Filling Information

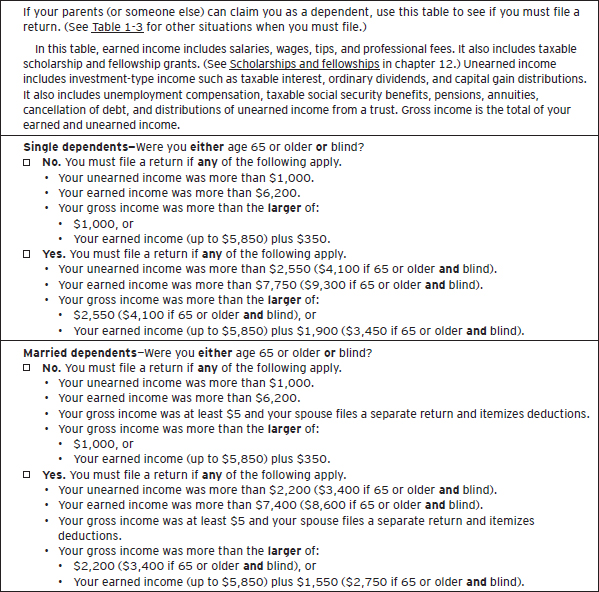

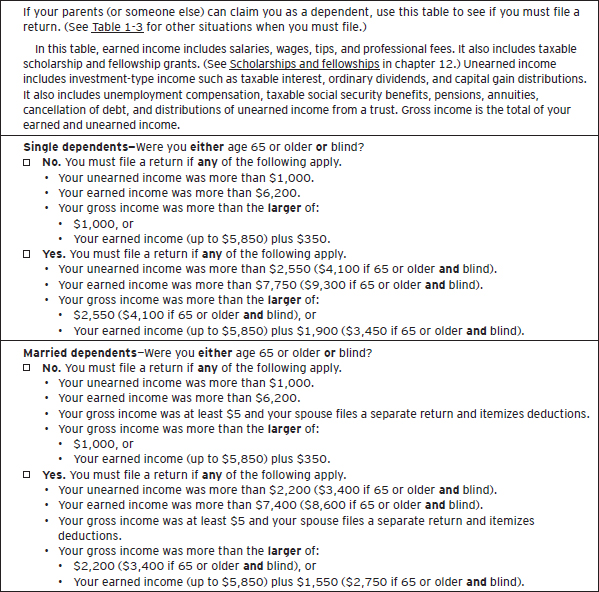

Chapter 1 Who must file. Generally, the amount of income you can receive before you must file a return has been increased. See Table 1-1, Table 1-2, and Table 1-3 for the specific amounts. A Special Note About the Affordable Care Act and Your 2014 Tax Return. When you file your 2014 tax return in 2015, you and your family will have to document that you had health care coverage throughout 2014. Under certain circumstances, you may be entitled to an exemption if you did not maintain coverage in 2014. Otherwise, you may need to make a payment with the 2014 return. For more information on the payment or exemptions, visit www.IRS.gov/aca. If you currently have qualifying health care coverage, you will not need to do anything more than maintain that coverage throughout 2014. If you buy insurance through the Health Insurance Marketplace, you may be eligible for an advance payment of the Premium Tax Credit to help pay for your insurance coverage. If you are receiving an advance payment of the Premium Tax Credit during 2014, you should report changes in your income or family size to your Marketplace. By reporting changes promptly, you can make adjustments that will help you get the correct amount. Receiving too much or too little in advance will affect your refund or balance due when you file your 2014 tax return in 2015. Visit www.IRS.gov/aca for information on the tax provisions of the Affordable Care Act and www.HealthCare.gov for Marketplace information. Table 1-1. 2014 Filing Requirements for Most Taxpayers * If you were born on January 1, 1950, you are considered to be age 65 at the end of 2014. ** Gross income means all income you received in the form of money, goods, property, and services that is not exempt from tax, including any income from sources outside the United States or from the sale of your main home (even if you can exclude part or all of it). Do not include any social security benefits unless (a) you are married filing a separate return and you lived with your spouse at any time during 2014 or (b) one-half of your social security benefits plus your other gross income and any tax-exempt interest is more than $25,000 ($32,000 if married filing jointly). If (a) or (b) applies, see the Instructions for Form 1040 or 1040A or Publication 915 to figure the taxable part of social security benefits you must include in gross income. Gross income includes gains, but not losses, reported on Form 8949 or Schedule D. Gross income from a business means, for example, the amount on Schedule C, line 7, or Schedule F, line 9. But, in figuring gross income, do not reduce your income by any losses, including any loss on Schedule C, line 7, or Schedule F, line 9. *** If you did not live with your spouse at the end of 2014 (or on the date your spouse died) and your gross income was at least $3,950, you must file a return regardless of your age. Table 1-2. 2014 Filing Requirements for Dependents See chapter 3 to find out if someone can claim you as a dependent. Table 1-3. Other Situations When You Must File a 2014 Return File online. Rather than filing a return on paper, you may be able to file electronically using IRS e-file. Create your own personal identification number (PIN) and file a completely paperless tax return. For more information, see Does My Return Have To Be on Paper, later. Change of address. If you change your address, you should notify the IRS. You can use Form 8822 to notify the IRS of the change. See Change of Address, later, under What Happens After I File. Direct deposit of refund. Instead of getting a paper check, you may be able to have your refund deposited directly into your account at a bank or other financial institution. See Direct Deposit under Refunds, later. If you choose direct deposit of your refund, you may be able to split the refund among two or three accounts. Pay online or by phone. If you owe additional tax, you may be able to pay online or by phone. See How To Pay, later. Installment agreement. If you cannot pay the full amount due with your return, you may ask to make monthly installment payments. See Installment Agreement, later, under Amount You Owe. You may be able to apply online for a payment agreement if you owe federal tax, interest, and penalties. Automatic 6-month extension. You can get an automatic 6-month extension to file your tax return if, no later than the date your return is due, you file Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. See Automatic