Clauses Excluding or Limiting Liability

7

Clauses Excluding or Limiting Liability

Contents

7.7 Unfair Contract Terms Act 1977

7.8 Unfair Terms in Consumer Contracts Regulations 1999

This chapter deals with the situations where parties attempt to exclude or limit their liability for breach of contract by including exclusion or exemption clauses in the contract. It is an area governed by both common law and statute. The statutory provisions were developed in the latter half of the twentieth century and tend to have a consumer focus. The common law rules were developed earlier to deal with imbalances in bargaining power between the parties. The common law is looked at first, here, followed by the statutory rules:

Rule of incorporation. Was the clause part of the contract? Was appropriate notice of it given to the other party?

Rule of incorporation. Was the clause part of the contract? Was appropriate notice of it given to the other party?

Rule of construction. Does the wording of the clause make it clear that it covers the breach that has occurred?

Rule of construction. Does the wording of the clause make it clear that it covers the breach that has occurred?

Statute

Statute

Unfair Contract Terms Act (UCTA) 1977. The statute makes some exclusion clauses void (for example, clauses which attempt to exclude liability for death or personal injury caused by negligence). Many other clauses are subject to a test of ‘reasonableness’. Case law on the Act has tended to allow businesses more freedom to exclude liability when contracting with each other than in contracts with consumers.

Unfair Contract Terms Act (UCTA) 1977. The statute makes some exclusion clauses void (for example, clauses which attempt to exclude liability for death or personal injury caused by negligence). Many other clauses are subject to a test of ‘reasonableness’. Case law on the Act has tended to allow businesses more freedom to exclude liability when contracting with each other than in contracts with consumers.

Unfair Terms in Consumer Contracts Regulations (UTCCR) 1999. These regulations derive from a European directive. They impose a requirement of ‘fairness’ on most terms in consumer contracts. ‘Good faith’ is part of the test of fairness.

Unfair Terms in Consumer Contracts Regulations (UTCCR) 1999. These regulations derive from a European directive. They impose a requirement of ‘fairness’ on most terms in consumer contracts. ‘Good faith’ is part of the test of fairness.

There is overlap between UCTA and UTCCR which at times makes it difficult to determine which should apply.

There is overlap between UCTA and UTCCR which at times makes it difficult to determine which should apply.

Proposals for reform. The Law Commission has recommended that the law should be simplified by combining the UCTA and the UTCCR into one statute.

Proposals for reform. The Law Commission has recommended that the law should be simplified by combining the UCTA and the UTCCR into one statute.

It will very often be the case that a contract will include a clause excluding or limiting the liability of one of the parties in the event of certain types of breach. The exclusion may be total, or may limit the party’s liability to a specified sum of money. There is nothing inherently objectionable about a clause of this kind. Provided that it has been included as a result of a clear voluntary agreement between the parties, it may simply indicate their decision as to where certain risks involved in the transaction should fall. If the contract involves the carriage of goods, for example, it may have been agreed that the owner should be responsible for insuring the goods while in transit. In that situation, it may be perfectly reasonable for the carrier to have very restricted liability for damage to the goods while they are being carried. The inclusion of the clause is simply an example of good contractual planning.1

7.2.1 IN FOCUS: EXCLUDING LIABILITY OR DEFINING OBLIGATIONS

It may be difficult at times to distinguish between a clause that limits liability and one that simply determines the obligations under the contract. Suppose, for example, that there is a contract for the regular servicing of a piece of machinery. The owner, O, is anxious that any replacement parts should be those made by the original manufacturer of the machine, M Ltd; the servicer, S, cannot guarantee that such parts will always be available. The situation might be dealt with in two ways. A clause might be inserted to say: ‘S will use parts manufactured by M Ltd when available, but may substitute equivalent parts if necessary to complete a service within a reasonable time.’ This would appear to define S’ obligations under the contract. Alternatively, the clause might say: ‘S will use parts manufactured by M Ltd, but will not be liable for any loss arising from the use of equivalent parts, if this is necessary to complete a service within a reasonable time.’ Here the clause is put in the form of a limitation of S’ liability, but in effect it produces the same result as the previous version of the clause. It is generally possible to rewrite any clause which, on its face, appears to limit liability for a breach of contract into one which defines the contracting parties’ obligations.2 If this is so, is there any need to treat ‘exclusion clauses’ as a special type of clause?3 Could not all clauses simply be subject to the standard rules of incorporation and interpretation which were discussed in Chapter 6? This has not been the traditional approach of the courts, though the distinction between the two types of clause is blurred in relation to the statutory controls which now apply.4 The courts, however, have tended to view clauses which attempt to limit liability as a separate category, and have developed particular rules to deal with them.

7.2.2 UNEQUAL BARGAINING POWER

Part of the reason why the courts have thought it necessary to develop special rules for exclusion clauses is that many such clauses are not simply the product of good contractual planning between parties bargaining on equal terms. They appear in standard form contracts, which the other party has little choice as to whether to accept or not, and may give the party relying on them a very broad exemption from liability, both in tort and in contract.5 When such inequitable clauses began to appear with some frequency in the nineteenth century, the courts devised ways of limiting their effectiveness. While the techniques adopted, as will be seen below, for the most part consisted of ‘heightened’ application of those used more generally for the purposes of constructing and interpreting contracts,6 the courts clearly viewed exclusion clauses as a particular type of clause needing special treatment. This separation of exclusion clauses from the general run of contractual provisions, and in particular the distinction drawn between clauses which exclude liability and those that define obligations, is understandable in the context of a general approach based on ‘freedom of contract’. If the courts were saying on the one hand that parties should be free to determine their own contractual obligations, and that the question of whether the obligations undertaken were ‘fair’ or ‘reasonable’ was generally irrelevant, it would cause problems if, on the other hand, they were seen to be interfering in this contractual freedom. By treating exclusion clauses as distinct from clauses defining obligations, such interference could be seen as limited and designed to tackle a particular type of situation tangential to the central issue of the freedom of the parties to determine their obligations towards each other.

