11 Expense Reimbursement Schemes

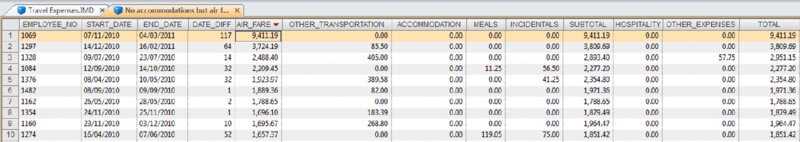

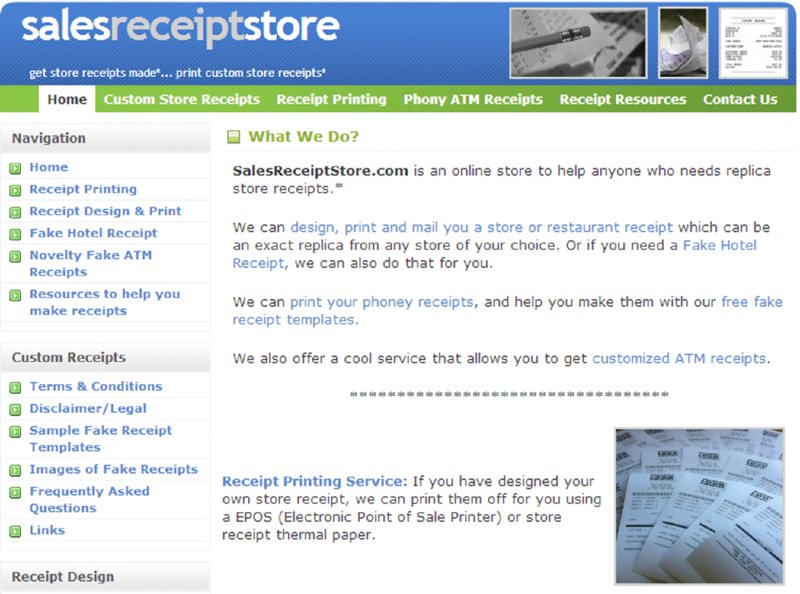

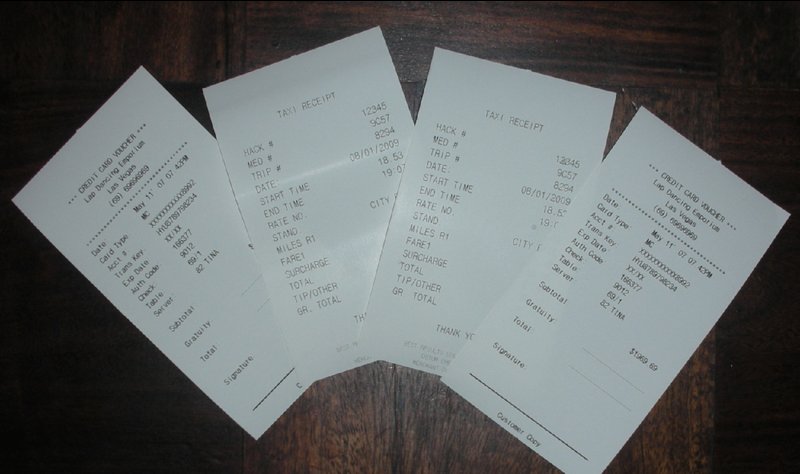

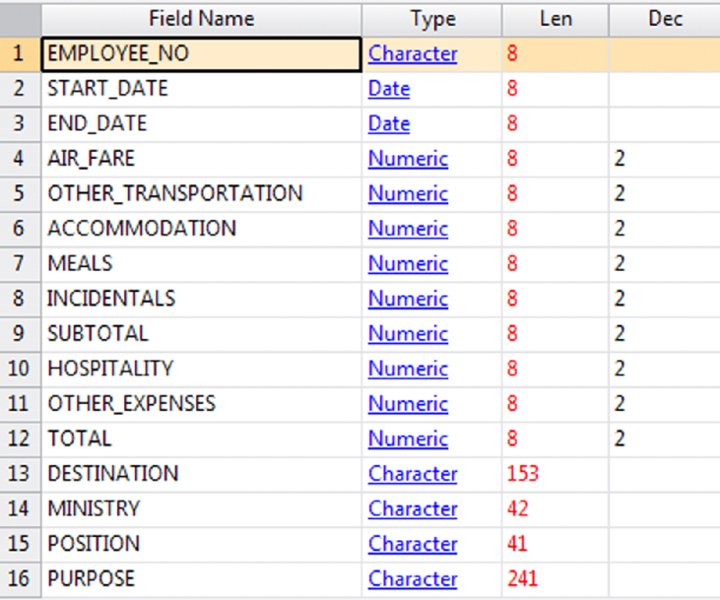

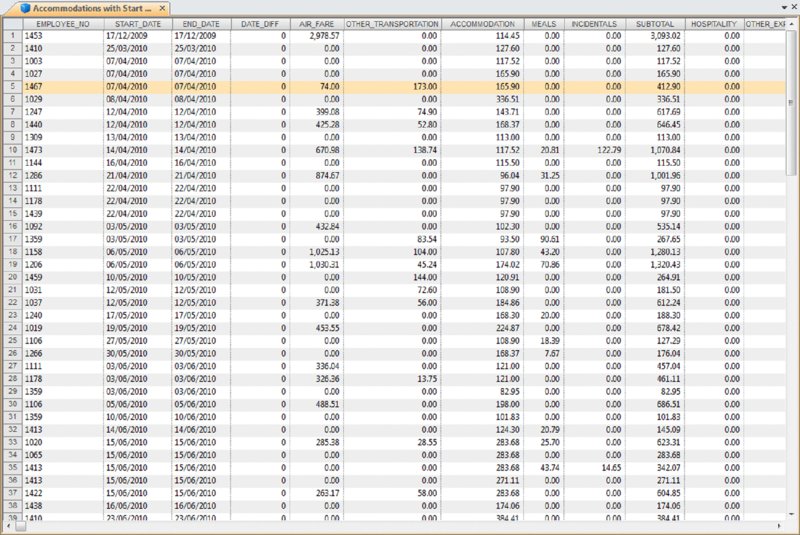

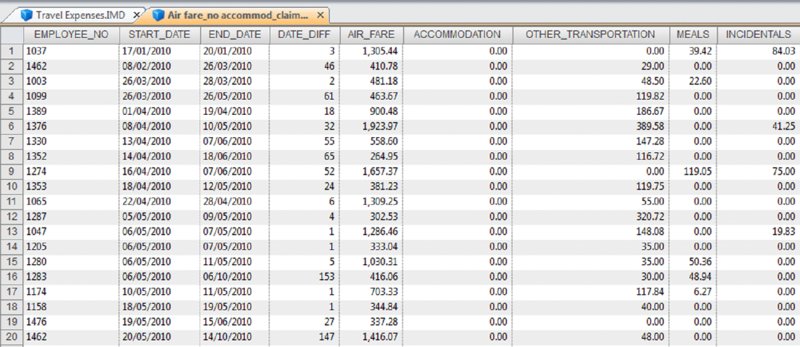

CHAPTER 11 THE MOST COMMON TYPE OF EXPENSE reimbursement paid by organizations to employees is for travel and entertainment expenses. Also popular are purchase cards or procurement cards, a form of company charge cards that are issued to employees. It is often used for, but not restricted to, buying low-value goods and services to avoid the cost of red tape or processing cost associated with the normal procurement procedures. The company normally pays purchase-card bills, so it is not specifically expense reimbursement to an employee’s out-of-pocket costs. However, discussions of purchase cards traditionally fall under the expense reimbursement scheme category. Travel and entertainment expenses are incurred at every level of employment, whether they are for sales, training, meetings, or attending conferences. Typically, those that incur the highest travel and entertainment expenses would be those in sales-related functions and executives of the company. Detection relies on review and analysis of the expenses, followed by a detailed audit of the expense reports and supporting documents. Analysis can only point out anomalies that must be followed up by a thorough review of source documents. Similarly, sampling techniques can only select transactions which need to be audited in detail. Fraud would unlikely be uncovered unless the sample happened to pull out a transaction to audit by chance. The smaller the sample, the lower the opportunity there is to detect travel and entertainment fraud. Analysis can initially be done on historical, budget, or other employee comparisons for an overview. These analyses may display unusual items or patterns. One must be familiar with the company’s travel policy and procedures in order to distinguish between acceptable or improper expense claims. Improper expense claims include: How fraudulent expense reimbursements are perpetrated is typically broken down into four categories: In an audit report released by the Parliament of Canada, titled “Review of Senator Wallin’s Travel Expense and Living Allowance Claims,” Senator Wallin was found to have claimed $90,323 in travel for non-Senate business, citing 79 examples.1 While the report lists a number of audit findings, only the expense mischaracterization categories from the audit report are highlighted