Drivers of political parties’ voting behaviour in European economic governance: the ultimate decline of the economic cleavage?

4 Drivers of political parties’ voting behaviour in European economic governance

The ultimate decline of the economic cleavage?

Introduction

Since the outbreak of the European financial crisis national parliamentary parties have been involved in approving the new legal and policy measures reforming European economic governance. The new role has been particularly challenging for national parties. On one hand, parliamentary parties, being responsible for tailoring national budgets, possess considerable fiscal policy expertise. Furthermore, financial crises are by no means new for parties: since the Second World War European economies have been regularly confronted with currency or asset prices crises. On the other hand, the introduction of a common currency (euro) radically changed the initial scope conditions. First, members of the eurozone were limited in their choice of anti-crisis policies: for instance, governments were no longer free to devaluate. Second, the crisis generated a profound tension between the domestic demands of national constituencies and international interdependence of decision-makers; that is, in many states the preferences of voters collided with the anti-crisis approach agreed by governments of the eurozone. The crisis also antagonized northern and southern European states giving rise to a new conflict between ‘surplus’ and ‘deficit’ eurozone states. Against that background, the general question emerges: to what extent has parliamentary parties’ voting behaviour on anti-crisis measures been affected by the new economic and institutional conditions? In particular, which factors account for national parliamentary parties’ vote outcomes on the major legislative measures reforming European economic governance? What are the major conflict lines among the analyzed parties? Are the established patterns of political parties’ voting behaviour confirmed or disconfirmed by the new empirical data?

According to the literature, political parties in democratic states fulfil two basic functions: they represent their voters and implement policies. The first function of political parties has been conceptualized as responsiveness (Mair, 2009; Bardi et al., 2014), meaning that citizens, by voting for a given party, select representatives who are expected to implement policies in accordance with their interests (Hibbing and Theiss-Morse, 2001). The second function of political parties, often referred to as responsibility, is associated with governing (Mair, 2009). Responsibility implies that parties respect international obligations vis-à-vis regional organizations or international markets (Bardi et al., 2014) but also take into account the long-term needs of their state that are rarely voiced directly by their voters, such as national security concerns.

A political system can be recognized as legitimate as long as political parties perform well their two basic functions. Namely, the two dimensions of legitimacy, input and output legitimacy (Scharpf, 2009) are closely linked to responsiveness and responsibility. Whereas output legitimacy concerns the performance of institutions in delivering policy outputs, input legitimacy denotes conditions for the democratic self-government and electoral accountability of governors. Therefore, a political system is legitimate if it fulfils the following conditions: political parties represent their voters’ interests organized along the main cleavages (responsiveness), governments and political parties remain accountable for their actions (responsiveness) and governments and political parties deliver policy outputs which satisfy their voters and respect international agreements (responsibility).

Recently, scholars have observed that the new circumstances generated by the sovereign debt crisis in the eurozone are likely to affect the responsiveness and responsibility of political parties (Bohle, 2014; Maatsch, 2014; Rose, 2014). In particular, the literature has observed that governing parties in bailout (debtor) states are more likely to prioritize international obligations vis-à-vis international markets than governing parties in creditor states (Bohle, 2014). This is because governments facing liquidity or solvency problems have to accept conditionalities accompanying a bailout loan: membership of the monetary union precluded alternative options, such as devaluation. By the same token, national parliamentary parties gave up sovereignty in the central area of their political activity, namely, the national budget. Parties in bailout states demonstrated that they are very much aware of the dilemma, as one Irish MP observed:

This country is fighting to get its sovereignty back, but the reality is that the future of Europe requires greater economic integration. We know the political reality that greater integration with a reduction in sovereignty may not be acceptable to the people.1

On the other hand, societies of northern European creditor states also voiced criticisms. In particular, many voters disapproved of financial solidarity measures among the member states of the eurozone. However, governments of creditor states, uncertain about the possible spillover of the crisis into their own states, and particularly into their banking systems (Thompson, 2013), had to provide financial guarantees to debtor states within the bailout fund. However, the driving motivation of political parties in creditor states was not solidarity but rather the national economic interest (Closa and Maatsch, 2014).