7.2.3 STATUTORY REGULATION

In the twentieth century, the fact that contracts at times needed regulation to achieve ‘fairness’ was acknowledged more directly and, moreover, Parliament intervened to add a statutory layer of controls on top of the common law rules (that is, the Unfair Contract Terms Act (UCTA) 1977 and the Unfair Terms in Consumer Contracts Regulations (UTCCR) 1999).7 These controls are not limited to clauses which are stated as excluding liability, but do extend to some extent to provisions which purport to define obligations. It may be that we are therefore moving towards a situation where the law of contract controls ‘unfair’ terms of whatever type, rather than having special rules for exclusion clauses. At the moment, however, the body of case law directed at exclusion clauses is still of sufficient importance to merit separate treatment. Despite the statutory interventions, the common law remains very important, not least because its rules apply to all contracts, whereas the UCTA 1977 and the UTCCR 1999 apply only in certain situations.

The approach of the courts to exclusion clauses has not traditionally been to assess them on their merits. In other words, they have not said ‘we think this clause is unreasonable in its scope, or unfair in its operation, and therefore we will not give effect to it’. As has been noted above, such an approach would have run too directly counter to the general ideas of ‘freedom of contract’, which were particularly important to the courts of the nineteenth century. So, instead, the courts developed and adapted formal rules relating to the determination of the contents of the contract, and the scope of the clauses contained in it, which were used to limit the scope of exclusion clauses. The main rules used are those of ‘incorporation’ and ‘construction’, though we will also need to note the so-called ‘doctrine of fundamental breach’.

A clause cannot be effective to exclude liability if it is not part of the contract. The ways in which the courts determine the contents of a contract have been considered in the previous chapter. The rules discussed there, including the parol evidence rule and its exceptions, are also relevant to the decision as to whether an exclusion clause is part of the contract. It will almost always be the case that an exclusion clause will be in writing – though there is no principle which prevents a party stating an exclusion orally, as with any other contractual term. The first question will be, therefore, whether that written term can be regarded as part of the contract. The courts have generally been concerned to limit the effect of exclusion clauses (particularly as regards consumers), and they have, therefore, in this context applied fairly strict rules as to the incorporation of terms. The rules are based on the general principle that a party must have had reasonable notice of the exclusion clause at the time of the contract in order for it to be effective. If, however, the contract containing the clause has been signed by the claimant, there will be little that the courts can do. In L’Estrange v Graucob,8 for example, the clause was in small print, and very difficult to read, but because the contract had been signed, the clause was held to have been incorporated. Scrutton LJ made it clear that in such cases questions of ‘notice’ were irrelevant:

In cases in which the contract is contained in a railway ticket or other unsigned document, it is necessary to prove that an alleged party was aware, or ought to have been aware, of its terms and conditions. These cases have no application when the document has been signed. When a document containing contractual terms is signed, then, in the absence of fraud, or, I will add, misrepresentation, the party signing it is bound, and it is wholly immaterial whether he has read the document or not …

This rule has been applied strictly by English courts.9 The main exceptions relate to the situations referred to by Scrutton LJ in the above quotation – that is, where the signature has been induced by fraud or misrepresentation.10 An example of the application of this principle is to be found in Curtis v Chemical Cleaning and Dyeing Co Ltd.11 The plaintiff had taken a dress for cleaning. She was asked to sign a receipt containing a widely worded exemption clause. On querying this, she was told by the assistant that the clause meant that the defendants would not accept liability for damage to the beads and sequins with which the dress was trimmed. When it was returned, the dress had a stain on it. The defendants relied on the exclusion clause, but the Court of Appeal held that the misrepresentation (albeit innocent) by the assistant of the scope of the clause overrode the fact that the plaintiff had signed the document.

A further possibility of challenge to a signature lies in the plea of non est factum, which is an argument that the party signing made a fundamental mistake about the nature of the document. This plea is rarely successful, however.12 In general, when a person has signed the document, it is taken as conclusive evidence that the person has agreed to the contract and all its terms.13

Where the contract has not been signed, the court will be concerned with such matters as the time at which the clause was put forward, the steps which were taken to draw attention to it, the nature of the clause, and the type of document in which it was contained. These matters will now be considered in turn.

7.4.1 RELEVANCE OF TIME

If a contract containing the clause has not been signed, then the time at which it is put forward will be important. If it is not put forward until after the contract has been made, then it clearly cannot be incorporated. All the main terms of the contract must be settled at the time of acceptance. This is, in effect, the same rule as was applied in Roscorla v Thomas,14 preventing a promise made after the agreement from being enforced, because no fresh consideration was given for it. In the same way, the promise by one party to give the other the benefit of an exclusion clause will be unenforceable if made after the formation of the contract. Thus, in Olley v Marlborough Court Hotel,15 the plaintiff made the contract for the use of a hotel room at the reception desk. A clause purporting to exclude liability for lost luggage was displayed in the room itself. It was held that this came too late to be incorporated into the contract.16 The position might have been different if the plaintiff had been a regular user of the hotel, and therefore as a result of a long and consistent ‘course of dealing’ could be said to have had prior notice of the clause.17 The defendant might then be entitled to assume that the plaintiff had previously read the clause even if this was not in fact the case.

