Chapter 17 Individual retirement arrangements (IRAs) ey.com/EYTaxGuide

There are two basic types of individual retirement arrangements (IRAs) discussed in this chapter: traditional IRAs and Roth IRAs. Each has different eligibility requirements and characteristics.

Traditional IRAs: If you are not eligible for your employer’s qualified retirement plan(s), or you are eligible but your income does not exceed specified limits, your contributions to a traditional IRA are deductible. Otherwise, you can only make nondeductible contributions to an IRA. Your maximum annual contribution is the lesser of $5,500 ($6,500 if you’re age 50 by the end of the year) or your taxable compensation. (This limit applies on a combined basis to your traditional [whether deductible or not deductible] and Roth contributions.) You defer paying taxes on the income earned by the funds held in your IRA until withdrawal. How distributions from traditional IRAs are taxed at the time of withdrawal depends on whether your contribution was deductible or nondeductible at the time it was made. Where all the contributions to the traditional IRA were deductible, all of the distribution is taxable. Where some or all of the contributions to the traditional IRA were nondeductible, the pro rata portion of the distribution that is attributable to your nondeductible contributions is not taxable.Roth IRAs: If your income is below specified levels, you can make nondeductible contributions to a Roth IRA. Although contributions are not deductible, distributions from your Roth IRA account, including income and any gains, are tax free if the distribution meets certain requirements. Like a traditional IRA, the maximum amount you can contribute to a Roth IRA in 2014 is limited to the lesser of $5,500 ($6,500 if you’re age 50 by the end of the year) or the amount of your taxable compensation. Your maximum allowable contribution to the Roth IRA may be further reduced depending on the amount of your modified adjusted gross income and your filing status. This chapter also discusses the simplified employee pension IRA (SEP IRA) and the Savings Incentive Match Plans for Employees (SIMPLE IRA). These are employer-sponsored plans that are established using IRAs. The SEP IRA and the SIMPLE IRA have different contribution limits, both from each other and from traditional and Roth IRAs.

Individual Retirement Arrangements (IRAs). IRAs come in several different “flavors”—traditional

Traditional IRA. There are two types of contributions to traditional IRAs—deductible and nondeductible. If you meet the eligibility standards for the year, the amount you contribute is deductible when contributed. If you don’t meet the eligibility standards for the year because of your income level and your employer provides a retirement plan, you can still contribute, but the amount is not deductible (nondeductible IRA). You may establish separate IRAs for deductible and nondeductible contributions or combine them into one IRA. The income you accumulate in a traditional IRA account is not taxed until you take a withdrawal. This is true whether the earnings are on deductible or nondeductible contributions. However, when you take a distribution, whether the original contribution was deductible or nondeductible, makes a difference. Where all the contributions to the traditional IRA were deductible, all of the distribution is taxable. Where some or all of the contributions to the traditional IRA were nondeductible, the pro rata portion of the distribution that is attributable to your nondeductible contributions is not taxable. In 2014, you can contribute up to the lesser of $5,500 ($6,500 if you’re age 50 by the end of the year) or the amount of your taxable compensation to a traditional IRA. (This is a combined limit with the Roth IRA.) You may also be eligible to deduct all or a portion of the contribution. The deduction is allowed as an adjustment in arriving at your adjusted gross income. Therefore, deducting your IRA contributions reduces your income subject to tax regardless of whether you itemize deductions. Three factors determine the extent to which you may deduct your contribution: the amount of your modified adjusted gross income; your filing status; and whether you are covered by a retirement plan at work.

For more information on figuring the deductible portion of your contribution to a traditional IRA, see How Much Can You Deduct?

Roth IRA. You can receive income accumulated within a Roth IRA account completely tax-free and penalty-free if certain conditions are met. In comparison, the income built up inside a traditional IRA is eventually subject to income tax at ordinary income tax rates as distributions are received. To qualify as a tax-free and penalty-free distribution, generally, the Roth IRA must have been established more than five years earlier and the distribution is received after you reach age 59½, made because you are disabled, made to a beneficiary following your death, or made to pay up to $10,000 (lifetime limit) of certain qualified first-time homebuyer amounts. Roth IRAs also have the advantage that there is no age at which minimum distributions must commence while you are alive.

