Chapter 40 What to do if you employ domestic help ey.com/EYTaxGuide

If you have a domestic helper who qualifies as your employee, you may have to pay social security and Medicare taxes, as well as federal and state unemployment taxes. You may also have to withhold federal income tax. In general, a person who works in or around your house qualifies as your employee if you control his or her working conditions—pay, work schedule, conduct, and appearance. This chapter spells out what federal tax rules govern domestic help and advises you on how to comply with them.

Both you and your employee are subject to social security and Medicare taxes (together known as FICA) if you pay your employee $1,900 or more during any calendar year. If you have paid any employee $1,000 or more in any calendar quarter during the current or preceding year, you are also subject to federal unemployment taxes (called FUTA) on every employee during the current year.

Your employee may ask you to withhold federal income tax from compensation. If you agree, you must withhold the proper amount from each paycheck. This withholding must be remitted to the IRS at specified intervals.

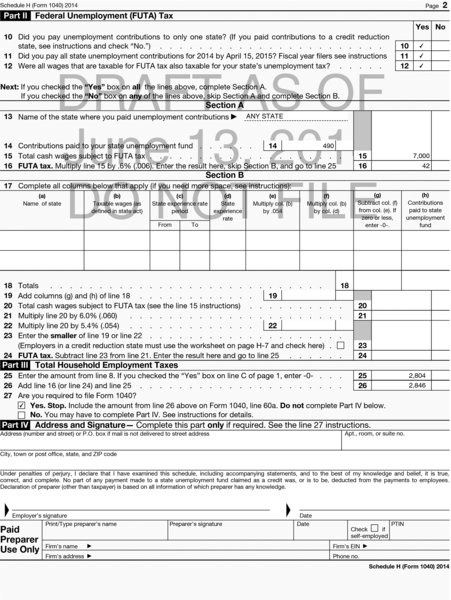

Use Schedule H (Form 1040) to compute federal taxes for your household employees and attach it to your personal income tax return.

If you pay your income taxes late, you may owe penalties and interest on the taxes described in this chapter as well as on your personal income taxes.

This chapter only discusses the federal taxes applying to household employees. There may be additional taxes due depending on the state and city where the services are performed.

You may also be subject to federal and/or state rules regarding employees’ pay and benefits. For example, state laws may dictate the maximum number of hours an employee may work, the amount to be paid for overtime, and/or the number of days of paid vacation and holidays to which the employee is entitled.

Even if your domestic employee does not have legal authorization to work in the United States, you are still liable for the payroll taxes discussed in this chapter.

Table 40-1

You may need to do the following things when you have a household employee.

When you hire a household employee: Find out if the person can legally work in the United States. Find out if you need to pay state taxes. When you pay your household employee: Withhold social security and Medicare taxes. Withhold federal income tax. Decide how you will make tax payments. Keep records. By February 2, 2015: Get an employer identification number (EIN). Give your employee Copies B, C, and 2 of Form W-2, Wage and Tax Statement. By March 2, 2015 (March 31, 2015, if you file Form W-2 electronically): Send Copy A of Form W-2 to the Social Security Administration (SSA). By April 15, 2015: File Schedule H (Form 1040), Household Employment Taxes, with your 2014 federal income tax return (Form 1040, 1040NR, 1040-SS, or Form 1041). If you do not have to file a return, file Schedule H by itself.

Paying employment taxes. In most cases, you are required to collect and remit social security and Medicare taxes on wages paid to your domestic employee(s). Fortunately, the federal government allows you to make these payments along with your personal income tax payments—either through withholding or estimated taxes. You file Schedule H with your Form 1040 to report these amounts.

Are your employees working legally in the U. S.? Federal law requires you to verify that your new employees are eligible to work in the United States. You and your employee must complete USCIS (U.S. Citizenship and Immigration Services) Form I-9, Employment Eligibility Verification, and you should keep it for three years from the date of hire or one year from termination of employment, whichever is later. You can get Form I-9 at www.uscis.gov

Federal employer identification number. If you employ someone to work in your home, you should apply for a federal employer identification number (EIN) to use when you file required forms. You can file for an EIN online. Go to www.irs.gov Employer Identification Number

Social security and Medicare wage threshold is $1,900. The social security and Medicare wage threshold for household employees is $1,900 for 2014. This means that if you pay a household employee cash wages of less than $1,900 in 2014, you do not have to report and pay social security and Medicare taxes on that employee’s 2014 wages. For more information, see Social Security and Medicare Wages in Publication 926, Household Employer’s Guide (For Wages Paid in 2014) .

If you pay someone to come to your home and care for it, your dependent, or your spouse, you may be a household employer. If you are a household employer, you will need an employer identification number (EIN) and you may have to pay employment taxes. If the individuals who work in your home are self-employed, you are not liable for any of the taxes discussed in this section. Self-employed persons who are in business for themselves are not household employees. Usually, you are not a household employer if the person who cares for your dependent or spouse does so at his or her home or place of business.

