The Role of Economic Analysis in Competition Law

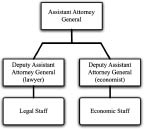

Figure 1: Pre-1983 Organisation of the Antitrust Division in the United States Department of Justice

As a result, the advice of the Chief Economist was usually filtered through a lawyer, the DAAG; when the Chief Economist was able to communicate the economists’ views directly to the AAG, it was only after the legal Deputy had presented the case to the AAG. It is therefore not surprising that in 1971 Judge Richard Posner described the Antitrust Division’s economists as ‘handmaidens to the lawyers, and rather neglected ones at that’.[4]

The structure in which economists played second fiddle to lawyers created organisational tension. Because the economists made their recommendations either through or after the lawyers, the economists were routinely put in the position of trying to explain why a case the lawyers said they could win should not be brought for lack of economic merit. As a result, agency lawyers long viewed economists unfavourably as ‘case killers’ who did not understand the law and who relied upon concepts and jargon the lawyers did not understand.

When economists and lawyers within an agency took diverging views on a particular issue—a common occurrence—the lawyers typically won. Perhaps this is because in disputes within a bureaucracy, the larger group usually wins; at both the FTC and the DOJ, the lawyers were by far the larger group. Another explanation for the ‘case killer’ view is that, prior to 1981, the ultimate decision makers at the FTC (the Commissioners) were almost always and at Justice (the AAG) were invariably lawyers[5] and therefore more inclined to understand and to favour the views of staff lawyers over those of staff economists.

This situation began to change in 1965, when Donald F Turner, who was both a lawyer and a PhD economist, became head of the Antitrust Division at the DOJ. Turner created the position of Special Economic Assistant to the AAG and staffed it with a distinguished economist who reported directly to him. Professor Oliver Williamson, the second Special Economic Assistant, observed that creation of that position ‘signaled that economic analysis would [] be featured more prominently in the decision to bring cases and in the manner in which the cases were argued’.[6]

In 1968 Turner introduced the first ‘Merger Guidelines’, which were based upon economic rather than legal principles. Before then it is not clear whether there was any consistent analysis prescribed for the staff’s evaluation of a proposed merger. The 1968 Guidelines classified markets using four-and eight-firm ‘concentration ratios’, that is, the percentage of sales in the merging firms’ market that, after the merger, would be made by the four largest and the eight largest firms in the market. Under the Guidelines, if the top four firms after the merger would have a projected market share in excess of 75 per cent, then the merger would be scrutinised in greater detail. Under this heightened scrutiny, if the acquiring firm had, for example, a 10 per cent market share and the acquired firm had two per cent or more of the market, then the Antitrust Division would ordinarily challenge the merger.[7] The Guidelines reflected the ‘conduct-structure-performance’ paradigm then dominant in industrial organisation economics[8] and already influential in the Supreme Court.[9] The idea was simple: A high level of concentration in a particular market would facilitate and therefore make more likely actual collusion or at least tacit agreement among the market participants to avoid vigorous competition, particularly with respect to prices.[10]

In 1973, Professor Tom Kauper, then head of the Antitrust Division, created the Economic Policy Office. As he later recalled, ‘A greater capacity for economic analysis was needed both in terms of the development of specific cases … and in the development of an overall program that made economic sense.’[11]

In 1981, when the Reagan Administration took office, there was a sea change in the policies and practices of both the Antitrust Division and the FTC. William F Baxter, a professor of law who had been thoroughly converted to economic analysis of law in general and of antitrust in particular became head of the Antitrust Division.[12] James C Miller, III became the first PhD economist (and non-lawyer) to chair the FTC since its creation in 1914.[13]

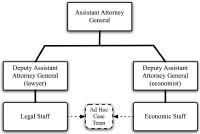

In 1983, the lead author of this essay became Baxter’s deputy and in 1985 succeeded him as AAG. As part of an overall reorganisation of the Antitrust Division to reflect its downsizing from a staff of 1,100 to about half that number, he elevated the position of the Chief Economist to that of a DAAG, thereby putting him at the same level as the senior-most lawyer reporting to the head of the Division (see Figure 2).[14] This structure remains in place today.