here: The amount related to non-Senate business from these claims totaled $90,323, as they fell into one or more of the following: Figure 11.1 Novelty Receipts Website Home Page Source: Sales Receipt Store, www.salesreceiptstore.com. Sample receipts from the novelty website are displayed in Figure 11.2. Figure 11.2 Sample Receipts from the Novelty Website Source: Sales Receipt Store, www.salesreceiptstore.com. To obtain false receipts, sometimes it is a simple matter of just asking the server at a restaurant or the taxi driver for blank receipts. Many are happy to accommodate. There are even restaurants that have a glass jar out for customers to leave unwanted receipts that other customers may take from. False receipts are a worldwide problem. A New York Times article dated August 3, 2013, describes the openness and prevalence of the trade in false receipts in China. “Signs posted throughout this city advertise all kinds of fake receipts: travel receipts, lease receipts, waste material receipts and value-added tax receipts.”3 It is not just restricted to employees defrauding the company of a few hundred dollars. The stakes are much, much higher. The New York Times article also notes that, “GlaxoSmithKline is still trying to figure out how four senior executives at its China operation were able to submit fake receipts to embezzle millions of dollars.” Detecting false or altered receipts is a significant challenge. Unless the quality of the fake receipts is so poor it can be spotted upon visual inspection, there is no way to really know whether the receipts are valid, short of confirming it with the issuing third parties. Even then, the receipts may be legitimate but were issued to someone else who had no need of them. Data analytics can help isolate unusual patterns or outliers of expense reimbursement and P-Card transactions. Resources can then be applied to the suspicious transactions for additional investigation. We will use real-life data obtained on the Internet in order to demonstrate some of the steps used to analyze data for outliers and anomalies. The analysis results provide the auditor with a good starting point to narrow down transactions to a manageable level for further review. While we only have access to the data set and not any backup or source documents, it is not possible to confirm any speculation or hypothesis resulting from the anomalies obtained from the analysis. The data is accessible to anyone with Internet access; the Ontario Government maintains it in an archived expense claim area.4 With much government oversight open to public