Like with a traditional IRA, the maximum amount you can contribute to a Roth IRA in 2014 is limited to the lesser of $5,500 ($6,500 if you’re age 50 by the end of the year) or the amount of your taxable compensation. Your maximum allowable contribution may be further reduced depending on the amount of your modified adjusted gross income and your filing status. No portion of your contribution to a Roth IRA is deductible.

See Roth IRAs

SIMPLE IRA. If you work for a small employer, your employer may be eligible to establish a SIMPLE IRA account for you. This is a plan similar to a 401(k) plan, but with lower limits on both the amount of contributions the employer can make and the salary deferrals you can make, compared to a 401(k) plan. Your employer will also be required to make a matching contribution of either 2% or 3% of your annual compensation to your SIMPLE account, depending on the terms of the plan adopted by your employer. Under a SIMPLE IRA, the contributions for you are made to your IRA rather than to an employer trust. You may also be able to establish a SIMPLE IRA if you are self-employed. Generally, the annual contributions and accumulated income are not taxable until you take distributions. The maximum limits on annual contributions to a SIMPLE IRA are substantially greater than for either a traditional or Roth IRA. In 2014, the limit is $12,000 ($14,500 if you are over age 50 by the end of the year). This is less than if your employer had established a 401(k) plan, and is coordinated with any amounts deferred to a 401(k) plan or a salary reduction simplified employee pension (SARSEP) plan of another employer. (New SARSEPS were prohibited after December 31, 1996.)

For more information on SIMPLE plans, see Savings Incentive Match Plans for Employees (SIMPLE),

SEP IRA. Employers may also establish a SEP IRA. In this structure, like the SIMPLE IRA, your employer makes contributions for you to your IRA. In most cases, there are only employer contributions to the SEP; however, before 1997 small employers were able to establish SARSEPs to accept elective deferrals. Employers who established a SARSEP before 1997 can continue to use them for both old and new employees as long as they had 25 or fewer employees in the prior year. The SEP contribution is made to a traditional IRA. The salary deferral limits are the same as for 401(k) plans ($17,500 in 2014, plus $5,500 if you have attained age 50 by the end of the 2014 calendar year). The limit is coordinated with any amounts deferred to a 401(k) plan or SIMPLE IRA of another employer. Rollovers to a traditional IRA. You can make a tax-free transfer of money or property you receive from a qualified retirement plan, including a traditional IRA, into a traditional IRA. This tax-free rollover must generally be accomplished by the 60th day after the day you first received the distribution. In addition, if the rollover is from one traditional IRA account into another traditional IRA account, you can only perform the rollover once per year. Through the end of 2014, the limitation of one rollover per 12-month period is applied with respect to each separate IRA account you own. After 2014, however, the 12-month limitation is applied to all of your IRA accounts on an aggregate basis, and you cannot make a non-taxable rollover from one IRA to another if you have already made a rollover from any of your other IRAs in the preceding 12-month period. This change does not affect the ability to transfer funds from one IRA trustee directly to another since such direct transfers are not rollovers. You can also make a direct rollover from a qualified retirement plan to a traditional IRA. In this case, the one-time rule does not apply. For more information, see Can You Move Retirement Plan Assets?

Converting a traditional IRA to a Roth IRA. You can convert assets held in a traditional IRA account into a Roth IRA. If you make the conversion, you will have to pay income tax on any portion of the distribution of the traditional IRA that had not been previously taxed. Converting to a Roth IRA may be more beneficial than leaving the assets in a traditional IRA if you plan on leaving the money invested for a long period of time. For more information, see Converting From Any Traditional IRA to a Roth IRA

Converting a qualified retirement plan to a Roth IRA. You can convert investments held in a qualified retirement plan (i.e., 401(k)), 403(b) tax-sheltered annuities, and government plans under Section 457 into a Roth. If you make the conversion, you will have to pay income tax on any portion of the distribution of the qualified plan that had not been previously taxed. However, the conversion from a qualified employer plan may take place only if there is a “distributable event,” such as separation from your employer or, under some plans, attaining age 59½.

