Economics of the Markets for Ships

Chapter 8

Economics of the Markets for Ships

Siri Pettersen Strandenes*

1. Introduction

Vessels are sold and purchased in several markets. New vessels are contracted and sold in the new building market, whereas the scrapping market balances scrapping volumes and prices. In the second-hand markets vessels are sold and purchased for further trading. Activities in the newbuilding and scrapping markets set the total transport capacities available to sea borne trade and passenger transport worldwide. In this they resemble other markets for capital equipment for use in production of goods or services. Transactions in the second-hand market on the other hand, do not change the available transport capacity world-wide, but only shift ownership of the existing transport capacity between the different shipowners or shipping companies. Therefore, the second-hand markets are kinds of auxiliary markets. (See Eriksen and Norman1 and Wijnolst and Wergeland2.)

In this chapter we will discuss the elements and the functioning of the markets for ships. In the next section we describe characteristics and differences of the markets in more detail. Thereafter we comment on the structure of the markets for ships before we discuss pricing and ship values in the last section. The points put forward are illustrated several places by graphs from the Platou Report3 published by R. S. Platou Shipbrokers a.s. on the web. We are thankful to Platou for making their report available on the Internet.

2. Main Characteristics of the Markets for Ships

The markets for ships fulfill, several of the requirements needed for well functioning markets. Generally there are few limits to entry into these markets. It also is fairly easy for ship owners to stay informed on the activities and developments in the markets compared to the situation in most other worldwide markets. The cost of exiting from these markets varies somewhat, but they tend to be fairly low, as we shall point out

Table 1: Real and auxiliary markets for vessels

| Real markets | Auxiliary markets | |

| Freight markets | Spot freight market | Time charter freight market Forward freight agreements |

| Markets for ships | Newbuilding market Demolition market | Second-hand market |

| Determination of transport capacity | Trading risk |

Source: Eriksen and Norman1

below. Shipbrokers operate in markets for ships and they collect relevant information and allocate it to the decision makers in the shipping industry. All these characteristics indicate that well functioning markets for ships exist.

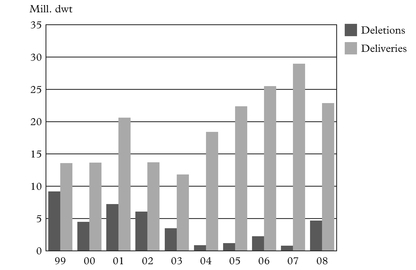

Demand for ships is derived from demand for transport services. This has implications for the markets for ships as it links the development in these markets directly to the conditions in the world economy and in international trade. Since trade flows fluctuate, so do the activities in the markets for ships. Deliveries and deletions of bulk carriers in the last 10 years may illustrate the degree of fluctuations. Figure 1 shows a wide variation in deliveries and strong shifts in deletions over the last 10 years. Such variations make timing crucially important for profits, but also more challenging to the decision makers in shipping.

In addition to these general characteristics of entry and exit and the availability of information, the markets for ships feature some specific characteristics. They function as the market place both for ship owners seeking ships to fulfil transport assignments and for asset players who focus on the potential rise in ship values, when they decide whether to enter the market. Hence, variations in prices and activities in the markets for ships attract investors that enter mainly to exploit such price variations. These players’ activities are positive in that they increase the liquidity of the markets for ships and thus ensure better allocation of vessels among ship owners servicing international trade. As long as the asset players make rational decisions, their activity also contribute by dampening price fluctuations and thus reduce the risk for ship owners who enter mainly to secure transport capacity for seaborne trade.

Similar to deep-sea shipping freight markets, the ships are traded in worldwide markets where agents from all over the world meet to trade. Ships thus, are traded among owners in geographically separate parts of the world. Shipowners do contract and scrap vessels abroad and far away from their home country. The bulk of scrapping activity, for example, takes place in Asia. Asian countries also dominate shipbuilding for large groups of vessels.