Figure 2: Post-1983 Organisation of the Antitrust Division in the United States Department of Justice

By the early 1980s not only were economists fully integrated into these agencies, but at least some of the agencies’ lawyers had been exposed to economics in law school. The introduction of economics and of PhD economists into law faculties had originated at the University of Chicago in 1939, when Henry Simons joined the faculty, followed by Aaron Director in 1948. For many years Director co-taught antitrust with Edward Levi in an unusual format whereby Levi would teach cases four days a week and on the fifth Director would show why the legal doctrine made no sense from an economic point of view.[15] The tradition of analysing legal rules and institutions from an economic point of view persisted at the University of Chicago and became much more widespread with the publication in 1974 of then-Professor Richard Posner’s Economic Analysis of Law.[16] By 1980, virtually all the leading law schools had appointed economists, some of whom also had a law degree.

The introduction of economics into antitrust analysis was particularly thoroughgoing. By the end of the decade Robert Bork’s seminal work The Antitrust Paradox (1978) had appeared.[17] That same year the first three volumes of the Areeda and Turner treatise, Antitrust Law, were published; the next two volumes, which dealt with mergers, followed in 1980.[18] All these works integrate price theory and college-level microeconomics into antitrust analysis. All of them were written by lawyers literate in economics; Turner was actually a PhD economist as well as a lawyer. As a result the books were accessible to and well understood by lawyers with even the most modest prior exposure to economics.

The 1982 Merger Guidelines reflected this greater economic sophistication developing in antitrust law. For example, the four- and eight-firm concentration ratios were replaced by the Herfindahl-Hirschman Index (HHI), which measures concentration using the whole market rather than looking only at the few largest firms.[19] The HHI is more sensitive because it gives more weight to firms with larger market shares.[20] The 1982 Guidelines also employed the Hypothetical Monopolist–SSNIP test, which defines the relevant market by asking whether a hypothetical monopolist could profitably impose a ‘small but significant non-transitory increase in price’[21] or if such a price increase would be frustrated by consumers switching to other products. The Guidelines looked not only to market structure and concentration—on which lawyers had traditionally focused but whose value has been proven neither theoretically nor empirically—but also to more theoretically and empirically established considerations, such as the likely competitive effects, entry, and efficiency gains associated with a merger.

As the lawyers within the agencies generally became (1) more comfortable with economic analysis of law and (2) more convinced of its relevance to antitrust law, they became less resistant to the recommendations of staff economists. Once viewed as case killers, economists came to be respected by lawyers because their work had become highly relevant, indeed usually essential, to the final decision whether to challenge a merger.

Today in the Antitrust Division, at least one staff economist is assigned to every civil investigation, including every merger investigation. Thus could Charles James, who headed the Antitrust Division in the early 2000s, say:

Our economists are an integral part of our investigations from beginning to end, and it is impossible for me to imagine the Department operating without them…. [E]conomists are involved not just in the decision-making functions of the Department, but in all phases of our inquiries.[22]

B. The Lessons of Experience

A country may organise its system of antitrust enforcement and review in many different ways. Indeed, the Appendix to this chapter reveals that the countries represented in this volume are diverse in this respect. Regardless of the structure, the newly created competition authorities in those countries are at a distinct advantage in that they can learn from the unfortunate history of antitrust enforcement in the United States and thereby avoid repeating the mistakes that were made there. In particular, it is easier for an agency to integrate economists and economic analysis in every phase of competition policy enforcement during its formative early years, before a different way of operating becomes entrenched and fosters incumbent interests that will resist change. Although the integration of economics and economists into a law enforcement setting may be unfamiliar and unwelcome in a legal culture that is not used to the idea, competition policy is one of the fields in which the argument for integration is at its strongest. Most observers would agree it would be peculiar for an environmental agency not to employ environmental scientists and it should, when the argument is laid out, seem equally strange for economists not to play a central role in the work of a competition authority. Competition was, after all, an economic concept before it was the subject of laws.[23]

