Chapter 11

Social security and equivalent railroad retirement benefits

ey.com/EYTaxGuide

This chapter explains the federal income tax rules for social security benefits and equivalent tier 1 railroad retirement benefits. It explains the following topics.

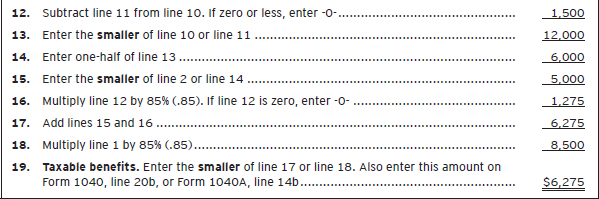

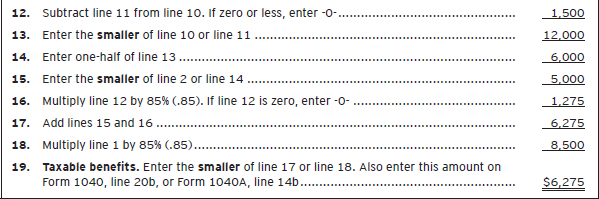

- How to figure whether your benefits are taxable.

- How to use the social security benefits worksheet (with examples).

- How to report your taxable benefits.

- How to treat repayments that are more than the benefits you received during the year.

Social security benefits include monthly retirement, survivor, and disability benefits. They do not include supplemental security income (SSI) payments, which are not taxable.

Equivalent tier 1 railroad retirement benefits are the part of tier 1 benefits that a railroad employee or beneficiary would have been entitled to receive under the social security system. They are commonly called the social security equivalent benefit (SSEB) portion of tier 1 benefits.

If you received these benefits during 2014, you should have received a Form SSA-1099, Social Security Benefit Statement, or Form RRB-1099, Payments by the Railroad Retirement Board. These forms show the amounts received and repaid, and taxes withheld for the year. You may receive more than one of these forms for the same year. You should add the amounts shown on all the Forms SSA-1099 and Forms RRB-1099 you receive for the year to determine the total amounts received and repaid, and taxes withheld for that year. See the Appendix at the end of Publication 915 for more information.

Note. When the term “benefits” is used in this chapter, it applies to both social security benefits and the SSEB portion of tier 1 railroad retirement benefits.

What is not covered in this chapter. This chapter does not cover the tax rules for the following railroad retirement benefits.

- Non-social security equivalent benefit (NSSEB) portion of tier 1 benefits.

- Tier 2 benefits.

- Vested dual benefits.

- Supplemental annuity benefits.

For information on these benefits, see Publication 575, Pension and Annuity Income.

This chapter does not cover the tax rules for social security benefits reported on Form SSA-1042S, Social Security Benefit Statement, or Form RRB-1042S, Statement for Nonresident Alien Recipients of: Payments by the Railroad Retirement Board. For information about these benefits, see Publication 519, U.S. Tax Guide for Aliens, and Publication 915, Social Security and Equivalent Railroad Retirement Benefits.

This chapter also does not cover the tax rules for foreign social security benefits. These benefits are taxable as annuities, unless they are exempt from U.S. tax or treated as a U.S. social security benefit under a tax treaty.

You may want to see:

505 Tax Withholding and Estimated Tax

505 Tax Withholding and Estimated Tax

575 Pension and Annuity Income

575 Pension and Annuity Income

590 Individual Retirement Arrangements (IRAs)

590 Individual Retirement Arrangements (IRAs)

915 Social Security and Equivalent Railroad Retirement Benefits

915 Social Security and Equivalent Railroad Retirement Benefits

1040-ES Estimated Tax for Individuals

1040-ES Estimated Tax for Individuals

SSA-1099 Social Security Benefit Statement

SSA-1099 Social Security Benefit Statement

RRB-1099 Payments by the Railroad Retirement Board

RRB-1099 Payments by the Railroad Retirement Board

W-4V Voluntary Withholding Request

W-4V Voluntary Withholding Request

To find out whether any of your benefits may be taxable, compare the base amount for your filing status with the total of:

- One-half of your benefits, plus

- All your other income, including tax-exempt interest.

When making this comparison, do not reduce your other income by any exclusions for:

- Interest from qualified U.S. savings bonds,

- Employer-provided adoption benefits,

- Foreign earned income or foreign housing, or

- Income earned by bona fide residents of American Samoa or Puerto Rico.

Children’s benefits. The rules in this chapter apply to benefits received by children. See Who is taxed, later.

Figuring total income. To figure the total of one-half of your benefits plus your other income, use Worksheet 11-1 later in this discussion. If the total is more than your base amount, part of your benefits may be taxable.

If you are married and file a joint return for 2014, you and your spouse must combine your incomes and your benefits to figure whether any of your combined benefits are taxable. Even if your spouse did not receive any benefits, you must add your spouse’s income to yours to figure whether any of your benefits are taxable.

Base amount. Your base amount is:

- $25,000 if you are single, head of household, or qualifying widow(er),

- $25,000 if you are married filing separately and lived apart from your spouse for all of 2014,

- $32,000 if you are married filing jointly, or

- $-0- if you are married filing separately and lived with your spouse at any time during 2014.

Social security and railroad retirement benefits are partially taxable if your total income (defined later in this paragraph) is more than $32,000 for married taxpayers filing jointly and $25,000 for single filers. If you are married filing separately and you lived with your spouse at any time during the year, your base amount is $0, which means that your social security retirement benefits are partially taxable regardless of your income level. Your total income is the sum of your adjusted gross income, tax-exempt income, excluded employer-provided adoption benefits, excluded foreign source income, excluded interest from U.S. savings bonds (interest excluded in connection with the payment of qualified education expenses), and one-half of your social security retirement benefits.

Tax-exempt income is not taxable for federal purposes, even if you receive social security benefits. However, it is one of the items taken into consideration in determining whether or not your income exceeds the threshold amount so that your social security benefits are taxable.

Only gold members can continue reading.

Log In or

Register to continue

505 Tax Withholding and Estimated Tax

505 Tax Withholding and Estimated Tax 575 Pension and Annuity Income

575 Pension and Annuity Income 590 Individual Retirement Arrangements (IRAs)

590 Individual Retirement Arrangements (IRAs) 915 Social Security and Equivalent Railroad Retirement Benefits

915 Social Security and Equivalent Railroad Retirement Benefits  1040-ES Estimated Tax for Individuals

1040-ES Estimated Tax for Individuals SSA-1099 Social Security Benefit Statement

SSA-1099 Social Security Benefit Statement RRB-1099 Payments by the Railroad Retirement Board

RRB-1099 Payments by the Railroad Retirement Board W-4V Voluntary Withholding Request

W-4V Voluntary Withholding Request