Use of the Twenty-Five Percent Rule in Valuing Intellectual Property

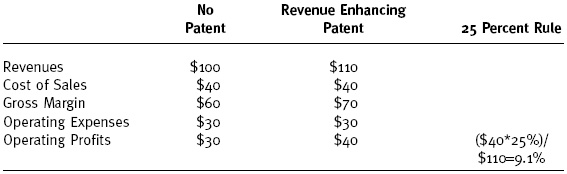

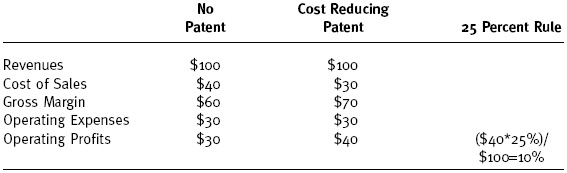

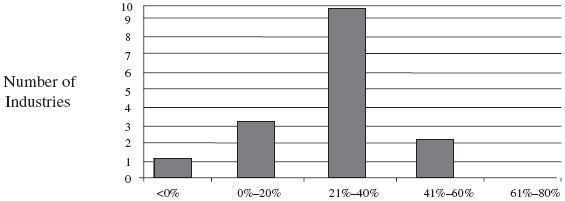

Chapter 3 This chapter is a study by Robert Goldscheider, John Jarosz, and Carla Mulhern. They present the definitive discussion, explaining and proving the broad validity of the famous Twenty-Five Percent Rule for deriving royalty rates. As the importance of intellectual property (IP) protection has grown, so has the sophistication of tools used to value it. Discounted cash flow,1 capitalization of earnings,2 return on investment,3 Monte Carlo simulation,4 and modified Black-Scholes option valuation methods5 have been of great value. Nonetheless, the fairly simple “Twenty-Five Percent Rule” (“Rule”) is over forty years old, and its use continues. Richard Razgaitis has called it the “most famous heuristic, or rule of thumb, for licensing valuation.”6 The Rule suggests that the licensee pay a royalty rate equivalent to twenty-five percent of expected profits for the product that incorporates the IP at issue. The Rule has been primarily used in valuing patents, but has been useful (and applied) in copyright, trademark, trade secret, and know-how contexts as well. Since the Rule came into fairly common usage decades ago, times, of course, have changed. Questions have been raised as to whether the factual underpinnings for the Rule still exist (i.e., whether the Rule has much positive strength) such that it can, and should, continue to be used as a valid pricing tool (i.e., whether the Rule has much normative strength). In this chapter, we describe the Rule, address some of the misconceptions about it, and test its factual underpinnings. To undertake the latter, we have examined the relationship between real-world royalty rates, real-world industry, and company profit data. In general, we have found that the Rule is a valuable tool, rough as it is, particularly when more complete data on incremental IP benefits are unavailable. The Rule continues to have a fair degree of both positive and normative strength. According to some sources, the Rule was formally developed decades ago by one of the authors, Robert Goldscheider.7 Mr. Goldscheider did, in fact, undertake an empirical study of a series of commercial licenses in the late 1950s.8 This involved one of his clients, the Swiss subsidiary of a large American company, with eighteen licensees around the world, each having an exclusive territory. The term of each of these licenses was for three years, with the expectation of renewals if things continued to go well. Thus, if any licensee turned sour, it could promptly be replaced. Even though all of them faced strong competition, they were, in fact, either first or second in sales volume, and probably profitability, in their respective markets. Those licenses, therefore, constituted the proverbial win-win situation. In them, the IP rights transferred included a portfolio of valuable patents, a continual flow of know-how, trademarks developed by the licensor, and copyrighted marketing and product description materials. For those licenses, the licensees tended to generate profits of approximately twenty percent of sales, on which they paid royalties of five percent of sales. Thus, the royalty rates were found to be twenty-five percent of the licensees’ profits, on products embodying the patented technology.9 Mr. Goldscheider first wrote about the Rule in 1971.10 He noted, however, that in some form it had been utilized by valuation experts prior to that.11 For example, in 1958, Albert S. Davis, general counsel of Research Corporation, the pioneer company in licensing university-generated technology, wrote: If the patents protect the licensee from competition, and appear to be valid, the royalty should represent about twenty-five percent of the anticipated profit for the use of the patents.12 A form of the Rule, however, existed even decades before that. In 1938, the Sixth Circuit Court of Appeals, in struggling with the problem of determining a reasonable royalty, heard expert testimony to the affect that . . . ordinarily, royalty rights to the inventor should bear a certain proportion to the profits made by the manufacturer, and that the inventor was entitled to a ‘proportion ranging from probably ten percent of the net profits to as high as 30 percent,’ which should be graduated by the competitive situation.13 Regardless of its origins or authorship, the concept has aided IP valuators for many years. In its pure form, the Rule starts with an estimate of the licensee’s expected profits, for the product that embodies the IP at issue. Those profits are divided by the expected net sales, over that same period, to arrive at a profit rate. That resulting profit rate, say sixteen percent, is then multiplied by twenty-five percent, to arrive at a running royalty rate. In this example, the resulting rate would be four percent. Going forward—or calculating backwards, in the case of litigation—the four percent royalty rate is applied to net sales, to arrive at royalty payments due to the IP owner. The licensee/user receives access to the IP, yet the price it pays (i.e., the royalty) will still allow it to generate positive product returns. The theory underlying this rule of thumb is that the licensor and licensee should share in the profitability of products embodying the patented technology. The a priori assumption is that the licensee should retain a majority (i.e., seventy-five percent) of the profits because it has undertaken substantial development, operational, and commercialization risks, contributed other technology/IP, and/or brought to bear its own development, operational, and commercialization contributions. Focus of the Rule is placed on the licensee’s profits, because it is the licensee who will be using the IP.14 The value of IP is, for the most part, dependent upon factors specific to the user (e.g., organizational