Trust Formation: The Beneficiary Principle

Chapter 6

Trust Formation: The Beneficiary Principle

Chapter Contents

Definition of the Beneficiary Principle

Exceptions to the Beneficiary Principle

As You Read

As you read, focus on the following:

the definition of the beneficiary principle: the central idea That English law prefers trusts to be for the benefit of an ascertained or ascertainable beneficiary rather than for a defined purpose;

the definition of the beneficiary principle: the central idea That English law prefers trusts to be for the benefit of an ascertained or ascertainable beneficiary rather than for a defined purpose;

how the beneficiary principle links in to the other requirements needed to declare an express trust; and

how the beneficiary principle links in to the other requirements needed to declare an express trust; and

exceptions to the beneficiary principle: what they entail, how they apply and their relevance to today’s world.

exceptions to the beneficiary principle: what they entail, how they apply and their relevance to today’s world.

Definition of the Beneficiary Principle

The beneficiary principle is the concept that a private, express trust must be for the benefit of a beneficiary who the trustees can either ascertain or is at least ascertainable. In practical terms, this means that the settlor must settle property on trust for the benefit of an individual or individuals (or, on some occasions, a company1) who are sufficiently well defined so that the trustees can understand the identity of the people for whom they are administering the trust.

This requirement can be contrasted with a trust being set up to pursue a purpose. English law traditionally frowns upon trusts being for the benefit of a purpose. As a general rule, a trust set up for a purpose instead of ascertained or ascertainable beneficiaries will be void. These principles can be illustrated by Re Astors Settlement Trusts.2

Viscount Astor purported to declare a trust in February 1945 of most of the issued shares in The Observer Limited, a company owning a national newspaper. The trust provided that the shares were to be held for a number of purposes including, for instance, ‘the establishment, maintenance and improvement of good understanding sympathy and co-operation between nations’ and ‘the preservation of the independence and integrity of newspapers’. Crucially, the trust was only established for purposes and it was not possible to say that any human beneficiary would directly benefit from the trust.

Roxburgh J held that the trust was void since there was no human beneficiary who could benefit from the trust. He relied on the earlier leading case of Bowman v Secular Society Ltd3 in which Lord Parker had said:4

A trust to be valid must be for the benefit of individuals … or must be in that class of gifts for the benefit of the public which the courts in this country recognize as charitable in the legal as opposed to popular sense of that term.

Roxburgh J examined the reasoning behind Lord Parker’s statement. He pointed out that at the heart of a trust was a series of equitable rights that a beneficiary enjoyed. These equitable rights had been ‘hammered out’5 in litigated cases over many years. Taken as a whole, the people who enjoyed the equitable rights under a trust — the beneficiaries — had the ability to enforce them against the trustees if the trustees refused to honour these rights voluntarily. Human beneficiaries could take court action against recalcitrant trustees. Roxburgh J confirmed that a trust required that there had to be a physical person who was a beneficiary and who could, if necessary, take such court action against the trustees to enjoy their equitable rights. Trusts for purposes, as Viscount Astor had declared, gave rise to no single individual enjoying equitable rights which meant there was no human person who had the right to take court action against the trustees if they failed in their duties as trustees.

EXPLAINING THE LAW EXPLAINING THE LAW |

Suppose Scott settles £100,000 on trust. He appoints Thomas as his trustee. Scott provides in the declaration of trust that he wants the money to be invested by Thomas and the proceeds to be used each year for the development of world peace.

No doubt this is a worthwhile purpose, but such a trust would be void since it infringes the beneficiary principle. Suppose Thomas refused to invest the money according to Scott’s wishes. Who would then enforce the trust against him? There is no-one to do so because there is no human beneficiary who could take court action against him. Remember that, as settlor, Scott cannot take action against the trustee for breach of trust because the settlor (unless he has expressly reserved such a power to himself in the trust documentation) has no involvement in the trust once it has been established.

