The Role of ‘Restitutionary Damages’

6

The Role of ‘Restitutionary Damages’

I Introduction

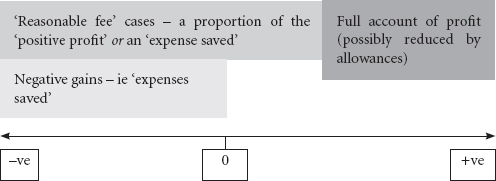

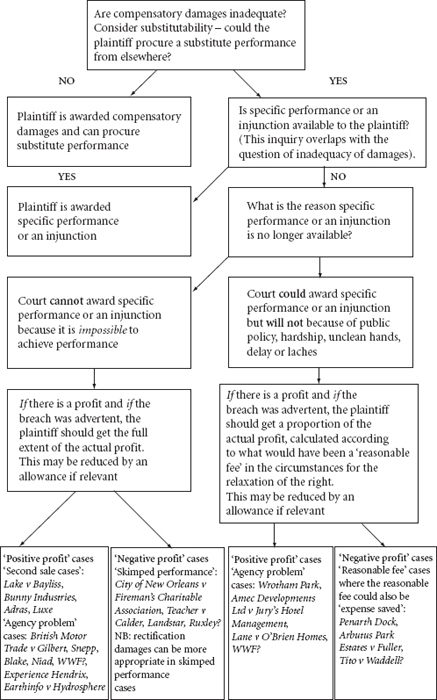

‘Restitutionary damages’ do not have a settled definition. At the least, they are said to encompass instances of subtractive unjust enrichment, and at the highest, they are said to encompass all forms of gain-based award. I suggest that ‘restitutionary damages’ for breach of contract should be subsumed into the category of disgorgement damages, because under my analysis, they are simply a mechanism for achieving partial disgorgement of gain. Rather than distinguishing between restitutionary damages and disgorgement damages for breach of contract, I argue that the scale of disgorgement ranges from a proportion of the profit at the lower end to disgorgement of full profit at the upper end. Typically courts assess the proportion of profit at the lower end of the scale by using the ‘reasonable fee’ measure, representing the amount which the claimant would have accepted for release from the contractual term. This is no more than a convenient fiction by which to assess the appropriate level of partial disgorgement.

The court’s choice between partial disgorgement at the lower end of the scale (ie a ‘reasonable fee’ representing a proportion of the profit) and full disgorgement (ie the entire profit) depends upon the reason why the specific relief was no longer available. There are two possibilities:

1. The court ‘will not’ order specific relief (eg because of delay on the part of the claimant, hardship to the defendant or broader public policy considerations).

2. The court ‘cannot’ order specific relief (eg impossibility or the need for constant supervision).1

In the second circumstance, the defendant has put specific performance out of the claimant’s reach by his conduct. Accordingly, it is appropriate that the defendant disgorge all or most of his profits because of the enhanced need for deterrence in such a situation. By contrast, in the first category specific relief is still available but the court has chosen not to award it for discretionary reasons. Thus, the defendant need only disgorge a ‘reasonable fee’ because the deterrent and punitive considerations are not as strong. And there are also reasons to deter claimants from excessive and inexcusable delays by reducing the award to a reasonable fee.

The position of damages for ‘skimped performance’ must also be considered. ‘Skimped performance’ involves a contract where the defendant saves an expense by not delivering full performance. There is an overlap between some ‘reasonable fee’ cases and skimped performance, in that the defendant could be said to have saved himself the expense of paying a fee to the claimant for release from his obligation, and the award of a ‘reasonable fee’ might reflect this. The Court of Appeal in Blake considered that skimped performance was a situation in which a court should award ‘restitutionary damages’, because such an award would be ‘simpler and more open’.2

Instead I will argue that in most cases of skimped performance, it will not be simpler or indeed necessary to award disgorgement damages, or ‘restitutionary damages’ for that matter.3 In many cases, damages will still be adequate to put the claimant in the position she would have been in if the contract had been performed, and thus this is the ‘next best’ remedy in the circumstances. The primary question in these cases is how the damages should be measured: according to the decrease in value or according to cost of rectification.4 In rare cases, it may be necessary to award disgorgement damages for skimped performance where damages are inadequate and performance is impossible. The main example of this is the case of a contract designed to avoid risk where the defendant skimped on performance and no harm occurred, but the claimant was exposed to risk as a result.

