Controlling Crimes of Globalisation: A Challenge for International Criminal Justice

Controlling Crimes of Globalisation

A Challenge for International Criminal Justice1

Introduction

Much of the existing literature on crime and justice in the realm of the international has addressed such matters as the impact of globalisation on conventional forms of crime, the growing significance of transnational forms of crime, and the challenges of addressing crimes that are in violation of international law. In this chapter we address a highly significant form of crime that has to date been largely neglected in this literature: crimes of globalisation.

While globalisation has many different dimensions, those most pertinent within the realm of crimes of globalisation include: (1) the growing global dominance and reach of neo-liberalism and a free market, capitalist system that disproportionately benefits wealthy and powerful organisations and individuals; (2) the increasing vulnerability of indigenous people with a traditional way of life to the forces of globalised capitalism; (3) the growing influence and impact of international financial institutions and the relative decline of the power of local or state-based institutions; and (4) the non-democratic operation of international financial institutions, taking the form of globalisation from above instead of globalisation from below. We will not engage with the huge, on-going dialogue here on whether globalisation has, on balance, promoted improvements in the quality of human life or has been a destructive force (Dean and Ritzer 2012; Smith 2013; Stiglitz 2007). We do not contest that by some measures, in at least some developing countries, the quality of life has improved during the era of expanding globalisation (Kenny 2011). But our focus here—as criminologists—is necessarily on the dark side of globalisation: what we refer to as crimes of globalisation. These are crimes that are specifically a product of the conditions of expanding globalisation, with the crimes of international financial institutions (IFIs) as the illustrative type of such crime. The IFIs adopt and implement policies that are criminal in the direct sense of having demonstrably harmful consequences, and they are also complicit in a broad range of state and transnational crimes. To cite just one dimension of such crime, we have the imposition of massive debt on developing countries, with the international financial institutions at the centre of this process (Toussaint and Millet 2010). The benefits of such debt overwhelmingly go to the political and business elites of the developing countries, with the burden of repaying the debt overwhelmingly falling upon the ordinary citizens of these countries. Debt repayments, then, have been demonstrated to involve a vast flow of money from the desperately poor of developing countries to the exceedingly rich financial institutions and corporations of the developed countries. Of the role of the international financial institutions in all of this, Toussaint and Millet note that “The list of their misdeed is long and the crimes they have committed and still commit are serious” (2010: 302). Global justice activists (and some economists) have called for the cancellation of the immoral (“odious”) debt imposed upon developing countries by the international financial institutions, and the establishment of alternative, sustainable approaches to financing development in these countries.

The two principal international financial institutions are the International Monetary Fund (IMF), which seeks to maximise financial stability, and the World Bank, which is primarily focused on promoting development (Jackson 2012; Woods 2006). In economically developing countries growing numbers of people, increasingly better informed and more easily mobilised via the Internet, are characterising themselves as victims of monumental crimes carried out by head of state regimes, with the complicit aid and influence of Western governments, corporations, and institutions including the international finance institutions. During the course of 2011, this situation was played out in Egypt, Tunisia, Libya, Bahrain, Yemen, Syria, and other Middle Eastern countries (Friedrichs 2013; Lynch 2012). While not attributable to IFIs directly, their policies and practices contributed importantly to the conditions which helped give rise to the uprisings (Jackson 2012; Sissako 2006). Such was the case with Egypt when it began to liberalise its economic policies, guided by the IFIs:

Consider that throughout the 1990s, and then in accelerated form after 2004, the Mubarak regime pushed through structural adjustment reforms demanded by the IMF-privatizing industry at a record pace, gutting social services, and reversing land reforms granted under the Nasser regime. These neo-liberal reforms have created massive polarization and immiseration. According to El-Nagger, the share of GDP acquired by wage earners decreased from 48.5 percent in the late 1980s to 28.6 percent in 1995-and less than 20 percent in 2007. (Hadas 2011: 57)

The gross mal-distribution in terms of consumption of natural resources that exists between the developed and developing world is also highly likely to be subjected to increasing challenge.