scrutiny, it is unlikely that there are any fraudulent transactions contained in the data set. Nevertheless, the data highlights the fact that all data contains some sort of anomalies and the auditor must be very aware of false positives. The auditor should reserve any conclusion until source documents are examined and possibly confirmed by issuing parties. The data was downloaded in the CSV-delimited format and unmodified in any way with the exception of the name field being replaced with an employee number field. The fields in the data set are shown Figure 11.3. Figure 11.3 Fields of the Travel Expenses Database The first step is to browse the data to become familiar with the contents of contained in each field. We then review the field statistics (not shown) for both the date and numeric fields. For the date-field statistics, we see that there are 2,800 records in the entire database, with the earliest date being October 30, 2009, and the latest date being March 31, 2011. For the numeric-field statistics, the critical information is that there are no negative values in any of the amount fields. The total field sums to $1,995,498.35 and there are a number of records that contain zero in other numeric fields. Since we have the fields START_DATE and END_DATE available to us, we can calculate the difference between the two dates and call the field DATE_DIFF. This will provide us with the time span of the travel claim. We must be familiar with the procedures regarding the date entry of these dates. Is it mandatory that the employee enter these dates and that the receipts must fall within the dates in order for the claim to be processed? What if the END_DATE is blank? Does the computer system apply the START_DATE there, as it appears to be a mandatory field? It is expected that there will be some keypunch errors, too. We do not know how the system works so we must maintain an open mind if we come across any anomalies when using the DATE_DIFF field in our analysis. Create a field called DATE_DIFF using the equation of @Age(END_DATE, START_DATE) There are 78 records with DATE_DIFF. The ones with differences of more than 60 suggest that those records contain claims where the employee traveled over 60 days. These may have errors in either the START_DATE or END_DATE, or have errors in both. It may be possible that several claims over a spread of time were combined into one claim. A review of the source documents and receipts can easily clear this up. Various analyses can be done using the DATE_DIFF field. Using the criteria of DATE_DIFF = = 0, 972 records were