Extension, later. Service in combat zone. You are allowed extra time to take care of your tax matters if you are a member of the Armed Forces who served in a combat zone, or if you served in the combat zone in support of the Armed Forces. See Individuals Serving in Combat Zone, later, under When Do I Have To File. Adoption taxpayer identification number. If a child has been placed in your home for purposes of legal adoption and you will not be able to get a social security number for the child in time to file your return, you may be able to get an adoption taxpayer identification number (ATIN). For more information, see Social Security Number (SSN), later. Taxpayer identification number for aliens. If you or your dependent is a nonresident or resident alien who does not have and is not eligible to get a social security number, file Form W-7, Application for IRS Individual Taxpayer Identification Number, with the IRS. For more information, see Social Security Number (SSN), later. Frivolous tax submissions. The IRS has published a list of positions that are identified as frivolous. The penalty for filing a frivolous tax return is $5,000. Also, the $5,000 penalty will apply to other specified frivolous submissions. For more information, see Civil Penalties, later. This chapter discusses the following topics. The filing requirements for each category are explained in this chapter. The filing requirements apply even if you do not owe tax. If you are a U.S. citizen or resident, whether you must file a return depends on three factors: To find out whether you must file, see Table 1-1, Table 1-2, and Table 1-3. Even if no table shows that you must file, you may need to file to get money back. (See Who Should File, later.) Common types of income are discussed in Part Two of this publication. Self-employed individuals. If you are self-employed, your gross income includes the amount on line 7 of Schedule C (Form 1040), Profit or Loss From Business; line 1 of Schedule C-EZ (Form 1040), Net Profit From Business; and line 9 of Schedule F (Form 1040), Profit or Loss From Farming. See Self-Employed Persons, later, for more information about your filing requirements. Filing status. Your filing status depends on whether you are single or married and on your family situation. Your filing status is determined on the last day of your tax year, which is December 31 for most taxpayers. See chapter 2 for an explanation of each filing status. Age. If you are 65 or older at the end of the year, you generally can have a higher amount of gross income than other taxpayers before you must file. See Table 1-1. You are considered 65 on the day before your 65th birthday. For example, if your 65th birthday is on January 1, 2015, you are considered 65 for 2014. Surviving Spouses, Executors, Administrators, and Legal Representatives You must file a final return for a decedent (a person who died) if both of the following are true. If you are a bona fide resident of Puerto Rico for the entire year, your U.S. gross income does not include income from sources within Puerto Rico. It does, however, include any income you received for your services as an employee of the United States or a U.S. agency. If you receive income from Puerto Rican sources that is not subject to U.S. tax, you must reduce your standard deduction. As a result, the amount of income you must have before you are required to file a U.S. income tax return is lower than the applicable amount in Table 1-1 or Table 1-2. For more information, see Publication 570, Tax Guide for Individuals With Income From U.S. Possessions. If you are a dependent (one who meets the dependency tests in chapter 3), see Table 1-2 to find out whether you must file a return. You also must file if your situation is described in Table 1-3. If a child’s only income is interest and dividends (including capital gain distributions and Alaska Permanent Fund dividends), the child was under age 19 at the end of 2014 or was a full-time student under age 24 at the end of 2014, and certain other conditions are met, a parent can elect to include the child’s income on the parent’s return. If this election is made, the child does not have to file a return. See Parent’s Election To Report Child’s Interest and Dividends in chapter 32. You must file a return if your gross income is at least as much as the filing requirement amount for your filing status and age (shown in Table 1-1). Also, you must file Form 1040 and Schedule SE (Form 1040), Self-Employment Tax, if: You must use one of three forms to file your return: Form 1040EZ, Form 1040A, or