Incorporation by a ‘course of dealing’ was considered in Kendall (Henry) & Sons v Lillico (William) & Sons Ltd.18 Here the contract was between buyers and sellers of animal feed. They had regularly contracted with each other on three or four occasions each month over a period of three years. On each occasion, a ‘sold note’ had been issued by the seller, which put responsibility for latent defects in the feed on the buyer. The buyer tried to argue that it did not know of this clause in the sold note. However, the House of Lords held that it was bound. A reasonable seller would assume that the buyer, having received more than 100 of these notes containing the clause, and having raised no objection to it, was agreeing to contract on the basis that it was part of the contract. Regularity is important, however, and Kendall v Lillico was distinguished in Hollier v Rambler Motors,19 where there had only been three or four contracts over a period of five years. It was held that an exclusion clause contained in an invoice given to the plaintiff after the conclusion of an oral contract for car repairs was not incorporated into the contract. Inconsistency of procedure may also prevent incorporation. In McCutcheon v MacBrayne,20 the plaintiff’s agent had regularly shipped goods on the defendant’s ship. On some occasions, he was required to sign a ‘risk note’ containing an exclusion clause, on other occasions the contract was purely oral. The agent arranged for the carriage of the plaintiff’s car that was lost as a result of the negligent navigation of the ship. No risk note had been signed, and the House of Lords refused to accept that the exclusion clause could be incorporated from the agent’s previous dealings. There was no consistent course of conduct sufficient to allow such an argument to succeed.

7.4.2 REQUIREMENT OF ‘REASONABLE NOTICE’

More commonly, the clause will be presented as part of a set of standard terms, which the other party will be given or referred to at the time of making the contract. In that situation, the test is whether ‘reasonable notice’ of the clause has been given.

Key Case Parker v South Eastern Railway (1877)21

Facts: The plaintiff had deposited a bag at a railway cloakroom. He was given a ticket in exchange. The front of the ticket, which contained a number and date, also said ‘See back’. On the other side of the ticket were various clauses, including one excluding liability for goods exceeding the value of £10. The plaintiff’s bag, worth £24.50, was lost. The jury found that the plaintiff had not read the ticket, nor was he under any obligation to do so. On that basis, the judge had directed that judgment should be given for the plaintiff. The defendant appealed.

Held: The Court of Appeal ordered a new trial, on the basis that the proper test was whether the defendants had given reasonable notice of the conditions contained on the ticket. The relevant principle was stated by Mellish LJ in the following terms:22

The test is therefore whether ‘reasonable notice’ of the clause has been given. The question of what constitutes reasonable notice is a question of fact. The standard to be applied is what is reasonable as regards the ordinary adult individual, capable of reading English.23 Thus, in Thompson v London, Midland and Scottish Railway,24 the fact that the plaintiff was illiterate did not help her. The position might be different, however, if the defendant had actual knowledge of the plaintiff’s inability to read the terms and conditions. In such a case, the giving of reasonable notice might require rather more of the party wishing to rely on the clause. In Thompson, the Court of Appeal also held that stating on a ticket ‘Issued subject to the conditions and regulations in the company’s timetables and notices’ was sufficient to draw the other party’s attention to the existence of the terms, and thereby to incorporate them into the contract. This was so even though the timetable containing the relevant clause was not available for free, but had to be purchased from the company. This is perhaps at the limits of what could amount to reasonable notice,25 but the principle remains that the contractual document itself does not need to set out the exclusion clause if it gives reasonable notice of the existence of the clause, and indicates where it can be read. What is reasonable will, of course, depend on all the circumstances. In Thompson, for example, the court placed some stress on the fact that the ticket was for a specially advertised excursion, at a particularly low price, and not for a regular service. There is some suggestion in the judgments, though the point is not made very clearly, that a different standard of notice might be required in relation to full-priced regular services. The point seems to be that special conditions, including the possibility of limited liability, were reasonably to be expected in relation to a cheap excursion, whereas there would not be the same level of expectation in relation to regular services.

For Thought

Do you think the outcome of Thompson would (should) have been the same if the plaintiff had been blind, and carried a white stick?

7.4.3 INCORPORATION AND UNUSUAL EXCLUSIONS

The Thompson decision is clearly helpful to the defendant. More recently, the courts have adopted an approach that requires an assessment of the nature of the clause alongside the amount of notice given. Thus, the more unusual or more onerous the exclusion clause, the greater the notice that will be expected to be given. In Spurling v Bradshaw,26 for example, Lord Denning commented that:27

Some exclusion clauses I have seen would need to be printed in red ink on the face of the document with a red hand pointing to it before the notice could be held to be sufficient.

