Standard deduction

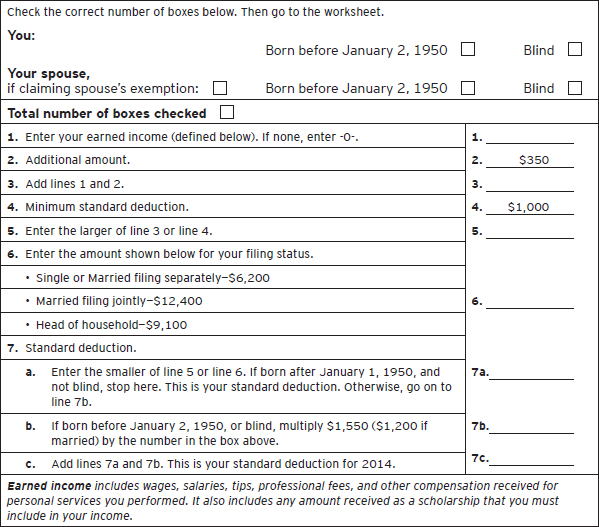

Chapter 21 Standard deduction increased. The standard deduction for some taxpayers who do not itemize their deductions on Schedule A (Form 1040) is higher for 2014 than it was for 2013. The amount depends on your filing status. You can use the 2014 Standard Deduction Tables in this chapter to figure your standard deduction. This chapter discusses the following topics. The standard deduction amount depends on your filing status, whether you are 65 or older or blind, and whether an exemption can be claimed for you by another taxpayer. Generally, the standard deduction amounts are adjusted each year for inflation. The standard deduction amounts for most people are shown in Table 21-1.

Standard deduction

What’s New

Standard Deduction Amount