Modified AGI limit for traditional IRA contributions increased. For 2014, if you were covered by a retirement plan at work, your deduction for contributions to a traditional IRA is reduced (phased out) if your modified AGI is:

More than $96,000 but less than $116,000 for a married couple filing a joint return or a qualifying widow(er), More than $60,000 but less than $70,000 for a single individual or head of household, or Less than $10,000 for a married individual filing a separate return. If you either lived with your spouse or file a joint return, and your spouse was covered by a retirement plan at work, but you were not, your deduction is phased out if your modified AGI is more than $181,000 but less than $191,000. If your modified AGI is $191,000 or more, you cannot take a deduction for contributions to a traditional IRA. See How Much Can You Deduct?

Modified AGI limit for Roth IRA contributions increased. For 2014, your Roth IRA contribution limit is reduced (phased out) in the following situations.

Your filing status is married filing jointly or qualifying widow(er) and your modified AGI is at least $181,000. You cannot make a Roth IRA contribution if your modified AGI is $191,000 or more. Your filing status is single, head of household, or married filing separately and you did not live with your spouse at any time in 2014 and your modified AGI is at least $114,000. You cannot make a Roth IRA contribution if your modified AGI is $129,000 or more. Your filing status is married filing separately, you lived with your spouse at any time during the year, and your modified AGI is more than -0-. You cannot make a Roth IRA contribution if your modified AGI is $10,000 or more. See Can You Contribute to a Roth IRA?

Qualified charitable distributions (QCDs). The provision for tax-free distributions from IRAs for charitable purposes does not apply for 2014 or later years.

A QCD was generally a nontaxable distribution made directly by the trustee of an IRA to an organization eligible to receive tax-deductible contributions. Under prior law, a person who was 70½ or older could instruct the trustee of his or her IRA to directly contribute a distribution of up to $100,000 per year from the IRA to a charity.

The amount distributed as a QCD would not be taxable to the account holder and counted toward the minimum required distributions the IRA account holder had for the year and. Furthermore, the opportunity to exclude IRA distributions that satisfied the requirements for qualified charitable distributions reduced adjusted gross income (AGI), which, in turn reduced the percentage limitations based on AGI that apply to various deductions and credits. On the other hand, a charitable deduction could not be claimed for the QCD.

2014 limits. You can find information about the 2014 contribution and AGI limits in Publication 590.

Contributions to both traditional and Roth IRAs. For information on your combined contribution limit if you contribute to both traditional and Roth IRAs, see Roth IRAs and traditional IRAs How Much Can Be Contributed? in Roth IRAs , later.

Statement of required minimum distribution. If a minimum distribution from your IRA is required, the trustee, custodian, or issuer that held the IRA at the end of the preceding year must either report the amount of the required minimum distribution to you, or offer to calculate it for you. The report or offer must include the date by which the amount must be distributed. The report is due January 31 of the year in which the minimum distribution is required. It can be provided with the year-end fair market value statement that you normally get each year. No report is required for IRAs of owners who have died.

IRA interest. Although interest earned from your IRA is generally not taxed in the year earned, it is not tax-exempt interest. Tax on your traditional IRA is generally deferred until you take a distribution. Do not report this interest on your tax return as tax-exempt interest.

Form 8606. To designate contributions as nondeductible, you must file Form 8606, Nondeductible IRAs.

Net Investment Income Tax. For purposes of the Net Investment Income Tax (NIIT), net investment income does not include distributions from a qualified retirement plan including IRAs (for example, 401(a), 403(a), 403(b), 408, 408A, or 457(b) plans). However, these distributions are taken into account when determining the modified adjusted gross income threshold. Distributions from a nonqualified retirement plan are included in net investment income. See Form 8960, Net Investment Income Tax—Individuals, Estates, and Trusts, and its instructions for more information.

Retirement savings through IRAs. Wealth can build up much faster in an IRA or other tax-deferred retirement plan than in a savings account or other non-tax-exempt investment. Because you do not have to pay income tax as your earnings accumulate within the IRA or plan, your investments compound in value more quickly. A person in the 28% tax bracket, for example, could end up with 1.7 times more money after tax on a $5,500 deductible IRA contribution held for 20 years than if he or she did not make the contribution. If the person’s marginal tax rate drops to 15% in retirement, he or she could have 2 times more money after tax.

If in 2014 you invested $5,500 in an IRA that earns 10% per year, it will be worth $26,640 in 2033 after all taxes are paid if you are in the 28% bracket. If in 2034 you retire and drop into the 15% tax bracket and take a distribution, your original $5,500 investment will be worth $31,451 after all taxes are paid.