Irrespective of the worldwide character of these markets, the activities are not evenly spread around the world. The industry has experienced a geographic shift as more and more of the newbuilding capacity moved eastward, first to Japan and later to South Korea. Now there is also strong competition within Asia, as China has become a major supplier in the market for new vessels together with South Korea and Japan. This move eastwards left Europe and USA with excess shipbuilding capacity. Now Asian shipyards also face excess capacity following the high expansion in yard capacity during

Source: The Platou Report 2009, p. 17

the recent shipping boom. Building capacity in the west partly was closed down and partly converted to other uses, for example to producing offshore equipment. Some yards switched toward building specialised ships. By specialised ships we mean research ships, naval ships and vessels tailor made for a specific trade or route. In this process, subsidies was used to try to halt the downsizing of newbuilding capacities in traditional shipbuilding nations in the west.

There is a long tradition for securing quality in the newbuilding markets stemming back to the introduction of ship classification in the nineteenth century. Classification societies have inspectors on the site to oversee the construction of the new vessels they are going to class. Quality assessment and quality requirements are challenges also to the functioning of and the activity in the other markets for ships, the second-hand and the scrapping market. The uncertainty about the quality of vessels being traded poses a problem affecting the decision makers’ information and therefore influences both pricing and the number of vessels traded. Quality is currently assessed mainly by numerous inspections of vessels. In addition to inspections performed by class societies, cargo owners, ports and creditors require inspections to assess the vessel. This is both costly and time consuming as commented for example in Fairplay.4 Bijwaard and Knapp5 find that there is a possible over-inspection of vessels. Introducing incentive contracts and signalling to induce operators to focus on quality may reduce the number of inspections. A preliminary discussion of the possibility for such schemes in the freight markets is found in Strandenes.6 Problems of assessing quality of vessels represent important imperfections in the second-hand market and influence the functioning of that market.

Quality assessments have other effects for the conditions in the scrapping market. When quality requirements increase, there will typically be a rise in the activity level in the scrapping market. Similarly, whenever policy decisions to phase out low quality vessels materialize, this will increase the volume of tonnage sold for scrapping.

2.1 Characteristics specific to the newbuilding market

Here we concentrate on how the other markets influence activities in the new building market. By the other markets we mean both the two other markets for ships and the freight or passenger markets. For more thorough discussions of the supply side in the newbuilding market and the shipbuilding industry, see Wijnolst and Wergeland.7

Ideally demand for new vessels reflects the need for transport capacity in the different vessel categories or types. It takes time, usually one to one-and-a-half years, but sometimes up to four years, from ordering a vessel until the vessel is delivered and starts operating in the market. Since freight markets are volatile this implies that vessels often are delivered into markets with freight rate levels that differ much from the market conditions prevailing when the vessels were ordered. A decision to order a vessel should, reflect the expected future freight rates or correspondingly the future income level over the economic life of the new vessel. Hence, a short-term dip in the freight rates upon delivery is of limited significance to the return from the investment. During the time it takes to build the vessels the long-term prospects for the freight markets may also change and especially so if the time for delivery is long. This means that ship owners sometimes may prefer to cancel an order or to convert the vessel into another size or kind of ship to adjust to the change in expected future demand for transport services.

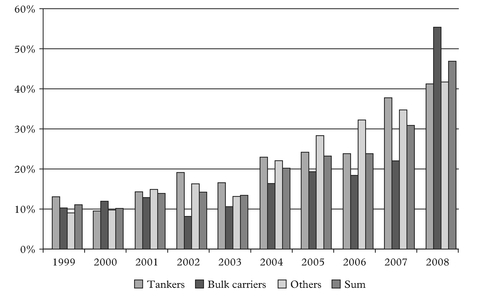

The large variation in the volume of new vessels ordered is one effect of such uncertainty about the future income for the vessels and the fluctuations in the freight markets. See, for example, Figure 2 on orders for new vessels as a percentage of the fleet

Source: Based on Table 1 and 4 in The Platou Report 2009, p. 40.

over the last ten-year period. Figure 2 also illustrates the variations that exist among the different vessel types when it comes to fluctuation in deliveries. In the years 1990–2001 the order book on the other hand varied from 2 to 13% of the existing fleet, compared to the 15–55% in later years.

2.2 Characteristics specific to the scrapping market

One might expect a synchronisation of the activity levels in the new building and scrapping market. This would be the case if the economic and technical lives of vessels were constant and similar across vessel types and contracting was made to replacement of old tonnage. We know that this is not the case and Figure 1 above nicely illustrates that the variations in the volume of new transport capacity delivered are not linked directly to the volume scrapped.

