Investing in Twenty-First Century Shipping: An Essay on Perennial Constraints, Risks and Great Expectations

Chapter 23

Investing in Twenty-First Century Shipping: An Essay on Perennial Constraints, Risks and Great Expectations

Helen Thanopoulou*

1. Introduction. Investing In Ships Revisited

The extraordinary twists and turns of the world economy since the start of the twenty-first century could not be more revealing or instructive of the inner workings of shipping investment. Shipping economics exist as a separate branch of economics for two reasons: the one is the cyclicality of the shipping markets; the other is the idiosyncratic nature of shipping investment. The two are inextricably linked: Investing in ships could be classified as an astute, a brave or an irrational decision depending on the state and the prospects of the shipping markets which rarely – if ever – fulfil the promises they seem to give. Yet the first decade of the current century unfolded as if this latter element of uncertainty had been removed as investors proceeded euphorically into taking the world fleet well over the one billion dwt mark.1 However, by the end of 2008 any doubts whether the “endemic tendency to over-invest”, as astutely described by the late B.N. Metaxas,2 stills holds in shipping had dissolved as freight rate lows – not seen since the dry-bulk crisis of the 1980s – succeeded the records the market had kept breaking since 2003. Late 2008 developments were not, however, the result of investors’ great expectations. As the first decade of the new century is drawing to a close pending massive future deliveries have yet to hit the market in order to be measured against future demand which remains an unknown quantity, literally. Nevertheless, the prospect of supply developments coinciding with an eventually protracted world trade recession have revived investors’ worst basic fears while painfully inviting a return to well-known basics of shipping economics.

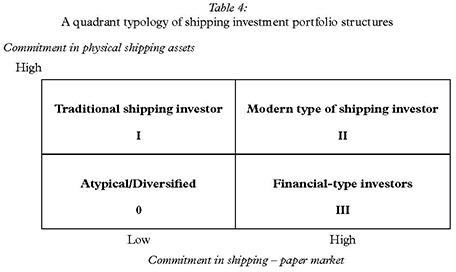

Less than a year from September 2008 – and about a quarter of a century later from the early 1980s – a familiar picture has formed: dearth of orders, death of shipyards, creation of equity funds to target distress sales of second-hand vessels as companies winding-down leave wound-up creditors with few options than to foreclose. Looking at this last cycle of shipping investment there are few better expressions to describe the way events have been unfolding than “Plus ça change plus c’est la même chose”.3 Despite main mechanisms and results remaining the same, the picture in shipping investment has changed also: firstly in the way physical and paper assets intertwine in what can be considered anymore as commonly managed shipping-based portfolios; second, in the way changes in the transactional setting in shipping resulted in aggravating risks or even adding new to the “standard” one of market cyclicality. All types of risk were highlighted most powerfully in the light of the manifestation of the “credit crunch” as a full-blown “credit crash” in late 2008, upsetting markets along with theoretical dogmas considered until then not only academically definitive but also final.4

This chapter focuses on traditional investment in physical shipping assets. The main text begins with familiarising the reader with the idiosyncrasies of shipping investment in the second section. Section 3 analyses the operational constraints that bulk and liner companies face when deciding to invest in either new or second hand-vessels. Section 4 discusses the difficult balancing act of weighing anticipated vessel endurance, cost differences and delivery lags in the investment decision; section 5 focuses on asset play on the basis of the experience from the last major shipping crisis with references to the period before and after the September 2008 financial crisis. The penultimate section 6 of the chapter reviews the setting for shipping investment in the twenty-first century while the summary in section 7 concludes by pointing to research themes that this decade’s developments bring to the fore.