However, if you do not have an IRA, the $5,500 you receive in 2014 is subject to tax immediately. If you are in the 28% bracket, you are left with only $3,960. Investing that $3,960 in 2014 in a non-IRA investment earning 10%, remaining in the 28% bracket until you retire, and being in the 15% bracket when you retire, will leave you with only $15,907 in 2034 after taxes.

Note: The highest tax bracket in 2014 is 39.6%. The savings resulting from an IRA may be different than indicated in this example for taxpayers in higher or lower tax brackets. Also, the results will be different for a contribution to a nondeductible IRA or to a Roth IRA.

An individual retirement arrangement (IRA) is a personal savings plan that gives you tax advantages for setting aside money for your retirement.

This chapter discusses the following topics.

The rules for a traditional IRA (any IRA that is not a Roth or SIMPLE IRA). The Roth IRA, which features nondeductible contributions and tax-free distributions. Simplified Employee Pensions (SEPs) and Savings Incentive Match Plans for Employees (SIMPLEs) are not discussed in this chapter. For more information on these plans and employees’ SEP IRAs and SIMPLE IRAs that are part of these plans, see Publications 560 and 590.

For information about contributions, deductions, withdrawals, transfers, rollovers, and other transactions, see Publication 590.

You may want to see:

560 Retirement Plans for Small Business590 Individual Retirement Arrangements (IRAs) 5329 Additional Taxes on Qualified Plans (including IRAs) and Other Tax-Favored Accounts8606 Nondeductible IRAs In this chapter, the original IRA (sometimes called an ordinary or regular IRA) is referred to as a “traditional IRA.” A traditional IRA is any IRA that is not a Roth IRA or a SIMPLE IRA. Two advantages of a traditional IRA are:

You may be able to deduct some or all of your contributions to it, depending on your circumstances, and Generally, amounts in your IRA, including earnings and gains, are not taxed until they are distributed. You can open and make contributions to a traditional IRA if:

You (or, if you file a joint return, your spouse) received taxable compensation during the year, and You were not age 70½ by the end of the year. What is compensation? Generally, compensation is what you earn from working. Compensation includes wages, salaries, tips, professional fees, bonuses, and other amounts you receive for providing personal services. The IRS treats as compensation any amount properly shown in box 1 (Wages, tips, other compensation) of Form W-2, Wage and Tax Statement, provided that amount is reduced by any amount properly shown in box 11 (Nonqualified plans).

Scholarship and fellowship payments are compensation for this purpose only if shown in box 1 of Form W-2.

Compensation also includes commissions and taxable alimony and separate maintenance payments.

Self-employment income.

The deduction for contributions made on your behalf to retirement plans, and The deductible part of your self-employment tax. Compensation includes earnings from self-employment even if they are not subject to self-employment tax because of your religious beliefs.

Nontaxable combat pay.

What is not compensation? Compensation does not include any of the following items.

Earnings and profits from property, such as rental income, interest income, and dividend income. Pension or annuity income. Deferred compensation received (compensation payments postponed from a past year). Income from a partnership for which you do not provide services that are a material income-producing factor. Conservation Reserve Program (CRP) payments reported on Schedule SE (Form 1040), Any amounts (other than combat pay) you exclude from income, such as foreign earned income and housing costs. You can open a traditional IRA at any time. However, the time for making contributions for any year is limited. See When Can Contributions Be Made?

You can open different kinds of IRAs with a variety of organizations. You can open an IRA at a bank or other financial institution or with a mutual fund or life insurance company. You can also open an IRA through your stockbroker. Any IRA must meet Internal Revenue Code requirements.

Kinds of traditional IRAs. Your traditional IRA can be an individual retirement account or annuity. It can be part of either a simplified employee pension (SEP) or an employer or employee association trust account.

There are limits and other rules that affect the amount that can be contributed to a traditional IRA. These limits and other rules are explained below.

Community property laws. Except as discussed later under Kay Bailey Hutchison Spousal IRA limit

Brokers’ commissions. Brokers’ commissions paid in connection with your traditional IRA are subject to the contribution limit.

Trustees’ fees. Trustees’ administrative fees are not subject to the contribution limit.