In Thornton v Shoe Lane Parking Ltd,28 this approach was applied, so that a clause displayed on a notice inside a car park, containing extensive exclusions, was held not to be incorporated into a contract which was made by the purchase of a ticket from a machine. The Court of Appeal did not decide definitively the point at which the contract was made, but it was probably when the customer accepted the car park owner’s offer by driving up to the barrier, thus causing the machine to issue a ticket. If that was the case, then, applying the same principle as in Olley v Marlborough Court Hotel,29 any conditions or reference to conditions contained on the ticket came too late – the contract was already made. It was not feasible, as would (at least theoretically) be possible if dealing with a human ‘ticket issuer’, for the recipient to inquire further about the conditions, or to reject the ticket. Even if the ticket could be a valid means of giving notice, however, or if the customer could be required to be put on inquiry by a notice at the entrance stating ‘All cars parked at owner’s risk’, there was an issue about the degree of notice required. The exclusion clause in this case was very widely drawn, and purported to cover negligently caused personal injuries (which the plaintiff had in fact suffered). As a result, the court felt that the defendant needed to take more specific action to bring it to the attention of customers. In the view of Megaw LJ:30

… before it can be said that a condition of that sort, restrictive of statutory rights [that is, under the Occupiers’ Liability Act 1957], has been fairly excluded there must be some clear indication which would lead an ordinary sensible person to realise, at or before the time of making the contract, that a term of that sort, relating to personal injury, was sought to be included.

In cases such as this, therefore, the nature and scope of the attempted exclusion becomes a relevant factor in relation to incorporation.

7.4.4 IN FOCUS: A COMMON LAW TEST OF ‘REASONABLENESS’?

The approach taken in cases like Thornton v Shoe Lane Parking suggests that the issue is not solely procedural, but is affected by the substance of the clause. We have seen that the same approach may be used in relation to other types of clause. Thus, in Chapter 6, it was noted that the same rule operated in Interfoto Picture Library v Stiletto Visual Programmes31 to prevent the incorporation of a clause which was not an exclusion clause, but which was nevertheless exceptional, and unusually onerous. Bradgate has argued that these cases, together with the Court of Appeal decision in AEG (UK) Ltd v Logic Resource Ltd,32 have, in effect, created a common law test of the ‘reasonableness’ of exclusion clauses.33 It is not clear, however, that they do go that far. If the person relying on the clause in each case had specifically drawn the other party’s attention to it, so that actual notice was given, it seems likely that the courts would have held it to be incorporated and enforceable. The same would be likely to be true if the contract containing the clause had been signed.34 It is only where there is reliance on ‘reasonable notice’, rather than actual knowledge, that the courts feel the need to consider the nature of the clause, and whether it is unusual. It is then still the reasonableness of the notice, rather than the reasonableness of the clause itself, that is the issue. The need for a common law test of substantive reasonableness is also unclear (as Bradgate recognises) given the statutory tests contained in the UCTA 1977, and the UTCCR 1999.35 In the AEG case, for example, the Court of Appeal also held the clause to be unreasonable under the 1977 Act. The existence of these statutory protections for the ‘vulnerable’ contracting party makes it less likely that the courts will expand the approach taken in Thornton, etc., into a more general test of the reasonableness of exclusion clauses.

7.4.5 NEED FOR A ‘CONTRACTUAL’ DOCUMENT

In order to be effectively incorporated, the exclusion clause must generally be contained, or referred to, in something that can be regarded as a contractual document. This is the aspect of the rule that reasonable notice must be given. Notice is unlikely to be regarded as reasonable if the clause appears in something that would not be expected to contain contractual terms.

Key Case Chapelton v Barry UDC (1940)36

Facts: The plaintiff wished to hire a deckchair. He took a chair from a pile near a notice indicating the price and duration of hire, and requesting hirers to obtain a ticket from the attendant. The plaintiff obtained a ticket, but when he used the chair it collapsed, causing him injury. It was accepted that the collapse of the chair was due to the negligence of the defendant (Barry UDC), but the council argued that it was protected by a statement on the ticket that ‘The council will not be liable for any accident or damage arising from hire of chair’.

Held: The Court of Appeal held that the ticket was a mere receipt. It was not a document on which the customer would expect to find contractual terms, and the exclusion clause printed on it was therefore not incorporated. The purpose of the ticket was simply to provide evidence for the hirer that he had discharged his obligation to pay for the chair. It was, the court felt, distinguishable from, for example, a railway ticket ‘which contains upon it the terms upon which a railway company agrees to carry the passenger’.

The plaintiff was entitled to recover for the council’s breach of contract. The test of whether a document is deemed to be contractual or not will, presumably, depend on what information, terms, etc., the court thinks that a reasonable person would expect to find on it. In fact, in this case, the ticket was in any case provided too late, as it was held that the contract was formed when the deckchair was first taken for use, whereas the ticket was not handed over until after this had been done.37

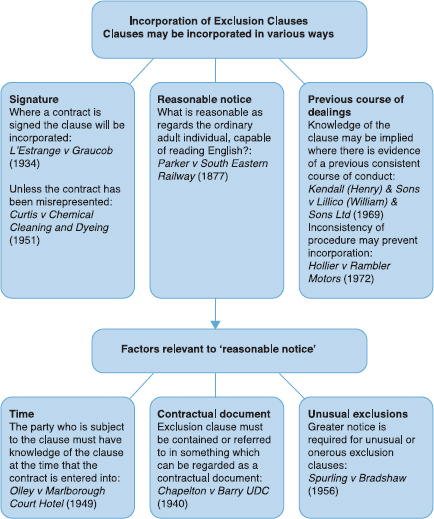

Figure 7.1

Once it has been decided that a clause has been incorporated into the contract, the next issue is whether it covers the breach that has occurred. In other words, the wording of the clause must be examined to see if it is apt to apply to the situation that has arisen. This is called the rule of ‘construction’, but might equally well be called the rule of ‘interpretation’. The clause is being ‘constructed’ or ‘interpreted’ to determine its scope.