2. Market Cyclicality and Investment in Commercial Vessels

Market cycles are common in competitive markets; fully competitive markets are, however, rather uncommon in the modern economy. As discussed earlier in this volume, while price fluctuations of fixed assets can be assessed in other markets, there is little comparison with the volatility asset prices in shipping have shown.5 The parallel effect of recessional factors on the shipping, shipbuilding and – usually – scrapping markets6 create an absolute impasse for investors who often found themselves with very substantial amounts of tied-up capital and practically little or no alternative use for assets often valued at no more than an insignificant fraction of their acquisition price. Equally, as developments related to cancellations following the 2008 financial crisis reminded, precipitated adjustments of previous investment decisions are achievable, often at a price that cash-poor market conditions may justify as entirely necessary, but can hardly qualify as totally ideal.

2.1 Investing in the different shipping segments

While volatility of asset prices can vary between individual shipping markets,7 due to differences in the market structure of traditional and specialised bulk shipping markets,8 it remains a common feature of all bulk shipping segments which make-up the majority of the world tonnage. Liner shipping is not exempt from asset price volatility either; while liner shipping idiosyncrasies may dictate a different approach with regard to investment, recent policy and market developments have increased risk for investors in container vessels as well.

As far as the bulk markets are concerned, volatility of both the freight markets and of asset prices should be considered as the key factors which should – or at least common sense would require so – weigh heavily on all decisions regarding investment in merchant vessels. In practice, an ex post analysis of investment decisions reveals that despite volumes of literature and a series of investment disasters there is still little practical understanding of the nature of the bulk shipping markets and of their idiosyncrasies. In this sense, the repetitive nature of shipping over-investment remains a conundrum especially when considering industry returns,9 pointing to either lack of investment memory or simply to the competitive nature of most shipping markets, or to a combination of both. The history of world shipping is fraught with examples of crises that can be blamed on excessive ordering more than they can be blamed on any other factor.10 When the competitive behaviour of investors is taken into account in the context of the competitive nature of most of the industry, the textbook ignorance of individual investors regarding the impact of their own investment decisions is put in context. What is, however, definitely intriguing is that patterns of over-ordering can be easily traced in this century even in markets where “speculative” investment (i.e. investment with no guaranteed demand) was previously unknown. This has been the case of Liquefied Natural Gas (LNG) carriers,11 since around the millennium, as the segment was evolving from a “hybrid”12 quasi-market to its current – more or less competitive than other shipping markets13 – structure. Regardless, however, of how different in nature the different bulk shipping segments can be, the inherent risks investors face are more or less common; they only differ in terms of the particular weight they can potentially hold in each individual market. Although the risks discussed below apply mostly to bulk shipping, it should be noted that the liner sector – shielded to a degree from excessively violent fluctuations until lately – remained exposed throughout its modern existence to the potential risks of large sunk costs and of technological obsolescence. In one of these synchronicities that abound in shipping, the manifestation of the financial crisis coincided with the end of the exemption of shipping conferences from European competition regulation; this was about a decade after US trades had seen the power of conferences weakened through the practical implications14 of OSRA 1998. Both regulatory changes increased the exposure of liner shipping to trade volatility; shortly after September 2008, the latter led to rate levels associated usually with bulk segments, smoothing in its wake differences between bulk and liner shipping investment risks.

2.2 Different markets – common risks

2.2.1 Uncertainty taken to the extreme

The first and foremost risk investors face when committing their money to bulk shipping comes from market volatility. Most markets tend to present fluctuations more in terms of volume of sales than in terms of price levels. Bulk fleets which constitute the bulk of the world’s tonnage15 as well, are as a rule affected by both vessel unemployment and rapidly declining prices at times of ever-returning shipping recessions which can appear with or without any – mostly unheeded by investors – warning. Liner owners have been finding increasingly that their predicament is not dissimilar. The quick reversal of shipping market conditions in the second half of 2008 has been in itself a “crash” course in what S. Kaplan and B.J. Garrick defined in 1981 as the “set of triplets” related to risk:16 the specific “scenario” was in the minds of very few at the time the bulk of – bulk and liner – orders had been placed; it was considered of low “likelihood” in the context of ever-growing confidence in infallible markets, but eventually the sheer force of the painfully felt “consequence” finally showed the range of magnitude that should have been attributed to the risk taken. While common investment appraisal techniques had traditionally not served shipping, even more modern approaches could well prove of limited use in investment planning in such extraordinary circumstances.