Rationale of the beneficiary principle

The main reason behind the requirement that a trust should have a human beneficiary benefiting from it has been shown in the examination of the judgment of Roxburgh J in Re Astors Settlement Trusts.6 His view, echoing that of Lord Parker in Barlow v Secular Society Ltd,7 reaffirmed the long-established position set out in Morice v Bishop of Durham8 that, as far as a trust was concerned, ‘[t]here must be somebody, in whose favour the court can decree performance’.

In this sense, equity is acting with a mixture of both pragmatism and pre-planning. Equity realises that not all trustees may act in the best interests of the beneficiaries but they may instead act to benefit themselves. For example, some trustees may simply fail in their obligations towards the trust by, for example, failing to take proper advice before investing trust money. If the trustees fail in their duties towards the trust, regardless of whether the trustees themselves benefit personally from their failings, there has to be someone who can take action against them. That person cannot be the settlor for, as we have seen, the settlor generally steps out of the trust once he has set it up. By almost a process of elimination, the only person left in the relationship to ensure that the trustees keep to the right track is the beneficiary. There is no-one else to take action against the trustees: for example, the court will not of its own instigation take action; neither is there an officer of the government whose job it is to hold trustees of private trusts accountable.

English law, therefore, embodies the idea that there must be someone who can take action against the trustees into one of the ingredients required to declare a trust: the beneficiary principle. The corollary of the principle, as illustrated by the facts of Re Astors Settlement Trusts, is that English law does not like trusts for purposes as a general concept.

There is a second reason for the law of trusts embodying the beneficiary principle. It is more of a legalistic reason. In Chapter 2 you saw how the concept of a trust involves split ownership: that the trustee holds the legal title to the property and the beneficiary enjoys the equitable interest. An equitable interest will, therefore, always exist in a trust. There must be someone who can enjoy that equitable interest as it cannot exist without it attaching to a beneficiary. An equitable interest cannot simply ‘float’ around without being owned because, of course, equity abhors a vacuum. The beneficiary principle, therefore, ensures that someone owns the equitable interest in the property of the trust. It is possible to see this second reason as being tied to the same underlying principle as certainty of object that was considered in Chapter 5. At their heart, both concepts require a beneficiary to be present in a valid trust.

The third reason given for the existence of the beneficiary principle is related to the rules against perpetuity.9 The rule against perpetuity which is relevant here is the rule against inalienability. This provides that the capital of the trust must reach the beneficiaries for them to enjoy at some point in the future. The idea behind this rule is that a trust must come to an end at some point. If the trust does not come to an end within the time period contemplated by this rule, it will be void for offending the rule against inalienability.

Trusts which do not have any identifiable beneficiaries but are instead for a purpose offend the rule against inalienability. This is because a purpose may well last forever, which will require the money to be reinvested time and again. As such, the money is tied up for the purpose instead of being available in the wider economy. The beneficiary principle thus supports the rule against inalienability by ensuring that there should be an identifiable beneficiary who will eventually take the legal title in the trust property and use the trust property in the wider economy.

Exceptions to the Beneficiary Principle

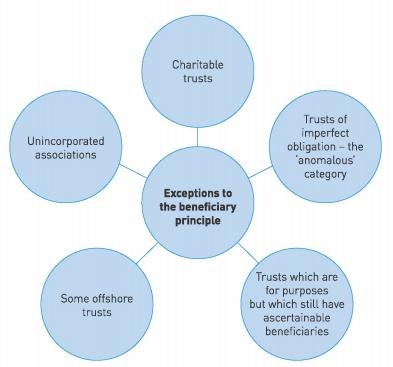

The general rule is that there must be a human beneficiary for there to be a valid declaration of trust. However, for almost every rule there is an exception. There are five main exceptions, see Figure 6.1.

Charitable trusts

Charitable trusts are a major topic of the law of trusts in their own right and are considered separately in Chapter 15.