7.5.1 CONTRA PROFERENTEM RULE

The rules of construction, like the rules for incorporation, are of general application, and can be used in relation to all clauses within a contract, not just exclusion clauses. The more general issues have been discussed in Chapter 6.38 There has been much case law, however, involving the proper interpretation of exclusion clauses. In this context, the courts have traditionally taken a stricter approach to construction than elsewhere. The rule of construction has been used as a means of limiting the effect of exclusion clauses, and a person wishing to avoid liability has been required to be very precise in the use of language to achieve that aim. One aspect of this is the contra proferentem rule, whereby an exclusion clause is interpreted against the person putting it forward. Thus, in Andrews v Singer,39 a clause excluding liability in relation to implied terms was ruled ineffective to exclude liability for breach of an express term. Similarly, in Wallis, Son and Wells v Pratt,40 it was held that a clause stating that the suppliers of goods gave no ‘warranty’ in relation to them did not protect them from being liable for a breach of ‘condition’.41 Moreover, if there is ambiguity in the language used, this will be construed in the claimant’s favour. Thus, it has been held that a reference in an insurance contract to excess ‘loads’ did not apply where a car was carrying more passengers than the number which it was constructed to carry.42 It has also been held that the phrase ‘consequential losses’ does not cover direct losses flowing naturally from the breach, such as lost profits.43

Particular difficulty can arise where the defendant seeks to exclude liability for negligence in the performance of a contract. The principles to be applied here were set out by the Privy Council in Canada Steamship Lines Ltd v The King.44 The court was dealing with Canadian law, but the principles have been taken as applying to English law as well.45 They were stated by Lord Morton as follows:

(1) If the clause contains language that expressly exempts the person in whose favour it is made (hereafter called ‘the proferens’) from the consequence of the negligence of his own servants, effect must be given to that provision …

(2) If there is no express reference to negligence, the court must consider whether the words used are wide enough, in their ordinary meaning, to cover negligence on the part of the servants of the proferens …

(3) If the words used are wide enough for the above purpose, the court must then consider whether the ‘head of damage may be based on some ground other than negligence’ … The ‘other’ ground must not be so fanciful or remote that the proferens cannot be supposed to have desired protection against it; but subject to this qualification … the existence of a possible head of damage other than negligence is fatal to the proferens even if the words used are prima facie wide enough to cover negligence on the part of his servants.

As the first principle makes clear, if the drafter of a contract wishes to ensure that negligence liability is covered, the safest way is to say so explicitly. The use of the word ‘negligence’ is obviously sufficient, but synonyms may also be enough. In Monarch Airlines Ltd v London Luton Airport Ltd,46 for example, it was held that the phrase ‘act, omission, neglect or default’ was clearly intended to cover negligence.

This is relatively straightforward. It is when the drafter of the contract decides to use general words such as ‘any loss howsoever caused’ that difficulties start to arise.47 In that situation, the second and third principles stated by Lord Morton come into play. A distinction then needs to be drawn between the situations where the defendant is liable only for negligence and where there is some other possible basis for liability. In the latter situation, the defendant will need to use words that specifically cover negligence in order to avoid liability. General words that purport to cover ‘all liabilities’ may well not be enough. If, for example, a bailee is strictly liable for the safety of the bailor’s goods, a general clause excluding liability will be taken to attach to the strict liability, and not to liability for negligence. Similarly, in White v John Warwick,48 in a contract for the hire of a bicycle, a clause exempting the owners from liability for personal injuries was held to cover only breach of strict contractual liability as to the condition of the bicycle, and not injuries resulting from negligence in the fitting of the saddle.49

The position is different if the only basis of liability that exists is negligence liability. Then the implication of Lord Morton’s second principle is that general words may be sufficient.50 In Alderslade v Hendon Laundry,51 the plaintiff had not received certain handkerchiefs which he had left with the defendant laundry. A clause in the contract stated ‘The maximum amount allowed for lost or damaged articles is 20 times the charge made for laundering’. Lord Greene MR took the view that as regards loss (as opposed to damage), the laundry could not be regarded as undertaking a strict obligation, but only to take reasonable care of items (that is, not to be negligent). On that basis, the clause was apt to cover negligence liability. Salmon LJ in Hollier v Rambler Motors,52 however, in discussing this case, took the view that it was the perception of the customer that was important:53

I think that the ordinary sensible housewife, or indeed anyone else who sends washing to the laundry, who saw that clause must have appreciated that almost always goods are lost or damaged because of the laundry’s negligence, and, therefore, this clause could apply only to limit the liability of the laundry, when they were in fault or negligent.

This must be regarded as having modified the approach taken by the Court of Appeal in Alderslade itself. The position thus now seems to be that where the reasonable claimant would read a clause as covering negligence, the courts will be prepared to allow exclusion without any specific reference to negligence, or the use of a general phrase clearly including negligence.54 In the end, it is a matter of attempting to assess the intentions and reasonable expectations of the parties.

Key Case Hollier v Rambler Motors (1972)55

Facts: The plaintiff’s car was at the defendant’s premises when it was damaged by fire, caused by the defendant’s negligence. There was a clause in the contract which stated ‘The company is not responsible for damage caused by fire to customers’ cars on the premises’.