At the outset, however, I will analyse the concept of ‘restitutionary damages’.

II What are ‘Restitutionary Damages’?

‘Restitutionary damages’ do not have a settled definition. It was for this reason that Lord Nicholls preferred not to use the term in his judgment in Blake, calling it an ‘unhappy expression’.5

The confusion stems in part from the two mutually exclusive meanings of the word ‘restitution’. Restitution may mean a ‘giving back’ of a benefit unjustly received, but it may also be a ‘giving up’ of a benefit made at the expense of a claimant, because a wrong has been committed against her.6 Commentators began to suggest that defendants who profited from their breach of contract should disgorge their gains, and called such damages ‘restitutionary damages’ in the second sense of the term above.7 However, restitutionary damages for breach of contract may also encompass other forms of remedy. This has caused difficulties for courts.

Section 344 of the US Restatement (Second) of Contracts provides a prime example of the confusion that is produced by a non-specific use of the word ‘restitution’. It states that contract law remedies have the purpose, among other things, of protecting a claimant’s ‘“restitution interest,” which is his interest in having restored to him any benefit that he has conferred on the other party’. Professor Kull has argued that in the Restatement (First) of Contracts, the restitution interest was intended to restore parties to the status quo because there was no ‘reliance interest’.8 By contrast, in the Second Restatement the comments on the section say that the court may ‘grant relief to prevent unjust enrichment.’ The examples cited in the comments suggest that in the United States, ‘restitutionary damages’ are intended to cover subtractive unjust enrichment or a ‘giving back’ of a benefit which has been conferred on the defendant by the contract and which it would be unjust for the defendant to retain. However, as Kull explains, because of the ambiguity of the word ‘restitution’ the section has also been used to justify a ‘giving up’ of a gain (ie disgorgement damages for wrongs).9

Scholars have also tried to fit the ‘reasonable fee’ cases into a subtractive unjust enrichment analysis. Beatson argues that restitutionary damages are awarded in cases involving unauthorised sale or use of property because there has been a substraction from the claimant’s dominium or his right to exclusive enjoyment of the property.10 The damages in these cases, whether awarded in contract or tort, are said to be restitutionary. Taking Beatson’s analysis a step further, Edelman has distinguished between restitutionary damages (an award based on unjust enrichment) and disgorgement damages (an award based on ‘giving up’ of a gain).11 He argues that restitutionary damages give back to the claimant an illegitimate transfer of value as a result of the defendant’s wrong, as measured by the objective receipt by the defendant. The cases where the claimant is awarded a ‘reasonable fee’ are said to be instances of restitutionary damages under this formulation: the reasonable fee represents the use value of a property or quasi-property right.12 By contrast, disgorgement damages are said to be damages which strip a defendant of a profit made at the claimant’s expense. This is not measured by what has been transferred (indeed, there need be nothing transferred from the claimant at all) but is purely measured by the subjective value of the gain to the defendant.13 Edelman sees awards of restitutionary damages and disgorgement damages as available throughout tort, equity, intellectual property and contract.

Thus far in this book, I have concentrated on disgorgement damages. The premise of disgorgement damages is clear enough. The claimant identifies a subjective actual profit made by the defendant as a result of the breach of contract, and the defendant must disgorge it to the claimant. The essence of disgorgement is deterrence.14

‘Restitutionary damages’ are more difficult. Edelman argues that the defendant has been unjustly enriched when he has appropriated the claimant’s rights, property or money, and that this unjust enrichment must be reversed. He uses the example of a tenant wrongfully remaining on the landlord’s land, committing trespass as a result.15 He explains:

Value, in the form of the use of the landlord’s premises, has been transferred to the trespassing tenant. Restitutionary damages could be sought by the landlord to reverse that wrongful transfer of value, measured in the form of the fair market value for the wrongful use of the land gained by the defendant during the appropriate period.16

According to Edelman, this does not mean that the claimant must have suffered a financial loss to match the ‘transfer of value’. In the landlord case, there is a subtraction from the claimant’s dominium rather than from his financial wealth. He goes on to say:

It might be objected that where the transfer is of the use of money or the use of property there is only a transfer from the claimant in the metaphysical sense that the defendant has utilised the valuable opportunity inherent in the claimant’s asset. But the word ‘transfer’ is still used . . . as it directs attention to the fact that the objective value received by the defendant must come from the claimant.17