2.2.2 Problematic fitting of common investment appraisal techniques

The risk of reduced sales or asset inactivity can be deemed common for shipping and all other markets. However, the prospect of freight levels continuously fluctuating not only adds to the real risk of investment, it also renders attempts for calculating this risk accurately rather ineffective. Indeed, most common investment appraisal techniques require some degree of assumed stability of prices or a predictable path of price changes and a reasonable chance of assets being fully employed when the investment starts yielding. In the case of bulk ships, common investment appraisal techniques can prove highly misleading and their role should be limited to that of a guide about what the investment would cost and what would be the expected return.17 More sophisticated approaches need to take into account long-term factors which are not always visible to outsiders to the industry. Unless investors and lenders alike are well versed in shipping market volatility incorporating it into any effort to appraise returns,18 only chance can reconcile predictions to results.

2.2.3 Large sunk costs

High volatility of freight rates and asset price volatility combine to create the perfect nightmare for the potential investor especially when resale values and alternative uses of the vessel themselves are considered. As already underlined, the scrap market usually shifts in parallel with the markets for shipping services and the markets for ships; this has been most evident over the crisis of the 1970s and the 1980s. That results in a barrier to exit which is difficult to surmount by a resale of the vessel for storage or other uses.19 It is perhaps better that too many investors go ahead with their plans ignoring the worst-case scenario or shipping would have become a market suffering from chronic under-investment: taking into account how few alternative uses and potential resale opportunities there are in a crisis should normally make the bravest of investors fret when considering the potential market depreciation of their assets. While there are few sunk costs of another nature for bulk shipping companies, liner companies face an additional sunk cost as they tend to invest heavily in offices, agency networks and, eventually, terminals as well. The relative stability of liner shipping business compared to the degree of volatility of bulk shipping markets and the nature of liner competition in the past moderated the exposure to sunk costs by limiting not their potential magnitude in absolute terms but the likelihood of the related scenario. However, adverse trade developments following the recent downturn, coupled by the impressive growth of the container fleet and the termination of the EU conference exemption, have changed the picture so drastically as to allow what has been recorded as “zero”20 rates to be observed in main routes.

2.2.4 Technological obsolescence

Ships not only become obsolete by wear and tear; they can also become obsolete through the introduction of a new type of vessel which would be deemed superior in terms of quality of service or indeed in terms of cost for providing shipping services. The product life cycle, as introduced by Dean many decades ago,21 finds application both in terms of types of tonnage as well as in terms of type of service.22 Although rarely taken into account23, technological obsolescence can reverse estimates of investment returns and shorten the economic life of a vessel dramatically. Developments in recent years in both specialised bulk shipping markets, such as reefers, and in liner shipping, which had provided in the 1960s the prominent example of the replacement of conventional general cargo ships by cellular ones, require that the impact of what could be termed broadly technological obsolescence – incorporating the aspect of size – and ensuing commercial obsolescence are taken into account. In bulk shipping, the fading-out of an entire segment of specialised bulk tonnage24 proved inevitable as technology and economies of scale combined to allow the cost-competitive carriage of cargo under controlled temperatures in suitable containers by liner operators. In the liner sector, unless smaller markets develop at a pace sufficient to absorb lower-capacity vessels removed from the main routes as carriers take advantage of economies of scale (or ironically unless trade declines to take vessel-capacity requirements to past levels), previous container vessel generations are extremely vulnerable25 as new larger ones add to competitors’ fleets. These examples from both liner and bulk shipping show a degree of commonality in terms of the risks investors are faced with in both markets; however, it is not necessarily so in terms of constraints under which investment decisions are taken in bulk and liner shipping although in the latter case the distinction between investor-operator and investor in tonnage alone becomes critical.