Definitional Clarification of Crimes of Globalisation

The concept of “crimes of globalisation” was first put forth in a paper for the American Society of Criminology Annual Meeting in 2000 (subsequently published as an article in Social Justice in 2002) with the title “The World Bank and Crimes of Globalisation: A Case Study” (Friedrichs and Friedrichs 2002). The concept of crimes of globalisation, as originally formulated, was limited to the demonstrably harmful activities of international financial institutions, with a special focus on one of these institutions, the World Bank. Since the original formulation of the concept, there has been a growing criminological interest in and research on these harms. Crimes of globalisation, then, are those demonstrably harmful policies and practices of institutions and entities that are specifically a product of the forces of globalisation, and that by their very nature operate within a global context. It is not typically the specific intent of those who engage in crimes of globalisation to cause harm. Rather, the devastating harm to vulnerable people in developing countries is a consequence of the skewed priorities of institutions and entities which favour the interests of the powerful and the privileged.

It should be noted, however, that the concept of crimes of globalisation is not synonymous with two formulations that have received significant recent attention: the “globalisation of crime” and “globalisation and crime” (e.g., Aas 2007; Karstedt and Nelken 2013; Larsen and Smandych 2008). The first of these terms refers broadly to long-standing forms of crime now carried out in an increasingly global context, and the second term refers broadly to the influence of globalisation on crime, as conventionally defined. Simon Mackenzie (2006) has introduced the term “systematic crime” in his discussion of the broad forms of global harm emanating from the practices of international financial institutions, and their complicity in denying the link between supporting interests of advanced economies and harm in developing countries.

The relationship of crimes of globalisation to the familiar terms such as transnational crimes and international crimes requires some attention here as well. “Transnational crimes” are essentially forms of crime that are increasingly carried out across borders and via international or global networks. The forces of globalisation are transforming and amplifying structures of opportunity for a wide range of different forms of criminal activity (Aas 2007, 2012). Some of these forms of crime (e.g., human, arms, and drug trafficking) are hardly new, but the transnational dimension of them has expanded (Albanese 2011). While potentially interconnected, transnational crimes are not synonymous with crimes of globalisation. Likewise, “international crimes” are best conceived of as violations of international law, which in their generic form (e.g., genocide, war crimes, crimes against humanity, and massive violations of human rights) have a long history. Such crimes have often been committed within national boundaries, but are increasingly carried out globally. International crimes are most typically thought of as “crimes of states” (state crime), but may also be committed by insurgencies, militias, and other parties. The crimes of international financial institutions also have a generic relationship to state-corporate crimes insofar as they are cooperative ventures involving public sector and private sector entities, and in some respects are hybrid public/private sector entities. The literature on state-corporate crime (e.g., Michalowski and Kramer 2006) has focused on crimes arising out of cooperative ventures involving states and corporations. Corporations—and increasingly multinational corporations—are also complicit in international crimes. Some of the corporations operating in Nazi Germany and its occupied territories, which played a role in the Holocaust, are classic cases of such crimes (Van Baar and Huisman 2012). In the more recent era, such corporations as Blackwater, Sandline, and Halliburton have been accused of violations of international law (Rothe 2009). While the aforementioned categories may appear to be separate phenomena, we suggest that they are multiply interrelated. The intersection of business and government has led to increased cases of a “globalised criminality.” In the recent era Western states as well as corporations have promoted neo-liberalism or a supposed “free market” model for the global political economy. Within such an environment the crimes of globalisation of international financial institutions are intertwined with the crimes of states. The policies and practices of the international financial institutions are largely driven by the global agenda of powerful developed states such as the United States. The conditions of globalisation produce expanding opportunities for such crime. The lines of demarcation between crimes of globalisation, transnational crimes, international crimes, state crimes, and state-corporate crimes are sometimes fluid and complex. Nonetheless, the key actors typically involved, the etiological factors, and the bodies of law violated tend to be different.