By contrast, in this book, I will concentrate on the cases involving breach of contract. It has been noted that Edelman’s thesis is particularly difficult to reconcile with the law on restitution for breach of contract.19

It should also be observed that it is difficult to separate out breach of contract cases definitively from cases involving other private law wrongs. In many of these cases there may also be a tort or an infringement of intellectual property rights concurrent with the breach of contract.20 Further, it is important to consider some of the wayleave cases, mesne profit cases and damages under Lord Cairns’ Act because these cases formed an essential plank of Lord Nicholls’ reasoning in Blake.21 Lord Nicholls drew from a variety of areas in common law and equity to show that gain-based damages (of one sort or another) had long been awarded in many areas of private law, and that there was no reason not to extend this into contract law. Nonetheless, the cases in tort and contract should not be elided: the two forms of action give rise to different considerations.22 Central to contract is the idea that the claimant has an interest in performance as a result of a voluntary obligation entered into by the parties. By contrast, in tort law the courts impose obligations absent a voluntary undertaking. Compensation in contract law is different to compensation in tort. Indeed, some have argued that ‘expectation damages’ for breach of contract are not really compensatory at all because, at least in some circumstances, the focus is on restoring the claimant to the position she would have been in if the contract had been performed, not on recompensing loss.23

In any case, it is suggested in the next section that the distinction between disgorgement damages and restitutionary damages is unsustainable.

III Restitutionary Damages — Still Unhappy

While Edelman’s distinction between disgorgement damages and restitutionary damages is beguiling, it should be rejected. The primary reason is that it is very difficult to identify the transfer of value from claimant to defendant in many cases, and this renders the analysis problematic for litigants, lawyers and judges to apply. One only need witness the confusion of cases following Blake described in the previous chapter to see how problematic the distinction may be. As Edelman has correctly intuited, my criticism is essentially that the notions contained in his analysis are too metaphysical. First, there is often no transfer of value in any concrete sense and, secondly, in many cases the benefit is not really taken from the claimant. It is for these reasons that the analysis has been described as ‘fundamentally misconceived’, as it ‘elides an important analytical distinction between subtractive transfers or “takings” and non-appropriative interferences with rights.’24Secondly, different obligations give rise to rights of different strengths, and the restitutionary damages analysis risks obscuring the difference between them.

There are numerous ‘reasonable fee’ cases which involve no subtraction or transfer from the claimant, including breaches of restrictive covenant, breaches of intellectual property rights and breaches of contract. All these cases concerned intangible rather than tangible property, and in these cases it is particularly difficult to argue that the defendant has appropriated anything from the claimant. Taking Wrotham Park as an example, the servient tenement holder made more extensive use of its own property than was permitted, but it is hard to say that anything is actually transferred from the owner of the dominant tenement. In fact, the defendant obtained a benefit which the claimant could never have had; the covenant merely entitled the claimant to deny the benefit in question to the defendant.25 Rotherham argues:

One problem with the analysis that interferences with rights amount to subtractions from the right holder’s dominium is that it proves too much: it is true whether or not the defendant really obtains a benefit from the wrong in question. . . . Such an analysis would miss the rather obvious point that the mere fact that an owner’s rights are breached does not mean that the defendant has obtained a benefit in the process.26

In those ‘reasonable fee’ cases where the defendant acquires possession of the claimant’s property, it is also difficult to see how value is transferred from the claimant to the defendant. Beatson has argued that the defendant acquires the claimant’s right to exclusive enjoyment of her property.27 However, this cannot be correct because the claimant continues to have a right to exclusive enjoyment, and it is this very right which allows her to sue.

By contrast, Edelman argues that the defendant acquires ‘value’ from the claimant by infringing her proprietary rights, in that the defendant utilises the valuable opportunity inherent in the claimant’s asset. However, this does not stand up on close analysis. First, it is difficult to see where there is a transfer from the claimant to the defendant if the defendant receives something which is apparently different from the thing owned by the claimant in the first place. In the case of a contract, the right to performance has not been ‘gained’ by the defendant, and it remains vested in the plaintiff.28 Secondly, Edelman’s account of restitutionary damages is founded on the idea that the claimant need not suffer any concrete loss, so it is not obvious that something has been transferred from the claimant to the defendant.

