9 MISREPRESENTATION

CHAPTER 9

MISREPRESENTATION

INTRODUCTION

So far in this book we have looked at the big ideas which underpin the modern law of contract and then moved on to look at the doctrines, rules and ideas which govern the way we look at formation. Determining when the parties became legally obliged to each other and the detail of how they are bound is crucial and a point we shall return to again and again. The main reason litigation will commence about a contract is where a breach of contract is alleged. We cannot determine whether there has been a breach unless we understand what the parties have agreed. If one of the parties claims there has been a mistake during formation, we cannot determine the validity of their claim unless we determine what it is that each of the parties assumed about performance as they entered into the agreement.

In this section of the book we look at an umber of problems which relate to formation which may allow one of the parties to have the contract set aside or to claim an extra-contractual remedy. Some of this behaviour is termed bargaining naughtiness and you will discover that many of the cases we turn to involve fraudsters. But in other instances agreement is defective because innocent misunderstandings have arisen or because one of the parties has been reckless in what they said. The main doctrines with which we are concerned here are those relating to misrepresentation, mistake, duress and unconscionability. These are all doctrines which operate in the ‘twilight zone’ of the law of contract.

MISREPRESENTATION AND PRE-CONTRACTUAL NEGOTIATIONS

During the course of pre-contractual negotiations people tend to make a variety of representations to each other. These might include comments about the condition of the thing being negotiated about, the standard of a service, the special characteristics of an item, and the price and method of payment. This is particularly the case in the business community where negotiations may be protracted. Many of these representations are sufficiently important that they will eventually become terms of the contract concluded between the parties. But it is also the case that negotiations break down or the parties do not expect all their statements to become contractual promises. This chapter focuses on whether negotiating parties can be found liable for the representations made before a contract is formed which do not become part of the contract.

In the previous chapter it was made clear that the judiciary are reluctant to impose unexpected obligations on the parties prior to them reaching agreement. This is in contrast to other jurisdictions, such as Germany, where a pre-contractual duty of good faith is proving increasingly popular. It has been argued that the traditional English approach increases market efficiency and benefits the business community. It protects the parties’ freedom to negotiate at length, explore possibilities and exchange the sort of information on which efficient dealings are based prior to the moment of responsibility. The rationale for this position is that, when the parties are inhibited by legal regulations during the negotiation process, they may not feel so free to exchange information relating to the deal they plan to make. Traditionally then, the boundaries of contractual obligations have been set from the moment at which agreement is reached.

Judicial attitudes have changed and no longer accord with this approach. Atiyah (1979) has argued that the law relating to misrepresentation was one of the first areas of law to show signs of retreat from the high-water mark of Victorian individualism. In The Rise and Fall of Freedom of Contract, he sketched out the background to developments in this area:

The older notion that a man could say what he liked to a prospective contracting party, so long only as he refrained from positively dishonest assertions of fact, seems to have come up against a new morality in the late nineteenth century. The courts began to insist on the duty of a party not to mislead the other party by extravagant or unjustified assertions … in their determination to stamp out the laxer business morality.

Since Atiyah first expressed this view there have been a number of inroads into the traditional approach. The most notable of these has been the Unfair Terms in Consumer Contracts Regulations 1999 in which the European Union has subjected certain types of terms to the test of good faith. The treatment of pre-contractual tenders considered in Chapter 7 above also reflects an attempt to protect the legitimate expectations of negotiating parties in the run up to the formation of a contract. Misleading statements about the price of goods and services, quantity, composition, strength and fitness for purpose have also been singled out for regulation by legislation such as the Trade Descriptions Act 1968 and the Consumer Protection Act 1987. More recently the Consumer Protection (Distance Selling) Regulations 2000 require that the seller must provide clear and comprehensible information to a consumer such as their name and address, a description of the goods, the price including taxes, delivery costs where they apply, arrangements for payment, arrangements for date and delivery, the right to cancel the order and the length of time that the offer or price remains valid in order to enable them to decide whether they want to buy.

However, the overall approach has been to adopt piecemeal solutions in response to problems of unfairness rather than to adopt an overriding principle of good faith. On the whole, even the modern cases continue to reflect the hold which market individualism continues to have on the English law of contract. The approach adopted to these problems is not to impose a positive duty on negotiating parties to behave well but to declare certain types of behaviour unacceptable. The distinction may appear subtle but it has considerable connotations. This approach, which has dominated the development of contractual doctrine, can be compared with the law of tort which has not been so shy of intervening in the regulation of pre-contractual negotiations. Here, interference has been justified on the basis that dishonesty in the pre-contractual period can distort the market which relies on the exchange of accurate information for its optimal efficiency. Viewed in this way, it has been argued that deliberate and dishonest inducements to enter into a contract which incur expenditure for one of the parties abuse the notion of freedom to contract and standards of morality. However, the law remains a somewhat confusing mixture of tort and contract, common law and equity. Underpinning this confusion is ambiguity about the proper ambit of contractual principles and concern about whether they should be stretched to cover a pre-contractual period. Elsewhere in this book it will be argued that the courts and legislature have been prepared to step in to regulate the negotiation process where consumers are concerned but have continued to make certain assumptions about contracting parties who trade as businesses.