Held: The Court of Appeal took the view that customers would assume that this clause related to fires that arose without negligence on the part of the defendant (though as a matter of law there would in fact be no liability in such a case). The clause was not, in effect, an exclusion of liability, but simply a ‘warning’ that the defendant was not, as a matter of law, liable for non-negligent fire damage. If the defendant wanted to exclude liability for negligence, this should have been done explicitly.

As the case shows, even where the only possible liability is for negligence, it is still better to use specific rather than general words.

The position as regards exclusion of liability for negligence was significantly affected by the UCTA 1977,56 and this may mean that, at least as far as consumers are concerned, the above rules will be of less significance. Clauses purporting to exclude negligence are either void (if relating to death or personal injury) or subject to a requirement of ‘reasonableness’. In the consumer context the courts may well be reluctant to find that attempts to exclude liability for failing to take reasonable care in the performance of a contract are ‘reasonable’, even where the negligence is the fault of the defendant’s employee rather than the defendant personally. In the commercial sphere, however, as has been indicated above, the courts still make regular reference to Lord Morton’s principles in the Canada Steamship case.57

7.5.2 RELAXATION OF THE RULE OF CONSTRUCTION

More generally, the existence of stricter statutory controls over exclusion clauses has encouraged the courts to take the line that there is no need for the rule of construction to be used in an artificial way to limit their scope. The consumer and the standard form contract are dealt with by the UCTA 1977 (and now also by the UTCCR 1999).58 Businesses negotiating at arm’s length should be expected to look after themselves. If they enter into contracts containing exclusion clauses, they must be presumed to know what they are doing. On three occasions since the passage of the UCTA 1977, the House of Lords has criticised an approach to the interpretation of exclusion clauses in commercial contracts, which involves straining their plain meaning in order to limit their effect. In Photo Production Ltd v Securicor Transport Ltd,59 Lord Wilberforce commented that in the light of parliamentary intervention to protect consumers (by means of the UCTA 1977):60

… in commercial matters generally, when the parties are not of unequal bargaining power, and when risks are normally borne by insurance, not only is the case for judicial intervention undemonstrated, but there is everything to be said, and this seems to have been Parliament’s intention, for leaving the parties free to apportion the risks as they think fit and for respecting their decisions.

Lord Diplock, agreeing with Lord Wilberforce, commented that:61

In commercial contracts negotiated between businessmen capable of looking after their own interests and of deciding how risks inherent in the performance of various kinds of contract can be most economically borne (generally by insurance), it is, in my view, wrong to place a strained construction on words in an exclusion clause which are clear and fairly susceptible of one meaning only …

Similarly, in Ailsa Craig Fishing Co Ltd v Malvern Fishing Co Ltd,62 Lord Wilberforce again expressed the view (particularly in relation to clauses limiting liability, rather than excluding it altogether) that:63

… one must not strive to create ambiguities by strained construction, as I think the appellants have striven to do. The relevant words must be given, if possible, their natural, plain meaning.

Lord Fraser agreed that limitation clauses need not:64

… be judged by the specially exacting standards which are applied to exclusion and indemnity clauses … It is enough … that the clause must be clear and unambiguous.

Finally, in George Mitchell (Chesterhall) Ltd v Finney Lock Seeds Ltd,65 Lord Bridge reaffirmed the need for straightforward interpretation:66

The relevant condition, read as a whole, unambiguously limits the appellants’ liability to replacement of the seeds or refund of the price. It is only possible to read an ambiguity into it by the process of strained construction which was deprecated by Lord Diplock in the Photo Production case … and by Lord Wilberforce in the Ailsa Craig case.

The interpretation of exclusion clauses in commercial agreements should now also take into account the approach of Lord Hoffmann in Investors Compensation Scheme Ltd v West Bromwich Building Society,67 as discussed in Chapter 6.68 That this is the correct approach was confirmed by the Court of Appeal in Keele University v Price Waterhouse.69

For Thought

Is it right that all commercial agreements should be approached in this way? Doesn’t the fact that the parties to a business contract may be of very different bargaining strength mean that in some circumstances a strict approach to interpretation would be justified?

7.5.3 IN FOCUS: FUNDAMENTAL BREACH

At one time, the view was taken by some courts, and in particular the Court of Appeal, that some breaches of contract are so serious that no exclusion clause can cover them. This was expressed in the so-called doctrine of fundamental breach. This doctrine found its origins in shipping law, where there is strong authority that if a ship ‘deviates’ from its agreed route, there can be no exclusion of liability in relation to events that occur after the deviation, even though the deviation was not the cause of any loss which occurs.70 Applied more generally to the law of contract, it took two forms. One was that there are certain terms within the contract that are so fundamental that there cannot be exclusion for breach of them. Such would be the situation where the contract stipulated for the supply of peas, and beans were provided instead.71 The supplier in such a case has departed so far from the basic contractual obligation that some courts felt that it could not be justifiable to allow him to exclude liability. To do so would appear to make a mockery of the whole idea of a contractual obligation. If, for example, a person who has contracted to sell potatoes supplies the same weight of coal, it surely ought not to be permissible to allow reliance on a broadly written exclusion clause that states ‘the supplier may substitute any other goods for those specified in the contract’. The rules of incorporation and construction do not have any necessary effect on such a clause. The answer appeared to be to treat the promise to supply potatoes as a ‘fundamental term’. Any breach of this term would provide a remedy to the other party irrespective of an exclusion clause.