In cases where a defendant makes use of the claimant’s property, there may well be a subtraction from the claimant’s proprietary rights. However, the defendant simply obtains possession and use of the claimant’s property, and it is difficult to see how this is a transfer in value from claimant to defendant.29

Rotherham has identified at least three ways in which a defendant could derive value by infringing the claimant’s rights:

1. A defendant may be ‘negatively enriched’ by saving the expense that would be incurred in paying a reasonable fee for the relaxation of the right infringed;

2. A defendant might sell an asset belonging to the claimant without authorisation, thereby realising its exchange value; and

3. A defendant might exploit an asset belonging to the claimant in a way which generates revenue.30

There are difficulties in analysing any of these situations involving an exchange of value from the claimant to the defendant. In the second and third situations, the defendant receives value, but that value is not derived from the claimant; rather it is derived from a third party or parties.31 In any case, the second and third situations are more likely to arise in relation to proprietary torts than in breach of contract cases.

The distinction between ‘restitutionary damages’ and disgorgement damages is ultimately unworkable because it does not distinguish between different types of rights adequately, but assumes all interests are equally important and should be protected in the same way. A particular focus of this book is the way in which the rights arising from contract are different to rights arising from torts or property. There is a danger if scholars lump together all ‘wrongs’ and apply an over-arching analysis. This will unintentionally eliminate important distinctions and ignore differences between juridical rights. The specific aim of contract law is to protect the claimant’s interest in performance, and thus breach of contract should not be elided with breach of tortious obligations: they do not share precisely the same aims, although some of the aims overlap.

A taxonomical criticism of Edelman’s analysis has been made by Professor Burrows who has noted that for every case of restitutionary damages for a wrong there also appears to be a case of subtractive unjust enrichment. This raises the question of the significance of the wrong to the relief. He notes, ‘[i]n contrast, the wrong is normatively crucial if the claimant seeks compensation or a gain-based measure that goes beyond compensation (or beyond reversing a transfer of value).’32 Therefore, it may even render the wrongs analysis otiose.

My fundamental difficulty with Edelman’s account is that it does not provide a set of criteria which indicate when a defendant has appropriated value from the claimant. It is hard to see how a court would apply his analysis in practice. Let us take, for example, the case of Experience Hendrix LLC v PPX Enterprises Inc,33 and apply his analysis to it. Using Edelman’s schema, there are two ways in which it could be analysed: first as a case of disgorgement damages for breach of contract, and secondly as a case where ‘restitutionary damages’ are available because there has been a ‘transfer of value’ from the claimant to the defendant. Analysing the case as one of full disgorgement damages is relatively easy. One looks at the actual profits made by PPX which it made as a result of breaching its agreement with Experience Hendrix not to publish certain songs, and one strips PPX of the profits attributable to the release of those songs.

How then would we analyse the case as one of restitutionary damages? It could perhaps be argued that there was a transfer of value from Experience Hendrix to PPX when PPX sold the rights to the songs to third parties in breach of its contract with Experience Hendrix. Using Edelman’s analysis, we might say that Experience Hendrix had the right to control the use of those songs (much as a landlord has a right to control the use of his property when a tenant wrongfully occupies it) and by letting another use the songs, PPX has transferred value from Experience Hendrix. However, PPX did not really receive value from Experience Hendrix; rather it received value from the third parties to whom it sold the recordings in breach of contract cases. There was never really any transfer. Moreover, Edelman would see that PPX utilised the valuable opportunity inherent in Experience Hendrix’s property; but Experience Hendrix never wanted to exploit that opportunity – its concern was rather to protect the quality of released recordings.34 The analysis looks rather forced and seems to rely on a very diffuse and imprecise notion of ‘transfer’ and ‘value’ which is unworkable in practice. In addition, a reasonable fee award could be regarded as an ‘expense saved’, which looks more like a disgorgement analysis than a restitutionary analysis. There is then a question of whether we choose a ‘restitutionary damages’ analysis or a disgorgement damages analysis. Given that the case can at least notionally be analysed as both, it is not clear which analysis should be preferred in the circumstances. Clearly the courts have had difficulties in establishing which analysis should be preferred.

Many of the problems which beset a restitutionary damages analysis fall away in the context of breach of contract if we see the ‘reasonable fee’ cases as instances of partial disgorgement. I will suggest in the next section that we ought to ‘collapse the categories’ of disgorgement damages and restitutionary damages into a single category of disgorgement damages designed to strip profit, albeit to a lesser or a greater degree.35 I do not seek to resolve the more fiercely debated controversy concerning the award of restitutionary damages for proprietary torts, as that is beyond the scope of this book. Nonetheless, I argue that my analysis is to be preferred in the context of contract law because, by the end of this book, it should be clear to lawyers, academics and litigants when and why a court may choose a ‘full disgorgement’ analysis over a ‘partial disgorgement’ analysis in some circumstances, and there is no need to resort to metaphysical ‘transfers’ or diffuse concepts of ‘loss’ and ‘gain’. Thus my theory is coherent and practical.