There are two key requirements for a trust to be charitable under the Charities Act 2011:

[a] there must be a charitable purpose as defined under s 3(1) of that Act; and

[b] the charity must be able to demonstrate, through its activities, a sufficient benefit to the public or a section of it, under s 2(1)(b ) of the Act.

Most trusts which meet these requirements of charitable status do not, of course, have defined human beneficiaries and some, at first glance, do not directly benefit humans at all.

APPLYING THE LAW APPLYING THE LAW |

Consider some of the most well-known charities in England and Wales such as the Royal Society for the Prevention of Cruelty to Animals (RSPCA), Barnardo’s or Cancer Research UK.

It cannot be said that any of these charitable trusts have defined human beneficiaries. Instead, they exist to benefit society as a whole through their daily activities.

Yet such trusts are permitted to exist and, in addition, can be granted charitable status which, as will become apparent,10 enables them to enjoy significant tax-saving advantages.

The reasons why such trusts are permitted even though they infringe the beneficiary principle are two-fold:

[b] The main reason underpinning the beneficiary principle is that there has to be somebody who can, if needed, take legal action to force the trustees to honour their obligations in administering the trust correctly. As far as charities are concerned, a separate mechanism exists to ensure that charitable trustees administer their charitable trust correctly. The Charity Commission is the relevant body responsible for overseeing charities and, if action is required to be taken against a charity’s trustees, such action is taken by the Attorney-General, one of the government’s legal officers. The Attorney-General acts on behalf of the Crown, whose overall responsibility it is to ensure that property belonging to a charity is administered correctly.

Trusts of imperfect obligation

A trust of an imperfect obligation is a trust which has no defined human beneficiary and which would, at first glance, appear to infringe the beneficiary principle since such a trust is for a purpose. These trusts are permitted to exist. They are an ‘anomalous’ 11 category of trusts which may, albeit sometimes quite loosely, benefit the public in some way. The reason why such purpose trusts are permitted to exist has not been fully explained judicially. In Re Astors Settlement Trusts,12 Roxburgh J acknowledged that the explanation put forward by the well-regarded academic Sir Arthur Underhill that such trusts were judicial ‘concessions to human weakness or sentiment’ 13 may well be correct. In addition, these types of trust are usually of small enough scope to be able to be controlled by the court if necessary.

Such trusts fall into three main categories:

[a] trusts relating to tombs and monuments;

[b] trusts for the provision of masses in private; and

[c] trusts benefiting a specific animal.

These purpose trusts are trusts which still, however, need to meet the other requirements to form a valid express trust. So they must comply with any requirements of formality, adhere to the principles of certainty and meet the rules against perpetuity. It would seem that the only requirement which is relaxed in their favour is the need to have a human beneficiary benefiting from the trust.

Trusts relating to tombs and monuments

These types of trust arise where property is left on trust with the purpose of providing for the establishment and/or upkeep of specific memorials in churches.

In Re Hooper,14 Harry Hooper left £1,000 on trust for trustees to invest and use the income for four purposes:

[a] the upkeep of his parents’ grave in Torquay cemetery;

[b] the upkeep of a vault and monument, also in Torquay cemetery, in which his wife and daughter were buried;

[c] the upkeep of a grave and monument in a churchyard near Ipswich in which his son was buried; and

[d] the care of a tablet and a window in a church at Ilsham, which were devoted to the memories of some of his family members.

The issue for the High Court was whether this trust was valid. Clearly, there could be no defined human beneficiaries of the trust, as all the people to whom the trust referred had already predeceased Mr Hooper.

Maugham J held that the trust overall was valid. In a short judgment, the reasoning why the trust was valid was not especially detailed. He followed an earlier High Court decision15 which had reached the same result and Maugham J was guided by matters of pragmatism:

The case does not appear to have attracted much attention in text-books, but it does not appear to have been commented upon adversely, and I shall follow it.16

The fourth part of the trust was, however, held to be charitable. Again, there is no explanation given by Maugham J but it may be presumed that he felt that it was for a valid charitable purpose (presumably for the advancement of religion) and could be said to benefit a section of the public through their enjoyment of viewing the tablet and the window in the church.

