Chapter 22 Medical and dental expenses ey.com/EYTaxGuide

Standard mileage rate. The standard mileage rate allowed for operating expenses for a car when you use it for medical reasons is 23½ cents per mile. See Transportation under What Medical Expenses Are Includible.

This chapter will help you determine the following.

What medical expenses are. What expenses you can include this year. How much of the expenses you can deduct. Whose medical expenses you can include. What medical expenses are includible. How to treat reimbursements. How to report the deduction on your tax return. How to report impairment-related work expenses. How to report health insurance costs if you are self-employed. You may want to see:

502 Medical and Dental Expenses969 Health Savings Accounts and Other Tax-Favored Health Plans Schedule A (Form 1040) Itemized Deductions Medical expenses are the costs of diagnosis, cure, mitigation, treatment, or prevention of disease, and the costs for treatments affecting any part or function of the body. These expenses include payments for legal medical services rendered by physicians, surgeons, dentists, and other medical practitioners. They include the costs of equipment, supplies, and diagnostic devices needed for these purposes.

Medical care expenses must be primarily to alleviate or prevent a physical or mental defect or illness. They do not include expenses that are merely beneficial to general health, such as vitamins or a vacation.

Medical expenses include the premiums you pay for insurance that covers the expenses of medical care, and the amounts you pay for transportation to get medical care. Medical expenses also include amounts paid for qualified long-term care services and limited amounts paid for any qualified long-term care insurance contract.

Marijuana and other controlled substances. The IRS has ruled that the cost of marijuana or any other federally controlled substance, even if recommended by a physician in a state whose laws permit such purchase and use, is not deductible. The U.S. Supreme Court has upheld this ruling.

Sex Change Operations. The IRS previously ruled that costs for gender reassignment surgery (and related medications, treatments, and transportation) may not be deducted as medical expenses. However, in February 2010, the U.S. Tax Court held that hormone therapy and sex reassignment surgery were not merely cosmetic, but instead deductible medical expenses, thereby permitting a taxpayer’s deductions for those costs. On the other hand, the U.S. Tax Court disallowed a deduction for a taxpayer’s breast augmentation surgery, because it was cosmetic surgery directed at improving appearance, not correcting a medical problem. The ruling was a partial victory for both the taxpayer and the IRS.

Breast-Feeding Supplies. Breast pumps and other lactation supplies are now tax deductible as medical expenses. In February 2011, the IRS reversed its long-held position prohibiting a medical expense deduction for such supplies. Amounts reimbursed for these expenses under flexible spending arrangements, Archer medical savings accounts, health reimbursement arrangements, or health savings accounts are not income to the taxpayer.

You can include only the medical and dental expenses you paid this year, regardless of when the services were provided. If you pay medical expenses by check, the day you mail or deliver the check generally is the date of payment. If you use a “pay-by-phone” or “online” account to pay your medical expenses, the date reported on the statement of the financial institution showing when payment was made is the date of payment. If you use a credit card, include medical expenses you charge to your credit card in the year the charge is made, not when you actually pay the amount charged.

Timing your medical expenses. Medical expenses don’t usually lend themselves to tax planning. However, because a medical deduction is available only in the year of payment, you may be able to maximize your deduction if you can control the timing of your payment.

To determine the most beneficial year of payment, you need to assess your situation prior to the end of the year. If it is clear that your current-year medical expenses will not exceed the nondeductible floor—10% of your adjusted gross income (AGI) (or 7.5% if you or your spouse are age 65 or older by the end of the taxable year; however, for alternative minimum tax purposes, this limitation is 10% regardless of age)—try to defer payment of any medical bills until after year-end (i.e., pushing payment into the next year). You may be able to salvage a deduction next year.

If you can schedule major or minor surgery in nonemergency cases, you should compare this year’s medical deductions with what they are likely to be next year to choose the more beneficial time. It is the date of payment—not the date of surgery—that determines the year in which you may deduct the expense. Remember, putting the charge on a credit card counts as payment at that time.

If you suspect that your adjusted gross income is going to drop substantially next year, defer the payment of medical bills. However, if you think your AGI is going to skyrocket next year, pay those bills now and try to salvage a deduction.

Prepaid medical expenses generally are not deductible until the year of treatment.

Separate returns. If you and your spouse live in a noncommunity property state and file separate returns, each of you can include only the medical expenses each actually paid. Any medical expenses paid out of a joint checking account in which you and your spouse have the same interest are considered to have been paid equally by each of you, unless you can show otherwise.