IV A Collapsing of Categories

Lord Nicholls himself seems to have envisaged the ‘reasonable fee’ and account of profits cases as being varieties of the same remedy for breach of contract. In Blake he said:

In a suitable case damages for breach of contract may be measured by the benefit gained by the wrongdoer from the breach. The defendant must make a reasonable payment in respect of the benefit he has gained.36

Lord Nicholls has since confirmed in extra-judicial comments37 that he envisaged a continuum of profits being stripped. Other commentators have also analysed the cases in this way.38 Certainly, in the cases under Lord Cairns’ Act upon which Lord Nicholls relied in Blake, the damages represent a form of monetised specific relief, awarded on principles previously discussed in the chapters on disgorgement damages.39

It is simpler and cleaner to reduce the two categories of award to one category of disgorgement damages, encompassing partial to full disgorgement. A sharp-line distinction between restitutionary damages and disgorgement damages is very difficult to make in practice, as Burrows has argued:

While one admires James Edelman’s sophisticated attempt to draw a principled distinction between restitutionary damages on the one hand and disgorgement damages on the other, it seems more accurate to accept that, putting to one side an account of profits, both negative and positive gains can be, and are, removed by an award of restitutionary damages. The measure of restitutionary damages may therefore be the ‘expense saved’ by the wrong or, more commonly, a ‘fair proportion of profits made’ by the wrong, taking into account a number of discretionary factors.40

By contrast, a division between partial and full disgorgement better accommodates the ‘expense saved’ cases.

An account of profits is at the top of the scale (maximum profit), but if the account of profits is reduced by an allowance for skill and effort41 then it will only represent a certain proportion of the profit (albeit probably a higher proportion than a ‘reasonable fee’). The ‘reasonable fee’ cases are generally lower in amount than the full account of profit but, depending upon what kind of a ‘reasonable fee’ the court thinks is appropriate, they may edge up towards the quantum of an account of profits reduced by an allowance. Indeed, the American Restatement of Restitution and Unjust Enrichment sees the market value of a benefit as the lower limit of restitution available, saying at § 51(2):

The value for restitution purposes of benefits obtained by the misconduct of the defendant, culpable or otherwise, is not less than their market value. Market value may be identified, where appropriate, with the reasonable cost of a licence.42

This is contrasted with what is effectively ‘full disgorgement’ in § 51(4).43

To add further complexity, there is an overlap between cases of ‘skimped performance’ (where damages are assessed according to the expense saved) and the ‘reasonable fee’ measure in some cases. The two are often one and the same because the failure to pay a licence fee is a notional expense which the defendant has saved. For example, both Strand Electric44 and Penarth Dock45 can be seen as cases where the ‘reasonable fee’ award also reflects the defendant’s saving in failing to pay a licence fee. Strand Electric was not a contract case, and the reasonable fee in that case was awarded for the tort of detinue, but Penarth Dock concerned concurrent contractual and tortious liability. In Penarth Dock, the defendant bought a pontoon from the claimant dock company. The written contract between the parties provided that ‘[a]lthough it [was] desirous to remove the Pontoon as speedily as possible, no time limit [was] to be imposed.’ However, express oral terms provided that the pontoon was to be removed within three months at the latest. Both parties knew the dock was to be closed and that this was why the claimant wanted the pontoon to be removed as speedily as possible. Notwithstanding this, the defendant did not remove the pontoon, despite requests from the claimant. The claimants alleged that the defendant became a trespasser on the docks once he had failed to remove the pontoon within three months and should pay a ‘reasonable fee’ representing what he would have had to pay to have the pontoon stored.46 Although Penarth Dock has generally been analysed as a case where a reasonable fee was awarded because the defendant had committed the tort of trespass, the court also found a breach of contract (including a breach of the collateral oral term). Thus, it could equally well be analysed as a case where a reasonable fee was awarded because the defendant breached his contract, and the ‘reasonable fee’ represented the amount he would have had to pay to have the pontoon stored at the dock (ie an ‘expense saved’ award).47

The Canadian case of Arbutus Park Estates v Fuller48 is another which could be analysed as either a ‘reasonable fee’ case or an ‘expense saved’ case. The defendant breached a restrictive covenant in favour of the claimant which prohibited the building of a ‘detached garage’ until the plans and specifications were approved by the claimant. The court refused to award an injunction, but the claimant was allowed to recover ‘reasonable fee’ damages, calculated according to the amount which the defendant had saved by failing to hire an architect to prepare the required plans.