Qualified reservist repayments. If you are (or were) a member of a reserve component and you were ordered or called to active duty after September 11, 2001, you may be able to contribute (repay) to an IRA amounts equal to any qualified reservist distributions you received. You can make these repayment contributions even if they would cause your total contributions to the IRA to be more than the general limit on contributions. To be eligible to make these repayment contributions, you must have received a qualified reservist distribution from an IRA or from a Section 401(k) or 403(b) plan or similar arrangement.

For more information, see Qualified reservist repayments under How Much Can Be Contributed? in chapter 1 of Publication 590.

General limit. For 2014, the most that can be contributed to your traditional IRA generally is the smaller of the following amounts.

$5,500 ($6,500 if you are 50 or older). Your taxable compensation This is the most that can be contributed regardless of whether the contributions are to one or more traditional IRAs or whether all or part of the contributions are nondeductible. (See Nondeductible Contributions

Example 1. Betty, who is 34 years old and single, earned $24,000 in 2014. Her IRA contributions for 2014 are limited to $5,500.

Example 2. John, an unmarried college student working part time, earned $3,500 in 2014. His IRA contributions for 2014 are limited to $3,500, the amount of his compensation.

Kay Bailey Hutchison Spousal IRA limit. For 2014, if you file a joint return and your taxable compensation is less than that of your spouse, the most that can be contributed for the year to your IRA is the smaller of the following amounts.

$5,500 ($6,500 if you are 50 or older). The total compensation includible in the gross income of both you and your spouse for the year, reduced by the following two amounts.Your spouse’s IRA contribution for the year to a traditional IRA. Any contribution for the year to a Roth IRA on behalf of your spouse. This means that the total combined contributions that can be made for the year to your IRA and your spouse’s IRA can be as much as $11,000 ($12,000 if only one of you is 50 or older, or $13,000 if both of you are 50 or older).

A wife holds a job that pays over $11,000 and her husband does not hold a job. The two spouses file a joint return and neither has attained age 50. They may contribute up to a total of $11,000 to IRAs. They may split the contribution between the husband’s and wife’s accounts in any way they wish, as long as no more than $5,500 is allocated to either account. For example, if they decided to make a total contribution of $7,500 they could put $5,500 in the wife’s IRA and $2,000 in the husband’s.

The working wife dies during the year after earning over $11,000. The nonworking husband is allowed to put $5,500 in his spousal IRA for the year, as long as he files a joint return with his deceased wife. A payment cannot be made to the decedent’s IRA for the year of death after she dies.

You should disregard community property laws when you are determining if you are eligible to make payments to an IRA for your nonworking spouse. Thus, your nonworking spouse is not considered to have earned half your income.

As soon as you open your traditional IRA, contributions can be made to it through your chosen sponsor (trustee or other administrator). Contributions must be in the form of money (cash, check, or money order). Property cannot be contributed.

Contributions must be made by due date. Contributions can be made to your traditional IRA for a year at any time during the year or by the due date for filing your return for that year, not including extensions.

Age 70½ rule. Contributions cannot be made to your traditional IRA for the year in which you reach age 70½ or for any later year.

You attain age 70½ on the date that is 6 calendar months after the 70th anniversary of your birth. If you were born on or before June 30, 1944, you cannot contribute for 2014 or any later year.

Designating year for which contribution is made. If an amount is contributed to your traditional IRA between January 1 and April 15, you should tell the sponsor which year (the current year or the previous year) the contribution is for. If you do not tell the sponsor which year it is for, the sponsor can assume, and report to the IRS, that the contribution is for the current year (the year the sponsor received it).

Filing before a contribution is made. You can file your return claiming a traditional IRA contribution before the contribution is actually made. Generally, the contribution must be made by the due date of your return, not including extensions.

Contributions not required. You do not have to contribute to your traditional IRA for every tax year, even if you can.

Direct deposit of tax refunds into an IRA account. You can choose to have the IRS directly deposit your tax refund into your IRA account(s) (and/or your spouse’s IRA account(s) if you file a joint tax return). Use Form 8888 to instruct the IRS to make a direct deposit to the IRA.

(You can also use Form 8888 to instruct the IRS to directly deposit your tax refund in up to three accounts. In addition to an IRA, an account can be a checking, savings, or health savings account (HSA), an Archer MSA, or Coverdell education savings account. You cannot have your refund deposited into more than one account if you file Form 8379, Injured Spouse Allocation.)

