Chapter 30 Limit on itemized deductions ey.com/EYTaxGuide

IRS Publication 17 (Your Federal Income Tax ) has been updated by Ernst & Young LLP for 2014. Dates and dollar amounts shown are for 2014. Underlined type is used to indicate where IRS text has been updated. Places where text has been removed are indicated by the sentence: Text intentionally omitted .

ey.com/EYTaxGuide

Ernst & Young LLP will update the EY Tax Guide 2015 website with relevant taxpayer information as it becomes available. You can also sign up for email alerts to let you know when changes have been made.

Limit on itemized deductions. Higher-income taxpayers can lose some of their itemized deductions. This can occur because total itemized deductions are reduced for taxpayers with adjusted gross income (AGI) above specified levels. The general rule is that certain itemized deductions are reduced by 3% of the amount by which your adjusted gross income (AGI) exceeds $254,200 for individual filers, $279,650 for heads of households, $305,050 if married filing jointly or a surviving spouse, and $152,525 if married filing separately. No more than 80% of the otherwise allowable deductions are phased out. The threshold AGI amount increases each year to reflect inflation.

The tax law limits the amount of certain itemized deductions that individuals can use to reduce their taxable income. For example, the threshold for deducting medical and dental expenses is 10% of adjusted gross income (7.5% if you or your spouse are age 65 or older by the end of the taxable year) (AGI) (see chapter 22 Medical and dental expenses ), certain miscellaneous deductions are limited to those in excess of 2% of adjusted gross income (see chapter 29 Miscellaneous deductions ), and home mortgage interest expense is subject to various limitations (see chapter 24 Interest expense ).

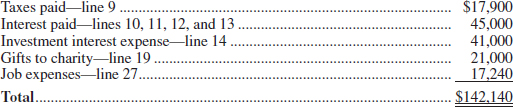

Congress has placed an additional “overall” limitation on the deductibility of a certain group of itemized deductions. Itemized deductions that are subject to this limitation include taxes, home mortgage interest, charitable contributions, and most miscellaneous itemized deductions. Medical expenses, casualty and theft losses, investment interest expense, and deductible gambling losses are not subject to this rule.

For 2014, the total of this group of deductions must be reduced by 3% of the amount of your adjusted gross income in excess of $254,200 for individual filers, $279,650 for heads of households, $305,050 if married filing jointly or a surviving spouse, and $152,525 if married filing separately. This limitation is applied after you have used any other limitations that exist in the law, such as the adjusted gross income limitation for charitable contributions and the mortgage interest expense limitations. No more than 80% of the otherwise allowable deductions are phased out. The threshold amounts are indexed annually for inflation.

This chapter discusses the overall limit on itemized deductions on Schedule A (Form 1040). The following topics are included.

Who is subject to the limit. Which itemized deductions are limited. How to figure the limit. You may want to see:

Schedule A (Form 1040) Itemized Deductions You are subject to the limit on certain itemized deductions if your adjusted gross income (AGI) is more than $305,050 if married filing jointly or qualifying widow(er), $279,650 if head of household, $254,200 if single, or $152,525 if married filing separately. Your AGI is the amount on Form 1040, line 38.

Which Itemized Deductions Are Limited?

Only gold members can continue reading.

Log In or

Register to continue

Schedule A (Form 1040) Itemized Deductions

Schedule A (Form 1040) Itemized Deductions