It is difficult to fit cases like Penarth Dock or Arbutus Park into the prism of subtractive unjust enrichment, particularly if one chooses to analyse them as a case of an ‘expense saved’ under a contract. Expenses saved do not fit into a subtractive unjust enrichment analysis. Instead, they fit better into a disgorgement analysis because there has been an ‘effective profit’, a saving of costs which would otherwise have been incurred, and these represent the ‘flip side’ or the ‘mirror’ of profits earned by breach.49 Consequently, it has been argued that expenses saved should be treated as a relevant gain for the purpose of the operation of gain-based relief.50

Full disgorgement strips the defendant of the actual gain, whereas partial disgorgement of a reasonable fee or an ‘expense saved’ only strips the defendant of a proportion of his profit, limited to a reasonable fee or market value of relaxation of the right.51 As Rotherham notes:

Much has been made of the distinction between two approaches to determining relief for restitution for wrongs: the award of a reasonable sum for the relaxation of the right in question and the account of profits. The suggestion is sometimes made that two such different remedies must reflect entirely different substantive rights. This is somewhat overstated. Both are measures of relief for enrichment by wrongs. Where the right breached has a market value, a choice has to be made between the remedies. The market value for relaxation of the right in question represents the immediate benefit made from the breach and reflects an objective or abstract measure. In contrast, profits subsequently made from exploiting the claimant’s property are less directly connected to the breach and, as the defendant’s actual gain, represent a more subjective measure.52

Expanding on this point, full disgorgement reflects the actual full gain made, and the ‘reasonable fee cases’ reflect a proportion of the gain (that is to say, the market price of gaining a release from the contract).53 Compelling a defendant to disgorge his actual profit ordinarily has a greater deterrent power than awarding a lesser ‘reasonable fee’.

Cunnington has argued that ‘reasonable fee’ awards cannot be the same as an account of profit because the former deals with anticipated profit whereas the latter deals with actual profit.54 According to Cunnington, the defendant’s actual profit is only used as a yardstick for what the anticipated profit would have been if the parties had entered into a hypothetical negotiation.55 By contrast, I argue that the actual profit is highly relevant to the remedy in these cases.56 In fact, an actual profit must be identified. The courts are imposing a licence fee ex post facto on the parties in light of the actual profits made by the defendant. ‘Reasonable fee’ agreements are frequently made between parties when one party wants to make use of another’s valuable resource or right. This is a more generous measure for defendants, because it is only a proportion of the actual gain, not the full actual gain. There is no special magic in Brightman J’s reference in Wrotham Park to ‘anticipated profit’.57 Brightman J simply causes the defendant to disgorge a proportion of the profit, and in working out the hypothetical licence fee, he presumes the actual profit is reflected in the hypothetical licence agreement the parties would have entered into. However, one must not be too dazzled by the hypothetical licence agreement: it is merely a convenient fiction to enable courts to calculate a lesser proportion of the profit.58

It is said that ‘reasonable fee’ awards may be made even when there is no actual profit made by the defendant. The case often used to illustrate this principle is Inverugie Investments Ltd v Hackett.59 In that case, the defendants owned a large hotel complex. The claimants occupied 30 apartments under a long term lease, but the defendants wrongfully ejected them and proceeded to use the apartments for their own benefit. Because of the low occupancy rates (35-40 per cent), the defendants did not make any profit from the trespass, but the Privy Council still awarded the claimant substantial ‘user damages’ calculated by reference to a reasonable rental value for all the apartments during the period the defendants had wrongfully occupied them.60 Under my scheme it could be said that the defendants still made a profit because they saved an expense by failing to pay fair rent for the hotel.