Although the literature on parliamentary parties’ behaviour in the European sovereign debt crisis is quickly growing, most published contributions have provided a fragmented picture. For instance, studies have often concentrated on the analysis of a single anti-crisis measure (Closa and Maatsch, 2014). Other studies have focussed only on a limited number of eurozone states (Wendler, 2014; De Giorgi and Moury, 2015) or exclusively on governing parties (Bohle, 2014). Finally, there are also studies which concentrate exclusively on the impact of formal competences on parliamentary parties’ behaviour (Fasone, 2014a). Against that background, the fragmented empirical evidence does not allow us to reach any general conclusions about the drivers of parliamentary parties’ behaviour in the reform of European economic governance. This chapter aims to fill that gap by analyzing how national parliamentary parties in eurozone states2 voted on the subsequent anti-crisis measures: the European Financial Stability Facility (EFSF) (establishment of the fund and increase of its budgetary capacity), the European Stability Mechanism (ESM) and the Treaty on Stability, Coordination and Governance in the Economic and Monetary Union (TSCG) also referred to as the Fiscal Compact. Although all the above mentioned measures belong to the so-called ‘reform package’, their content differs substantially. The EFSF and the ESM established a bailout found providing financial support to eurozone member states which could no longer finance themselves on the markets (due to liquidity or solvency problems). While the EFSF was established as a temporary solution, the ESM became a permanent bailout fund. The Fiscal Compact is a stricter version of the previous Stability and Growth Pact. Member states bound by the treaty are required to introduce into domestic law a self-correcting mechanism which shall guarantee that their national budgets are balanced. In particular, the general budget deficit shall not exceed 3 percent of GDP, the structural deficit shall be less than 1 percent of GDP and the debt-to-GDP ratio shall remain below 60 percent.

In the empirical dimension, the chapter tests the extent to which the vote outcome can be explained by the following factors: (1) international interdependence, (2) response to voters’ preferences, (3) institutional cleavage (government-opposition), (4) economic policy preferences, (5) party’s position on the EU, (6) conflict between creditors and debtors and (7) formal approval procedures. The empirical analysis is conducted with help of the statistical binary logit model; the unit of the analysis is defined as the vote of a particular party on a given anti-crisis measure.

The analysis demonstrated that governing parties, irrespective of their policy preferences or bailout status, voted in favour of anti-crisis measures. That finding clearly confirmed the power of international interdependence in decision-making on European economic governance. In contrast, opposition parties voted either in favour or against. The decisive factor explaining opposition parties’ vote outcome has been their position on the EU. In particular, opposition parties that voted against anti-crisis measures were Eurosceptic. Furthermore, whereas negative votes among opposition parties were less likely the higher the ‘trust of the population in its government’ and the trust in the problem-solving capacity of the EU, the likelihood of no-votes increased with the level of trust in national parliaments. Interestingly, opposition parties’ policy preferences measured on the economic left–right scale do not seem to have any significant impact. Furthermore, an additional test measuring the impact of extreme left–right positions on the vote outcome did not produce significant results either.

This chapter begins by discussing the literature and hypotheses explaining national parliamentary parties’ voting patterns on European issues. The next section presents the legal status of the European anti-crisis measures and explains how they were approved by national legislators. Finally, after a short presentation of the methodological approach, the chapter engages with empirical findings. The last sections (discussion and conclusions) evaluate the empirical and normative implications of findings and suggest directions for further research.