Form 1040. (But also see Does My Return Have To Be on Paper, later.) Form 1040EZ is the simplest form to use. You can use Form 1040EZ if all of the following apply. If you do not qualify to use Form 1040EZ, you may be able to use Form 1040A. You can use Form 1040A if all of the following apply. You must meet all these requirements to use Form 1040A. If you do not, you must use Form 1040. You must use Form 1040 if any of the following apply. You may be able to file a paperless return using IRS e-file (electronic filing). If your 2014 adjusted gross income (AGI) is less than a certain amount, you are eligible for Free File. See your tax return instructions for details. If you do not qualify for Free File, then you should check out IRS.gov for low-cost e-file options or Free File Fillable Forms. Table 1-4 lists the benefits of IRS e-file. IRS e-file uses automation to replace most of the manual steps needed to process paper returns. As a result, the processing of e-file returns is faster and more accurate than the processing of paper returns. However, as with a paper return, you are responsible for making sure your return contains accurate information and is filed on time. Table 1-4. Benefits of IRS e-file Using e-file does not affect your chances of an IRS examination of your return. To verify your identity, you will be prompted to enter your adjusted gross income (AGI) from your originally filed 2013 federal income tax return, if applicable. Do not use your AGI from an amended return (Form 1040X) or a math error correction made by the IRS. AGI is the amount shown on your 2013 Form 1040, line 38; Form 1040A, line 22; or Form 1040EZ, line 4. If you do not have your 2013 income tax return, you can quickly request a transcript by using our automated self-service tool. Visit us at IRS.gov and click on Order a Return or Account Transcript or call 1-800-908-9946 to get a free transcript of your return. (If you filed electronically last year, you may use your prior year PIN to verify your identity instead of your prior year AGI. The prior year PIN is the five digit PIN you used to electronically sign your 2013 return.) You will also be prompted to enter your date of birth. For more details, visit www.irs.gov/efile and click on “Individuals.” Power of attorney. If an agent is signing your return for you, a power of attorney (POA) must be filed. Attach the POA to Form 8453 and file it using that form’s instructions. See Signatures, later, for more information on POAs. State returns. In most states, you can file an electronic state return simultaneously with your federal return. For more information, check with your local IRS office, state tax agency, tax professional, or the IRS website at www.irs.gov/efile. As with a paper return, you may not get all of your refund if you owe certain past-due amounts, such as federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or certain other federal nontax debts, such as student loans. See Offset against debts under Refunds, later. Refund inquiries. Information about your return will generally be available within 24 hours after the IRS receives your e-filed return. See Refund Information, later. Amount you owe. To avoid late-payment penalties and interest, pay your taxes in full by April 15, 2015. See How To Pay, later, for information on how to pay the amount you owe. IRS approved tax preparation software is available for online use on the Internet, for download from the Internet, and in retail stores. For information, visit www.irs.gov/efile. Free help in preparing your return is available nationwide from IRS-trained volunteers. The Volunteer Income Tax Assistance (VITA) program is designed to help low to moderate income taxpayers and the Tax Counseling for the Elderly (TCE) program is designed to assist taxpayers age 60 or older with their tax returns. Many VITA sites offer free electronic filing and all volunteers will let you know about the credits and deductions you may be entitled to claim. To find a site near you, call 1-800-906-9887. Or to find the nearest AARP TaxAide site, visit AARP’s website at www.aarp.org/taxaide or call 1-888-227-7669. For more information on these programs, go to IRS.gov and enter keyword “VITA” in the search box. April 15, 2015, is the due date for filing your 2014 income tax return if you use the calendar year. For a quick view of due dates for filing a return with or without an extension of time to file (discussed later), see Table 1-5. Table 1-5. When To File Your 2014 Return For U.S. citizens and residents who file returns on a calendar year.