This latter part of the decision illustrates that the courts prefer, if possible, not to recognise valid trusts of imperfect obligation, but instead hold them to be valid charitable trusts. Indeed, the courts have no wish to extend these categories of purpose trust and prefer to keep them within narrow confines as illustrated by Re Endacott.17

In this case, Albert Endacott wrote his will in which he left his residuary estate (worth approximately £20,000) to North Tawton Devon Parish Council for them to provide ‘some useful memorial to myself’.The Court of Appeal held that the obligatory nature of Mr Endacott’s bequest meant that a trust had been created. The issue was whether such a trust could be valid given that there was no human beneficiary who could enforce the trust. It was clearly a trust for a purpose.

The Court of Appeal held that the trust could not be valid. It was a type of trust which left far too much open to be decided in the future. No-one could police this type of trust over what the North Tawton Devon Parish Council chose to spend the money on.

Lord Evershed MR believed that the categories of trusts of imperfect obligation ought not to be extended in the future. A cardinal principle in English law was that a trust required an ascertained or ascertainable beneficiary to enforce it. Trusts of imperfect obligation were an exception to that requirement but, as an exception, they had to be kept within narrow confines. Harman LJ went further, saying that all categories of trusts of imperfect obligation:

stand by themselves and ought not to be increased in number, nor indeed followed, except where the one is exactly like another.18

He summed up his true feelings on cases of trusts of imperfect obligation, calling them ‘troublesome, anomalous and aberrant’.19

The decision also illustrates that the courts will have little sympathy for purpose trusts of a capricious nature.

It appears, then, that trusts involving the establishment or upkeep of memorials will be permitted, but only when such trusts are well defined so that they can be said to be managed by the court if necessary. Widely drafted trusts involving awarding the recipient a great deal of discretion over the type of memorial to be established will not be permitted.

Trusts for the provision of Masses in private

This second type of trust of imperfect obligation is based upon a particular type of ceremony in the Catholic Church: the Mass.

Typically, a settlor will set up a trust in which money is left to the Catholic Church which helps to meet the additional costs of a priest being available to conduct a separate Mass for the soul(s) of the person named in the trust. The souls who are usually mentioned in the trust are those of the settlor’s spouse, family and friends and perhaps the settlor themselves. These types of trust are usually created in the settlor’s will and so only take effect on the settlor’s death. There is no living beneficiary who would be able, if necessary, to enforce the trust. This is a further example of a trust for a purpose: the purpose being to pray for the souls mentioned in the trust.

That this type of trust could exist as a trust of imperfect obligation was decided by the House of Lords in Bourne v Keane.20 This area had been wrapped up in the historical development of the Church of England in its break-away from the Catholic Church. Previous case law, espe-cially West v Shuttleworth,21 had decided that leaving property to the Roman Catholic Church to pay for a priest to say Masses constituted a ‘superstitious use’ which was not permitted under the preamble to the Chantries Act 1547. By way of departure from this previous jurisprudence, the House of Lords in Bourne v Keane decided that the Chantries Act 1547 had not been enacted with the intention to prevent property being left for such masses to be said.

In the case itself, Edward Egan made a will in which he left £200 to Westminster Cathedral and his residuary estate to the Jesuit Fathers. In both instances, the money was left for Masses to be said.

The House of Lords held that such gifts were valid. As Lord Birkenhead LC pointed out, gifts to the Catholic Church to build a new church or provide for an altar in an existing church had long been held to be valid (albeit as valid charitable gifts). He said that it would be an ‘absurdity’ if:

a Roman Catholic citizen of this country may legally endow an altar for the Roman Catholic community, but may not provide funds for the administration of that sacra-ment which is fundamental in the belief of Roman Catholics, and without which the church and the altar would alike be useless.22

A more recent case which has considered this issue is Re Hetherington.23 The case concerned the will of Margaret Hetherington. She was described as a ‘devout Roman Catholic’,24 so it was not surprising that she desired to benefit the Catholic Church in her will. Two clauses of her will are relevant here. First, she left £2,000 to the Roman Catholic Church Bishop of Westminster ‘for the repose of the souls of my husband and my parents and my sisters and also myself when I die’. Second, she left her residuary estate to the Roman Catholic Church St Edward’s Golders Green ‘for Masses for my soul’. The issue for the High Court was whether such provisions in the will could validly take effect as trusts of imperfect obligation.