What factors explain political parties’ voting patterns on European anti-crisis measures? Literature review and hypotheses

The literature on political parties identifies the following factors as possibly accounting for political parties’ vote outcomes on the European anti-crisis measures: international obligations (Bohle, 2014; Rose, 2014), domestic voters’ preferences (Downs, 1957; Dalton, 1985; Ezrow et al., 2010), party positions on redistribution (Alesina and Rosenthal, 1995; Boix, 2000; Broz, 2013; Closa and Maatsch, 2014; Maatsch, 2014), position on European integration (Hooghe and Marks, 2008; Szczerbiak and Taggart, 2008 and 2013), impact of bailout loans (Bohle, 2014; Maatsch, 2014) and formal approval procedures (Coutts et al., 2015, Maatsch, 2015).

The first hypothesis tested in this chapter stipulates that due to the presence of international obligations, governing parties in both creditor and debtor states vote in favour of anti-crisis measures. Responsibility towards international obligations is foremost a feature of governing, not opposition, parties. According to Birch (1964) and Mair (2011) responsibility of governing parties implies prudence, consistency and predictability in their actions over a longer period of time as well as a sense of duty to respect international norms and commitments that have been made by previous governments. In other words, there is an expectation that democratic governments, as representatives of their states at the international area, shall respect existing international agreements even if they are not entirely in favour of them.

The European financial crisis has demonstrated that prioritization of international responsibility by decision-makers very often stands in conflict to the principles of sovereignty and democracy. According to Rodrik (2011), global economic integration generated a profound tension between the principles of democracy, sovereignty and economic integration. This tension has been carried to extremes by the financial crisis in Europe.

The interdependence of national economies in the eurozone is particularly strong. First, membership of the monetary union has an impact on states’ financial position on the markets. When the common currency was introduced, peripheral states could borrow more cheaply on international markets, benefiting from lower interest rates. As some economists observed (de Grauwe and Ji, 2012), financial markets underpriced the risk before the crisis and overpriced it during the crisis. As a consequence, governments were under pressure to overcome domestic opposition. They were aware that a failure to ratify in one state could put the whole reform process on hold, which could have profound economic consequences for all members of the eurozone. The task proved to be particularly difficult to governments in bailout states that committed themselves to anti-crisis legislation even though these measures limited their sovereignty and became contested by the voters.

Finally, the literature on political parties stresses the impact of the very close link between governments and parliamentary majorities on decision-making processes. First, the literature notes that governing parties rarely vote against measures approved by their governments (Raunio, 2009). On the contrary, they seek to legitimize their government’s decision. That mechanism is related to the fact that the major cleavage in domestic politics is between government and opposition and not between government and national parliament. Secondly, given the intergovernmental and technocratic form in which the anti-crisis measures were negotiated, governing parties were more likely to identify with them than the opposition parties.

In contrast to governing parties, opposition parties are not constrained by international obligations: they could respond to the preferences of their constituencies (as a vote- or office-seeking strategy) or vote according to their ideological position. The by now classic spatial electoral models demonstrate that parties, in order to get re-elected, tend to address the short-term interests of the median voter (general electorate model) (Downs, 1957) or the interests of the mean party supporter (partisan constituency model) (Dalton, 1985; Ezrow et al., 2010). Ratification of anti-crisis measures provided a particular opportunity for opposition parties to vote responsively, particularly if governing parties disregarded their voters’ opinions. Therefore, according to the second hypotheses tested in this chapter, opposition parties are more likely to vote responsively the higher the public discontent with the reform process.

The literature demonstrates that parties’ behaviour is also influenced by ideology (Cranston and Mair, 1980). As parties adhere to certain ideologies in a path-dependent manner, it is possible to predict parties’ behaviour on that basis. According to the literature, parties opt for macroeconomic measures which coincide with their general economic ideology: parties located on the economic ‘right’ opt for neoliberal measures, whereas parties located on the economic ‘left’ advocate ‘Keynesian’ ones (Alesina and Rosenthal, 1995; Boix, 2000).

The literature notes that while the conflict over redistribution is present at the European level, it differs to some extent from the conflict over national policies (Hooghe and Marks, 2008). While in nation–states redistribution takes place at the individual level (from the richer to the poorer citizens), in the EU redistribution has a national dimension (from the wealthier to poorer states). As the literature notes, the willingness to redistribute is higher if recipients are perceived as members of the same community. Therefore, pursuit of redistribution between states is likely to encounter more contestation than within one state.