Stated in this form the doctrine had close links with the ‘deviation’ principle in shipping law, which similarly is concerned with the breach of a specific obligation regarded as being central to the contract. The second form of the doctrine of fundamental breach was different in that it looked not at the particular term that had been broken, but at the overall effects of the breach that had occurred. If the breach was so serious that it could be said to have destroyed the whole contract, then again, exclusion of liability should not be possible. Two cases illustrate these two aspects of the doctrine: Karsales v Wallis72 and Harbutt’s Plasticine Ltd v Wayne Tank and Pump Co Ltd.73 In Karsales v Wallis, the contract was for the supply of a Buick car, which the plaintiff had inspected and found to be in good condition. When delivered (late at night), however, it had to be towed, because it was incapable of self-propulsion. Amongst other things, the cylinder head had been removed, the valves had been burnt out, and two of the pistons had been broken. The defendant purported to rely on a clause of the agreement that stated:

No condition or warranty that the vehicle is roadworthy, or as to its age, condition or fitness for purpose is given by the owner or implied herein.

The county judge held for the defendant, but the Court of Appeal reversed this. The majority of the Court (Lord Denning reached the same conclusion, but on slightly different grounds) held that what had been delivered was not, in effect, a ‘car’. The defendant’s ‘performance’ was totally different from that which had been contemplated by the contract (that is, the supply of a motor vehicle in working order). There was, therefore, a breach of a fundamental term of the agreement, and the exclusion clause had no application.

In Harbutt’s Plasticine, the contract involved the supply of pipework in the plaintiff’s factory. The type of piping used was unsuitable, and resulted in a fire that destroyed the whole of the plaintiff’s factory. The obligation to supply piping that was fit for its purpose could clearly have been broken in various ways, not all of which would have led to serious damage to the plaintiff’s premises. In this case, however, the consequences of the defendant’s failure to meet its obligation in this respect were so serious that the Court of Appeal regarded it as a ‘fundamental breach’ of the contract, precluding any reliance on an exclusion clause.

These two Court of Appeal decisions illustrate that a ‘fundamental breach’ could occur either through the breach of a particularly important term, or through a breach which had the consequences of destroying the whole basis of the contract.

In arriving at its decision in Harbutt’s Plasticine, however, the Court of Appeal had to deal with the views expressed by the House of Lords in Suisse Atlantique Société d’Armemente SA v Rotterdamsche Kolen Centrale NV.74 The case concerned a charter which included provisions whereby, if there were delays, the charterers’ liability was limited to paying $1,000 per day ‘demurrage’. The owners attempted to argue that the charterers’ breach was so serious that the demurrage clause should not apply, and that they should be able to recover their full losses. The House of Lords rejected this and, in so doing, expressed strong disapproval of the argument that there was a substantive rule of law which meant that certain types of breach automatically prevented reliance on an exclusion clause. As Viscount Dilhorne commented:75

In my view, it is not right to say that the law prohibits and nullifies a clause exempting or limiting liability for a fundamental breach or breach of a fundamental term. Such a rule of law would involve a restriction on freedom of contract and in the older cases I can find no trace of it.

As this quotation illustrates, the House was of the opinion that the parties should generally be allowed to determine their obligations and the effect of exclusion clauses in their contract. If there was a breach that appeared fundamental, then it was a question of trying to determine the parties’ intentions as to whether such a breach was intended to be covered by any exclusion clause. Of course, as Lord Wilberforce noted,76 ‘the courts are entitled to insist, as they do, that the more radical the breach, the clearer must be the language if it is to be covered’, but the question is one of the proper construction of the clause, and not a rule of law.

In Harbutt’s Plasticine, the Court of Appeal attempted to distinguish Suisse Atlantique on the basis that in that case the parties had continued with the charter even after the alleged fundamental breach. The Court of Appeal therefore argued that the principles outlined by the House of Lords in Suisse Atlantique should apply only where there was an affirmation of the contract by the parties following the breach, and not where the breach itself brought the contract to an end. In the latter type of situation, there should be no possibility of reliance on an exclusion clause. The difficulty with this argument was that it is a well-established principle in contract law that a breach never in itself brings a contract to an end.77 The party not in breach always has the option (if the breach is a serious one) of either accepting the breach and terminating the contract or affirming the contract and simply suing for damages. Suppose, for example, there is a contract for the sale of components that are to be supplied with certain fixing holes drilled in them. If, when delivered, the fixing holes are not there, this will amount to a breach of ‘condition’ by virtue of s 13 of the Sale of Goods Act 1978.78 The buyer will have the right to accept the breach, reject the goods and sue for damages. Alternatively, however, the buyer may affirm the contract, accept the goods, and simply sue for the cost of having the holes drilled, and any other consequential losses. The Court of Appeal in Harbutt’s Plasticine took the view that this did not apply to certain fundamental breaches of contract, which themselves brought the contract to an end, without the need for acceptance by the party not in breach. This view, was, however, firmly rejected by the House of Lords in Photo Production Ltd v Securicor Transport Ltd,79 which overruled Harbutt’s Plasticine, and finally disposed of the argument that certain types of fundamental breach could never be covered by an exclusion clause.80

7.5.4 ANY BREACH, NO MATTER HOW SERIOUS, MAY BE EXCLUDED

The decision of the House of Lords in Photo Production v Securicor81 finally confirmed that, in business to business contracts it was possible for liability for any breach to be excluded, no matter how serious, or what its effect on the contract.