3. Operational Constraints of Bulk and Liner Acquisitions

Examining investment attitudes automatically leads to discussing the particular constraints operating companies face when proceeding to vessel acquisitions. The question of company motives for investing seems prima facie naive; a blanket statement on profit maximisation would seem to provide the rule. However, as business goals26 can deviate from this axiom so can investment motives. In the case of shipping this will be largely dependant on the nature of the shipping company. Although a small minority today, state enterprises had been a force to be reckoned with27 in the not too distant past and for some, at the time, the potential source of threats to free competition in shipping which has yet to materialise. State companies, however, are likely to have different motives than the typical shipping company of private ownership when considering investment. By the same token, the profit maximisation rule is unlikely to apply to integrated shipping divisions of non-shipping companies; the most known example of companies of the latter type historically is that of shipping divisions or subsidiaries28 of large oil companies.29 In the case of state companies the motive for an investment decision might be the balance of payments, national security, including securing supply chains, or eventually that of national prestige;30 all result equally in particular constraints under which investment decisions have to be taken. If investment would for instance be decided to align to the growth of national trades, new investment could be a multiple of what competitive advantage and ship values would dictate, assuming that cash-flow and capital availability do not come into play in the case of state companies. Table 1 summarises the different positions of each main type of shipping

Table 1: Investment/divestment constraints in shipping31

| Company type | Constraints |

| Bulk | insignifi cant in most cases |

| Liner | frequency constraints, cooperation constraints, route constraints |

| Non-commercial: state-owned or integrated | �share� of own transport as defi ned/desired by parent company or state policy |

company vis-á-vis the potential special constraints under which they consider new investment in tonnage in addition to habitual business ones associated with investment decisions.

3.1 Investing in bulk shipping: no holds barred

The most significant differences in terms of investment constraints exist between liner and bulk shipping companies (assuming both are under private ownership). Bulk shipping companies, unlike liner companies, are usually exempt of limitations when programming investment or divestment in ships and hence determining company size. In most cases a bulk shipping company will invest (or divest) in whatever type or size of bulk vessel it considers profitable on the basis of the state and the prospects of the freight and ship markets. A bulk shipping company mainly active in the dry bulk sector may invest in tanker vessels also or even completely shift from the dry to the liquid bulk market if the prospects of the tanker market look more promising or vice-versa.32 By the same token, a bulk company can choose to diversify by investing into more than one bulk shipping segment including specialised shipping markets. Investment/ divestment flexibility may be affected mainly due to governance or regulation issues pertaining to specific company structures such as listed companies. However, when it comes to the specialised bulk shipping segments absolute investment freedom might in reality prove a little more relative: specialised vessel types, such as Liquefied Petroleum Gas carriers (LPGs), Liquefied Natural Gas carriers (LNGs) or chemical carriers, still require a significant degree of know-how and experience to consider entry into these markets as automatic or barrier free. The role of bulk shipping pools33 in the specialised shipping markets and of other companies open to manage outside tonnage alongside their own or eventually act as managers only,34 has nevertheless preserved the right of shipowners to enter with minimum investment even in specialised shipping segments; shipping pools had been found, however, to be a constraint for owners when it comes to divestment affecting asset-play opportunities.35

3.2 Investing in liner tonnage: operational and cooperation constraints

Liner shipping companies are without doubt under more constraints when considering their investment policy not only by comparison to bulk shipping companies but also by comparison to a large number of industries. These constraints relate not only to the specific characteristics of the routes these companies serve, but also to the cooperation agreements liner companies usually have; very few, usually among the top two or three largest, have historically survived successfully without resorting to what has been described as strategic or operational alliances of various forms.36 Pools and consortia – the latter evolving over the last 15 years into global alliances – have dominated the supply of liner shipping services;37 these forms of cooperation between container carriers allowed to combine capacity to serve trade routes which became increasingly demanding in terms of capacity and frequency. Operational cooperation normally requires that operational capacity adjustments – and hence investment decisions – are planned from a common perspective otherwise under-utilisation of capacity and problems in network planning, or equipment incompatibity lurk. It is possible that a combination of these constraints together with the eagerness of outside investors38 to invest in the container market has led to an – increasing over recent years – part of tonnage being drawn from the container charter market.39 The nature of the liner business itself, which is the provision of regular advertised and – increasingly over the globalisation era – frequent sailings of containerships, precludes drastic capacity reductions or service withdrawals through massive asset-play motivated divestment due to loss of goodwill,40 cyclical downturns notwithstanding. In this regard the combination of co-operation agreements together with the existence of a pool of container tonnage available in the container charter market has added to the flexibility of liner shipping companies which would otherwise remain much more restricted than their bulk counterparts in terms of freedom in investment and divestment decisions.