Brief Overview of Crimes of Globalisation

The IMF and the World Bank have arguably done more harm to more people than any other pair of non-military institutions in human history.

—David Korten, When Corporations Rule the World

(cited in Jackson 2012: 76)

While still in its infancy, the criminology of crimes of globalisation has now produced some research studies examining the interrelationships between the above-noted types of crimes and the harms and crimes associated with crimes of globalisation. The original journal article by Friedrichs and Friedrichs (2002) analysed the Pak Mun dam case where the World Bank helped finance the building of the dam in eastern Thailand in the early 1990s. The process of planning, constructing, and operating this dam was undertaken without obtaining input from the fishermen and villagers who lived along the river. The construction of the dam had a detrimental effect on the environment, flooding the adjacent forests. Friedrichs and Friedrichs suggest that this effect violated the World Bank’s own policies on cultural property destruction. Most importantly, a severe decline in the fish population occurred, and as a consequence, the way of life of indigenous fishermen dependent upon abundant fish for food and income was annihilated. The resettlement of the fishermen and compensation for their losses was wholly inadequate. Traditional communities began to disintegrate, yet the World Bank failed to take responsibility for its actions and policies that were at root of the crisis.

Several years later, Rothe, Muzzatti, and Mullins (2006) conducted research that explored the interrelations between the IMF and the World Bank, and legacies of colonialism along with foreign policies that set the stage for large-scale atrocities and crimes of states. Exploring the circumstances leading to the sinking of the ferry Le Joola, the authors demonstrated that while the state of Senegal had a core liability for this maritime tragedy, with its dramatic loss of lives, one could not overlook the role that international financial institutions played in the facilitation of this crime. The authors’ thorough investigation and analysis of the reasons and forces behind the Le Joola sinking suggested that international financial institutions bore some clear culpability for the disaster. In response to Structural Adjustment Programs (SAPs) imposed by the IMF, the Senegalese government was forced to cut spending in many areas. These spending cuts extended to ferry programs central to transportation in Senegal, especially in relation to its geographic location. This had a direct impact on the upkeep and return of the Le Joola to open waters. When the ferry capsized, only one of its two engines was functioning and 1,863 passengers were killed. Most crucially, the authors of this study demonstrated why scholars need to examine the criminogenic effects of policies and practices of international financial institutions in developing countries such as Senegal. These policies and practices privilege capitalistic profit over human lives and a better quality of life for people in developing countries.

An article by Rothe, Mullins, and Sandstrom (2009) took a parallel approach, exploring the role of international financial institution policies in the conditions leading to the Rwandan genocide in 1994. While the World Bank and the IMF did not seek to instigate economic collapse or to promote genocide, their policies and their systematic inattention in Rwanda set the stage for a political and economic disaster, as well as the genocide itself. The authors suggested that these international financial institutions knowingly violated their own standards, as well as international human rights principles. Through the imposition of harsh conditions tied to their financial aid, they facilitated criminal activities on a massive scale.

Ezeonu and Koku (2008) also adopted the crimes of globalisation concept. They demonstrated the key contributing role played by the neo-liberal policies of international financial institutions in sub-Saharan Africa, in expanding the vulnerability of people in this region to HIV infection. They called for more systematic criminological attention to the victimisation of people in developing countries as a consequence of the promotion of neo-liberal policies and practices in an increasingly globalised world (see also Ezeonu 2008).

In a similar vein, Rothe (2010a, 2010b) provided an analysis of the complicity of international financial institutions in heightened levels of corruption and the suppression or violation of human rights in developing countries. Analysing such complicity seems especially important given that these institutions claim to be engaged in combating corruption in developing countries, including those linked to transnational and multinational corporations. The anti-corruption initiatives include threatening to withhold much needed economic aid and loans in the absence of action taken against corrupt activities in these countries. Rothe illustrated the specific role of the international financial institutions in the illegal expropriation of the rich natural resources of the Democratic Republic of Congo by the neighbouring countries of Uganda and Rwanda. Beyond theft on a grand scale, Rwandan and Ugandan state forces and militias also engaged in especially atrocious human rights violations conducted against civilian populations, including forced labour, systematic rape, and widespread killing. Through their funding of African states engaged in crimes against both their own citizens and those of neighbouring countries, the international financial institutions bear some responsibility for these crimes.