To have the IRS directly deposit your tax refund into your IRA account, you must establish the IRA at a bank or other financial institution before you request direct deposit. You must also notify the trustee of your account of the year to which the deposit is to be applied. If you do not, the trustee can assume the deposit is for the year during which you are filing the return. For example, if you file your 2014 return during 2015 and do not notify the trustee in advance, the trustee can assume the deposit into your IRA is for 2015. If you designate your deposit to be for 2014, you must verify that the deposit was actually made to the account by the original due date of the return, without regard to extensions. If the deposit was not made into your account by April 15, 2015, the deposit is not an IRA contribution for 2014 and you must file an amended return and reduce any IRA deduction and any retirement savings contribution credit you claimed.

Generally, you can deduct the lesser of:

The contributions to your traditional IRA for the year, or The general limit (or the Kay Bailey Hutchison Spousal IRA limit, if it applies). However, if you or your spouse was covered by an employer retirement plan, you may not be able to deduct this amount. See Limit If Covered by Employer Plan

Trustees’ fees. Trustees’ administrative fees that are billed separately and paid in connection with your traditional IRA are not deductible as IRA contributions. However, they may be deductible as a miscellaneous itemized deduction on Schedule A (Form 1040). See chapter 28

Brokers’ commissions. Brokers’ commissions are part of your IRA contribution and, as such, are deductible subject to the limits.

Full deduction. If neither you nor your spouse was covered for any part of the year by an employer retirement plan, you can take a deduction for total contributions to one or more traditional IRAs of up to the lesser of:

$5,500 ($6,500 if you are age 50 or older in 2014). 100% of your compensation. This limit is reduced by any contributions made to a 501(c)(18) plan on your behalf.

Kay Bailey Hutchison Spousal IRA. In the case of a married couple with unequal compensation who file a joint return, the deduction for contributions to the traditional IRA of the spouse with less compensation is limited to the lesser of the following amounts.

$5,500 ($6,500 if the spouse with the lower compensation is age 50 or older in 2014). The total compensation includible in the gross income of both spouses for the year reduced by the following three amounts.The IRA deduction for the year of the spouse with the greater compensation. Any designated nondeductible contribution for the year made on behalf of the spouse with the greater compensation. Any contributions for the year to a Roth IRA on behalf of the spouse with the greater compensation. This limit is reduced by any contributions to a 501(c)(18) plan on behalf of the spouse with the lesser compensation.

Note. If you were divorced or legally separated (and did not remarry) before the end of the year, you cannot deduct any contributions to your spouse’s IRA. After a divorce or legal separation, you can deduct only contributions to your own IRA. Your deductions are subject to the rules for single individuals.

Covered by an employer retirement plan. If you or your spouse was covered by an employer retirement plan at any time during the year for which contributions were made, your deduction may be further limited. This is discussed later under Limit If Covered by Employer Plan Nondeductible Contributions

The Form W-2 you receive from your employer has a box used to indicate whether you were covered for the year. The “Retirement plan” box should be checked if you were covered.

Reservists and volunteer firefighters should also see Situations in Which You Are Not Covered by an Employer Plan

If you are not certain whether you were covered by your employer’s retirement plan, you should ask your employer.

We recommend that you check your Form W-2 to ensure that the coverage status is accurate. The rules used to determine if you are covered by an employer’s plan will depend on the type of plan maintained by your employer. If you are not sure what type of plan your employer maintains, you should ask your employer. The information may also be found in the Summary Plan Description, which can be obtained from your employer. You test eligibility to participate in your employer’s plan based on the plan year ending with or within the tax year. Generally, you will be considered covered if:

Your employer maintains a defined benefit pension plan and you meet the plan’s eligibility requirements. Your employer maintains a defined contribution money purchase plan, you meet the plan’s eligibility requirements, and your employer is required to make a contribution to your account. Your employer maintains a profit-sharing plan and makes a contribution that is allocated to your account or allocates a forfeiture to your account, or you make any contribution with respect to a plan year ending with or within your tax year. Your employer maintains a 401(k), a SEP, or a 403(b) plan, and for the plan year ending with or within your tax year, you elect to defer any compensation. Assume that you first became eligible to participate in your employer’s profit-sharing plan on July 2, 2014. Your employer makes a contribution for the plan year ending on June 30, 2015. You will not be considered an active participant until 2015, since that is the first tax year during which an allocation was made to your account.