4. Newbuilding Vs Second-Hand Vessels: Balancing Delivery Lags With Vessel Endurance

Both bulk and liner companies, are faced with a number of alternative choices when they decide to proceed with new investment. Although often a fraction of such levels, deep-sea going vessel values, especially of newbuildings, have been on average in the order of tens of millions of dollars in the past decades. The globalisation of the shipbuilding industry and the expansion of capacity have resulted in multiplying choices for placing orders but equally in dividing prices by a factor analogous to the observed successive waves of shipbuilding capacity coming into the market.41

Despite, however, the relatively easy access to shipping investment through the enlargement of the circle of shipbuilding competitors, aggressive competition42 and abundant finance in the post-war period, the role of fixed cost remains critical for shipping competitiveness. In this regard, the choice between investing in a newbuilding or in a second-hand vessel must take into account market prospects for both the freight and – the closely related – ship markets, current price levels as well as price differences between new and old tonnage.

4.1 Know thy market: New-orders vs second-hand acquisitions

Acquiring vessels is perhaps the major pillar of company strategy in an industry environment that is characterised by cyclicality of both income and asset values especially when the exit barriers already discussed are taken into account. The realisation by many firms of the importance of investment decisions in this context is perhaps at the origin of the popularity of second-hand acquisitions of vessels. Otherwise, taking into account the existence of abundant finance and – for most of the post-war period – of attractive prices, grants or of a combination of all of the above, it would seem surprising that second-hand vessels would be an investment option at all. Investing in secondhand tonnage implies not only a shorter economic life of the vessel but also assuming the risk of hidden defaults that can eventually still remain undetectable despite strict checks before the purchase of the vessel.

The reasons for the popularity of second-hand acquisitions are in essence two-fold: (a) when investing in a second-hand ship the shipping company faces a much lower capital cost43 compared to the alternative of a newbuilding; and (b) the waiting time for the actual delivery of the ship is minimal compared to the “normal” 1.5 to two years in the case of new orders. Normality is, however, the exception in a competitive market entirely open and extremely vulnerable to the influence of a multitude of exogenous factors. The quick reversal of market conditions due to the oil shock of 1973 is in that sense a classic example which shows how investment in newbuildings can prove riskier than investment in second-hand vessels. During the first half of the 1970s the expected delivery lag for orders placed at the time was often much longer than the 18–24 month usual range.44 As the case of the 1970s proved, lags can be catastrophic if vessels are to be delivered so late that they cannot catch even a glimpse of the short booms which characterise shipping;45 investors placing orders in the final years of the latest peak were painfully reminded so. Delays guarantee that delivery will come after – or sometimes long after – the relatively brief period of prosperity has degenerated into a lengthy recession if not into a full-blown depression as the case was for many segments in the crisis of the 1970s and the 1980s.

In view of these remarks, it could seem that opting for readily available second-hand vessels while freight rates are still climbing is more effective. At least the market seems to share such a view as price differentials between new-buildings and second-hand vessels tend to narrow – or even reverse – as shipbuilding availability tightens;46 the repeat of this phenomenon in the twenty-first century has a long history in modern shipping as data for the first post-World War II years suggest.47 Yet, as the most important disadvantage of a second-hand acquisition is the – normally – much shorter economic life of the ship, narrowing price differentials between new and second-hand tonnage during market booms are a strong indication that shipping investors obey to laws particular to this industry and often to this industry alone: while the short duration of shipping booms is perhaps the only certainty one can have about bulk shipping markets, even cash-tight companies risk their liquidity betting on excessively priced second-hand vessels at the peak of the market. The multitude of arrests and foreclosures at the downturn of markets serve as ex-post evidence that rationality of expectations or just plain rationality48 has found its way into the academic books but not in investment behaviour in shipping.