Community property states. If you and your spouse live in a community property state and file separate returns, or are registered domestic partners in Nevada, Washington, or California, any medical expenses paid out of community funds are divided equally. Each of you should include half the expenses. If medical expenses are paid out of the separate funds of one individual, only the individual who paid the medical expenses can include them. If you live in a community property state, and are not filing a joint return, see Publication 555, Community Property.

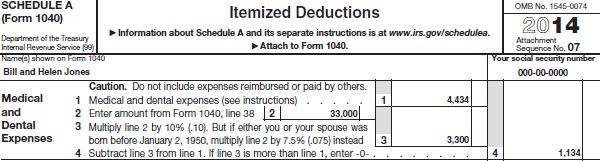

Generally, you can deduct on Schedule A (Form 1040) only the amount of your medical and dental expenses that is more than 10% of your AGI Form 1040, line 38).

Example. You are unmarried and under age 65 and your AGI is $40,000, 10% of which is $4,000. You paid medical expenses of $2,500. You cannot deduct any of your medical expenses because they are not more than 10% of your AGI.

For 2014 through 2016, taxpayers under age 65 are only allowed to deduct medical and dental expenses that are more than 10% of adjusted gross income (AGI). The 7.5% limit will continue to apply for taxpayers age 65 and over. (For alternative minimum tax (AMT) purposes, however, medical expenses are deductible only to the extent that they exceed 10% of AGI, regardless of your age.) Beginning in 2017, the medical and dental expenses for all taxpayers is scheduled to be increased to a 10% limit.

Example 1. In 2014, you are 35 years old and your AGI is $40,000; 10% of which is $4,000. You paid medical expenses of $3,500. You cannot deduct any of your medical expenses because they are not more than 10% of your AGI.

Example 2. In 2014, you are 70 years old and your AGI is $40,000; 7.5% of which is $3,000. You paid medical expenses of $3,500. You can deduct $500 of medical expenses.

Example 3. You were born December 1, 1950. Since you will be under age 65 during all of 2014, you will be subject to the 10% of AGI limit. If your AGI is $40,000—10% of which is $4,000—and you paid $3,500 in medical expenses, you cannot deduct any of your medical expenses. Since you will reach age 65 during 2015, you in turn will be subject to the lower 7.5% limit on AGI for 2015 and 2016. If your AGI is $40,000—7.5% of which is $3,000—and you paid $3,500 in medical expenses, you can deduct $500 for medical expenses in 2015. Beginning in 2017, the 10% limit on AGI applies to you, regardless of age.

Example 4. You were born December 1, 1950, your spouse was born July 1, 1949, and you file a joint return. Since your spouse will turn age 65 during 2014, your combined medical and dental expenses are subject to the 7.5% of AGI limit through the end of 2016. Beginning in 2017, the 10% of AGI limit applies to you both regardless of your ages.

You can generally include medical expenses you pay for yourself, as well as those you pay for someone who was your spouse or your dependent either when the services were provided or when you paid for them. There are different rules for decedents and for individuals who are the subject of multiple support agreements. See Support claimed under a multiple support agreement

You can include medical expenses you paid for yourself.

You can include medical expenses you paid for your spouse. To include these expenses, you must have been married either at the time your spouse received the medical services or at the time you paid the medical expenses.

Example 1. Mary received medical treatment before she married Bill. Bill paid for the treatment after they married. Bill can include these expenses in figuring his medical expense deduction even if Bill and Mary file separate returns.

If Mary had paid the expenses, Bill could not include Mary’s expenses in his separate return. Mary would include the amounts she paid during the year in her separate return. If they filed a joint return, the medical expenses both paid during the year would be used to figure their medical expense deduction.

Example 2. This year, John paid medical expenses for his wife Louise, who died last year. John married Belle this year and they file a joint return. Because John was married to Louise when she received the medical services, he can include those expenses in figuring his medical expense deduction for this year.

You can include medical expenses you paid for your dependent. For you to include these expenses, the person must have been your dependent either at the time the medical services were provided or at the time you paid the expenses. A person generally qualifies as your dependent for purposes of the medical expense deduction if both of the following requirements are met.

The person was a qualifying child (defined later) or a qualifying relative (defined later), and The person was a U.S. citizen or national, or a resident of the United States, Canada, or Mexico. If your qualifying child was adopted, see Exception for adopted child , next. You can include medical expenses you paid for an individual that would have been your dependent except that:

He or she received gross income of $3,950 or more in 2014, He or she filed a joint return for 2014, or You, or your spouse if filing jointly, could be claimed as a dependent on someone else’s 2014 return. Exception for adopted child. If you are a U.S. citizen or U.S. national and your adopted child lived with you as a member of your household for 2014, that child does not have to be a U.S. citizen or national or a resident of the United States, Canada, or Mexico.