Sir Nicolas Browne-Wilkinson, V-C, held that the provisions of Mrs Hetherington’s will could take effect as valid charitable trusts. They were plainly for the benefit of religion. In addi-tion, there was nothing in the will which provided the Masses had to be said in private. Where a gift for the benefit of religion could be celebrated either privately or publicly, the Vice-Chancellor followed the earlier decisions in Re White25 and Re Banfield26 and held that the service should be carried out in public. Through attending the service, members of the public could benefit from the spiritual nature of the religious rite. This public benefit meant that Mrs Hetherington’s trusts could be seen to be of a charitable nature and were valid on this basis.

The decision again illustrates the reluctance of the courts in modern times to find examples of trusts of imperfect obligation. Sir Nicolas Browne-Wilkinson again referred to trusts of imperfect obligation as ‘trusts of the anomalous class’27 which suggests he had little appetite to keep this category of trust alive by adding further examples to it. On the facts, it was not necessary to hold that Mrs Hetherington’s were further examples of trusts of imperfect obligation and the Vice-Chancellor instead preferred to recognise the trusts as examples of more soundly-established charitable trusts.

ANALYSING THE LAW ANALYSING THE LAW |

Think about whether the decision in Re Hetherington, to prefer the trust as being of a charitable nature, is necessarily consistent with the House of Lords decision in Bourne v Keane. Whilst the House of Lords did not extensively consider the issue of whether Edward Egan’s gift could have charitable status, Lord Buckmaster did appear to rule out that possibility when he said that ‘[i]n the present case, no general charitable intention is disclosed’.

The Vice-Chancellor in Re Hetherington held that where the trust was silent on whether the Masses could be said in public or in private, they should be said in public since this would provide sufficient benefit on members of the public who attended to mean that the trust could have charitable status.

Yet the facts in neither case suggested that the settlor had made any express intention clear as to whether the Masses were to be said in public or private.

The House of Lords in Bourne v Keane appears to have assumed that the Masses were to be said in private and that there was no public benefit to be attained from the services. At the very least, the decision in Re Hetherington stretches the settlor’s intentions by providing that the Masses can be said in public where the settlor has not provided that the service must be held in private. Lord Buckmaster in Bourne v Keane had presumably thought that such a development was not a possibility on the facts before him.

Trusts to benefit a specific animal

Trusts established to benefit animals in general (e.g. the RSPCA) will usually have charitable status as enhancing animal welfare is a charitable purpose under s 3(1)(k) of the Charities Act 2011. Public benefit in protecting animals was explained by Swinfen Eady LJ in Re Wedgwood28 in that such a trust:

tends to promote and encourage kindness towards [animals], to discourage cruelty … and thus to stimulate humane and generous sentiments in man towards the lower animals, and by these means promote feelings of humanity and morality generally, repress brutality, and thus elevate the human race.29

Trusts set up to benefit only one particular type of animal — for example, the Royal Society for the Protection of Birds — are usually considered charitable too for the same reasons.

The category of trust considered here is that which is established to protect the settlor’s personal animals. These trusts cannot be charitable as they do not benefit the public but rather just the settlor. Such trusts were recognised as valid trusts of imperfect obligation in Re Dean.30

Mr William Dean was an animal lover. He provided in his will that his freehold land should be held on trust. It was to be subjected to an annual sum of £750 being taken out of the income from it and given to his trustees so that they would have sufficient money to be able to look after his eight horses and his dogs. The trust was to last for 50 years from his death.