More recent literature focussing on the financial crisis (Broz, 2013) also demonstrates that a response – like the run-up – to a crisis is also likely to be informed by the economic ideology of the governing political party. In particular, political parties representing the right-wing of the economic spectrum are likely to advocate pro-cyclical measures, such as so-called ‘austerity’ policies. In contrast, parties representing the economic left are more likely to propose anti-cyclical measures, for instance, increases in government spending. In general, given the fact that the European anti-crisis measures are based on pro-cyclical ‘austerity’ policies, it can be expected that opposition parties representing the economic ‘right’ (both in debtor and creditor states) support these measures to a greater extent than parties located on the economic ‘left’.

However, it is also likely that the influence of the economic ideology varies across different anti-crisis measures. On one hand, as the right-wing parties are less sympathetic towards redistribution, they may be more likely to vote against the EFSF and the ESM than the left-wing parties. On the other hand, right-wing parties may be more willing to vote in favour of the Fiscal Compact, for it strengthens the budgetary surveillance and makes it difficult to pursue interventionist politics. In order to test that, the quantitative analysis investigates the impact of economic ideology along each particular measure.

According to the fourth hypothesis tested in this chapter, Eurosceptic opposition parties are more likely to vote against anti-crisis measures than pro-European parties. As many authors have noted (Szczerbiak and Taggart, 2008 and 2013), parties classified as Eurosceptic object in principle to any and all initiatives that might assign more competences to Brussels. Two aspects of the reform are likely to be contested by Eurosceptic parties: establishment of the bailout fund and closer surveillance of national budgetary politics by the European Council and the European Commission. On one hand, Eurosceptics in debtor states are likely to disapprove their partial loss of sovereignty related to entering a bailout programme. Namely, in bailout states budgetary policy is no longer exclusively controlled by the executive and legislature, but also by the so-called ‘Troika’ composed of the European Commission, the European Central Bank and the International Monetary Fund, which supervises compliance with the Memoranda of Understanding. On the other hand, although creditor states remain sovereign in their national budgetary politics, they provide financial guarantees to states that received a loan from the bailout fund. If bailout states fail to service their debt, creditor states are obliged to pay their share. Hence, it is very likely that Eurosceptic parties in creditor states will also take a negative stance. Finally, it can also be expected that closer surveillance of national budgets by the Council and the Commission will be contested by Eurosceptic parties.

In the literature we find an argument that the introduction of bailout loans had an impact on political parties’ behaviour (Maatsch, 2014). Bailout programmes generated a conflict between northern and southern European states. Whereas in debtor states the resentment was fuelled by the disapproval of austerity measures and loss of national sovereignty, the antagonism in creditor states was generated by anti-solidaristic attitudes (Closa and Maatsch, 2014). The resentment evoked by the bailout has not cross-cut with any pre-existing political division; rather, it has manifested itself within parties representing the economic left, right, pro- and anti-European positions. As a consequence, the bailout conflict can be associated rather with the national level. Against that background, if the contestation of anti-crisis measures is explained by the bailout conflict, the votes against are likely to be observed across different ideological positions of parties in both creditor and debtor states.

Finally, it has been observed that specific voting procedures in parliaments (for instance, simple versus special majorities) also influence vote outcomes. Various empirical studies have demonstrated that there was a significant divergence in approval procedures of anti-crisis measures (Benz, 2013; Coutts et al., 2015; Fasone, 2014b, Maatsch, 2015). In particular, in bailout states governments introduced various institutional arrangements which allowed approving anti-crisis measures with a minimized risk of defection. In contrast, in creditor states anti-crisis measures were approved predominantly with standard procedures.