infrastructure).15 IP, like any other asset, derives its value from the use to which it will be put.16 Focus also is placed on expected profits, because the license negotiation is meant to cover forthcoming, and ongoing, use of the IP.17 It is the expected benefit from use of the IP that will form the basis for the licensee’s payment of an access fee. Past, or “sunk,” costs typically should be ignored because a decision is being made about the future.18 That is, what future price results in the product being a sound investment? Any product, in which the projected marginal benefits exceed the projected marginal costs, should be undertaken. Focus is placed on long-run profits, because access to IP often will afford the user more than just immediate benefits.19 Focusing on a single month, or single year, typically will not properly represent the forthcoming, and ongoing, benefits of the IP. In many instances, it takes some period of time for a new company, or new product, to obtain its operational efficiencies and a steady state. Furthermore, up front investments often need to be amortized over the economic life of a product, not just its starting years, in order to properly evaluate the economic returns for the product. Finally, the Rule places focus on “fully-loaded” profits, because they measure the accounting returns on a product. Gross profits represent the difference between revenue and manufacturing costs. Gross profits, however, do not account for all of the operating expenses associated with product activity. Those costs include marketing and selling, general and administrative, and research and development expenses. Some of those costs are directly associated with product activity, others are common across product lines. Fully-loaded profits account for the fact that a variety of non-manufacturing overhead expenses are undertaken to support the product activity, even though they may not be directly linked to certain volume or activity levels. Such costs are often driven by product activity. Failure to take into account these operating expenses may lead to an overstatement of the returns associated with the sales of a product. According to Smith and Parr: Omission of any of these [overhead] expenses overstates the amount of economic benefit that can be allocated to the IP. In a comparison of two items of IP, the property that generates sales, captures market share, and grows, while using less selling and/or support efforts, is more valuable than the one that requires extensive advertising, sales personnel, and administrative support. The economic benefit generated by the property are most accurately measured after considering these expenses.20 According to Parr: The operating profit level, after consideration of the non-manufacturing operating expenses, is a far more accurate determinant of the contribution of the IP. The royalty for specific IP must reflect the industry and economic environment in which the property is used. Some environments are competitive and require a lot of support costs, which reduce net profits. IP that is used in this type of environment is not as valuable as IP in a high-profit environment where fewer support costs are required. A proper royalty must reflect this aspect of the economic environment in which it is to be used. A royalty based on gross profits alone cannot reflect this reality.21 Fully loaded profits may refer to either pretax profits or operating profits. Pretax profits are calculated as revenue minus 1) cost of goods, 2) non-manufacturing overhead expenses, and 3) other income and expenses. The historical relationships underlying the Rule, however, have in fact been between royalty rates and operating profits.22 The latter is revenue minus 1) cost of goods sold, and 2) non-manufacturing overhead. Not subtracted out are other income and expenses. In many cases, these two measures of profit are quite similar; in other cases, they are not. Given that the value of IP is independent of the way in which a firm or project is financed,23 from a theoretical point of view, the operating profit margin is the correct measure to use. Suppose that firm A and firm B each have one piece of identical IP, and each manufactures and sells one product which embodies that IP. The only difference between the firms is that firm A is heavily financed by debt and firm B is not. Firm A would then have significant interest expenses to deduct from its operating profits, resulting in pretax profit levels below operating profit levels. Firm B does not have any interest expense to deduct. Thus, on an operating profits basis, firm A and firm B would have equivalent profit margins; but, on a pretax basis, firm B would be considerably more profitable. Application of the Rule to operating profits would result in the same royalty rate in the case of firm A and firm B, whereas application of the Rule to pretax profits would result in a lower royalty rate for firm A. Since the underlying IP, and the products embodying it, are identical for both firms, one would expect to obtain the same resulting royalty rate. Thus, application of the Rule to operating profits would yield the appropriate results. IP, like any asset, can be—valued using three sets of tools. They are often referred to as the income approach, the market approach, and the cost approach.24 The income approach focuses on the returns generated by the user, owing to the asset at issue. The market approach focuses on the terms of technology transfers covering comparable assets. The cost approach focuses on the ability, and cost, to develop an alternative asset that generates the same benefits. The Rule is a form of the income approach. It is particularly useful when the IP at issue comprises a significant portion of product value, and/or the incremental benefits of the IP are otherwise difficult to measure. IP is often priced based on the enhanced revenue, and/or reduced costs, that it generates versus the next best