Federal judges. For purposes of the IRA deduction, federal judges are covered by an employer retirement plan.

Special rules apply to determine the tax years for which you are covered by an employer plan. These rules differ depending on whether the plan is a defined contribution plan or a defined benefit plan.

Tax year. Your tax year is the annual accounting period you use to keep records and report income and expenses on your income tax return. For almost all people, the tax year is the calendar year.

Defined contribution plan. Generally, you are covered by a defined contribution plan for a tax year if amounts are contributed or allocated to your account for the plan year that ends with or within that tax year.

A defined contribution plan is a plan that provides for a separate account for each person covered by the plan. Types of defined contribution plans include profit-sharing plans, stock bonus plans, and money purchase pension plans.

Defined benefit plan. If you are eligible to participate in your employer’s defined benefit plan for the plan year that ends within your tax year, you are covered by the plan. This rule applies even if you:

Declined to participate in the plan, Did not make a required contribution, or Did not perform the minimum service required to accrue a benefit for the year. A defined benefit plan is any plan that is not a defined contribution plan. Defined benefit plans include pension plans and annuity plans.

No vested interest. If you accrue a benefit for a plan year, you are covered by that plan even if you have no vested interest in (legal right to) the accrual.

Unless you are covered under another employer plan, you are not covered by an employer plan if you are in one of the situations described next.

Social security or railroad retirement. Coverage under social security or railroad retirement is not coverage under an employer retirement plan.

Benefits from a previous employer’s plan. If you receive retirement benefits from a previous employer’s plan, you are not covered by that plan.

Reservists. If the only reason you participate in a plan is because you are a member of a reserve unit of the armed forces, you may not be covered by the plan. You are not covered by the plan if both of the following conditions are met.

The plan you participate in is established for its employees by:The United States, A state or political subdivision of a state, or An instrumentality of either (a) or (b) above. You did not serve more than 90 days on active duty during the year (not counting duty for training). Volunteer firefighters. If the only reason you participate in a plan is because you are a volunteer firefighter, you may not be covered by the plan. You are not covered by the plan if both of the following conditions are met.

The plan you participate in is established for its employees by:The United States, A state or political subdivision of a state, or An instrumentality of either (a) or (b) above. Your accrued retirement benefits at the beginning of the year will not provide more than $1,800 per year at retirement. If either you or your spouse was covered by an employer retirement plan, you may be entitled to only a partial (reduced) deduction or no deduction at all, depending on your income and your filing status.

Your deduction begins to decrease (phase out) when your income rises above a certain amount and is eliminated altogether when it reaches a higher amount. These amounts vary depending on your filing status.

To determine if your deduction is subject to phaseout, you must determine your modified adjusted gross income (AGI) and your filing status. See Filing status Modified adjusted gross income (AGI) Table 17-1 17-2 to determine if the phaseout applies.

Table 17-1 1 on Deduction If You Are Covered by Retirement Plan at Work

If you are covered by a retirement plan at work, use this table to determine if your modified AGI affects the amount of your deduction.

IF your filing status is… AND your modified AGI is… THEN you can take… single $60,000 or less a full deduction. more than $60,000 but less than $70,000 a partial deduction. $70,000 or more no deduction. married filing jointly $96,000 or less a full deduction. more than $96,000 but less than $116,000 a partial deduction. $116,000 or more no deduction. married filing separately2 less than $10,000 a partial deduction. $10,000 or more no deduction.

1 Modified AGI (adjusted gross income). See Modified adjusted gross income (AGI)

2 If you did not live with your spouse at any time during the year, your filing status is considered Single for this purpose (therefore, your IRA deduction is determined under the “Single” column).

Table 17-2 1 on Deduction If You Are NOT Covered by

If you are not covered by a retirement plan at work, use this table to determine if your modified AGI affects the amount of your deduction.