A qualifying child is a child who:

Is your son, daughter, stepchild, foster child, brother, sister, stepbrother, stepsister, half brother, half sister, or a descendant of any of them (for example, your grandchild, niece, or nephew), Was:Under age 19 at the end of 2014 and younger than you (or your spouse, if filing jointly), Under age 24 at the end of 2014, a full-time student, and younger than you (or your spouse, if filing jointly), or Any age and permanently and totally disabled, Lived with you for more than half of 2014, Did not provide over half of his or her own support for 2014, and Did not file a joint return, or, if he or she did, it was only to claim a refund. Adopted child. A legally adopted child is treated as your own child. This includes a child lawfully placed with you for legal adoption.

You can include medical expenses that you paid for a child before adoption if the child qualified as your dependent when the medical services were provided or when the expenses were paid.

If you pay back an adoption agency or other persons for medical expenses they paid under an agreement with you, you are treated as having paid those expenses provided you clearly substantiate that the payment is directly attributable to the medical care of the child.

But if you pay the agency or other person for medical care that was provided and paid for before adoption negotiations began, you cannot include them as medical expenses.

Child of divorced or separated parents. For purposes of the medical and dental expenses deduction, a child of divorced or separated parents can be treated as a dependent of both parents. Each parent can include the medical expenses he or she pays for the child, even if the other parent claims the child’s dependency exemption, if:

The child is in the custody of one or both parents for more than half the year, The child receives over half of his or her support during the year from his or her parents, and The child’s parents:Are divorced or legally separated under a decree of divorce or separate maintenance, Are separated under a written separation agreement, or Live apart at all times during the last 6 months of the year. This does not apply if the child’s exemption is being claimed under a multiple support agreement (discussed later).

A qualifying relative is a person:

Who is your:Son, daughter, stepchild, foster child, or a descendant of any of them (for example, your grandchild), Brother, sister, half brother, half sister, or a son or daughter of either of them, Father, mother, or an ancestor or sibling of either of them (for example, your grandmother, grandfather, aunt, or uncle), Stepbrother, stepsister, stepfather, stepmother, son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law, or sister-in-law, or Any other person (other than your spouse) who lived with you all year as a member of your household if your relationship did not violate local law, Who was not a qualifying child (see Qualifying Child earlier) of any other person for 2014, and For whom you provided over half of the support in 2014. But see Child of divorced or separated parents , earlier, and Support claimed under a multiple support agreement , next. Support claimed under a multiple support agreement. If you are considered to have provided more than half of a qualifying relative’s support under a multiple support agreement, you can include medical expenses you pay for that person. A multiple support agreement is used when two or more people provide more than half of a person’s support, but no one alone provides more than half.

Any medical expenses paid by others who joined you in the agreement cannot be included as medical expenses by anyone. However, you can include the entire unreimbursed amount you paid for medical expenses.

Example. You and your three brothers each provide one-fourth of your mother’s total support. Under a multiple support agreement, you treat your mother as your dependent. You paid all of her medical expenses. Your brothers reimbursed you for three-fourths of these expenses. In figuring your medical expense deduction, you can include only one-fourth of your mother’s medical expenses. Your brothers cannot include any part of the expenses. However, if you and your brothers share the nonmedical support items and you separately pay all of your mother’s medical expenses, you can include the unreimbursed amount you paid for her medical expenses in your medical expenses.

Medical expenses paid before death by the decedent are included in figuring any deduction for medical and dental expenses on the decedent’s final income tax return. This includes expenses for the decedent’s spouse and dependents as well as for the decedent.

The survivor or personal representative of a decedent can choose to treat certain expenses paid by the decedent’s estate for the decedent’s medical care as paid by the decedent at the time the medical services were provided. The expenses must be paid within the 1-year period beginning with the day after the date of death. If you are the survivor or personal representative making this choice, you must attach a statement to the decedent’s Form 1040 (or the decedent’s amended return, Form 1040X) saying that the expenses have not been and will not be claimed on the estate tax return.

Only gold members can continue reading.

Log In or

Register to continue

502 Medical and Dental Expenses

502 Medical and Dental Expenses 969 Health Savings Accounts and Other Tax-Favored Health Plans

969 Health Savings Accounts and Other Tax-Favored Health Plans  Schedule A (Form 1040) Itemized Deductions

Schedule A (Form 1040) Itemized Deductions