Mance LJ in Experience Hendrix LLC v PPX Enterprises Inc seemed to accept that ‘reasonable fee’ damages for breach of contract could be awarded regardless of whether any actual profit was made, saying:

In such a context it is natural to pay regard to any profit made by the wrongdoer (although a wrongdoer surely cannot always rely on avoiding having to make reasonable recompense by showing that despite his wrong he failed, perhaps simply due to his own incompetence, to make any profit). The law can in such cases act either by ordering payment over of a percentage of any profit or, in some cases, by taking the cost which the wrongdoer would have had to incur to obtain (if feasible) equivalent benefit from another source.61

Again, this could simply be seen as an award of a reasonable fee to reflect the expense saved by the defendant. However, one must be careful in measuring the reasonable fee, as the court may end up awarding what Friedmann has called ‘attributed gain’.62 That is to say, the court ‘attributes’ a gain to the defendant although this bears very little resemblance to what did occur, or what was likely to occur. This is not the same as partial disgorgement because it does not depend on the specific actual gains made by the defendant, but on certain assumptions the court is willing to make in the claimant’s favour.63

Where torts such as trespass, detinue and the like are concerned, courts are more likely to award ‘attributed gains’ to a claimant. The question is whether we should allow this in breach of contract as well. In Pell Frischmann the court effectively awarded an ‘attributed gain’ for breach of contract.64 The claimant, Pell Frischmann Engineering Limited, entered into a joint venture agreement with the defendants to develop an oilfield in Iran. The Iranian government agency with which the parties were dealing became frustrated with the claimant’s behaviour over the course of negotiations. Eventually, the defendants commenced negotiations with the Iranian government agency to develop the oil field without the claimant’s involvement. This was in breach of the joint venture contract between the claimant and the defendants, which provided that the defendants were to work exclusively with the claimant, and that the defendants were not to approach the Iranian government agency without the consent of the claimant. The Privy Council found that the claimant was entitled to a ‘reasonable fee’ representing the amount it would have accepted to be released from its contract. The ‘reasonable fee’ was calculated according to the anticipated profit rather than actual profit. The proportion of the anticipated profit awarded by the Privy Council (US$2.5 million) was vastly greater than the actual profit made by the defendants (at the greatest estimate, US$1 million to US$1.8 million). The generosity of the Privy Council’s award was particularly surprising because it found that the claimant showed ‘extraordinary and unexplained delay in bringing proceedings’, and the claim would have been statute-barred in most jurisdictions.65 Contrary to Pell Frischmann, I submit that partial disgorgement damages for breach of contract should be based on a proportion of actual gains. Perhaps some would argue that the claimant should not lose out merely because the venture was less profitable than expected.66 But when the court stripped the defendants of more than the actual gain made, it effectively awarded punitive damages. As discussed in chapter two,67 punitive damages for breach of contract are generally unavailable in most common law countries, and when they are available, as in Canada, the behaviour in question tends to involve an abuse of contractual power which is morally repugnant.68 The parties in Pell Frischmann were commercial entities who were evenly matched. While the conduct in question may have been sharp, it appears that the claimant also flirted with other joint venture partners and engaged in hard-nosed commercial conduct. Consequently it is not a case where it was appropriate to punish the defendants.

Thus, although Lord Nicholls said in Blake that there was no reason that contract rights should be treated differently to proprietary rights,69 in this regard, the law should proceed cautiously. A precondition of any relief is that the defendant must have made an actual profit. This profit may be a ‘negative gain’ in the sense that it may be an expense saved. Further, the actual profit should be the yardstick of the award.

In assessing the ‘reasonable fee’, courts should utilise evidence of real bargains wherever possible.70 It has been noted that ‘reasonable fee’ awards tend to be arbitrary, and that in some cases, there is no evidence of whether there was an actual profit, let alone what an appropriate proportion of that profit would be in the circumstances.71 Although it may increase the cost of litigation,72 claimants should produce evidence as to the actual profit, and where appropriate, evidence of similar bargains. This is preferable to arbitrary awards based on unknown profits.

Finally, as with full disgorgement damages, I argue that the breach of contract must be advertent for partial disgorgement damages to be awarded.73 It has been argued that such awards do not possess deterrent characteristics.74 Rather, I would say that the strength of the deterrent and punitive effect of partial disgorgement damages correlates directly to the proportion of the gain disgorged, and thus they certainly tend to be weaker in this regard than full disgorgement damages. Nonetheless, it is appropriate that the advertence requirement be maintained.

V When Should ‘Reasonable Fee’ Awards be Granted?