Employees under the age of 18 at any time during the year are exempt from social security and Medicare taxes, regardless of how much they earn, provided household services are not their main job. If the employee is a student, providing household services is not considered to be his or her principal occupation.

Paying the “nanny” tax. Employers are required to report the social security, Medicare, and federal unemployment taxes due on domestic workers’ wages on the employers’ Form 1040, Schedule H. The taxes can be paid through the employers’ estimated tax payments. Alternatively, the employer could increase federal withholding on his or her own wages and pay these taxes on the domestic worker in that manner.

If you use a placement agency that exercises control over what work is done and how it will be done by a babysitter or companion who works in your home, that person is not your employee. This control could include providing rules of conduct and appearance and requiring regular reports. In this case, you do not have to pay employment taxes. But, if an agency merely gives you a list of sitters and you hire one from that list, the sitter may be your employee.

If you have a household employee you may be subject to:

Social security and Medicare taxes, Federal unemployment tax, and Federal income tax withholding. Social security and Medicare taxes are generally withheld from the employee’s pay and matched by the employer. Federal unemployment (FUTA) tax is paid by the employer only and provides for payments of unemployment compensation to workers who have lost their jobs. Federal income tax is withheld from the employee’s total pay if the employee asks you to do so and you agree.

For more information on a household employer’s tax responsibilities, see Publication 926 and Schedule H (Form 1040) and its instructions.

State employment tax. You may also have to pay state unemployment tax. Contact your state unemployment tax office for information. You should also find out whether you need to pay or collect other state employment taxes or carry workers’ compensation and/or disability insurance. For a list of state unemployment tax agencies, visit the U.S. Department of Labor’s website at www.workforcesecurity.doleta.gov/unemploy/agencies.asp

You may be able to claim a child and dependent care credit for the expenses you incur for domestic help. See chapter 33 Child and dependent care credit , for more information.

Janice is single and works to keep up a home for herself and her dependent father. Her adjusted gross income of $25,000 is entirely earned income. Her father was disabled and incapable of self-care for 6 months. To keep working, she paid a housekeeper $600 per month to care for her father, prepare lunch and dinner, and do housework. Her credit is as follows:

Total work-related expenses (6 × $600) $3,600 Maximum allowable expenses $3,000 Amount of credit (30% of $3,000) $ 900

Employee or independent contractor? Whether or not a person who provides services in and around your house is your employee depends on the facts and circumstances of the situation. In general, a person is your employee if you control his or her working conditions and compensation. A person does not have to work for you full time to qualify as your employee.

Generally, workers are classified based on how they perform their work and their accountability for it. By definition, independent contractors are responsible for results, not how their tasks are accomplished. On the other hand, individuals who are instructed as to when, where, and how to complete their jobs would probably be considered employees. If you determine that your domestic helpers are employees, you must withhold and match social security and Medicare payments and may be subject to paying federal and state unemployment taxes as well.

To gain a better understanding of the distinction between an independent contractor and an employee, consider the person who mows your lawn. If the person works for an independent lawn service and is supervised by the lawn company that also provides its own equipment—all you provide is the grass—there’s little question that the provider is an independent contractor. However, if a college student cuts your lawn using your mower, and you give specific instructions as to how and when to do the job, he or she will be considered your employee.

To enable you to determine whether a person is indeed an independent contractor, there are certain common indicators that can help. An independent contractor:

Works for several homeowners Provides his or her own tools and supplies to perform the job Can bring in additional help if he or she deems necessary Determines how the results will be accomplished Is paid by the job, not by the hour Advertises his or her services May be fired at will Can set his or her own hours and leave when the job is completed If you have reason to believe that a person is an independent contractor and not your employee, you should not withhold social security tax from his or her compensation. You may want to get a signed letter from this person indicating that he or she is an independent contractor and is responsible for his or her own employment taxes.

Records you need. When you hire a household employee, make a record of that person’s name and social security number exactly as it appears on his or her social security card. You will need this information when you remit social security, Medicare, federal unemployment, and withholding of federal income taxes.

An employee who does not have a social security number should apply for one using Form SS-5, Application for a Social Security Card. This form is available at all Social Security Administration offices, or on the Social Security Administration website at www.socialsecurity.gov/online/ss-5.pdf

If your employee is not eligible to obtain a social security number, he or she may obtain an individual taxpayer identification number (ITIN) by filing Form W-7 with the IRS. The ITIN can be used on a tax return wherever a social security number should be used. You should note that the ITIN is for IRS records only. It does not change the employee’s status with the USCIS or his or her entitlement to social security or other employment benefits.

Employer identification number (EIN).

Only gold members can continue reading.

Log In or

Register to continue