7 Skimming and Cash Larceny

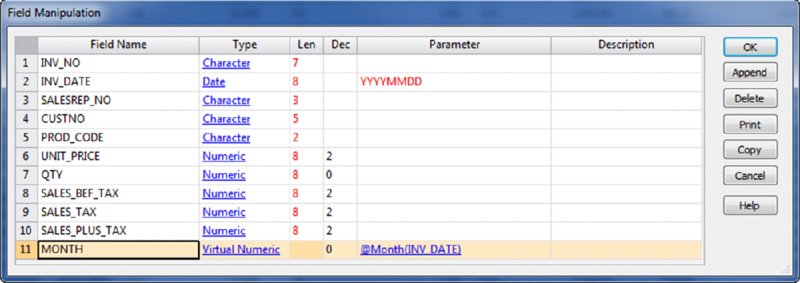

CHAPTER 7 WHEN WE HEAR ABOUT skimming fraud in the news these days, it is usually related to the theft of credit or debit card information using an electronic device that skims or reads and stores customer credit card information from the magnetic stripe on the cards. With the advent of chip technology, where the customer has to enter a personal identification number (PIN) to complete a transaction, skimming magnetic stripes has moved on to skimming radio-frequency identification (RFID) tags information embedded in new credit cards. RFID transactions are for small currency transactions that need no signature or PIN. When we speak about skimming, we are talking in the more traditional sense of removing cash prior to the cash being entered into the business system. This differs from cash larceny where the cash is stolen after it is recorded in the business system. Because of the recording processes, larceny is much simpler to detect than skimming as it leaves audit trails. Any employee who handles cash is in a position to skim. This includes bank tellers, sales staff, waitstaff, parking attendants, apartment managers, and others whose duties include the collection of cash from customers. It is not only employees that may skim, but owners of the business have incentives to skim also. It may be to reduce obligations such as retaining sales taxes collected or to reduce income taxes or royalties payable. It may also be to create a slush fund to make unrecorded payments such as bribes. Skimming can occur when cash is removed from the mail or from the cash register till. The simplest form is by just not entering the sale at all. Have you ever noticed that when you purchase a single item at grocery stores or fast-food stalls and the cash register was still opened from the last transactions, the cashier might not ring up your sale, take your cash, and give you change? You should carefully check your change, as you might also be short-changed, either on purpose or by accident, when the cashier has to do the math manually. Sales could also be recorded for a lesser amount than actually charged and the difference pocketed. Recording discounts or larger than normal discounts that are not offered to the customer also puts cash into the employee’s pocket while still balancing with the cash register. Excessive refunds, price adjustments, discounts, voids, and no-sale transactions should be reviewed carefully on an employee-by-employee basis as these transactions may be related to skimming. A sophisticated, but less successful, form of not having the sale show up on the cash register tape includes removing the print ribbon temporarily; another scheme is to remove the after-hours sales recorded on register tapes and insert a fresh, blank roll for regular hours. While this may have worked in the past, modern cash registers or electronic cash registers have built in Z and X totals that cannot be accessed or reset without a physical key or access codes. Even if sales are not printed on the cash register tape, the amounts are still cumulated in the Z and X totals, as discussed in Chapter 16 on zapper fraud. These totals would not then reconcile to the amounts shown (or not shown) on the tape. Cash larceny can include both cash and other negotiable items such as checks. It can take place at the point of sales, during the bank deposit process, or during incoming payments for accounts receivable. Since the revenues are recorded on the books already, it takes additional efforts to cover up any significant amounts of larceny. Small amounts taken from the cash register till are normally accepted by the organization and written off as cash shortages. This occurs in any type of organization that transacts in cash. There will always be some errors where the customers paid too much or too little by mistake. Customers may not know that they were given too much change or undercharged, but even if they are aware, they may not complain when it is in their favor. Other forms of covering up may be taking the cash from someone else’s cash register or reversing recorded sales as voids or refunds. Proceeds from a sale can be retained by the employee if the employee can debit the accounts receivable of a fictitious account or another real account that is due to be written off as a bad debt. If the employee can have the equivalent amount taken offset by recording discounts of the same total amount, the books remain balanced. In cases where receipts for cash payments are issued but no receipts are issued for payment by checks, checks can be substituted for cash taken and the receipts register would still reconcile to the total. We will use the sample sales files included with the IDEA software. There are sales for two separate years. The current year sales file is called “Sample—Detailed Sales” with 2011 transactions and the other is called “Sample—Detailed Previous Year” and contains transactions for 2010. The files each have 10 fields, including an invoice date field, as shown in Figure 7.1. We may be performing analysis based on the month of the sale, so we append an eleventh field called MONTH, using the function and equation of @Month(INV_DATE) to isolate the month from within the invoice date field. Figure 7.1 Fields for Both the 2011 and 2010 Sample Detailed Sales Files A review of the field statistics for both years shows that there was only one negative sales amount in 2011 and no negative amounts in 2010. Also of interest was that in 2010, there were significant sales being done on the weekend and less so in 2011.

Skimming and Cash Larceny

SKIMMING

SKIMMING

CASH LARCENY

CASH LARCENY

CASE STUDY

CASE STUDY