If one is to distinguish between ‘reasonable fee’ awards and full accounts of profit it is necessary to establish criteria according to which a claimant will be awarded a lesser or a greater measure. The measure which is awarded depends upon why specific relief could not be awarded in a particular case. There are two reasons why specific relief may be declined:

1. The court ‘will not’ order specific relief (eg because of delay on the part of the claimant, hardship to the defendant or broader public policy considerations).

2. The court ‘cannot’ order specific relief (eg impossibility or the need for constant supervision).75

Where a court could order specific relief for breach of contract but ‘will not’, a court will order a ‘reasonable fee’ award. Wrotham Park itself is just such a case. The defendants in that case were aware of a restrictive covenant preventing them from building more than a specified number of houses, but received advice that the covenant would be unenforceable, and so proceeded to build more houses than were allowed in breach of the covenant. The court could have ordered that the terms of the restrictive covenant be obeyed by ordering the houses, which were built in breach of it, to be pulled down, but Brightman J refused to order an injunction, saying:

The erection of the houses, whether one likes it or not, is a fait accompli and the houses are now the homes of people. I accept that this particular fait accompli is reversible and could be undone. But I cannot close my eyes to the fact that the houses now exist. It would, in my opinion, be an unpardonable waste of much needed houses to direct that they now be pulled down and I have never had a moment’s doubt during the hearing of this case that such an order ought to be refused.76

Therefore, his Honour declined to award specific relief for public policy reasons, on the basis that to pull down perfectly good housing would be a waste. Instead, his Honour awarded 5 per cent of the anticipated gain from the development.77

Other recent cases where a ‘reasonable fee’ has been awarded for breach of contract include Amec Developments Ltd v Jury’s Hotel Management (UK) Ltd78 and Lane v O’Brien Homes.79 As with Wrotham Park, each case involved a negative covenant over land.

In Amec, the negative covenant was in favour of land owned by Amec. It provided that any building on Jury’s land would not be nearer than a certain specified distance. Jury breached this covenant by constructing a hotel which was closer to Amec’s land than the specified distance. Amec became aware of the breach once foundations were laid. It initially sought a mandatory injunction to demolish the premises. Both parties seemed to have delayed resolving the issue during which time the hotel was erected. By the time the matter came before Mann QC, the claimant merely sought damages in lieu of an injunction. Mann QC held that a proportion of Jury’s profit from building in breach of the covenant should be paid to Amec. He faced substantial difficulty in calculating the profit Jury had gained by building in breach of the covenant. It was clear that Jury could not have fitted the same number of rooms in a smaller footprint, and that they profited to some extent. Jury argued that the profit was very small (half of £281,000), and Amec argued that the profit was enormous (half of £3 million). In the event, Mann QC applied Wrotham Park and used hypothetical negotiations as a basis for calculation and arrived at a ‘reasonable fee’ of £375,000.80

Lane concerned a contract of sale of certain land in Sussex. The claimant sold the land to the defendant but retained another neighbouring piece of land. The claimant’s house was on the land which she sold to the defendant. The trial judge found that there was no relevant restrictive covenant in the contract for the sale of land, but that a collateral contract was formed whereby the defendant promised not to build more than three new houses on the land.81 The defendant obtained planning permission which allowed it to build four new houses on the land. The claimant obtained an interlocutory injunction restraining the defendant from building any further. The trial judge found that the claimant had lost an opportunity to bargain with the defendant for the building of four houses, and that the claimant would have considered such a bargain. He awarded the claimant over 50 per cent of the profit, which he calculated according to the profit the defendant made by building an extra house (£150,000 damages derived from an expected profit of £280,000). The trial judge’s decision was upheld by David Clarke J. The damages in Lane represented an unprecedentedly large proportion of the profit. This shows that the dividing line between an account of profit and a ‘reasonable fee’ is not clear. Lane looks almost like an account of profit reduced by an allowance for skill and effort rather than a ‘reasonable fee’.

By contrast, where a court cannot order specific relief, because it is impossible to do so or because the performance must be constantly supervised, Cunnington argues that a court will order full disgorgement (subject perhaps to an allowance). Blake was a case where specific relief was impossible: George Blake had breached his contract irredeemably, and it was impossible to rectify. Accordingly, the House of Lords was correct to award full disgorgement for breach of contract. In the circumstances of the case, too, it is not surprising that the House of Lords declined to award an allowance for skill and effort.

This analysis shows further why WWF and Experience Hendrix were both incorrectly decided. In each of these cases, specific relief could not