The activity level in the scrapping markets fluctuates, as do the freight level and conditions in the freight markets. Even though reactions are lagged this indicate that the economic life of a vessel is linked to the freight level and the income expected over the rest of the vessel’s technical life.

Scrapping volumes furthermore reflect political decisions on phasing out of vessels that do not fulfil the stricter requirements on environmental and safety standards being introduced. This means that the phasing out plan for single hull tankers set by International Maritime Organisation (IMO) is reflected in the scrapping volumes. Some single hull tankers are converted to floating oil producing vessels instead of being scrapped. This also reduces the oil carrying capacity of the tanker fleet.

Fluctuations indicate that the capacity level in the scrapping industry should be flexible. As stated above entry into the market has hitherto been fairly easy. To set up a new scrapping site one needs a beach and labour. This has been available mainly in the Asian countries with China, Bangladesh, Pakistan and India as the important locations. Environmental concerns have set focus on scrapping activity both following from the potential spills into the waters surrounding the scrapping site and the health problems faced by workers in the scrapping industry. A change in requirements will influence the costs of entry and exit in the scrapping industry and thus the flexibility in capacity. In the future we may therefore experience higher fluctuations in scrapping prices than those we see currently. The effects on pricing will be discussed in more detail below.

2.3 Characteristics specific to the second-hand markets

As pointed out in the introduction to this chapter the second-hand markets differ from new building and scrapping markets by being auxiliary markets in the sense that they do not change the number of vessels or the transport capacity offered in the markets. This contrasts with the other markets for ships, which have expansion or contraction of transport capacity as their main function. The purpose of a second-hand market is to reallocate vessels among operators and thereby to increase the efficiency in markets for transport services. By doing so, second-hand markets support efficient use of capital equipment in the shipping industry and contribute to reducing transport costs in world trade.

Transactions performed in the second-hand markets also contribute to the efficiency in seaborne transport in another way. When ship owners can sell the bulk of their real capital in a liquid second-hand market, their exit costs are pushed down. Similarly the

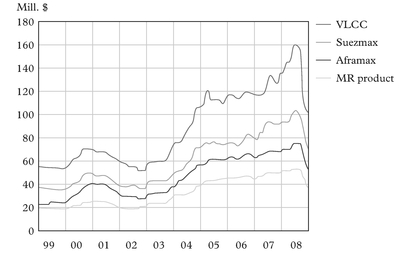

Source: The Platou Report 2009, p. 16.

existence of second-hand markets facilitates entry into shipping, since potential suppliers may buy an existing vessel and enter the transport market on short notice. Both aspects affect competition in the freight markets in a positive way. In addition shipowners may also use the flexibility to switch markets or restructure their fleet in line with changes in demand.

Viable second-hand markets do not eliminate the exit costs, however. Ship values fluctuate with freight market conditions as is illustrated by Figure 3. Hence, the value of the vessel may be low when the owner wishes to sell and exit. Therefore second-hand markets reduce, but do not eliminate, costs of exit compared to an alternative setting were ship owners had to scrap their capital equipment to exit.

Not only ship owners who operate vessels, but also investors who purchase and sell vessels for asset play, enter the second-hand market. Their activities increase the liquidity of the second-hand market and contribute to a better functioning market and thus to a more efficient allocation of capital equipment in the freight market. In a study of the dry bulk market Alizadeh and Nomikos8 thus find that there is a negative relationship between the volume of transactions in the second-hand market and price volatily.

2.4 Characteristics of markets for different vessel types

In the above comments on the different markets for ships we have indicated that the situation differs somewhat among vessel types. In the newbuilding market some suppliers specialise in building a restricted number of vessel types. There are for example, yards that specialise in cruise vessels. Most European shipbuilders concentrate on specialised vessels either cruise vessels, ferries, fast vessels or supply or research vessels. Producing these vessels is more profitable when labour costs are high labour than producing standardised tanker or dry bulk carriers under similar cost conditions. Thus, a main difference in supply of the different ship types in the new building market is the location of the yards and thereby the cost level for labour employed. There is, however, an eastward move also for specialised vessels, similar to the one experienced earlier by contractors of standard wet and dry bulk vessels.

In the scrapping market there is little differentiation on vessel type.