IF your filing status is… AND your modified AGI is… THEN you can take… single, head of household , or qualifying widow(er) any amount a full deduction. married filing jointly or separately with a spouse who is not covered by a plan at workany amount a full deduction. married filing jointly with a spouse who is covered by a plan at work$181,000 or less a full deduction. more than $181,000 but less than $191,000 a partial deduction. $191,000 or more no deduction. married filing separately with a spouse who is covered by a plan at work2 less than $10,000 a partial deduction. $10,000 or more no deduction.

1 Modified AGI (adjusted gross income). See Modified adjusted gross income (AGI)

2 You are entitled to the full deduction if you did not live with your spouse at any time during the year.

Social security recipients. Instead of using Table 17-1 Table 17-2

You received social security benefits. You received taxable compensation. Contributions were made to your traditional IRA. You or your spouse was covered by an employer retirement plan. Use those worksheets to figure your IRA deduction, your nondeductible contribution, and the taxable portion, if any, of your social security benefits.

Deduction phaseout. If you were covered by an employer retirement plan and you did not receive any social security retirement benefits, your IRA deduction may be reduced or eliminated depending on your filing status and modified AGI as shown in Table 17-1

If your spouse is covered. If you are not covered by an employer retirement plan, but your spouse is, and you did not receive any social security benefits, your IRA deduction may be reduced or eliminated entirely depending on your filing status and modified AGI as shown in Table 17-2

Filing status. Your filing status depends primarily on your marital status. For this purpose, you need to know if your filing status is single or head of household, married filing jointly or qualifying widow(er), or married filing separately. If you need more information on filing status, see chapter 2

Lived apart from spouse. If you did not live with your spouse at any time during the year and you file a separate return, your filing status, for this purpose, is single.

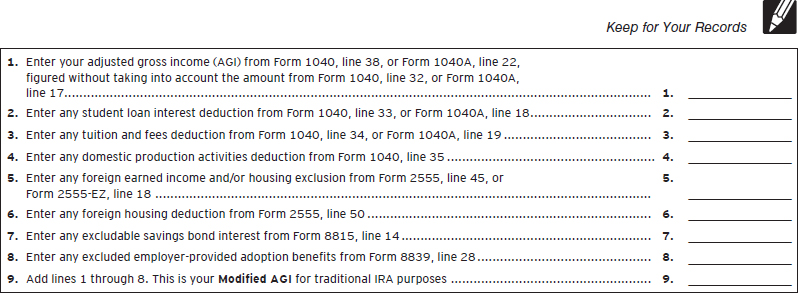

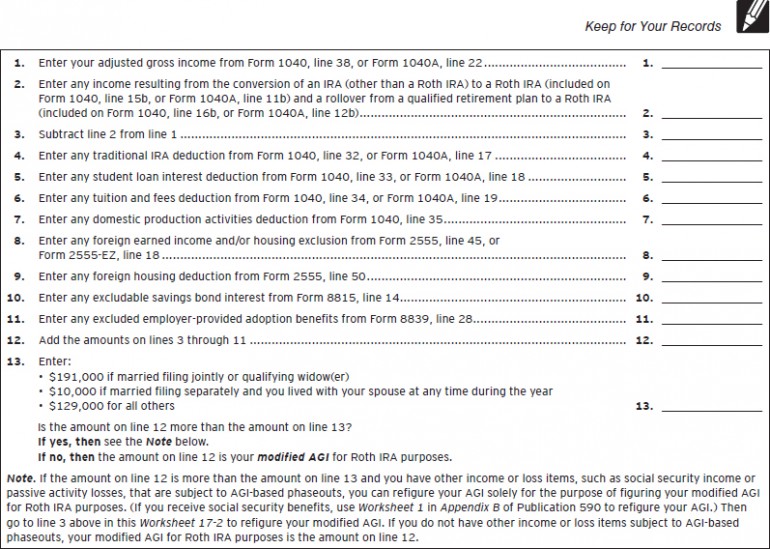

Worksheet 17-1

Use this worksheet to figure your modified adjusted gross income for traditional IRA purposes.

560 Retirement Plans for Small Business

560 Retirement Plans for Small Business 590 Individual Retirement Arrangements (IRAs)

590 Individual Retirement Arrangements (IRAs)  5329 Additional Taxes on Qualified Plans (including IRAs) and Other Tax-Favored Accounts

5329 Additional Taxes on Qualified Plans (including IRAs) and Other Tax-Favored Accounts 8606 Nondeductible IRAs

8606 Nondeductible IRAs