Parallel circumstances have arisen in other parts of the world. Stanley (2009) analysed the role of the international financial institutions in Indonesia. They directed some $30 billion to the Suharto regime, despite its known record of massive corruption, false accounting, and a militaristic appropriation of aid funds. As the World Bank’s focus was on supporting Indonesia, the state was able to use funds supposedly intended to reduce poverty in its brutal campaign against civilians in the state of Timor-Leste. This campaign’s purpose was to terrorise people to deter them from voting for independence from Indonesia. One could identify many other cases in Asia and other parts of the world where the international financial institutions have been complicit in supporting corrupt, authoritarian regimes and facilitating their massive violations of human rights.

The concept of crimes of globalisation has also been adopted in relation to forms of crime that occur in the context of globalisation but do not specifically involve the international financial institutions. Wright and Muzzatti (2007) have addressed the global restructuring of agriculture and food systems—“agri-food globalisation”—with some specific attention to the victimisation of huge numbers of animals (e.g., 58,000 sheep stranded at sea for almost three months in 2003, in violation of animal welfare law). Altogether, policies and practices relating to the global restructuring of agriculture and food systems were driving up food prices, pushing tens of millions of people towards hunger and starvation, and developed country farm subsidies were driving large numbers of farmers in developing countries into desperate circumstances—to the advantage of corporate and high finance interests in the wealthy countries of the world. Giant American agribusiness corporations, such as Cargill and Archer Daniels Midland (ADM), and outside investors, through their exploitative activities in developing countries, were contributing to the on-going suffering on many levels in those countries (Kugelman 2013; North 2011). This is a phenomenon under-studied by criminologists.

While the research on crimes of globalisation to date has contributed to increased attention to these specific types of crimes, what remains glaringly absent is increased attention to theory generation to explain crimes of globalisation. Consequentially, the following section presents an exploratory integrated theoretical framework for analysing crimes of globalisation.

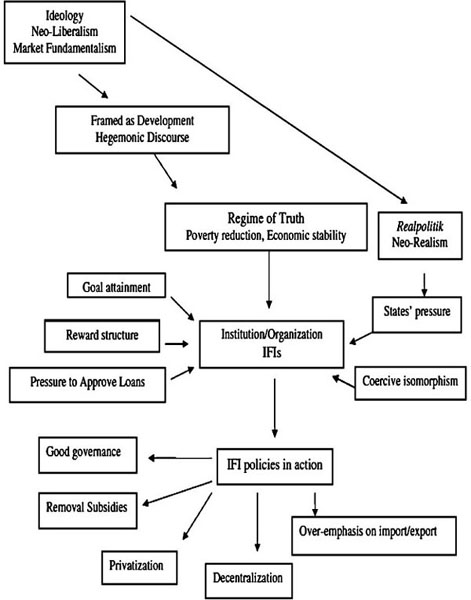

Explaining Crimes of Globalisation: Towards an Integrated Theory

Criminological inquiry has, for the most part, produced theories addressing one specific level of analysis (e.g., interactional, meso or community, and/or structural level). However, due to the complexities of “crimes of globalisation,” and in particular crimes of international financial institutions (complicit and implicit), utilising theories that explain only the individual level processes or even that of organisations is bound to overlook the complexities of such cases. At the global level, any initiatives at explanation should begin with a sense of humility: in other words, the globalised world we live in is so endlessly complex, with countless different variables interacting on multiple different levels, that full-fledged explanation (and prediction) is tremendously difficult. Nonetheless, the simplistic and one-dimensional explanations of crime advanced by some criminologists—e.g., “the general theory of crime”—are quite useless in relation to crimes of globalisation. To the extent that we can hope to understand crimes of globalisation, we suggest that an integrated theoretical approach is necessary.