The factors which mostly disempowered national parliament in southern European states were: the legislation of emergency (fast-track procedures and mergers), national constitutional or supreme courts’ activity and the loss of substantial equality by parliaments. Fast-track procedures are codified in each European state; their major goal is to accelerate the legislative process in unusual circumstances. Fast-track arrangements differ from state to state: they can concern limitation in the number of plenary debates (i.e. from three to one) but also elimination of voting (Maatsch, 2015). Mergers constitute legislative packages composed of two or more legal acts which usually have to be debated together and approved with one vote, which seriously limits the impact of parliaments. According to the literature, courts’ rulings have rather disempowered national parliaments in bailout states3 and empowered selected parliaments in creditor states (predominantly the Bundestag). Finally, acquisition of a bailout loan was often conditioned on approval of specific anti-crisis measures (i.e. the Fiscal Compact). That factor limited parliaments in bailout states in their sovereign exercise of formal powers (hence, limitation of substantial equality). According to the literature, states which approved all anti-crisis measures by means of standard procedures were: Belgium, Austria, Estonia, Finland, Germany, Ireland, Luxemburg, Slovakia and Slovenia (Fasone, 2014b; Coutts et al., 2015; Maatsch, 2015). States which applied fast-track procedures or mergers were: Spain, France, Cyprus, Greece, Italy, Malta, Netherlands and Portugal. As a consequence, if vote outcome is explained by differences in voting procedures, the variation is to be observed at the country-level. Hence, parliamentary parties in bailout states are less likely to vote against anti-crisis measures than parliamentary parties in creditor states.

Research design, methodological approach and the database used in this study

The empirical data on the dependent variable (vote outcome by party) have been obtained from the internet pages of national parliaments. All national parliaments publish their vote outcomes, though the form in which the data is presented, as well as the grade of detail, may differ. In particular, some parliaments publish detailed name-lists; others only provide data on how each parliamentary party voted. Furthermore, whereas some parliaments publish vote outcomes together with minutes from plenary sessions during which the voting took place, others provide vote outcomes in separate documents. Due to these discrepancies it was sometimes necessary to enquire directly at national parliaments in order to establish how the official information can be accessed.

Explanatory variables were obtained from three different sources. The data on lending operations (bailouts) were obtained from the internet pages of the European Financial Stability Facility4 and the European Stability Mechanism.5 The data on trust in institutions and evaluation of their effectiveness in combating the crisis were obtained from Eurobarometer surveys 73, 74, 75, 76 and 77. Finally, political parties’ positions regarding the European integration as well as economic preferences were extracted from the PIREDEU database. The first limitation of the source was that PIREDEU does not provide information on small (often regional) parties which are usually poorly represented at the national level (one or two seats). Second, the database has not covered political parties which were established shortly before the analyzed votes. As a consequence, a number of observations had to be excluded from the analysis.

In the analytical model the vote outcome on a given measure was matched with the corresponding results of the Eurobarometer survey. The analysis covered almost all states of the eurozone, namely, Austria, Belgium, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Luxemburg, Malta, Netherlands, Portugal, Slovakia, Slovenia and Spain.6

In total, the sample consists of 383 votes. Due to missing values in the PIREDEU dataset, the data used for the regression analysis had to be reduced to 264 observations. An observation has been defined as one vote of a particular party on a given measure (or bundle of measures). In the 16 countries included in the sample, a total of 58 votes have been analyzed. The dependent variable has been operationalized as the majority vote outcome of a given party on a given measure.

In order to test the hypotheses, a set of different regression models has been run on the dataset. First, it turned out that none of the governing parties in the sample voted against any of the measures.7 Therefore, the variable ‘government party’ by itself could already explain 113 positive outcomes. The sample was, hence, reduced to opposition parties. Second, the data plot shows that 332 out of 383 party votes were unanimous so that a discrete model was preferred over a logistic regression. In the dataset covering only opposition parties the dependent variable was defined as ‘majority against’.