The integration of industrial organisation (IO) economists into the work of a competition agency raises a number of questions about the internal organisation of that agency. The fundamental question is whether the economists should report directly to the person or group of persons who make the enforcement decision or, alternatively, be embedded in the legal staff that alone reports to the decision maker(s).[24] Experience suggests the former organisation works well, probably better than the alternative, but it does require that an economist from one chain of command and lawyers from the other be integrated into each ad hoc team conducting an investigation or pursuing a case, as illustrated below in Figure 3.

Figure 3: Ad hoc Case Teams in the United States Department of Justice

A related question is how a law enforcement agency should recruit and retain a high-quality staff of IO economics considering the different cultures in which lawyers and economists are trained and typically employed. In the United States at least, the best IO economists tend to teach at the university level rather than work for industrial or consulting firms, although they may well do some part-time consulting work. The key to assembling and retaining an excellent staff of economists in a competition agency, therefore, is to fit employment at the agency into the career path of first class IO economists. That means the economist’s experience at the agency must help advance his academic career rather than be a detour from that path.

The experience of the Antitrust Division shows it is possible to attract high quality staff economists by providing a working environment that to some degree replicates the intellectual environment of an economics faculty. Of course, the economist’s principal activity in the competition agency is the economic analysis of real world situations in real time, whereas his or her principal activities in a university are teaching and research. Still, agencies can provide some benefits of the academy to their economists by giving them a certain amount of time for their own research and writing, publishing a series of ‘working papers’, hosting a lecture series in which academic economists present their work, and so on. Perhaps the essential ingredient, however, is that the Chief Economist be a highly-respected academic for whom service at the competition agency is more like a fellowship at another university than time out of the academy altogether. By attracting a series of leading IO economists to serve in that role, the Antitrust Division has been able to attract high quality junior economists who know they will benefit from working under the distinguished Chief Economist and who realistically expect to leave the agency within some years in order to take up an entry-level academic post or to join a consultancy. This pattern of hiring newly minted PhD economists who will in time depart keeps the agency in touch with current economic thinking. There may well be other ways to organise a competition agency that are better suited to the local circumstances of different countries, but the point remains that the competition agency can and should be staffed by the best economic talent, as opposed to permanent bureaucrats of the sort too often found in other government offices.

Relatedly, in the last decade or two it has become essential that a competition agency have both economists and lawyers learned in the fields, respectively, of intellectual property and intellectual property rights. Scientific and technical developments in the pharmaceutical and particularly the digital electronics industries have spawned a host of new and thorny issues for competition policy. Advances in digital technology and the growth of the internet have significantly altered the competitive landscape in those and in many other industries, including prominently newspapers, book publishing and distribution,[25] motion picture distribution and exhibition, musical recordings, and general retailing; indeed, few if any sizeable industries have not been affected in some competitively relevant way by digital technology. Dominant firms have emerged in markets with significant network effects. In some there has been a succession of dominant firms—competition being for the field rather than within the field—often with ambiguous implications for competition policy.[26]

Competition agencies around the world are not of one mind about these developments. They are, however, in almost constant dialogue about them, in part because agencies in multiple jurisdictions are called upon to analyse the competitive implications of the same mergers, the same joint ventures, and business practices of the same dominant firms. Because there are diverse views, and because the same product market may have different participants and market shares in different jurisdictions, each competition agency needs its own ability to analyse the competitive implications of transactions and conduct in which intellectual property and intellectual property rights are important components. Attracting and keeping specialists in these fields is made more difficult by the competition of private sector employers and it is, again, the agency’s challenge to provide an intellectually and professionally rewarding experience if it is not consistently to be over-matched by the parties that come before it.