obtained, which means that 972 of the 2,800 claims/records were for travel that started and ended on the same day. Conversely, 1,828 of the records showed travels of 1 day or more. To obtain transactions where there are accommodation costs and both the start and end of the travel claim are on the same date, we extract the records using this formula: DATE_DIFF = = 0 .AND. ACCOMMODATION > 0 There were 124 records obtained as shown in Figure 11.4. Figure 11.4 Results of Accommodations with No Overnight Travel To obtain transactions where there are airfare costs and both the start and end of the travel claim are on the same date, we extract the records using this formula: DATE_DIFF = = 0 .AND. AIR_FARE > 0 There were 311 records obtained. Where the start and end dates are on the same day that contains airfare amounts and accommodation costs, we extract the matching records with this formula: DATE_DIFF = 0 .AND. AIR_FARE > 0 .AND. ACCOMMODATION > 0 There are 273 records outputted. Where the start and end dates are not on the same day that contains airfare amounts and accommodation costs, we extract the matching records with this formula: DATE_DIFF > 0 .AND. AIR_FARE > 0 .AND. ACCOMMODATION > 0 There are 116 records outputted. From the travel expense data set, we can look for travel claims that were for more than the same day with an airfare expense but not accommodations. Using this formula, 116 records matched, as displayed in Figure 11.5. DATE_DIFF > 0 .AND. AIR_FARE > 0 .AND. ACCOMMODATION = 0 Figure 11.5 Overnight Travel with Flight without Accommodations Here are examples of the top-10 highest airfare claims where there are no accommodations and the employees did not return home on the same day. From the “Travel Expenses” database, we extract to a new file using the equation of DATE_DIFF > 0 .AND. AIR_FARE > 0 .AND. ACCOMMODATION=0. We then index on the AIR_FARE field by descending order for us to be able to review the top-10 or any of the 116 resulting records, as shown in Figure 11.6. Figure 11.6 Top-10 Airfare Amounts Another method to arrive at the top-10 flight costs that match our criteria is to use the results from Figure 11.5

Expense Reimbursement Schemes

DATA AND DATA ANALYSIS

DATA AND DATA ANALYSIS

Days Traveled

Same Day Traveled with Accommodation Charges

Same Day Traveled with Flight Charges

Same Day Traveled with Both Flight and Accommodation Charges

Traveled Overnight with Both Flight and Accommodation Charges

Traveled Overnight with Flight but No Accommodation Charges

Top-10 Flight Charges with No Accommodation Charge and Traveled Overnight