The following independent variables were tested in different model layouts:

Party-related variables:

- position_EU (positive or negative attitude towards EU according to PIREDEU)

- position_leftright (according to PIREDEU scale)

- position_extreme (created from PIREDEU; distance from political centre)

Country-related variables:

- bailout state (dummy variable)

- fast track (simplified parliamentary procedure)

- unemployment (Eurostat)

- trust_national government (Eurobarometer)

- trust_national parliament (Eurobarometer)

- trust_EU (Eurobarometer)

- effective_EU (Eurobarometer)

- effective_natgov (Eurobarometer)

Content-related variables:

- EFSF-1 (dummy variable)

- EFSF-2 (dummy variable)

- Fiscal Compact (dummy variable)

- ESM (dummy variable)

Constructed variable:

- bailout × leftright (bailout = −1 and non-bailout = 1; left = negative, right = positive)

Based on the PIREDEU classification of parties on the left–right axis, the impact of the economic stance of the parties on their voting behaviour was tested. Next to the standard PIREDEU left–right variable, an ‘extreme position’ variable was created measuring the distance from the political centre. The idea behind this second variable was that the correlation with the vote outcome could be u-shaped or v-shaped, with parties both on the extreme left and on the extreme right voting more regularly against the measures.

Another variant of the PIREDEU classification was a multiplication with the bailout variable (in this case 1 for non-bailout states and −1 for bailout states). On the one hand, it was likely that right-wing parties in wealthier countries would be reluctant to support the analyzed measures due to their economic stance and their national economic interests. On the other hand, left-wing parties in bailout states could have rejected the analyzed measures also due to their ideological stance and their national economic interests. However, none of the left–right variables were significant. By contrast, the ‘pro-EU’ variable was highly significant in all of the models.

Empirical findings

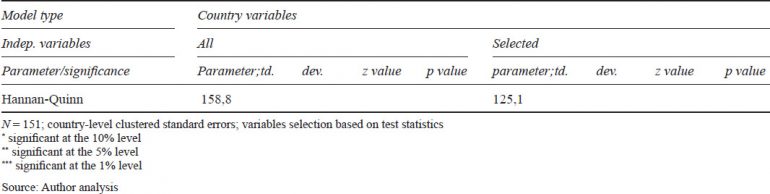

The following variables turned out to be significant in the model with the best fit: ‘pro-Europeanness’ of the party according to PIREDEU (fewer refusals), trust of the population in its government (fewer refusals), trust of the population in its parliaments (more refusals) and positive evaluation of the EU’s effectiveness with regard to the combat of the crisis (fewer refusals). Though the model can only partially explain the vote outcomes, the strong significance of the ‘pro-EU’ variable and the missing impact of left–right cleavages are robust results.

The empirical findings confirm the first hypothesis: almost all governing parties voted in favour of anti-crisis measures throughout the whole period, irrespective of the measure in question, level of social contestation or presence of financial assistance programme in their state. Therefore, the variable ‘government party’ could already explain 113 out of 207 positive outcomes. Furthermore, almost all governing parties voted unanimously in favour: there were no internal splinter groups voting against anti-crisis measures. There was also no change over time or across different anti-crisis measures. Namely, governing parties have not voted differently on the bailout fund and the Fiscal Compact.

In the second step, the analyzed sample was narrowed down to opposition parties in order to investigate which factors account for their vote outcome. According to the hypotheses tested in this chapter, opposition parties are free from international obligations and, hence, their vote on anti-crisis measures can be informed by different factors. The explanatory model tested whether opposition parties’ vote outcomes corresponded to (1) their voters’ preferences, (2) general macroeconomic preferences of political parties (3) political parties’ positions on European integration, (4) presence of a financial assistance programme and (5) formal approval procedures. The analysis demonstrated that opposition parties’ voting behaviour could be explained by the following factors: political parties’ position on European integration, public trust in national governments and in national parliaments. Other variables tested in this study did not turn out to be significant.