C. Competition Advocacy

The economic analytic capacity of a properly staffed competition agency is also a resource with the potential to improve decision making throughout the Government of which it is a part. Indeed, the agency can probably make a greater contribution to consumer welfare through advocacy within the councils of government than it can through its enforcement of competition law in the private sector because governments typically make decisions heedless of their anti-competitive impact. Each department and agency of government has its own mission and it is rare indeed for one of them to consider whether a decision it is contemplating might better serve the public if altered in some way not inconsistent with its primary goal.

A government regulatory body contemplating a new or changed regulation will ordinarily receive input from the affected industry and perhaps from other interests with a stake in that industry, such as labour unions or suppliers. If it hears anything from anyone expressing concern about the anti-competitive effect its proposed decision is likely to have, it will probably be from a relatively unsophisticated consumer association and, if the experience in the United States is a guide, even that type of input will be rare. As public choice economists have long recognised, consumers are less likely to be represented because they each have a small interest in any particular government decision, so it is not worth their while to organise, whereas other interest groups with a large stake in that decision do find it cost-beneficial to expend efforts to influence the Government.[27]

The large number of significant government regulatory initiatives with adverse effects upon competition and the paucity of protests from consumers mean the gains from sophisticated competition advocacy are potentially very great. Persuading an environmental protection agency, for example, to take a market-oriented rather than a command-and-control approach to regulating the emissions of a particular pollutant may reduce the costs of regulation greatly without at all impairing and indeed perhaps increasing its efficacy.[28]

In the United States, both the Antitrust Division and the FTC have long had active programmes of competition advocacy.[29] They have pointed out the anti-competitive consequences of measures proposed or adopted by legislatures, licensing boards, and other regulatory agencies at both the state and the federal levels. For example, the Antitrust Division recently submitted comments to the Department of Transportation regarding airline alliances[30] and to the Federal Communications Commission regarding its national broadband policy;[31] the FTC recently submitted comments to state legislatures regarding the provision of pharmaceutical services.[32]

Competition advocacy need only be tolerated by the larger government to be cost-effective because even an occasional victory for competition can dwarf the cost of the competition agency’s advocacy programme. So much the better, however, if the competition agency’s concerns must be addressed by the sectoral regulators and other government departments to whom they are addressed. This is the institutional arrangement long established in Korea, where the FTC has been very influential. In its own words:

The Korean Competition Law (Monopoly Regulation and Fair Trade Act) requires other ministries to have prior consultation with the KFTC on whether their proposed acts and decrees have any clause having anti-competitive effects on business, which is very unique as a competition advocacy role in Korea. As such … the competition advocacy role of the competition authorities … is deemed one of the core functions of the KFTC …

Policies, once formulated, are difficult to change. In this regard, the KFTC Chairman can ensure that the views of the competition agency are reflected in the policy-making by attending and expressing his opinions at the Cabinet Meetings.[33]

Few if any other competition agencies share the enviable arrangement that gives the Korean FTC the influence it has within the Government of Korea. Many agencies, however, could on their own initiative advocate competitive alternatives to anti-competitive government decisions, as the competition agencies of the United States have done. When a persuasive case for competition is put before an open-minded decision maker in a programmatic agency, he may be quick to alter his course, to the benefit of consumers. Even if he is not inclined to do so, he may find himself without a convincing reason for insisting upon a course that the competition agency has shown harms consumers.

III. Economic Analysis and the Relationship between Agencies and the Courts

It is not enough that the agency deciding whether to challenge a merger or a business practice as anti-competitive is an expert in economic analysis; the agency must be able to defend its decision to a judge who is unlikely to have access to an economist and is unlikely himself to be an expert in competition law—let alone price theory. In this section we explore the dynamic between the agencies and the courts in a world where competition policy is highly dependent upon economic analysis.