Key Case Photo Production Ltd v Securicor Transport Ltd (1980)

Facts: The plaintiffs owned a factory, and engaged the defendants to provide security services, which included a night patrol. Unfortunately, one of the guards employed by the defendants to carry out these duties started a fire on the premises that got out of control, and destroyed the entire factory. Thus, rather than protecting the plaintiffs’ property as they had been contracted to do, the defendants could be said to have achieved the exact opposite. The contract, however, contained a very broadly worded exclusion clause, which, on its face, seemed to cover even the very serious breach of the agreement that had occurred. The Court of Appeal took the view that this could not protect the defendants. There had been a fundamental breach, and the exclusion clause was ineffective.

The decision in Photo Productions is a strong affirmation of the ‘freedom of contract’ approach to commercial agreements, and a rejection of an ‘interventionist’ role for the courts.

7.5.5 THE CURRENT POSITION

The demise of the doctrine of fundamental breach as a rule of law (and there has been no attempt to revive it since the Photo Production decision) has to some extent simplified the law in this area. It may still be difficult to decide in particular cases, however, what to do where a breach effectively negates the whole purpose of the contract. It is a matter of looking at the precise wording of the exclusion clause and trying to determine the intentions of the parties in relation to it. The likelihood of exclusion being effective will decrease with the seriousness of the breach, but it is now always a question of balance, rather than the application of a firm rule.

In considering where the balance is likely to be struck, some of the older case law may still be relevant in indicating the types of situation where the courts will require considerable convincing that the parties really did intend that a serious breach was intended to be covered by the exclusion clause. Some of the cases referred to above, such as Karsales v Wallis82 and Harbutt’s Plasticine Ltd v Wayne Tank and Pump Co Ltd,83 may be relevant in this context. A decision to similar effect is Pinnock Bros v Lewis and Peat Ltd,84 where the contract was for the supply of copra cake to be used as cattle feed. The cake was contaminated with castor beans, and the cattle became ill. There was an exclusion clause expressed to cover liabilities for ‘defects’ in the goods. The court refused to apply the clause, holding that what was supplied was so contaminated that it could not be called ‘copra cake’ at all. On its proper construction, therefore, the clause referring to ‘defects’ was not apt to cover the situation.85 In Glynn v Margetson & Co,86 a bill of lading relating to a contract for the carriage of a cargo of oranges from Malaga to Liverpool contained a clause allowing considerable freedom (referring to most of Europe and the ‘the coasts of Africa’) in the route which could be taken ‘for the purposes of delivering … cargo … or for any other purposes whatsoever’. The ship, having loaded the oranges, went to a port some 350 miles in the opposite direction from Liverpool to collect another load before proceeding to Liverpool. The oranges had deteriorated on arrival as a result of the prolonged voyage. The detour made here was strictly within the terms of the bill of lading,87 but the House of Lords nevertheless held the carrier liable. It took the view that the clause in the bill of lading could not have been intended to allow the carrier to act in a way which was inconsistent with the ‘main purpose’ of the contract, that is, to deliver the cargo from Malaga to Liverpool. Finally, in Gibaud v Great Eastern Railway Co,88 the contract was for the storage of a bicycle in the cloakroom at a railway station. It was in fact left in the booking hall, from which it was stolen. The owner had been given a ticket that limited the railway’s liability to £5. The Court of Appeal considered the argument that the defendant could not rely on the clause because the bicycle had not been kept in the cloakroom. It accepted, following Lilley v Doubleday,89 that where the bailee of goods had undertaken to store them in a particular warehouse but in fact stored them elsewhere, the benefit of an exclusion clause would be lost. The principle was that:90

… if you undertake to do a thing in a certain way, or to keep a thing in a certain place, with certain conditions protecting it, and have broken the contract by not doing the thing contracted for in the way contracted for, or not keeping the article in the place where you have contracted to keep it, you cannot rely on the conditions which were only intended to protect you if you carried out the contract in the way in which you had contracted to do it.

On the facts, however, it was held that there was no binding obligation to store the bicycle in the cloakroom, so that the railway company was able to take the benefit of the clause.

The courts are also likely to be reluctant to find that a clause allows a defendant to escape liability where there has been a deliberate breach of contract. Thus, in Sze Hai Tong Bank Ltd v Rambler Cycle Co Ltd,91 the carrier delivered goods to a person who was known to have no authority to receive them,92 and this resulted in a loss to the owner. The carrier attempted to rely on a clause in the bill of lading which stated that its liability ended once the goods were ‘discharged’ from the ship. The Privy Council held, however, that the clause could not have been intended to cover the carrier if the goods had simply been handed over to a passer-by. It must have been intended only to cover an authorised discharge, and not a deliberate delivery to an unauthorised recipient.93 More recent confirmation of this approach to deliberate breaches is to be found in Internet Broadcasting Corporation Ltd v Mar LLC,94 where the High Court suggested that:95

There is a presumption, which appears to be a strong presumption, against the exemption clause being construed so as to cover deliberate, repudiatory breach.

Very clear words would be needed to cover such a breach, and even then there would be reluctance to apply the literal meaning where to do so would defeat the ‘main object’ of the contract.96

Common law

Common law