alternative.25 Holding all else constant, the extent of that excess or incremental value may form the upper bound for the appropriate price.26 The Rule can be—applied when the licensee reports product line revenue, and operating profit data, for the product encompassing the IP. It need not be the case that the IP at issue is the only feature driving product value. In fact, underlying the Rule is the understanding that a variety of factors drive such value. That is why only a portion of the profits—twenty-five percent—is paid in a license fee, which is why the appropriate profit split may be much less than twenty-five percent of product profit. The Rule also can be—applied when the licensee does not report profits at the operating profit level. (In fact, there are very few instances in which firms report product profits at such a level.) As long as product revenue, and costs of goods sold, are reported (i.e., gross margins are available), the accountant or economist can—allocate common (or non-manufacturing overhead) costs to the product line in order to derive operating profits. The illustration in Exhibit 3.1 shows how the Rule is applied. A patent may enhance or improve product revenue through increased prices—though that may occur with a reduction in volume27—or through increased volume. The second column in Exhibit 3.1 illustrates the impact of a revenue-enhancing patent. Applying the Rule to the expected operating profits results in a royalty rate of 9.1 percent. A patent may also reduce product costs. Exhibit 3.2 illustrates that applying the Rule to such expected operating profits results in a royalty rate of ten percent. Valuators and courts who use the Rule occasionally split the expected or actual cost (i.e., incremental) savings associated with the IP at issue.28 According to Degnan and Horton’s survey of licensing organizations, that base a royalty payment on projected cost savings, almost all of them provide for the licensee paying 50 percent or less of the projected savings.29 The apparent reasoning is that such incremental benefits should be shared. Splitting the cost savings seventy-five/twenty-five, however, may not be consistent with the Rule. In Exhibit 3.2, the incremental, or additional, cost savings are $10. Multiplying that amount by 25 percent results in a running royalty rate of 2.5 percent ($10 × 25%/$100), which is one-sixteenth of the new “product” profits, rather than one-quarter. Applying the Rule to incremental savings, or benefits, results in a running royalty that is lower than the rate dictated by the Rule. It may undercompensate the IP owner. The Rule, in its pure sense, should be applied to fully-loaded operating profits, not to already computed incremental benefits. Several courts have implicitly recognized the problem of splitting incremental benefits. In Ajinomoto, the district court wrote: Although the ‘licensing rule of thumb’ dictates that only one-quarter to one-third of the benefit should go to the owner of the technology . . . given [defendant’s] relatively low production costs, and its belief that the sale of [the product] would increase [convoyed sales], the court concludes that [defendant] would have been willing to share all of the benefit with [plaintiff] and that [plaintiff] would have settled for nothing less.30 Furthermore, in Odetics, the federal circuit court noted that “one expects [an infringer] would pay as much as it would cost to shift to a non-infringing product.”31 And in Grain Processing, the federal circuit court adopted the lower court’s reasoning, that an infringer “would not have paid more than a three percent royalty rate.” The court reasoned that this rate would reflect the cost difference between infringement and non-infringement.32 To the extent that incremental benefits (i.e., cost savings) have already been calculated, any profit split applied to those may not be consistent with the Rule. In theory, the licensee should be willing to accept a royalty that is close to one hundred percent, rather than twenty-five percent, of the cost savings. The Rule is used in actual licensing and litigation settings. Over the past three decades, a variety of commentators have noted its widespread use.33 In their survey of licensing executives, published in 1997, Degnan and Horton found that roughly twenty-five percent (a sheer coincidence) of licensing organizations used the Rule as a starting point in negotiations.34 They also found that roughly fifty percent of the organizations used a profit sharing analysis—of which the Rule is a variant—in determining royalties.35 A dramatic employment of the Rule occurred in the early 1990’s, in the course of negotiations between two major petrochemical companies, respectively referred to as “A” and “B”. A was a leading manufacturer of a basic polymer product (“X”), with annual sales of over $1 billion. Its process (“P-1”) required the purchase from B of an intermediate compound (“Y”) in annual volumes of over $400 million. A owned a patent, which would expire in seven years, on its P-1 process to manufacture X. A developed a new process (“P-2”) to make X, and decided to switch all its production of X to the new process, essentially for cost reasons, but also because P-2 was more flexible in producing different grades of X. P-2 did not involve the need to purchase Y from B. Rather than simply abandon P-1, however, A decided to offer B the opportunity to become the exclusive worldwide licensee of P-1. The argument was that such a license could be profitable to B because it was a basic producer of Y, which A had been purchasing at a price containing a profit to B. Meaning B could thus manufacture X on a cost-effective basis. Another attraction of such a license was that it could compensate B for the loss of its sales of Y to A.

Use of the Twenty-Five Percent Rule in Valuing Intellectual Property

INTRODUCTION

HISTORY OF THE RULE

EXPLANATION OF THE RULE

ILLUSTRATION OF THE RULE

APPLICATION OF THE RULE