of Your Home (Including Use by Daycare Providers) 946 How To Depreciate Property

946 How To Depreciate Property  Schedule A (Form 1040) Itemized Deductions

Schedule A (Form 1040) Itemized Deductions 2106 Employee Business Expenses

2106 Employee Business Expenses 2106-EZ Unreimbursed Employee Business Expenses

2106-EZ Unreimbursed Employee Business Expenses