IS IT A TERM?

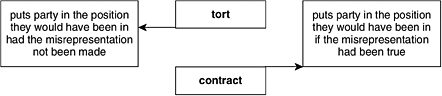

Since most contracts are made orally, or are a mixture of oral and written terms, it can be difficult to decide which pre-contractual representations become terms of the contract and which are excluded from the contract and become what lawyers refer to as ‘mere’ representations. Although the latter affect the contract, they do not become an integral part of it and, if untrue, do not give rise to a breach of contract. In practical terms the distinction is less important than it was before the Misrepresentation Act 1967, since the remedies available to those who are the victims of pre-contractual misrepresentations are now akin to, but not the same as, the remedies for breach of contract. However, there continue to be reasons why it is important for a lawyer to argue that a representation became a term of the contract. These include the fact that breach brings with it an automatic right to damages whereas this is discretionary in the case of mere representations. Moreover, there are different rules relating to the amount of damages that should be made available in the two cases which may affect the litigation strategy adopted.

Today, the test of whether a representation has become a term of the contract depends on an objective appraisal of whether the representor intended to be bound to the truth of the statement so as to render themselves liable to an action for breach? The courts have laid down certain guidelines when seeking an answer to this question, but the essential criterion adopted by the courts would seem to be that of fairness in the particular circumstances presented to them. So, for instance, in Oscar Chess Ltd v Williams (1957), Williams sold a car for £280 to a car dealer. He innocently described it as a 1948 model but, unbeknown to him, the logbook had been forged. In fact it had been registered in 1939 and was worth £175. The statement was held to be a misrepresentation but not a term of the contract. This was because the dealer might have bought the car anyway and was in a good position to discern the age of the car. Lord Denning LJ laid down a number of criteria to distinguish terms from mere representations. He argued that:

(a) the more important a statement made during negotiations, the more likely it is a term;

(b) the longer the time between the making of the statement and the agreement being concluded, the more likely that it is not a term;

(c) if an oral statement is not recorded in a written contract, it is evidence against a term being intended;

(d) the statement is more likely to be a term if made by a person possessing special skill or knowledge regarding its truth.

Whilst there are no hard and fast rules when trying to determine whether a representation is a term or not, the main theme running throughout the case law is a consideration of whether it was reasonable in the circumstances to rely on the representations made. Thus, in Bentley v Harold Smith (Motors) Ltd (1965), where the positions were reversed, a pre-contractual statement made by a dealer to a private purchaser was held to be a term of the contract. The dealer stated that a car had done 20,000 miles when it had in fact done almost 100,000. The statement by the dealer, who was in a much better position to check its truth, was held to be a term and contractual damages were awarded.

MISREPRESENTATION: THE GENERAL RULES

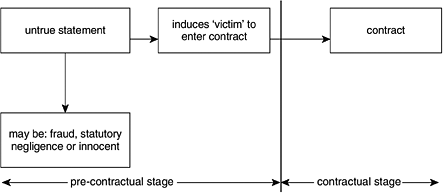

As attitudes towards pre-contractual negotiations have changed, the law has provided some relief through the doctrines of fraud and misrepresentation for those who have been misled in pre-contractual negotiations. As a general rule a party must not make any false and misleading statements to the other party which induces them to enter into a contract. If they do, they may result in successful claim of misrepresentation. The courts have defined misrepresentation as an untrue statement of existing fact made by one party to the other which, while not forming part of the contract, is nevertheless one of the reasons that induces them to enter into it. Figure 9.1 below shows what needs to be proved in pictorial form. As with promissory estoppel, the essence of the doctrine is reliance. Although there is no general duty to disclose material facts, a single word, a nod, a shake of the head or a smile may amount to a misrepresentation of fact if it is misleading and relied upon. A finding of misrepresentation will allow the misled party to avoid the obligations posed by the resulting contract, if the statement subsequently turns out to be untrue. In these circumstance, consent to enter the contract is said to be vitiated and the agreement false.

Although silence does not otherwise amount to misrepresentation, a partial non-disclosure may do so. A statement may omit facts which render what is actually said false or misleading. So for instance, a comment made during pre-contractual negotiations to the effect that a piece of machinery has run without any hitches for 10 years which fails to indicate that it has broken down repeatedly in its 11th year could be viewed as a misrepresentation. It is also the case that a statement may be made which is true at the time, but which to the representor’s knowledge ceases to be true before the contract is entered into. Here, a failure to inform the representee of the change in circumstances will amount to misrepresentation. So, for example, in With v

Figure 9.1 : The elements of misrepresentation