Filling Information

What’s New

IF your filing status is . . .

AND at the end of 2014 you were . . .*

THEN file a return if your gross income was at least . . .**

single

under 65

$10,150

65 or older

$11,700

married filing jointly***

under 65 (both spouses)

$20,300

65 or older (one spouse)

$21,500

65 or older (both spouses)

$22,700

married filing separately

any age

$ 3,950

head of household

under 65

$13,050

65 or older

$14,600

qualifying widow(er) with dependent child

under 65

$16,350

65 or older

$17,550

You must file a return if any of the four conditions below apply for 2014.

1. You owe any special taxes, including any of the following.

a. Alternative minimum tax.

b. Additional tax on a qualified plan, including an individual retirement arrangement (IRA), or other tax-favored account. But if you are filing a return only because you owe this tax, you can file Form 5329 by itself.

c. Household employment taxes. But if you are filing a return only because you owe this tax, you can file Schedule H by itself.

d. Social security and Medicare tax on tips you did not report to your employer or on wages you received from an employer who did not withhold these taxes.

e. Recapture of first-time homebuyer credit.

f. Write-in taxes, including uncollected social security and Medicare or RRTA tax on tips you reported to your employer or on group-term life insurance and additional taxes on health savings accounts.

g. Recapture taxes.

2. You (or your spouse, if filing jointly) received HSA, Archer MSA, or Medicare Advantage MSA distributions.

3. You had net earnings from self-employment of at least $400.

4. You had wages of $108.28 or more from a church or qualified church-controlled organization that is exempt from employer social security and Medicare taxes.

Reminders

Introduction

Do I Have To File a Return?

Individuals—In General

U.S. Citizens and Resident Aliens Living Abroad

Residents of Puerto Rico

Individuals With Income From U.S. Possessions

Dependents

Certain Children Under Age 19 or Full-Time Students

Self-Employed Persons

Aliens

Who Should File

Which Form Should I Use?

Form 1040EZ

Form 1040A

If you receive a capital gain distribution that includes un-recaptured Section 1250 gain, Section 1202 gain, or collectibles (28%) gain, you cannot use Form 1040A. You must use Form 1040.

Form 1040

Does My Return Have To Be on Paper?

IRS e-file

• Free File allows qualified taxpayers to prepare and e-file their own tax returns for free.

• Free File is available in English and Spanish.

• Free File is available online 24 hours a day, 7 days a week.

• Get your refund faster by e-filing using Direct Deposit.

• Sign electronically with a secure self-selected PIN and file a completely paperless return.

• Receive an acknowledgement that your return was received and accepted.

• If you owe, you can e-file and pay electronically either online or by phone, using your bank account or a credit or debit card. You can also file a return early and pay the amount you owe by the due date of your return.

• Save time by preparing and e-filing federal and state returns together.

• IRS computers quickly and automatically check for errors or other missing information.

• Help the environment, use less paper, and save taxpayer money—it costs less to process an e-filed return than a paper return.

Using Your Personal Computer

Through Employers and Financial Institutions

Free Help With Your Return

Using a Tax Professional

When Do I Have To File?

For Most Taxpayers

For Certain Taxpayers Outside the U.S.

No extension requested

April 15, 2015

June 15, 2015

Automatic extension

October 15, 2015

October 15, 2015