As expected, opposition parties demonstrated an entirely different pattern of voting behaviour from governing parties. In roughly 38 percent of the votes, the party majority voted against the measures. Hence, the goal of the second step in the analysis was to establish which opposition parties voted in favour and which voted against. Out of various regression models which were tested for this study, a binary logit model was selected as the reference model based on model test statistics. In that model the dependent variable has been operationalized as ‘majority of parliamentarians within a political party voted against’. The model correctly predicts 138 out of 151 cases. Together with the 113 positive votes by government parties, the two-step model can explain 251 out of 274 cases, or 92 percent.

The variable measuring support for European integration was highly significant in all models. The finding demonstrates that parties voted on anti-crisis measures according to their position on European integration. In particular, pro-EU parties supported the analyzed anti-crisis measures whereas Eurosceptic parties opposed them. That trend was observed both in creditor and debtor states.

Interestingly, three variables created from Eurobarometer results turned out to have a significant impact. In countries where the public trust in the national government has been high, the measures negotiated at the EU level were also more often supported by the opposition parties. By contrast, in countries where the level of trust in national parliaments was high, opposition parties were more likely to vote against the analyzed measures. Finally, in countries where the population perceived the EU as effective in combating the crisis support for the measures was also higher in parliament.

| Independent variables | Coefficient | Standard deviation | z value | p value |

|---|---|---|---|---|

constant | +1,97 | 0,982 | +2,00 | 0,045** |

Party: | ||||

Positive perception of EU | -0,20 | 0,068 | −2,93 | 0,003*** |

Population: | ||||

Trust in national government | -0,10 | 0,046 | −2,16 | 0,031** |

Trust in national parliament(s) | +0,14 | 0,055 | +2,60 | 0,009*** |

EU problem-solving capacity | -0,10 | 0,046 | −2,10 | 0,036** |

McFadden’s R2 | 0,46 | Akaike (AIC) | 119,0 | |

Corrected R2 | 0,41 | Schwartz | 134,1 | |

Log likelihood | 54,5 | Hannan-Quinn | 125,1 |

* significant at the 10% level

** significant at the 5% level

*** significant at the 1% level

N = 151; country-level clustered standard errors variables selection based on test statistics

Source: Author analysis

The fixed effects of the different measures were not significant in the reference model, meaning that the parties’ voting behaviour did not change significantly over time. Opposition parties seemed to vote on the subsequent measures applying the same criteria, even though both the content and the legal status of the measures differed significantly.

Furthermore, the economic cleavage (left–right) was not significant for the vote outcome in any of the tested models. Surprisingly, vote outcomes on the reform process of the European economic governance were not related to the basic macroeconomic positions of political parties. An alternative variable was created in order to test whether extreme economic positions (extreme left or extreme right) had an impact on the vote outcome. Here the expectation was that the relation with the vote outcome could be u-shaped or v-shaped, with parties both on the extreme left and on the extreme right voting more regularly against the measures. However, that was not the case. The differences in parties’ vote outcome could not be attributed to economic positions, even the extreme ones. As a consequence, economic positions of parties were irrelevant for the vote outcome on anti-crisis measures. Finally, none of the country-level variables investigating whether vote outcomes correlated with the presence of a bailout loan or particular ratification procedure proved to be significant.

The qualitative analysis of voting behaviour among independent (unaffiliated) MPs did not yield a pattern; that is, they voted both in favour of and against the anti-crisis measures. Independent (unaffiliated) MPs usually constitute a small share of all national MPs, approximately 1 percent or less. However, in some bailout states their number has increased in recent years. In Greece the share even grew to almost 10 percent as Greek MPs have begun to abandon their mainstream parties in protest.