5. Investment Strategies, Risk and Asset Play: a Twenty-First Century Perspective

The frequent and very ample fluctuations of second-hand ship prices which follow in general the fluctuations in the freight rates – albeit not necessarily so in the very short-run – create the opportunity (not the certainty) of large profits from speculation on ships, a strategy/activity called asset play. Asset play has indeed compensated for lacklustre margin profits in shipping. It has, however, overshadowed the advantages of astutely timed investment in ships without – necessarily – the ex-ante intention to further sell them but simply the acquisition of additional tonnage or fleet renewal at low(er) prices. While investment strategies are associated often with asset play, if not with asset play alone, there is scope for a company to formulate a general strategy of acquisitions regardless of whether the intention is to use ships for trade or trade them per se as sheer commodities.

5.1 Limiting risk: a shipping averse investment strategy

Risk aversion and shipping investment are not necessarily antonyms but they would hardly be classified as synonyms either.49 However, had most market participants been following a strategy with a view to avoiding risk entirely, supply of shipping services would have been considerably tighter50 as the only real guarantee from cash-flow pressures and company vulnerability in cyclical markets would be to finance purchases entirely by equity. Although not necessarily a net profit maximisation strategy, as traditional loan finance may be more advantageous especially at times of high inflation, it is definitely the most conservative approach. The use of some debt finance need not necessarily put companies at bankruptcy risk as long as their cash-flow situation is healthy and projections and decisions are balanced and guided respectively by the knowledge of market cyclicality. Excesses in all directions – including expectations51 – seem, however, to characterise all aspects of shipping investment increasing risk but also creating market opportunities as prices falter.

Acquisition prices do not have to be ridiculously low to allow for a competitive fixed-cost, although this has been recorded in the past as well. To be competitive in terms of capital cost companies have essentially to acquire vessels at significantly lower prices than the prices competitors had to pay for their own tonnage often just by waiting or speeding up investment decisions by only a few months. The investment strategy of a firm becomes thus a relative one and a continuous effort to take advantage of significant asset price shifts over time periods which may represent only a tiny fraction of the entire life expectancy of the vessel. As operating costs for similar vessels are easily adjustable – variations which cannot be effectively hedged stemming essentially from manning costs – market survival and success can easily be shown to depend to a very large extent on fixed cost (i.e. essentially capital cost in bulk shipping and hence on investment strategies).

5.2 Fixed cost and investment strategy: still the essence of competitiveness

Shipping competitiveness is a complex issue related to market structures. However, in both liner and bulk shipping markets capital cost is, as a rule, the single most important element of total cost, while investment strategies can make or break companies as the impact of investment related paid-out costs determines the resilience of companies in times of crises.52 Fixed cost influences company competitiveness through (a) differences in acquisition prices of either new buildings or second-hand vessels; (b) differences in the way capital is raised; and (c) differences in the terms of finance of vessel acquisitions.53 Minimising fixed cost provides a significant advance on competitors in the main bulk markets where cost leadership is still the main viable option, without taking into account the idiosyncrasies of some very specialised shipping segments or those of liner shipping where quality of service and product differentiation may have a role to play in company strategy.

Shipping has always been perceived as capital intensive and automation and the downsizing of manning requirements have contributed little in changing this; on the contrary, the labour to capital ratio seems to have declined in the post-war period.54 However, past progress towards automation combined with quality concerns have removed the focus from the prospect of the ever-more automated ship. Hence, as there are few margins for minimising the cost of main inputs such as bunkers or stores,55 the efforts for achieving an overall low cost cannot but concentrate on what constitutes on average half of the total cost of shipping services56 (i.e. capital cost).