Investment Rates of Return and Royalty Rates

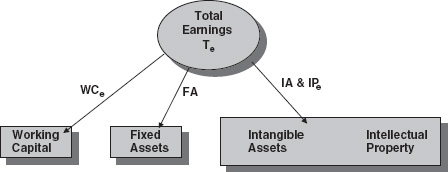

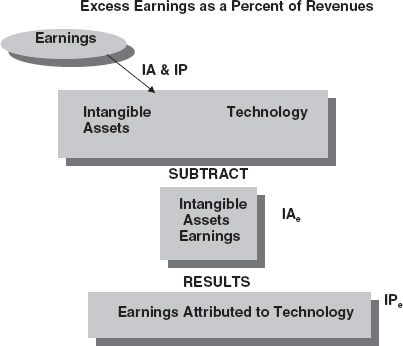

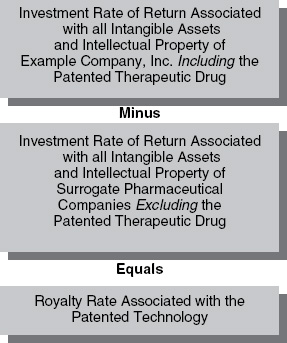

Chapter 9 This section presents an approach for determining a royalty rate based on investment rate of returns. This analysis requires consideration of the profits expected from exploitation of the various assets of a business, including the technology that will be licensed. By allocating a fair rate of return to all of the integrated assets of a business, including the licensed technology, a fair rate of return for use of a specific patent can be derived and expressed as a royalty rate. The basic principles in this type of analysis involve looking at the total profits of a business, and allocating the profits among the different classes of assets used in the business. When a business demonstrates an ability to earn profits above that which would be expected from operating a commodity-oriented company, then the presence of IP, such as patented technology, is identified. An allocation of the total profits derived, from using all assets of the company, can attribute a portion of the profits to the technology of a business. When the profits attributed to technology are expressed as a percentage of revenue, royalty rate guidance is obtained. The investment rate-of-return analysis yields an indication of a royalty rate for a technology license, after a fair return is earned on investment in the other assets of the business. Thus, a royalty rate conclusion, that is supported by an investment rate-of-return analysis, allows for payment of a royalty to a licensor, while still allowing a licensee to earn a fair investment rate-of-return on its own, non-licensed assets used in the business. This section of the report explores the use of financial analysis techniques to derive royalty rates. The method is based on the idea of allocating the total earnings of a technology-based business, among the different asset categories employed by the business. Exhibit 9.1 starts with the concepts introduced earlier, and adds notations that will be used in the following paragraphs to develop the method. The earnings of a business are derived from exploiting its assets. The number of assets in each category, along with the nature and quality of the assets, determines the level of earnings that the business generates. Working capital, fixed assets, and intangible assets are generally commodity-type assets, that all businesses can possess and exploit. As previously discussed, a company that possesses only these limited assets will enjoy only limited amounts of earnings, because of the competitive nature of commodity-dominated businesses. Te = WCe + FAe + IA and IPe The earnings associated with use of intangible assets and IP are represented by IA and IPe. This level of earnings can be further subdivided into earnings associated with the use of the intangible assets (IAe), and earnings associated with the use of IP (IPe) as shown below: IA and IPe = IAe + IPe An appropriate royalty rate is equal to the portion of IPe that can be attributed to the use of the subject technology. The royalty rate to associate with a specific technology equals the earnings derived from the technology, divided by the revenue derived with the technology, as shown in Exhibit 9.2. Specifically, a company lacking intangible assets and technology would be reduced to operating a commodity-oriented enterprise, where competition and lack of product distinction would severely limit the potential for profits. Conversely, companies possessing proprietary assets can throw-off the limitations of commodity-oriented operations, and earn superior profits.

Investment Rates of Return and Royalty Rates

BASIC PRINCIPLES

INVESTMENT RATE OF RETURN ROYALTY RATES

ROYALTY RATES