Discussion and conclusions

The chapter analyzed national parties’ vote outcomes on the major anti-crisis measures reforming the European economic governance, namely the European Financial Stability Facility (EFSF) (both the establishment of the fund and the increase of its budgetary capacity), the European Stability Mechanism (ESM) and the Fiscal Compact. The analysis covered all eurozone members,8 with exception of two states. The unit of the analysis was defined as a vote by a party on a particular measure. The sample comprises 402 observations. The empirical analysis was based on a set of logit models testing the impact of the following factors: governing status, the economic left–right cleavage, position on EU integration, impact of public opinion (measured by trust in national and EU institutions and evaluation of their crisis-solving capacity), the impact of the conflict between debtor and creditor states as well as the impact of formal ratification procedures.

The chapter demonstrates that the voting pattern of governing and opposition parties reflects an entirely different pattern. Whereas none of the governing parties in the sample voted against the analyzed anti-crisis measures, opposition parties voted in favour or against. As expected, the support of governing parties was driven by the international responsibility to continue reforms of the European economic governance as well as the awareness of interdependence of states in the eurozone. In particular, given the fact that the analyzed anti-crisis measures required the unanimous approval of all states (or ‘special’ majorities), governing parties were aware that a failure to ratify by their state could put the whole reform process on hold.

In the light of recent developments in several European states, it has to be noted that during the period of the analysis, there were no radical left, radical right or TAN governments. Therefore, we do not know whether these parties would also support anti-crisis measures on the grounds of international responsibility.9

The major factor explaining opposition parties’ vote outcomes across all model formulations was their position on the EU. In particular, Eurosceptic opposition parties opposed anti-crisis measures whereas pro-EU opposition parties supported them. As a consequence, opposition parties have not differentiated between the ratification of the bailout fund and the Fiscal Compact even though the content of the two measures could be evaluated differently by the left-wing and right-wing parties. That finding demonstrates that opposition parties’ position on anti-crisis measures boiled down to the basic question whether a given party supported the European integration project or not.

Furthermore, opposition parties’ vote outcome has been fairly responsive towards voters’ preferences. In particular, in states where voters’ trust in their governments was high, opposition parties were more likely to vote in favour of all analyzed anti-crisis measures. On the contrary, opposition parties were more prone to vote against anti-crisis measures if voters’ trust in national parliaments was high. Finally, the analysis also demonstrated that the higher the public trust in the capacity of the EU to solve the financial crisis, the more likely were the opposition parties to vote in favour of anti-crisis measures. How to interpret these findings? Primarily, if voters believe that governments, but also the EU, represent properly their interests, opposition parties are also more likely to demonstrate their consent towards the anti-crisis politics. In other words, the more the voters were satisfied with the output legitimacy (performance of national or EU institutions in delivering satisfactory policy outputs), the more likely were the opposition parties to support anti-crisis measures. However, if voters declare that they trust predominantly in national parliaments, opposition parties are more prone to vote against anti-crisis measures. It particular, high public trust in national parliaments signals that voters do not only trust the ruling majority but also – or rather – opposition parties. Hence, high trust in parliaments suggests that alternative policy-proposals are also recognized as legitimate by the voters. That encourages opposition parties to challenge the governing majority.

Probably the most surprising finding is the irrelevance of the left–right cleavage for the vote outcome. The model also tested the impact of the radical left and right positions, but these proved to be irrelevant. Furthermore, the growing public discontent with the reform of EU economic governance was not reflected in the vote outcomes. Rather, the data suggest a disconnection between the parties’ vote outcomes and their voters’ preferences. Finally, the majority of governing and opposition parties reached an internal consensus on anti-crisis measures and voted unanimously in favour or against them. The finding confirms that the analyzed parties managed to present unitary positions even in a highly controversial policy area such as European economic governance.

The implications of the findings presented in this chapter go beyond the approval of anti-crisis measures. In the literature, national parliamentary parties were recognized to play an important role in domesticating and normalizing EU policy-making. According to Kröger and Bellamy (2016: 4):

The politicisation of EU affairs need not be equated with Euroscepticism and the rise of populist movements. Rather, by debating EU matters more fully within national parliaments, parties can reconnect EU policy to domestic democratic processes and the normal political cleavages of left and right.